About - Synchrony Financial : SYF

Summary

- Synchrony Financial is a good buy due to solid fundamentals, strong financial health.

- Impressive Q3 results with $1.94 diluted EPS, 70.4 million active accounts, and a 15.04% net interest margin indicate robust profitability and growth potential.

- Valuation metrics, including low P/E and PEG ratios, highlight SYF's strong cash flow generation and undervaluation relative to earnings growth potential.

- Risks include interest rate fluctuations, regulatory pressures, and dependence on retail partners, but the diversified portfolio and efficient operations support long-term growth.

Business

Synchrony Financial, together with its subsidiaries, operates as a consumer financial services

company in the United States. It provides credit products, such as credit cards, commercial credit

products, and consumer installment loans. The company also offers private label credit cards, dual

co-brand and general purpose credit cards, short- and long-term installment loans, and consumer

banking products; and deposit products, including certificates of deposit, individual retirement

accounts, money market accounts, and savings accounts, and sweep and affinity deposits, as well as

accepts deposits through third-party securities brokerage firms. In addition, it provides debt

cancellation products to its credit card customers through online, mobile, and direct mail; and

healthcare payments and financing solutions under the CareCredit and Walgreens brands; payments and

financing solutions in the apparel, specialty retail, outdoor, music, and luxury industries, such

as American Eagle, Dick's Sporting Goods, Guitar Center, Kawasaki, Pandora, Polaris, Suzuki, and

Sweetwater. The company offers its credit products through programs established with a group of

national and regional retailers, local merchants, manufacturers, buying groups, industry associations,

and healthcare service providers; and deposit products through various channels, such as digital and

print. It serves digital, health and wellness, retail, home, auto, telecommunications, jewelry,

pets, and other industries. The company was founded in 1932 and is headquartered in Stamford,

Connecticut.

Moat & Earnings

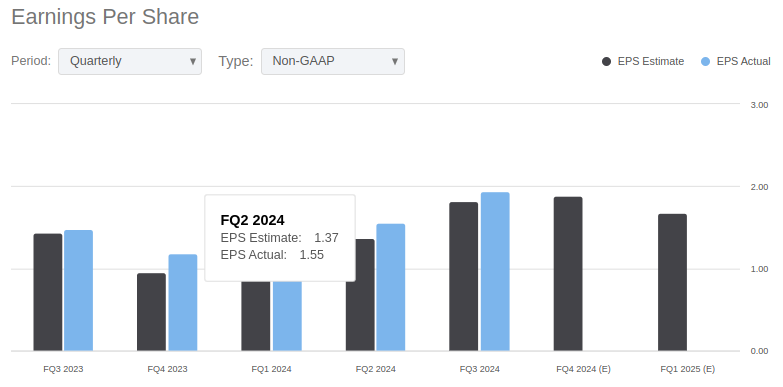

Synchrony Financial is signaling quite clearly, in the third quarter, what kind of operational health

and growth potential the company has. With such impressive diluted EPS of $1.94, such strong profitability

tells you that Synchrony is doing a great job of turning revenue into earnings while resisting the urge

to increase costs. Solid customer retention and acquisition, which supports sustainable revenue growth,

the company has 70.4 million active accounts. The current rising demand for credit, along with the rising

interest rates that are redounding to the bank, would definitely benefit from the 15.04% net interest

margin, which indicates the sound supervision of loan products resulting in efficient lending and strong

returns. Taken together, these metrics show that Synchrony is on solid ground to keep growing and to make

for an attractive investment with an expanding but stable business model.

The third quarter results show an increase of 38 basis points (bps) for both 30+ days past due and 90+ days past due loan receivables and an increase of 27 bps. This mild rise in delinquencies, while just that, is a sign for investors to watch, signaling a possible decline in the credit quality of Synchrony’s loan book. A more meaningful signal is the 90+ days past due increase over both the previous month and the same month last year. Specifically, it indicates accounts in deeper arrears that may or may not end up being written off or requiring provisions for credit losses.

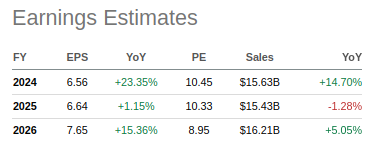

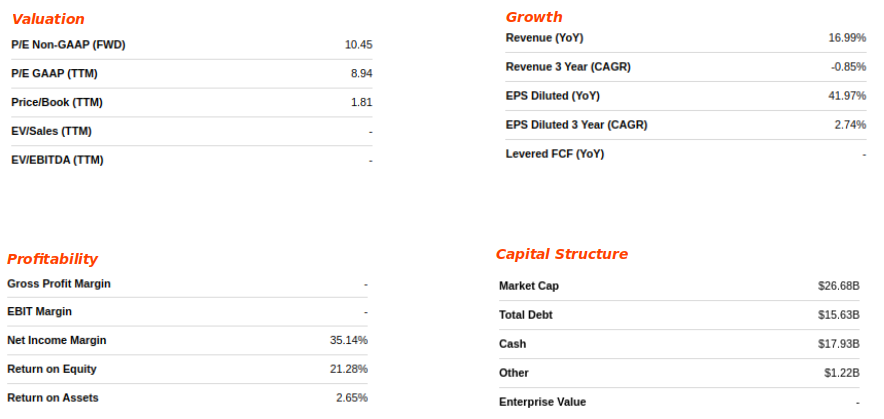

A PEG ratio below 1.0 typically suggests that a stock is undervalued relative to its expected earnings growth, and SYF's PEG ratio is well below the sector median of 0.74. This signals that the stock has strong growth potential relative to its current price. Its growth is solid but looking there is still room for growth and expand into new markets. Furthermore, SYF’s Price-to-Cash Flow ratio of 2.67 is substantially lower than the sector median of 11.28, pointing to the stock’s strong cash flow generation and suggesting it is undervalued based on its ability to produce cash. Its strong cash profile is a proof that the company is generating a significant amount of cash flows. These ratios collectively make a compelling argument that SYF represents a strong buy opportunity.

Risks

One risk to which Synchrony Financial Synchrony is exposed is the environment of interest rates

and macroeconomic changes. Rising interest rates have increased its net interest income, but

if consumer spending slows down or interest rates rise further, it may deteriorate its credit

quality if loans become hard to repay. Higher default rates, therefore, and higher provision

for credit losses would be expected to affect profitability. Regulatory pressure is another

risk, especially as the company with such an expansive presence in consumer credit finds its

way. Compliance costs may increase due to any change in lending regulations or new consumer

protection laws, or lending opportunities could be reduced. Additionally, Synchrony’s reliance

on retailers to provide credit partners makes it vulnerable to the risk of dependence on retailers,

and in particular, the risk of disruption to its credit card base related to financial difficulties

or ‘retail shift’ by key partners into alternative credit providers.

Conclusion

In the long term, they’re in a strong position: their profitability is solid, their

operations are efficient, and a diversified portfolio with resilience against market volatility.

A key strength is the company’s ability to grow net interest income in an environment of rising

rates. As macro makes it appear more uncertain than ever to be up and running, Synchrony is doing

the right thing and positioning itself to be even more successful. By and large, the prospect of

Synchrony as an investment here in the long term is positive. The company has a great trajectory

for growth, excellent operating efficiency, and a good revenue base with diversification that

should propel stable, profitable growth moving forward.