About - Taiwan Semiconductor : TSM

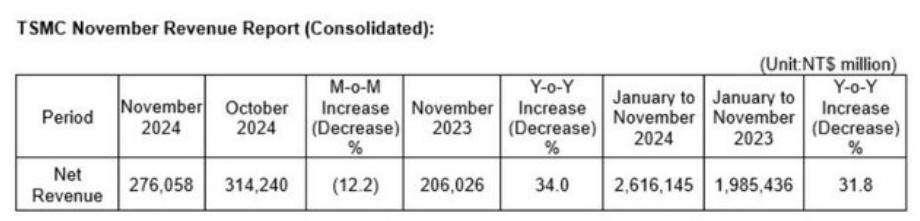

WOW, Just see below

Summary

- TSMC's global expansion and diversification efforts, including new fabs in Arizona, Japan, and Germany, position it to mitigate risks and capitalize on AI demand.

- TSMC's global expansion and diversification efforts, including new fabs in Arizona, Japan, and Germany, position it to mitigate risks and capitalize on AI demand.

- Short-term risks include market volatility, potential AI slump, geopolitical tensions, and recession fears, but TSMC's promising roadmap and undervaluation make it a strong buy..

Business

Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries,

manufactures, packages, tests, and sells integrated circuits and other semiconductor

devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States,

and internationally. It provides a range of wafer fabrication processes, including

processes to manufacture complementary metal- oxide-semiconductor (CMOS) logic,

mixed-signal, radio frequency, embedded memory, bipolar CMOS mixed-signal, and

others. The company also offers customer and engineering support services;

manufactures masks; and invests in technology start-up companies; researches,

designs, develops, manufactures, packages, tests, and sells color filters; and

provides investment services. Its products are used in high performance computing,

smartphones, Internet of things, automotive, and digital consumer electronics.

The company was incorporated in 1987 and is headquartered in Hsinchu City, Taiwan.

Moat & Earnings

Without AI, companies like NVIDIA Corporation (NVDA) would have been very little

known in the broader sense. Jensen Huang would have been relatively unknown.

A CEO of a graphics card company that saw some sort of press before AI as the

go-to for bitcoin mining. Before AI and bitcoin mining, the company was known

among the gaming enthusiasts who were building their PC rigs to be able to

run Crysis with somewhat of a decent frame rate. All of that has changed in

just a short couple of years. The company's been working hard on its chips

that fueled the AI revolution, the modern gold rush so to speak, and certainly

many benefited, especially NVDA.

TSMC is expanding its presence across the globe. three fabs are being built in Arizona to support the demand and to solidify its leadership in the semiconductor industry. The last of the fabs will incorporate the latest 3nm and 2nm technology and will start production in 2028. I think it is safe to say that TSMC will continue to benefit from the grants and subsidies of the CHIPS Act, just as will Intel, but seeing that TSMC has the most advanced technology out there, the US will certainly want to have such capacity on their soil, away from the hands of China.

The fabs in Japan are another key strategy for diversifying away from Taiwan and solidifying its presence across the globe, which should ease the fears of a Chinese invasion of the island. The company expects to ship logic chips for camera sensors and automotive by the end of this year. This further diversifies away from risks of slowing down AI in the future.

