About - Carnival Cruise Lines : CCL

Summary

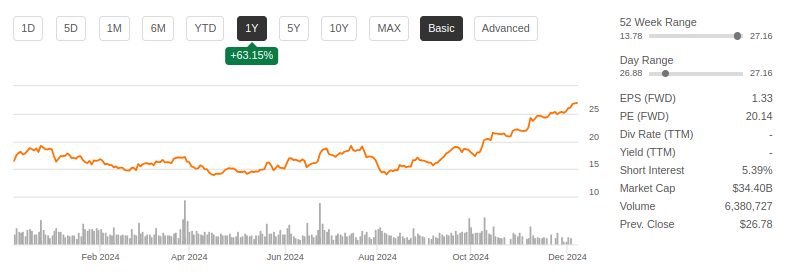

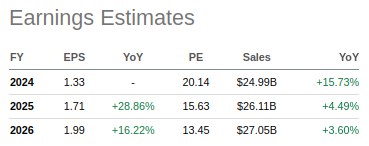

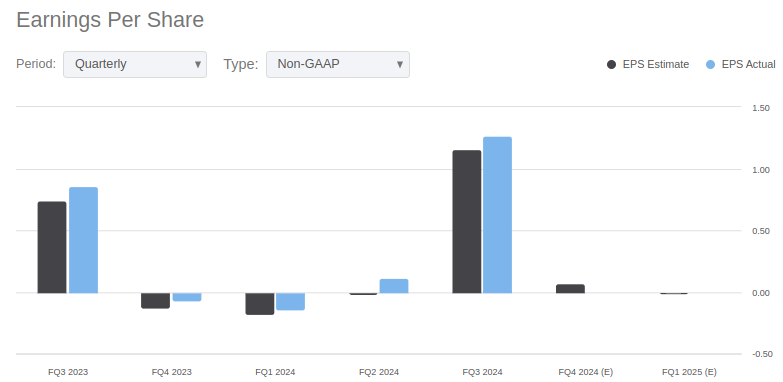

- Carnival Cruise Lines (NYSE:CCL) in its September 30th, 3Q24 earnings release achieved one of the best post-Covid performances in the entire consumer leisure space. It broke the records of many of its pre-Covid metrics. In brief, it appears the company has now shed most of its Covid blues. Its strategy post-Covid bears a similar focus to that of Warner Bros. Discovery (WBD): FCF, mainly aimed at rapid debt repayment.

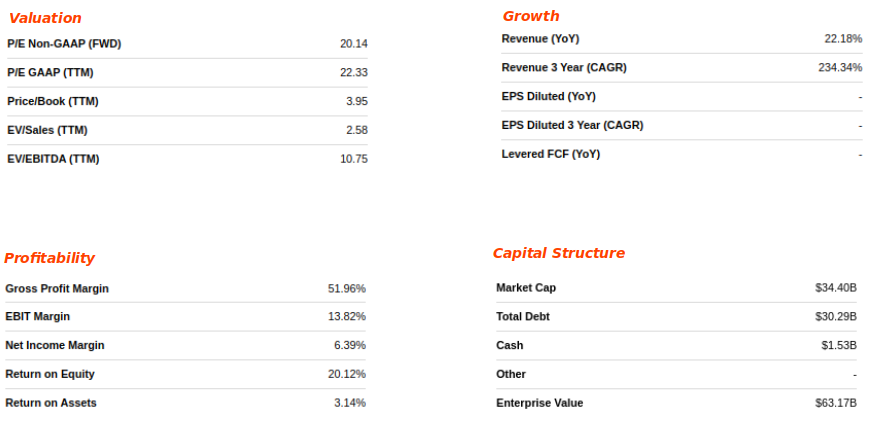

- Generating max FCF devoted to paying down massive debt as speedily as possible unfortunately doesn't work for WBD stock, but it clearly has for CCL. Getting the balance sheet healthy, cutting operating costs and rebuilding the fortress of product and marketing expansion that propelled you to global leadership in the sector is the CCL pathway. Moody's, S&P and Fitch have all upgraded CCL's credit ratings to BB. The balance sheet is getting healthier. Management says it's committed to continuing paydowns.

Business

Carnival Corporation & plc engages in the provision of leisure travel services in North

America, Australia, Europe, Asia, and internationally. The company operates through four

segments: NAA Cruise Operations, Europe Cruise Operations, Cruise Support, and Tour and Other.

