About - Turning Point Brands : TPB

Summary

- Turning Point Brands manufactures and sells tobacco-related products such as rolling papers, chewing tobacco, and has more recently started selling nicotine pouches.

- The company has had negative revenue growth in recent years, but the scaling FRE nicotine pouch brand could revitalize growth.

- The CDS segment's revenues have turned dire, but as the segment scales down, it will drag down total revenues less in the future.

Business

Turning Point Brands (NYSE:TPB) manufactures and sells rolling papers, cigars,

moist snuff tobacco, chewing tobacco, and other tobacco/vape related products

through brands such as Zig-Zag, Stoker’s, and multiple other names. In addition,

the company now sells nicotine pouches through the FRE brand and nicotine infused

cotton through the Cotton Mouth brand, acting in a better-growing market.

The company gets the overwhelming majority of revenues from the United States,

but also sells internationally.

Since the company had an IPO in 2016, the stock has returned very well, despite

a poor performance from 2021 forward. The stock has again started to perform very

well in the past year, with higher margins sustaining themselves after 2021.

Turning Point Brands also pays a growing dividend in addition, although quite

a modest one at a current yield of only 0.84%.

Moat & Earnings

Turning Point Brands mainly sells tobacco-related products, and acts on a

highly mature industry, achieving significant growth is difficult for the

company. While the company achieved growth in prior years aided by $106

million in cash acquisitions from 2016 to 2021, revenues have turned into

negative growth territory from Q3/2021 forward. The market didn’t like poor

the revenue trajectory, as the stock had its peak in February of 2021 –

stronger revenues are needed to satisfy investors.

