About - Exxon Mobil Corporation : XOM

Summary

- Exxon Mobil shares are at the bottom of their trading range, offering reasonable value and a well-covered, potentially growing dividend.

- Exxon Mobil's capex is capped, and the company is ensuring dividend safety even if oil prices drop significantly.

- Risks include lower commodity prices, geopolitical tensions, and potentially higher costs in capital projects, but shares have strong support and potential upside.

Business

Exxon Mobil Corporation engages in the exploration and production of crude oil and

natural gas in the United States and internationally. It operates through Upstream,

Energy Products, Chemical Products, and Specialty Products segments. The Upstream

segment explores for and produces crude oil and natural gas. The Energy Products

segment offers fuels, aromatics, and catalysts, as well as licensing services.

It sells its products under the Exxon, Esso, and Mobil brands. The Chemical

Products segment manufactures and markets petrochemicals including olefins,

polyolefins, and intermediates. The Specialty Products segment offers performance products,

including lubricants, basestocks, waxes, synthetics, elastomers, and resins. The

company also involves in the manufacturing, trade, transport, and sale of crude oil,

natural gas, petroleum products, petrochemicals, and other specialty products;

and pursuit lower-emission business opportunities, including carbon capture and

storage, hydrogen, lower-emission fuels, and lithium. Exxon Mobil Corporation was

founded in 1870 and is based in Spring, Texas.

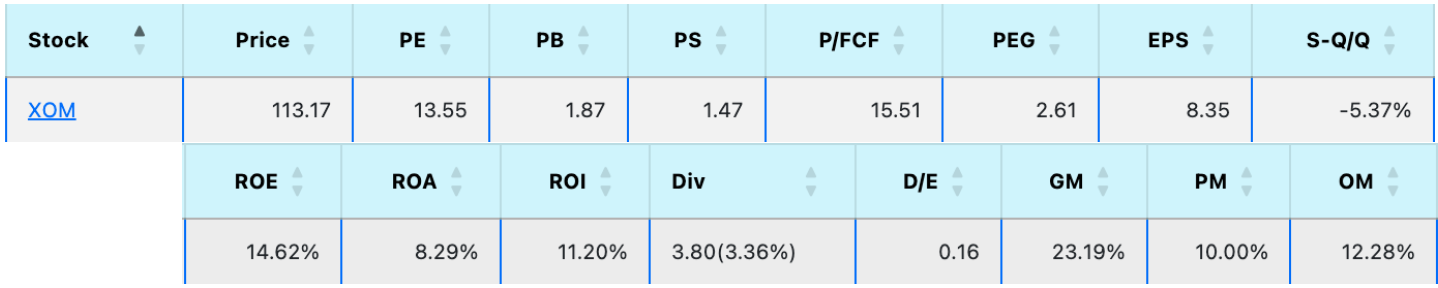

Moat & Earnings

Exxon Mobil Corporation (NYSE:XOM) has recently declined along with oil and the energy

sector, but shares appear to now be sitting at the bottom of their trading range.

Exxon Mobil offers reasonable value here, as well as a well-covered dividend that

has the potential to grow in coming years if oil and gas prices can maintain current

levels, especially if these commodities were to increase. Further, it appears as

though XOM shares have another level of strong support just below where, where

shares are likely to at least temporarily stop upon any potential breach of the

apparent trading range. For these reasons, Exxon Mobil presents a reasonably

strong value at risk here.

