About - Aflac Inc : AFL

Summary

- Aflac has demonstrated financial strength through its increased revenue, net investment gains, and decreased benefits and claims.

- The current dividend yield remains modest at 1.8%, but the dividend growth rate sits in the double digits. This is accompanied by an extremely healthy payout ratio.

- AFL's portfolio of debt investments, including middle market loans and commercial real estate, has helped generate higher revenues, but vulnerability exists with potential interest rate cuts and poor credit ratings.

Business

Aflac Incorporated, through its subsidiaries, provides supplemental health and life

insurance products. The company operates through Aflac Japan and Aflac U.S. segments.

The Aflac Japan segment offers cancer, medical, nursing care, work leave, GIFT, and

whole and term life insurance products, as well as WAYS and child endowment plans

under saving type insurance products in Japan. The Aflac U.S. segment provides

cancer, accident, short-term disability, critical illness, hospital indemnity,

dental, vision, long-term care and disability, and term and whole life insurance

products in the United States. It sells its products through sales associates,

brokers, independent corporate agencies, individual agencies, and affiliated

corporate agencies. Aflac Incorporated was founded in 1955 and is headquartered

in Columbus, Georgia.

Moat & Earnings

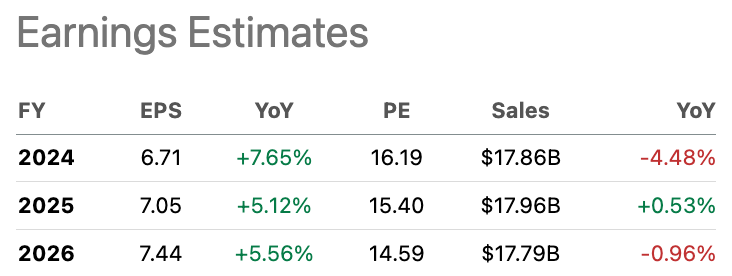

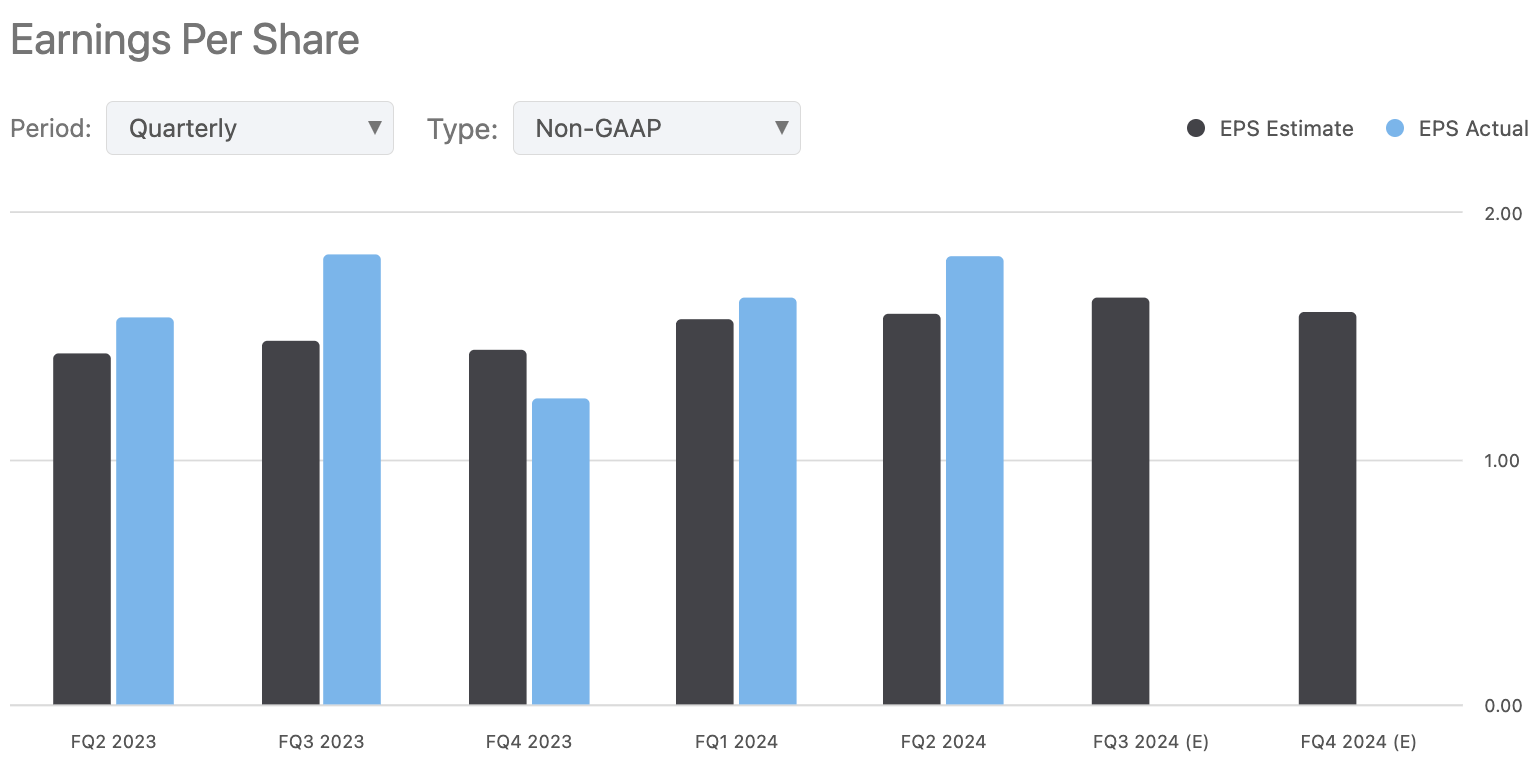

About a month ago, AFL reported their Q2 earnings, and the results were positive. On one end,

earnings per share came in at $1.89 and beat expectations by a sizeable $0.29 per share.

This was a large increase from the prior year's total of $1.58 per share, representing a

growth in earnings of 15.8%. Additionally, revenue for the quarter was reported at $5.1B,

which beat expectations by $830M. However, on a year-over-year basis, the revenue

decreased by about 0.6%.

In addition, net earnings ultimately increased by 28.8% for the last six-month period because of the accompanying decrease in benefits and claims. Think of benefits and claims as the expenses that AFL has to incur during the quarter. Total benefits and expenses decreased by 6.2%, amounting to $6.38B, which was a decrease over the prior year's total of $6.8B.