Risks

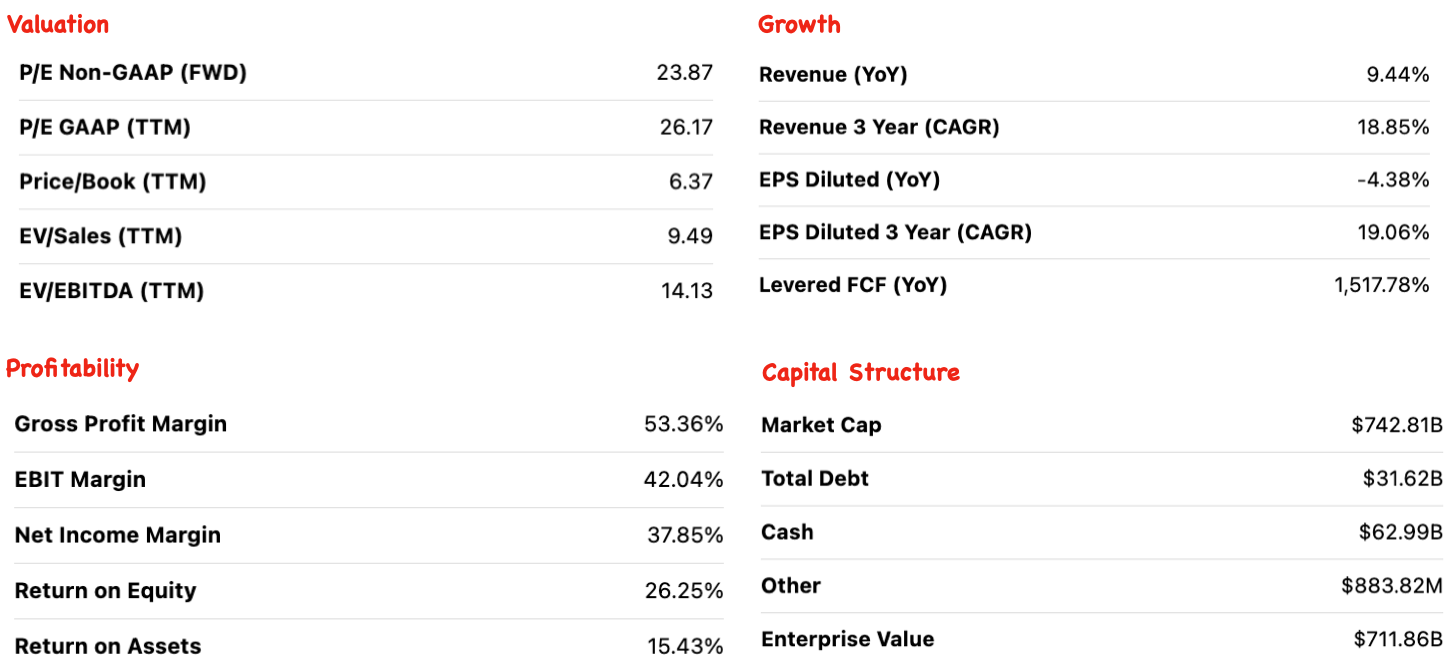

Firstly, the semiconductor market volatility and frothy valuations do not paint a

good picture. Even if I think TSMC is undervalued compared to many other

semiconductor companies, that doesn't mean its share price is not going to be

affected. NVDA will have to do miracles over the next year or so to justify

its almost $3T market capitalization. That is one tall order in my opinion.

Any meaningful weakness over the next few quarters or the beat wasn't large enough,

will send the company's shares down, just like it did last week. There was a

time when semiconductor stocks were in a negative sentiment. Just one year ago,

no one liked them and TSMC was trading at around 12 P/E ratio. That was a

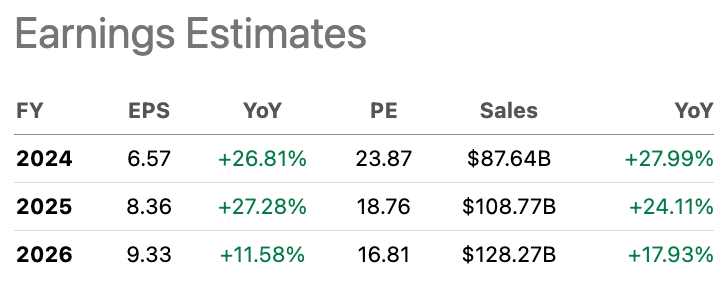

no-brainer buy in my opinion. Now that its PE ratio about doubled, it is not

as cheap as it was, but I believe the outlook is very positive and the TTM

P/E ratio of 25 is decent.

Secondly, which is more of a long-term risk, the slump in AI is going

to come, there is no doubt about it. The big tech companies will start

to ease up on CapEx spending eventually. Especially if all of that

capital injected into AI does not yield any revenues or improve their

bottom line meaningfully. The big risk here is that all this money spent

will amount to nothing basically. The missing revenue is a real risk.

Lastly, the obligatory geopolitical risks are still there. The most recent

quarterly report showed that the company gets 16% of its sales from China,

which is the highest in a long while. This will deter many investors who are

not fans of such risks and want nothing to do with China. Further restrictions

on China may affect TSMC's top line, but in my opinion, even with such a

percentage coming from China, not all of that revenue will be lost. Especially

with the diversification efforts the company has been achieving, the China risk

should diminish meaningfully over the next couple of years.

