About - PayPal Holdings, Inc. : PYPL

Summary

- The financial sector's growth contrasts with rising household debt and declining savings, raising concerns about consumption sustainability.

- PYPL is recovering from a downtrend, aiming for a long-term uptrend, but caution is needed as it encounters critical resistance levels.

- Investors should follow a contingency plan, taking profits or setting stop losses, and wait for potential retracement before adding new position.

Business

PayPal Holdings, Inc. operates a technology platform that enables digital payments

on behalf of merchants and consumers worldwide. It operates a two-sided network at

scale that connects merchants and consumers that enables its customers to connect,

transact, and send and receive payments through online and in person, as well as

transfer and withdraw funds using various funding sources, such as bank accounts,

PayPal or Venmo account balance, PayPal and Venmo branded credit products comprising

its installment products, credit and debit cards, and cryptocurrencies, as well as

other stored value products, including gift cards and eligible rewards. The company

provides payment solutions under the PayPal, PayPal Credit, Braintree, Venmo, Xoom,

Zettle, Hyperwallet, Honey, and Paidy names. The company was founded in 1998 and is

headquartered in San Jose, California.

Moat & Earnings

The positive momentum in the financial sector has led to a protracted expansion over the past

year, only second to the technology sector, which has primarily outperformed all other

groups. Insurers in property and casualty have led the rally, followed by asset management

companies and diversified banks. In contrast, shell companies and actors in mortgage

financial services are the only two losers over the past year, the latter industry

losing a massive 32% of its valuation. Insurance companies, financial data providers,

and stock exchange operators have recently shown relative strength. In contrast,

shell companies and actors in mortgage financial services continue to lag, the

latter losing 8% in the current week and 15% over the past month. Financial

conglomerates and banking institutions have also shown some signs of weakness.

Typically, those companies are susceptible to interest rate changes and become

more relevant to the extremes of a stock market cycle.

With the US consumer having boosted its consumption pace through significant debt

accumulation, the debt carried forward has reached new record levels. Credit card

balances have risen to $1.1T, with an increase of $27 billion in Q2 2024, marking

a 5.8% rise compared to last year. Auto loan balances grew by $10B, reaching $1.63T.

Mortgage balances grew by $77B, reaching $12.52T by the end of June. In total,

household debt increased to $17.80T in the second quarter, with an overall

delinquency rate unchanged from the previous quarter, with 3.2% of outstanding

debt currently in some stage of delinquency. The personal savings rate continued to drop,

standing at 3.4% by the end of Q2, at levels seen during the financial crisis of 2008,

raising questions about the consumer's economic health and the sustainability of

the consumption pace.

The Amplify Mobile Payments ETF (IPAY) has continued recovering after bottoming in

October 2023, breaking above its 200-day Exponential Moving Average [EMA] while

confirming this breakout and forming an uptrend channel. The industry benchmark

isn't showing strong momentum. Still, it seems to be set for a moderate positive

performance as observed in the relative strength when compared to the broader

equity market, represented by the iShares Russell 2000 ETF (IWM), the positively

crossing Moving Average Convergence Divergence [MACD], and consistent buying

pressure, as indicated by the uptrending On Balance Volume [OBV] indicator.

PYPL is still underperforming the broader technology market, the Nasdaq

Composite (IXIC), or, more narrowly, the Nasdaq-100 tracked by the Invesco QQQ

ETF (QQQ), and buying pressure is still sluggish, as observed in the flat OBV.

However, as shown in its price action and the prolonged flat MACD, the stock has

bottomed. It is overcoming significant overhead resistance, a sign it could be

set up for entering a new uptrend cycle.

As PayPal continues to demonstrate strength due to operating optimization

and stable customer activity growth. Revenue totaled $7885 mln (+8.2% y/y). Total

payment volume totaled $416 814 mln (+10.7% y/y) and the total take-rate was

1.72% (-0.03% y/y). Decline in take-rate continues due to exceeding growth of

unbranded checkout (Venmo, Braintree) volumes. Adjusted EBITDA totaled $1701

mln (+19.3% y/y). Though the company doesn't disclose its headcount numbers,

operations & support expenses decreased to $436 mln (-11% y/y). It is likely

that PayPal will cut customer support, optimizing the bottom-line structure,

so the margins remain increasing even despite the exceeding growth of less

profitable business segments. Free cash flow totaled $1368 mln. Management

raised the guidance for free cash flow in 2024 from $5 bln to $6 bln

(We expect $6 bln). It is planned to direct all FCF toward repurchasing

shares. Annualized buyback yield will total ~ 8.1%.

