About - United Airlines : UAL

Summary

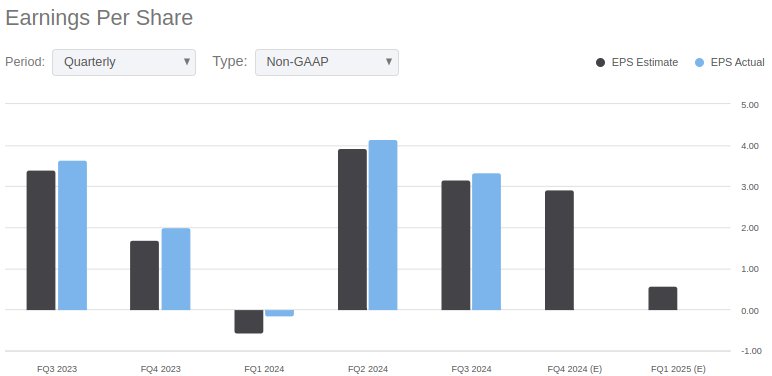

- For 3Q24, United Airlines generated $14.85 billion in revenues, representing a 2.48% year-on-year growth. Although EPS of $3.33 beat estimates, net income fell by 15.13% year-on-year.

- Expect the continued strength and demand in the airline industry to continue to serve as tailwinds for UAL. ACI expects passenger growth for 2024 will surge by 7% in North America.

- UAL is poised to expand its revenue through multiple initiatives such as expanding its international reach, increasing its fleet size, and enhancing other ancillary programs such as MileagePlus.

Business

United Airlines Holdings, Inc., through its subsidiaries, provides air transportation services in

North America, Asia, Europe, Africa, the Pacific, the Middle East, and Latin America. The company

transports people and cargo through its mainline and regional fleets. It also offers catering,

ground handling, flight academy, and maintenance services for third parties. The company was

formerly known as United Continental Holdings, Inc. and changed its name to United Airlines

Holdings, Inc. in June 2019. United Airlines Holdings, Inc. was incorporated in 1968 and is

headquartered in Chicago, Illinois.

Moat & Earnings

For 3Q24, UAL generated $14.85 billion in revenues, representing a 2.48% year-on-year growth and -0.95%

sequential decline; additional UAL beat revenue estimates by $116.19. Gross margin improved due to

relatively lower cost of goods; UAL's gross margin improved to 64.02% as compared to 62.27% in the same

period last year. However, net margin deteriorated primarily due to higher operating expenses.

As a percentage of revenues, SG&A for 3Q24 increased to 33% as compared to 30.59% in the same period

last year. Total expenses as a percentage of revenues increased from 50.19% to 53.82%. On a year-on-year

perspective, net income fell by 15.13%; however, UAL posted an EPS of $3.33, beating estimates

by $0.16.

More importantly, the outlook for air travel remains healthy and is likely to continue seeing growth. ACI expects global air travel will continue to grow at a CAGR of 5.57% through 2028. Total passengers will likely increase from 9.5B in 2024 to 11.8 billion by 2028. That being said, it will be important for us to closely monitor key risks such as geopolitical tensions, labor market disputes, and delays in aircraft deliveries; these are the major risk factors that may cause a dislocation in demand for air travel.

In terms of UAL's international reach, the company plans to continue its international expansion. Recently, the company announced its largest international expansion in history. By mid-2025, UAL will add 8 new destinations covering Ulaanbaatar (Mongolia), Kaohsiung (Taiwan), Nuuk (Greenland), Palermo (Italy), and more. UAL will also offer new routes and connections such as Tokyo-Ulaanbaatar, Washington-Dakar, and Houston-Puerto Escondido. All of these indicate that UAL remains committed to expanding its revenue capacity.

Supporting its international expansion, UAL has committed to 676 new aircraft. Although deliveries from Boeing (BA) will be delayed, UAL still expects to receive another 22 aircraft for the rest of FY2024 and another 78 aircraft in 2025, bringing the total aircraft for FY2024 and FY2025 to approximately 994 and 1072. Utilizing FY2023 data, UAL had generated about 56 million per airplane; all else equal, and without factoring any inflation, this will translate to an additional $2.7 billion (+5.11% year-on-year) and $4.3 billion (+7.74% year-on-year) in revenues for FY2024 and FY2025, respectively.