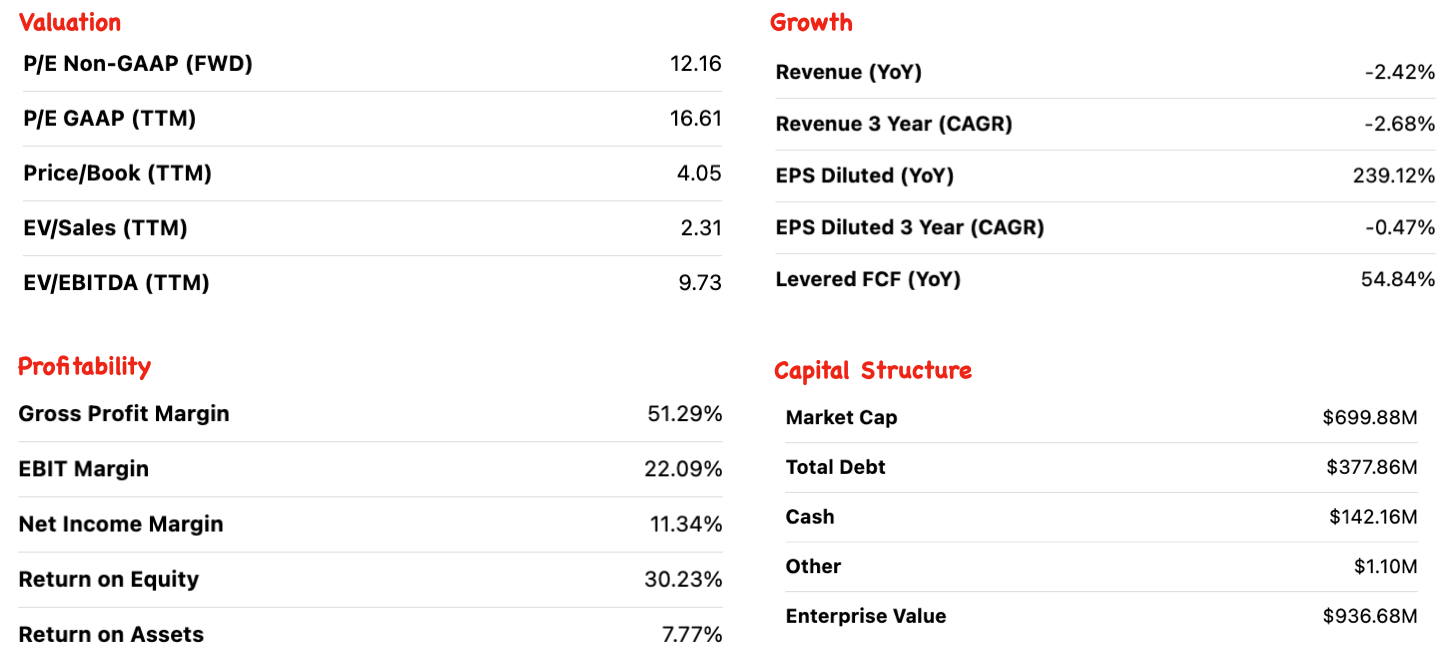

Historically, Turning Point Brands’ margins have been mostly unrelated to revenue growth. Turning Point Brands continues to achieve high and stable operating margins, even achieving good margin expansion from 2019 forward despite weak revenues in the past couple of years. If continued, the past couple of years’ negative revenue growth should eventually affect margins negatively, but with FRE potentially aiding future growth, the effect shouldn’t be dramatic.