PayPal is executing on its plans to reaccelerate business growth, as average revenue

per user and account engagement continue to rise at a fast pace. In the second quarter,

PayPal delivered growth in the number of active users for the first time since 2022,

with the metric expanding by 2 mln to 429 mln (+0.5% q/q). The average number of

transactions per active account was 60.9 (+11% y/y) and the

average size of a transaction was $63.3 (+2.2% y/y). Importantly, due to the initiative

to move merchants to the parent platform, the dilution of the payment structure slowed

down and the income of the transaction segment came to $3608 mln (+8% y/y).

The payment processing rate, or take rate, averaged 1.72% of TPV (-0.03% y/y). The faster

development of third-party networks (Venmo, Braintree) continues to weigh on the take rate,

but management said it keeps working on Braintree's pricing, so we believe that

transaction processing margins, while still being squeezed, will return to moderate

growth as early as 2025 as merchant agreements are renegotiated. The most important

aspect that management discussed at the conference call was competition.

For the past few months, the market has been wary of increased competition from Apple and

other payment service providers, but the growth of PayPal's total payments volume remains

healthy. Moreover, PayPal's market share in the PC payment niche remained unchanged, and

the service continues to be the most popular payment method for online shoppers that use

their PCs and laptops.

On the expenses side, PayPal's costs dynamics were also in line with our expectations, and we only adjusted them taking into account factors such as, The company continued to cut support staff in the second quarter, which has a positive effect on margins. The company continued to cut support staff in the second quarter, which has a positive effect on margins. As such, we set the EBITDA forecast for 2024 at $6765 mln (+12.4% y/y) and for 2025 at $7 353 mln (+8.0% y/y).

The company's management raised the guidance for free cash flow in 2024 from $5 bln to $6 bln (we forecast $6077 mln). All of the FCF earned in 2024 is set to be directed toward share repurchasing. That amount would be equivalent to 8.1% of the company's capitalization. We assume that, while the stock is cheap, the company will continue to buy back its shares from the market, with the spending on the repurchase potentially reaching as much as $8 bln (11% of the current market capitalization) in 2025.

Risks

PayPal has underperformed the market for quite some time due to negative information

background. Though financials have been growing at healthy rates, delivering revenue

& EPS beats for many consecutive quarters, the narrative has been largely negative.

PayPal's strategy isn't about aggressive market expansion. It was back in 2022 when

the management said that loyal customer activity was the main focus, and the strategy

is working perfectly. If we look at Q2 2022 operating metrics, there were 429 mln active

customers, about 5 513 mln payment transactions and $339 719 mln of total payment volume.

Then, in Q2 2024 there were still only 429 mln active accounts, but the payment

transactions number grew to 6 580 mln and the TPV - to $416 814 mln. Basically,

the LTV of an average PayPal customer increased by 23%, far outpacing inflation rates.

PayPal isn't burning cash trying to compete with digital payments upstarts. Rather than

fueling rivalry, the company prefers to collaborate. It's better to make a dollar on a

cross-transaction than to spend a hundred on the possibility of making two dollars sometime

in the future. Cooperation already includes Apple Pay, Payoneer, Mastercard and many other

companies. Recently, PayPal agreed to expand its partnership with Adyen, which will provide

additional momentum for branded checkout.

Although there is serious competition in mobile payments, PayPal's management mentioned

that they don't see the market share deteriorating in the PC segment.

The digital payments industry is highly competitive, with significant players like Apple,

Square, and traditional financial institutions ramping up their efforts. Apple's expanding

presence with Apple Pay, in particular, poses a threat to PayPal's market share, especially

in the mobile payments segment. Although PayPal has maintained its dominance in the PC

payment niche, increased competition could erode its market position over time.