To actively enhance demand and retain customers, UAL continues to work on its MileagePlus and Connected Media program, investing in critical technologies and enhancing program features. In relation to MileagePlus, UAL has included mile pooling, allowing members to pool miles including up to four people, including children. By Mid-2025, the program will also offer more ways to redeem points. Overall, revenues from MileagePlus have already increased by 11% while active membership was up 13%.

Apart from continuously driving growth and expanding revenue capacity, UAL's current priority is also to expand their margins. Unfortunately, as of the latest earnings call, the management team had stated that they are not prepared to give guidance on margin expansion.

However, the management team did emphasize that UAL is at "an inflection point that would kick off a multiyear run that looked a lot like the 2012 to 2014 for airline earnings". To put it into context, pre-tax profit margin was initially negative in 2012. Pre-tax profit margin continued to improve up to 2015, expanding significantly to approximately 11%; during this period, pre-tax profit margin expanded by about 436 bps annually.

As a reference, in FY2023, 1% of revenues is approximately $537 million, representing at least 20% of net income. UAL does not need to expand its margins by 400 bps per year to generate significant value. Savings of merely 2% a year will be significant and highly accretive to the company's bottom line and free cash flow.

Risks

Airlines face the same risks as normal companies, but with an exponential impact. There are two

major risks right now: the possibility of an oil shock due to escalating tensions in the Middle East

and any weakness in U.S. consumer spending that could trigger or indicate a recession. With razor-thin

margins like 4.4% YTD after the incremental salaries negotiated with pilots, any negative impact coming

from rising Jet Fuel prices or even lower pricing power could turn the company in negative territory.

This would definitely lead to a revaluation of United's multiple and impact investors returns.

Conclusion

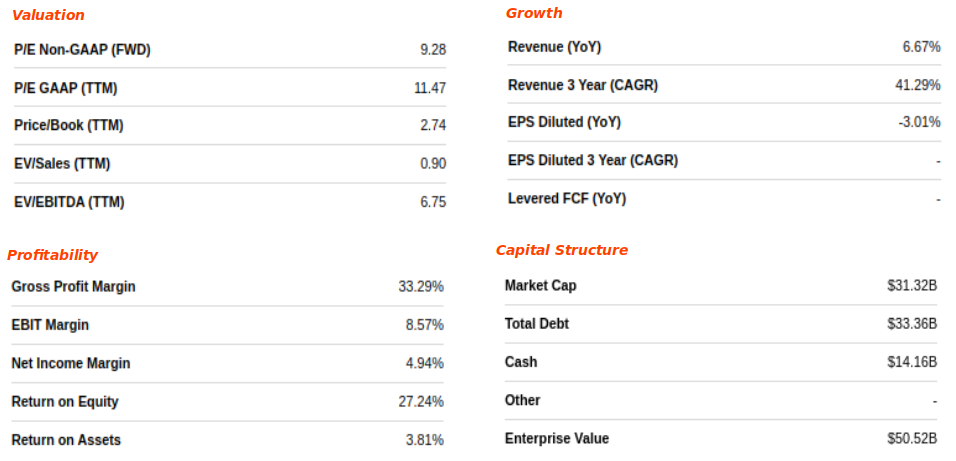

Overall, UAL remains an attractive opportunity despite its share price surging by more

than 120% YTD. Apart from continued strength and demand in the industry, UAL is employing

multiple initiatives to ensure revenue expansion. The company's priority in expanding margins

will also be highly beneficial to shareholders and the valuation of UAL. More importantly,

upside potential exists. Based on my valuation analysis, there is an upside potential of 54%.

That being said, investors should closely monitor the developments surrounding BA. Aircraft delivery

delays from BA will be the most important factor affecting UAL's ability to expand its revenue

meaningfully. Although BA's worker strike has ended, the company is still struggling. BA had just

recently decided to cut 10% of its workforce and may have liquidity issues. UAL expects 78 aircraft

in 2025; if we assume that BA only delivers 45 per year through FY2025 and FY2028, the upside potential

is merely 8%.