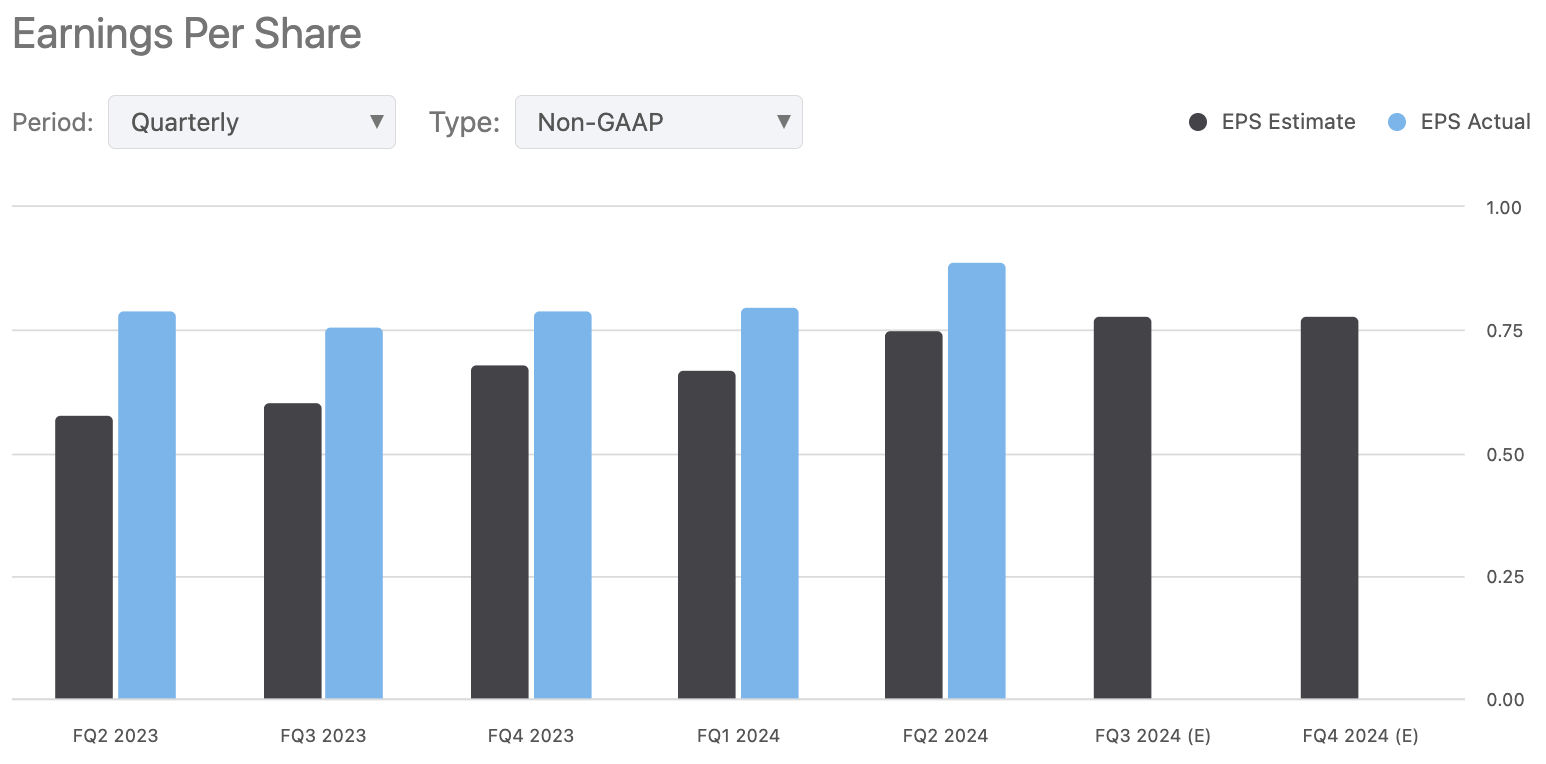

Zig-Zag showed a growth of 11.5%, Stoker’s a growth of 8.0%, and Creative Distribution Solutions a dramatic decline of -44.9% - Turning Point Brands’ core focus segments are showing a great performance. The CDS segment’s revenue fall makes the segment worth only 14% of revenues in Q1, making potential future revenue declines not as significant for the company. The reported quarter was overall very good, as the market interpreted it, with Zig-Zag and Stoker’s showing a very good performance.

Risks

The competition for each segment is high, and is given by large companies with a

historical presence in the tobacco market. In any case, due to the decrease in the

consumption of traditional cigarettes, these companies are also diversifying their

products towards secular markets within the same industry. Republic Tobacco, L.P.,

HBI International, Good Times USA, LLC, and New Image Global, Inc are the main

competitors for ZigZag. Swedish Match, the American Snuff Company, LLC, Swisher

International Group, Inc., and U.S. Smokeless Tobacco Company are competitors

for the Stoker's product segment.

Along with competitive risks, it must be considered that any decrease in product

consumption would generate a decrease in sales that would translate into lower

margins for reinvestment in its brands and new products. Although the forecasts

are good for the secular tobacco industry, these trends may not come to pass

for a variety of reasons. On the other hand, the legislation on this type of

market is high, and any radical change in this sense could mean complications

when it comes to the distribution and marketing of its products both nationally

and internationally.

Conclusion

Turning Point Brands yields stable and good cash flow yield. While the company’s

growth has lagged in the past couple of years due to a mature industry and very

weak CDS revenues, future growth could be better as the FRE nicotine pouch brand

scales. The first quarter of 2024 already showed an elevated growth in the

company’s main segments and shows potential for better growth in coming years.

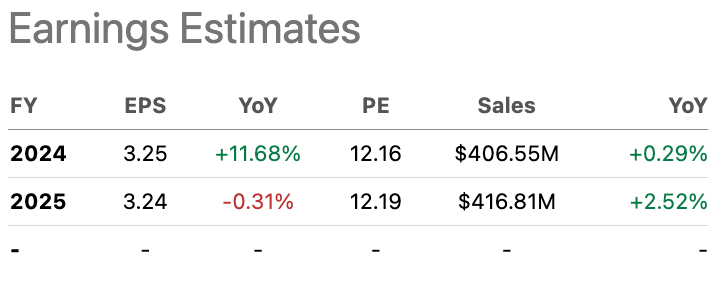

With the valuation having good space upwards even with modest earnings estimates,

I have a buy rating for the stock for the time being.