We believe that the risk is mostly mitigated by the collaboration efforts, and the

risk-premiums are already attractive enough.

We believe that management's efforts to encourage merchants to use Branded Checkout

(Fastlane, PPCP) will support the TPV structure and margins, but there's still a risk

that profitability could decline in the future, especially as the impact of cost

reductions fade.

PayPal's strategy relies heavily on partnerships with other payment service providers

and technology companies. Any disruption or changes in these relationships, such as a

shift in priorities or technological compatibility issues, could negatively impact

PayPal's ability to grow or maintain its market share.

As a global payments provider, PayPal is subject to a complex web of regulations across

different jurisdictions. Changes in regulatory frameworks, data privacy laws, or financial

transaction standards could impose additional costs or limit the company's operational

flexibility. Moreover, any legal disputes or fines related to compliance issues could

harm PayPal's reputation and financial standing.

PayPal's performance is tied to consumer spending and global economic conditions.

Economic downturns, fluctuations in currency exchange rates, or changes in consumer

behavior could adversely affect the company's transaction volumes and overall revenue

growth. Additionally, PayPal's exposure to international markets increases its

vulnerability to geopolitical risks and regional economic instability.

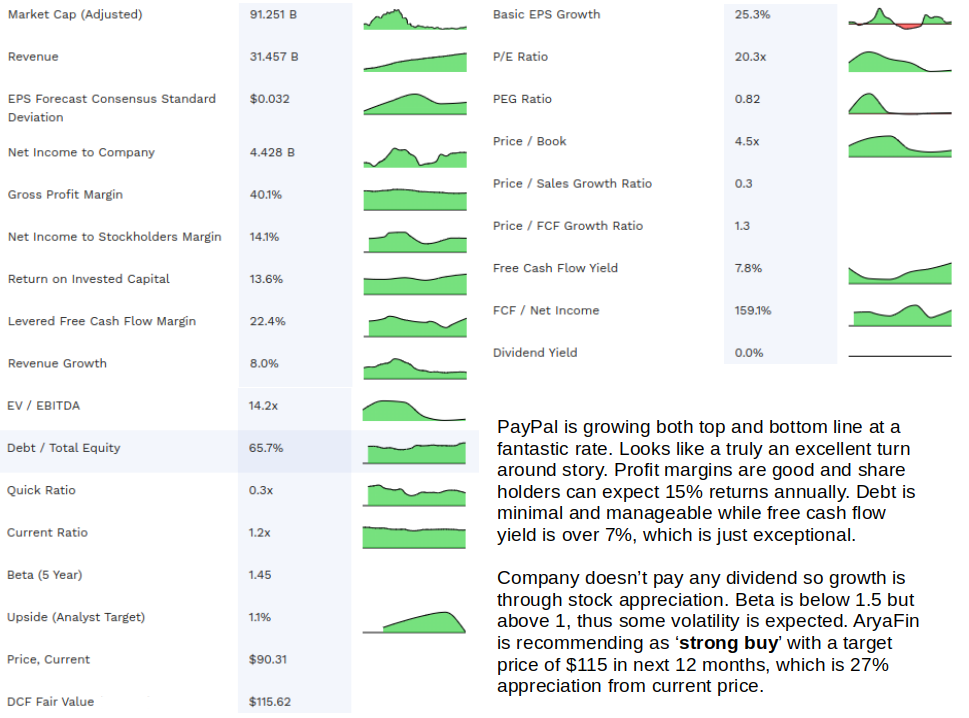

Conclusion

PayPal's ability to maintain revenue growth and optimize its operational structure

highlights its resilience in a competitive market. The company's focus on enhancing

customer engagement and leveraging strategic partnerships positions it well for

sustained performance. With strong free cash flow supporting shareholder returns through

buybacks, PayPal is set to deliver value even as it navigates challenges from competitors.

Overall, PayPal's balanced approach between growth and profitability makes it a compelling

investment opportunity.

To manage the position, we recommend keeping an eye on financial statements of PayPal

and its competitors (Visa, MasterCard, Affirm, Square) industry research (McKinsey,

Capgemini, Worldpayglobal).