It operates port destinations, private islands, and a solar park, as well as owns and operates

hotels, lodges, glass-domed railcars, and motor coaches. The company offers its services under

the Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, Costa Cruises,

AIDA Cruises, P&O Cruises, and Cunard brand. Additionally, it sells its cruises primarily

through travel agents, tour operators, vacation planners, and websites. Carnival Corporation

& plc was founded in 1972 and is headquartered in Miami, Florida.

Moat & Earnings

There are three classifications for cruise brands: contemporary, premium and luxury.

Contemporary brands are the broadest segment of the cruise vacation industry, appealing mostly

to families with children of all ages, with a focus on features to please all customers.

Cruises tend to last 7 days or less.

The premium brands focus on quality, comfort and often have more destination-focused

itineraries. Cruises in this category tend to last between 7 and 14 days.

The luxury experience might have the same duration as the premium brands, but they come with

the highest standards of accommodation and service, along with smaller vessel size and often

exotic itineraries (being smaller, they can access ports that bigger ships cannot).

The industry is dominated by a few big players: Carnival Corporation, Royal Caribbean Group,

Norwegian Cruise Line Holdings and MSC Cruises. Together, these represent approximately

80% of global cruise industry supply.

Carnival Corporation, along with its peers, was extremely impacted by the pandemic, as the

industry saw its business disappear during the peak of the lockdowns. The volume of

passengers started normalizing only in 2023.

Seasonality is a major factor in the industry, as demand for cruises peak in the third quarter (roughly May-September), resulting in higher ticket prices and occupancy levels. Strategically, companies will often schedule maintenances in the first and second quarters, to ensure that most of the ships will be available for the peak season.

Roughly ~30% of the revenue comes from onboard activities, which customers pay for separately (not included in the regular ticket, unless specifically bought in a bundle package). Most of these are offered by independent concessionaires, which pay a percentage fee to Carnival Corporation. These can be exclusive beverages, casinos, full-service spas, art sales, laundry and dry-cleaning services, among other services.

br>

In addition, net earnings ultimately increased by 28.8% for the last six-month period because of the accompanying decrease in benefits and claims. Think of benefits and claims as the expenses that AFL has to incur during the quarter. Total benefits and expenses decreased by 6.2%, amounting to $6.38B, which was a decrease over the prior year's total of $6.8B.

What CCL management confirmed in response to 3Q analyst questions that they do not see the growing niche of river cruises in their priority list despite growth in that sector. Also, no dividends in sight until the debt load gets much lighter and the revenue arc as planned comes in as planned. Greece, a potential new but small market, is still in negotiations with local officials.

Over 73% of 95m US millennials surveyed by Pew Research answered 'yes' when asked if they would like to go on a cruise. The considerations: cost, short durations, and fun themes. Cruising has long appealed to older and retired generations - the average age of cruisers being 62, comprising a large percent of passengers on longer distance and farther geography vacations. In brief, the runaway share leadership by CCL disproportionately benefits from the growth of these two demos. Baby boomers count, of course, but that cadre is starting to decline as a key segment for marketing.

Y for You, O for Only, L for Live, O for Once - hence Yolo. Drilled somewhat down, Pew researchers found the generation less interesting in acquiring things. This includes cars, status jobs, upscaled living quarters, high fashion clothing, jewelry, and all manner of things prior generations strived for over decades. Instead, their value system's foundation is experience. Food, restaurant dining, travel for exploring and expedition, smartphone babble, gatherings with friends, healthy lifestyles, pop culture. Neatly fit inside this youth bubble is the cruise. CCL is the biggest and best, catering to the mass of the younger generation with offerings that match their YOLO inclinations.

Risks

There are quite a few risks to this thesis:

1. Another global pandemic. The last one almost bankrupted the company.

While I think this is unlikely, it's important to point out that I don't believe CCL

can survive another period of lockdowns.

2. Rising fuel costs. War in the Middle East being the most likely, but not the only,

factor that could lead to a rise in oil prices and subsequently, fuel costs. This could

severely impact CCL's margins.

3. Skyrocketing interest rates. Despite its aggressive deleveraging plan, CCL currently

carries a lot of debt, and higher interest rates might make it harder for the company to

refinance at lower rates.

Conclusion

Despite these considerations, I think CCL offers an attractive risk/reward at current levels,

with a healthy margin of safety.