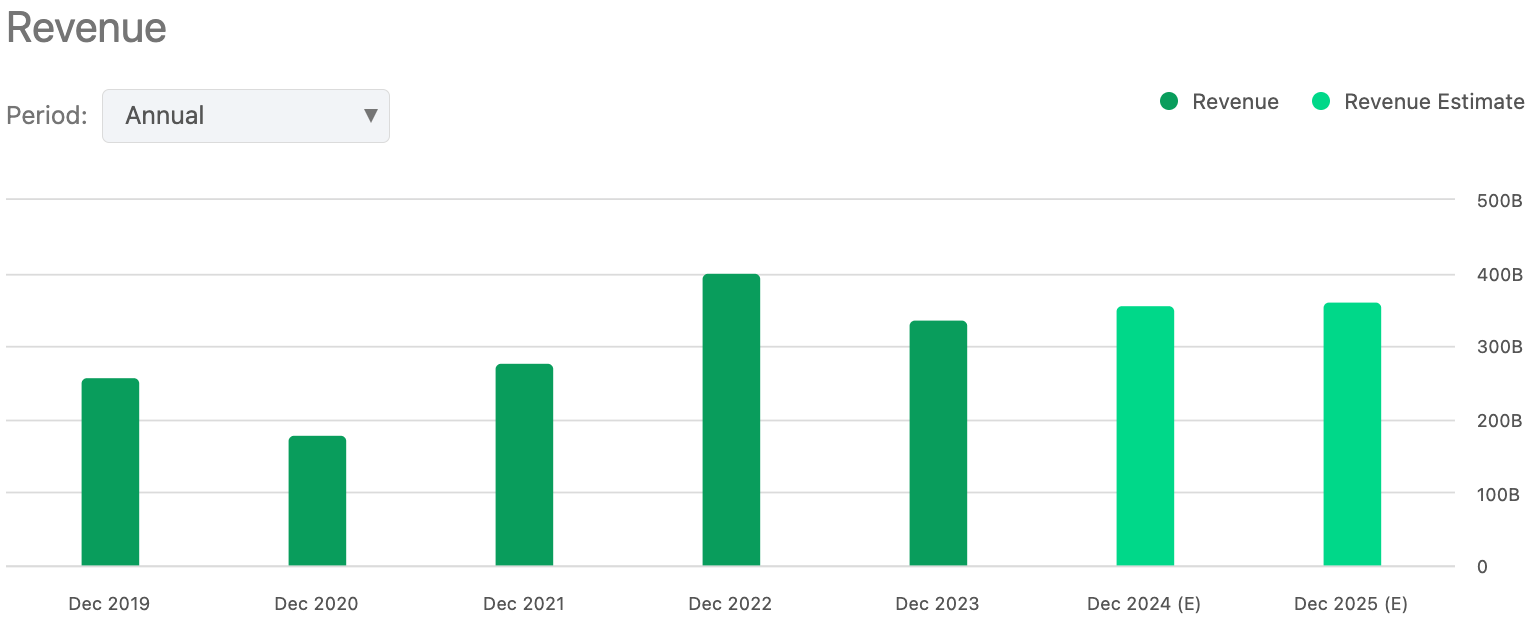

During the prior quarter, Exxon Mobil closed on the acquisition of Pioneer Natural Resources, which was an all-stock purchase for about $60 billion. This deal significantly increased Exxon Mobil's Permian Basin production to about 1.3 million barrels of oil equivalent per day and the Permian Basin now accounts for roughly one-third of Exxon Mobil's total upstream production. Exxon Mobil appears to intend to further develop the company's Permian Basin production through efficient and aggressive development of Pioneer's assets.

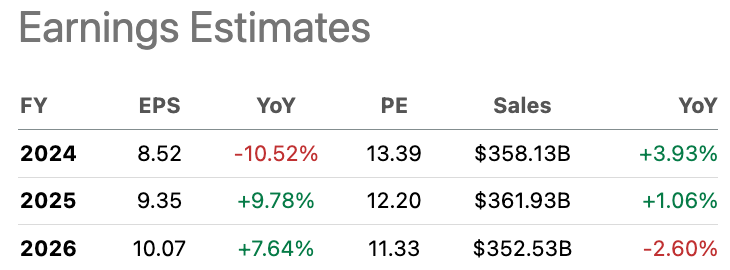

Exxon Mobil guided that it has capped its spending to $20-$25 billion per year through 2027, but that was prior to current plans regarding Permian Basin development. Nonetheless, it is unlikely that even if Exxon Mobil opts to quickly ramp up Permian Basin production its capex would surpass 30 billion, and is likely to be less than $28 billion in each of the next two years, and still potentially under $25 billion. At this rate, XOM's dividend appears wholly safe, even if oil prices were to decline by as much as 40 percent. If Exxon Mobil is capable of accomplishing its Permian Basin goals for production and 15% cost synergies over Pioneer's costs, as well as its other production initiatives, the company should be able to cover the dividend even if energy prices halved from current levels. Moreover, if energy prices do not sustain such declines, the dividend is likely to grow over this timeframe.

In addition to the Permian Basin, Exxon Mobil's profitability should substantially benefit from bringing online Guyana production that should run at higher margins. Precise timing on the ramping of such production is still uncertain. Exxon Mobil is likely to provide updates to capex and earnings guidance in December, and I expect that the company will provide a conservative estimate that it can protect the 2025 dividend so long as Brent pricing remains above $50 per barrel, and this number could fall to $45 per barrel in 2026.