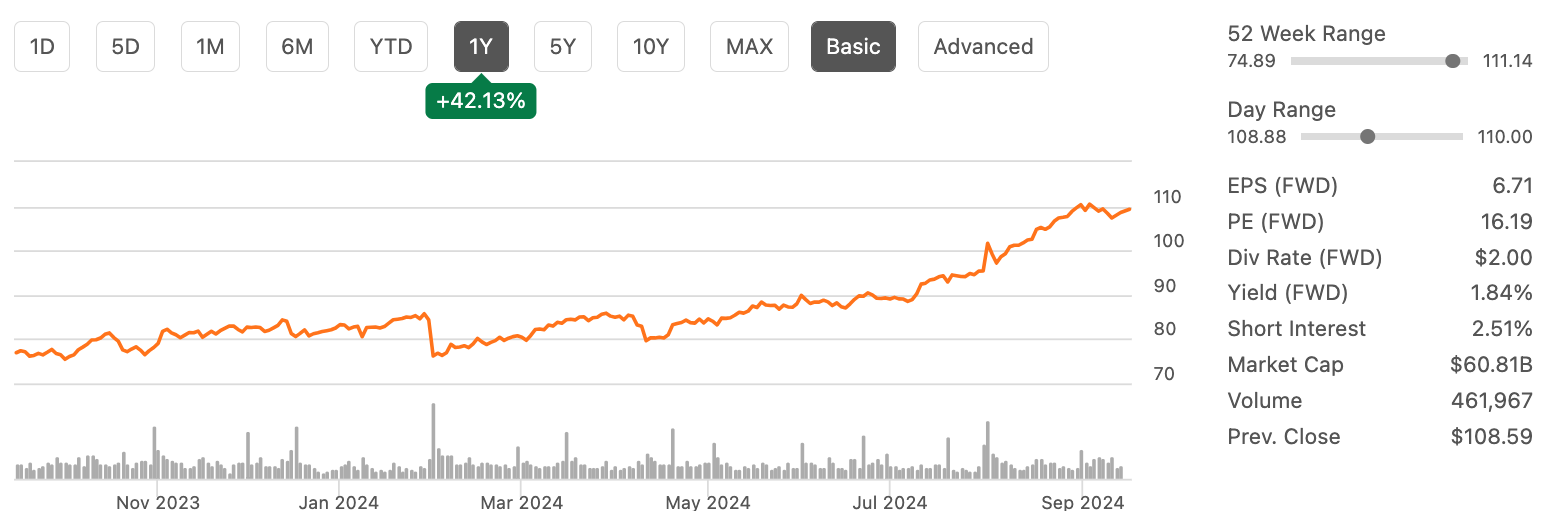

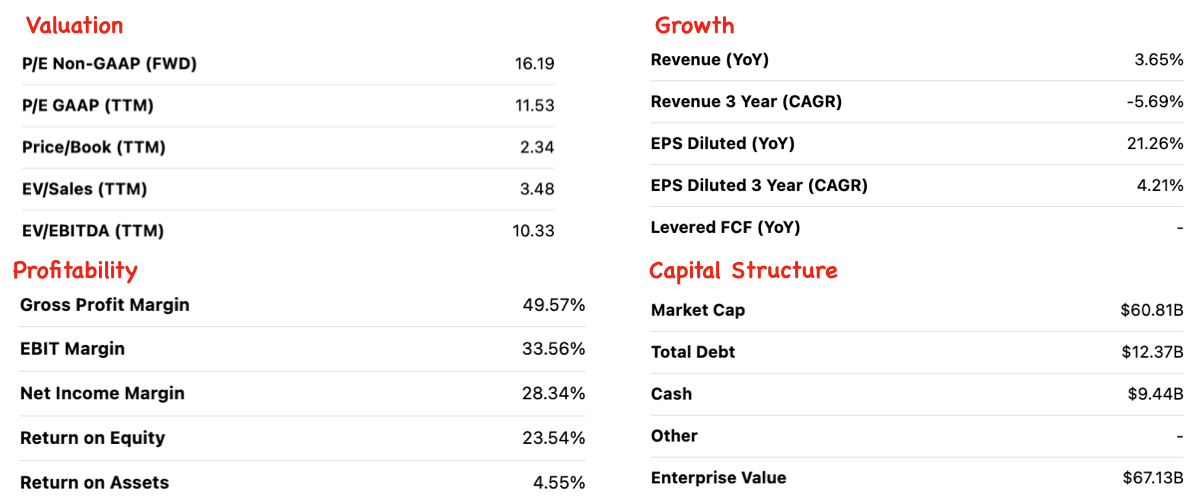

AFL currently trades at a forward price to earnings ratio of 11.1x, which undercuts the sector median of 12.3x. Therefore, AFL could still have some upside potential. Year-over-year EBITDA growth has been massive at 22.8% which is accompanied by an EBITDA margin of 33.6%. While future interest rate cuts may slow down the rate of growth, I still believe that this strong performance will result in continued upside. AFL currently has a Quant rating of a strong buy with a score of 4.78. However, I think it's worth shifting focus to AFL's portfolio of debt investments since it has helped the business generate elevated levels of income and grow earnings more rapidly.