There has been a lot of talk lately of a recession hitting very soon. History

may not repeat itself but when the FED pivots, the markets tend to do poorly

for the next year or so. With massive revisions to the employment data flowing

in, the highest we have seen since '09, it is hard to not draw comparisons.

Conclusion

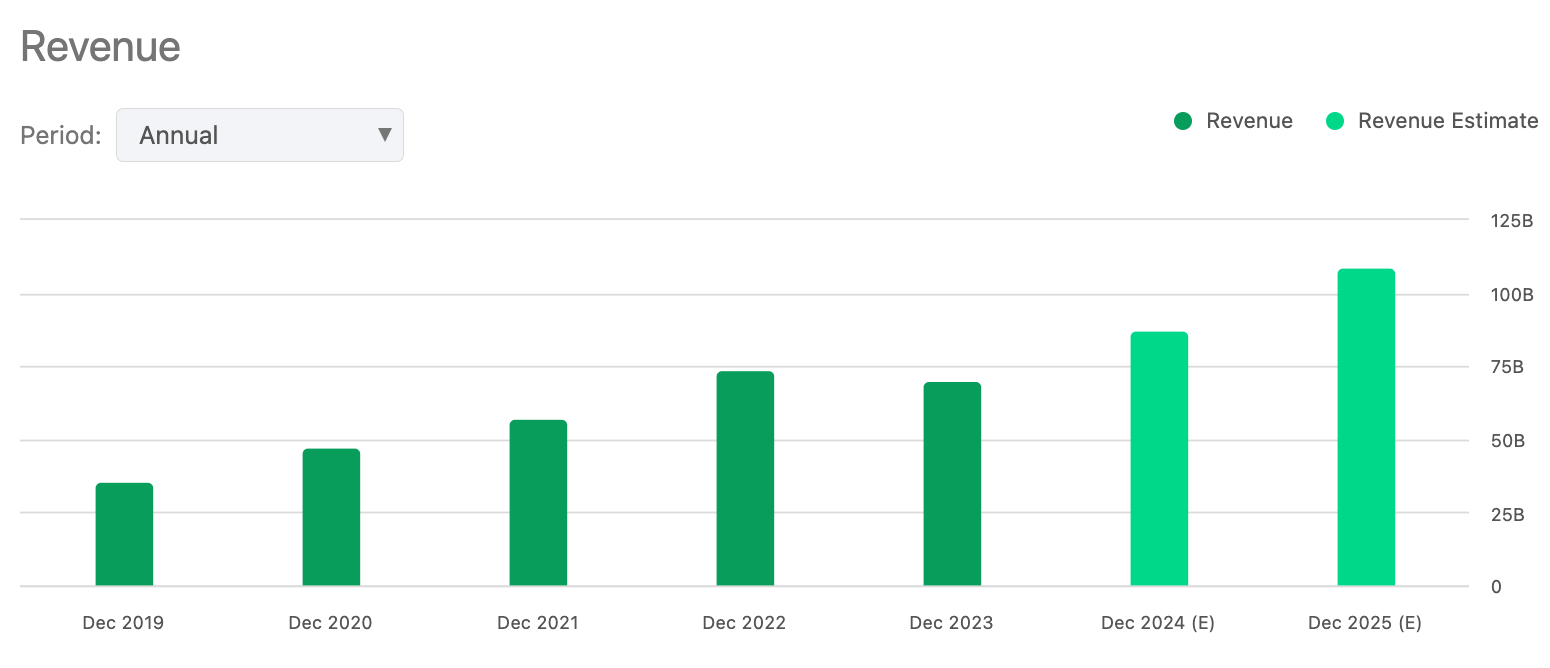

These are the reasons to keep calm in such turbulent times and continue to hold and

buy more on meaningful dips just like we saw recently. The company's roadmap looks

very promising, which solidifies my long-term outlook. I still believe that many

investors do not recognize the company's true potential and how central it is to

many technologies out there, not just AI, which is front and center as of right now.

AI came, and it will probably eventually be replaced by another advanced technology,

if TSMC is to remain the key leader in the industry, it will most likely be selling

the pickaxes for the next modern gold revolution and reap the rewards for decades

to come.

The volatility in the markets will probably present even better opportunities for

entry in the long run, but I will continue to average down until something drastic

changes in the company's operations, but for now, the company remains a strong buy

in my opinion.