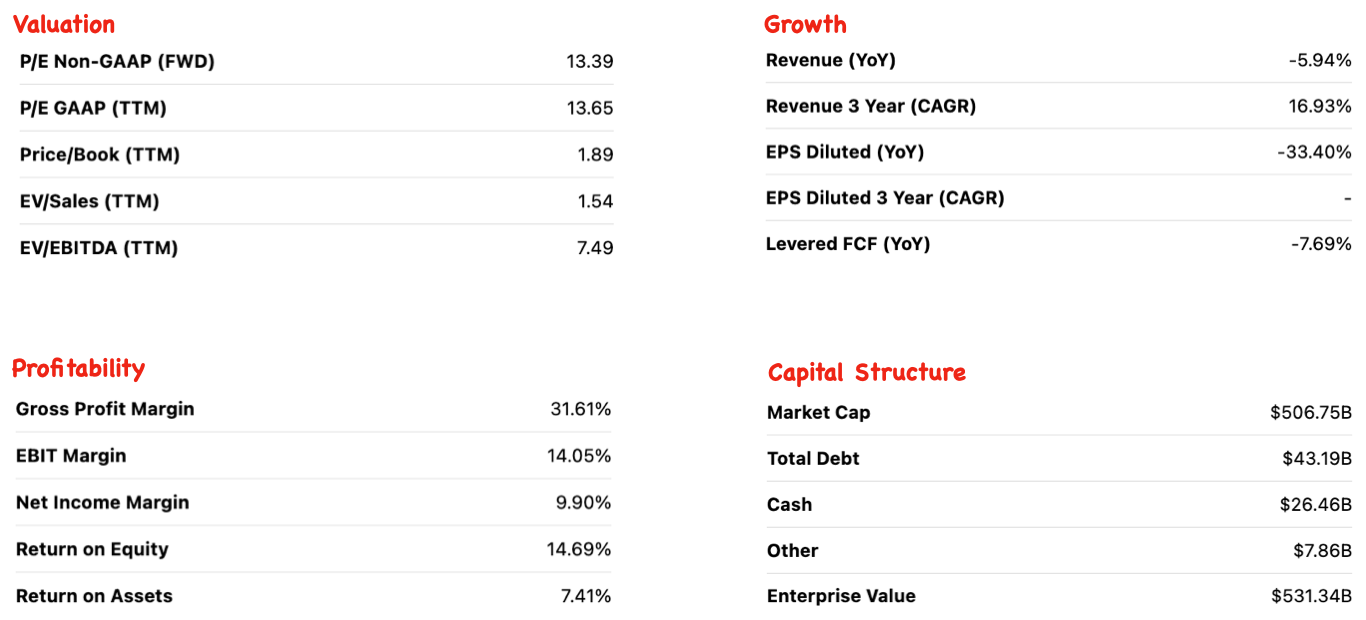

I believe Exxon Mobil shares have a fair value of roughly $135 to $140 per share, and that this level has the strong potential to increase if the company's Guyana business ramps efficiently, or if its specialty products and refining production margins outperform. This value estimate is predicated on Exxon Mobil forecasting 2025 EBITDA of at least $85 billion, and presuming a conservative fair value for XOM shares is at 7-7.5x EBITDA.

Exxon Mobil shares seem to be at the bottom of their recent trading range. Since peaking in the mid $120s in April, shares have largely been stuck in a fairly tight and narrowing trading range. Since mid-July, shares have largely remained between $113 and $120 per share. Further, prior to this, XOM shares bounced off the $110 range in both June and July. Therefore, it appears that shares are unlikely to break $113 in the near term, and that even if they do, they are likely to find strong support at around $110.

Risks

Exxon Mobil faces many risks, several of which are rather obvious. The clearest risk

to Exxon Mobil is that of lower commodity prices, especially if they are caused by a

significant reduction in global demand for petroleum-based energy and other products.

The primary concern in terms of demand destruction would likely come from Asia,

where demand levels are more sensitive to economic conditions. Other geopolitical

risks also have unpredictable effects on energy pricing and demand, where conflict

often causes prices to spike, but not always. For example, recent tensions in the

Middle East appear to be coinciding with falling energy pricing.

Other risks include the possibility of higher than budgeted costs being incurred

on Exxon Mobil's capital projects, such as Guyana and the Permian Basin. Similarly,

there remains the overhang of the dispute between Chevron Corporation (CVX) and

Exxon Mobil over Hess' 30% stake in Guyana. Exxon Mobil claims it has a right of

first refusal to that stake. It appears the market is already anticipating Chevron

will largely prevail in that dispute, so there should not be much downside risk to

that result, or it is likely already mostly priced into shares, but that is not

certain.

Conclusion

Exxon Mobil shares appear to be in a tight trading range that is just above

strong support. I believe that shares have a fair value that is roughly 15-20%

above current trading levels. Given that shares could soon reprice to reflect

such a value, while also currently trading at what seems to be roughly 3-5% over

a reasonably strong support level, Exxon Mobil presents a reasonable value

at risk.