Aflac has been able to generate higher revenues through its diverse portfolio of debt investments. Aflac maintains a portfolio of exposure to middle-market loans and commercial real estate. Starting with the loan portfolio, AFL has been able to efficiently capitalize in the current high interest rate environment due to following a floating rate structure on first-lien senior secured loans. A floating rate structure has been beneficial because as interest rates rise, so do the amount of interest payments received from borrowers. As a result, it's no coincidence that AFL's price took off alongside the federal funds rate.

They've managed to secure these investments on a senior secured basis as well, which offers a greater sense of security and stability. First-lien senior secured debt sits at the top of the corporate capital structure, which means that it has the highest priority for repayment. This is helpful in cases where borrowers default on their debt and need to liquidate assets because it ensures that AFL recovers some invested principal rather than losing everything.

The loan portfolio also remains highly diversified across many sectors, with a primary focus on healthcare investments accounting for 24%. AFL tens to focus on making investments to companies with an EBITDA range below $50M as it offers a larger window of opportunity for growth. Their loan portfolio has a net book value of about $4.4B with a yield of 11.05% that's spread across 299 individual issuers.

AFL also maintains investments in commercial real estate. Total net book value sits at $7.2B with a yield at 7.7%. Similarly to the loan portfolio, AFL's real estate exposure has been structured on a floating rate senior secured basis and maintains a high level of diversity across property type and geography. The largest property type in their portfolio consists of multifamily properties, accounting for 42%. The portfolio spans across office buildings, retail properties hospitality, and industrials.

As of the latest declared quarterly dividend of $0.50 per share, the current dividend yield sits at 1.8%. The dividend remains well-supported with a payout ratio of only 28%. This is extremely impressive for a company that has consecutively increased their dividend payouts for over 41 years in a row. For reference, the sector median dividend payout ratio sits close to 40%. Not only does it remain at a low risk of cuts, but the dividend growth rate has also been extremely impressive.

Risks

While the portfolio of debt investments has helped AFL generate higher levels of earnings

since rates were hiked to their decade highs, I do believe the time of higher rates is

coming to an end. When rates start to get cut, AFL may not be able to continue pulling

in the same levels of net investment income. Interest rates will decrease and the

portfolio of middle-market loans will no longer be able to pull in higher interest

payments from borrowers. Therefore, we may see a dip in income that's generated from

their debt investments and if revenue doesn't grow. However, impacts here could

potentially be offset by positive growth of the commercial real estate portfolio as

occupancy levels increase.

We also have to take into consideration that AFL's portfolio of debt investments has poor

credit ratings. Their debt investments have been exposed to borrowers that are rated below

investment grade. We can see that the average credit rating of their borrowers is mostly

rated at a BB. For reference, credit ratings of BBB- and below are considered below

investment grade. This simply means that these borrowers may not have strong balance

sheets with large cash cushions to help them navigate extended headwinds. This increases

how vulnerable they are to challenging market conditions and can lead to an increased

rate of defaults in a higher interest rate environment.

We have no idea where interest rate cuts will fall yet, but if they are not significant,

AFL still remains vulnerable to defaults within its portfolio. Lastly, the commercial

real estate portfolio contains office property exposure, which has not been an ideal

sub-sector of real estate. As remote work continues to become more globally accepted

as a norm, the demand for these properties is seeing a shift. This remains an area

of the portfolio that I suspect will see low occupancy levels and not fulfill its

full income-earning potential.

Conclusion

AFL portfolio of investments has brought in higher net investment income that has

contributed to accelerated earnings growth. Additionally, the dividend remains

well-supported by a very low payout ratio that leaves plenty of room for future growth.

The dividend continues to grow at a double-digit rate, which can enable a rapid growth

of dividend income when held with a long-term outlook in mind. Therefore, AFL makes

for a great dividend growth holding and the total return has the potential of being

comprised of both capital appreciation and income.