Weekly Market Commentary - Sept 7th, 2024 - Click Here for Past Commentaries

The labor market is clearly alarmingly slowing down.

-

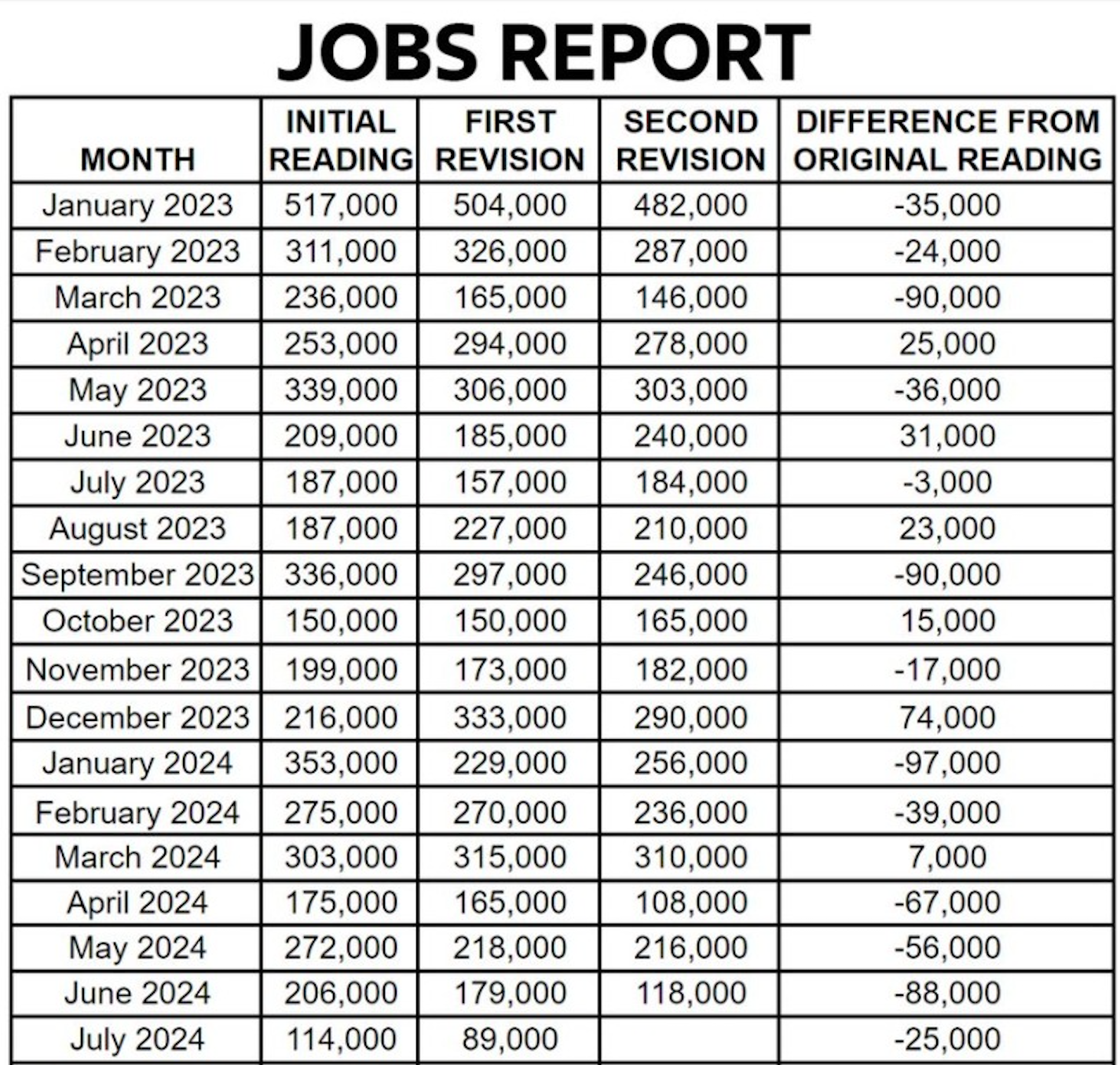

The U.S. labor market was a key focus point for investors last week, with Friday's

August nonfarm jobs report perhaps being the most highly anticipated data

point of the week. Overall, the jobs report confirmed signs of a weakening

U.S. labor market — with a drop in the unemployment rate from 4.3% to 4.2%

offset by a clear softening trend in new jobs added and several downward

revisions. After the soft jobs report, markets continued a sell-off that

began in the seasonally volatile month of September. The S&P 500 is down

about 4% from recent highs but remains higher by more than 13% year to

date. In our view, the slowing labor market certainly adds risk to the

economic outlook, but the figures thus far don't point to an imminent

collapse or recession in the short term.

Above chart is distrubing though, is labor data manipulated during meetings and then revised quitely? What used to be abnormal is new normal.

-

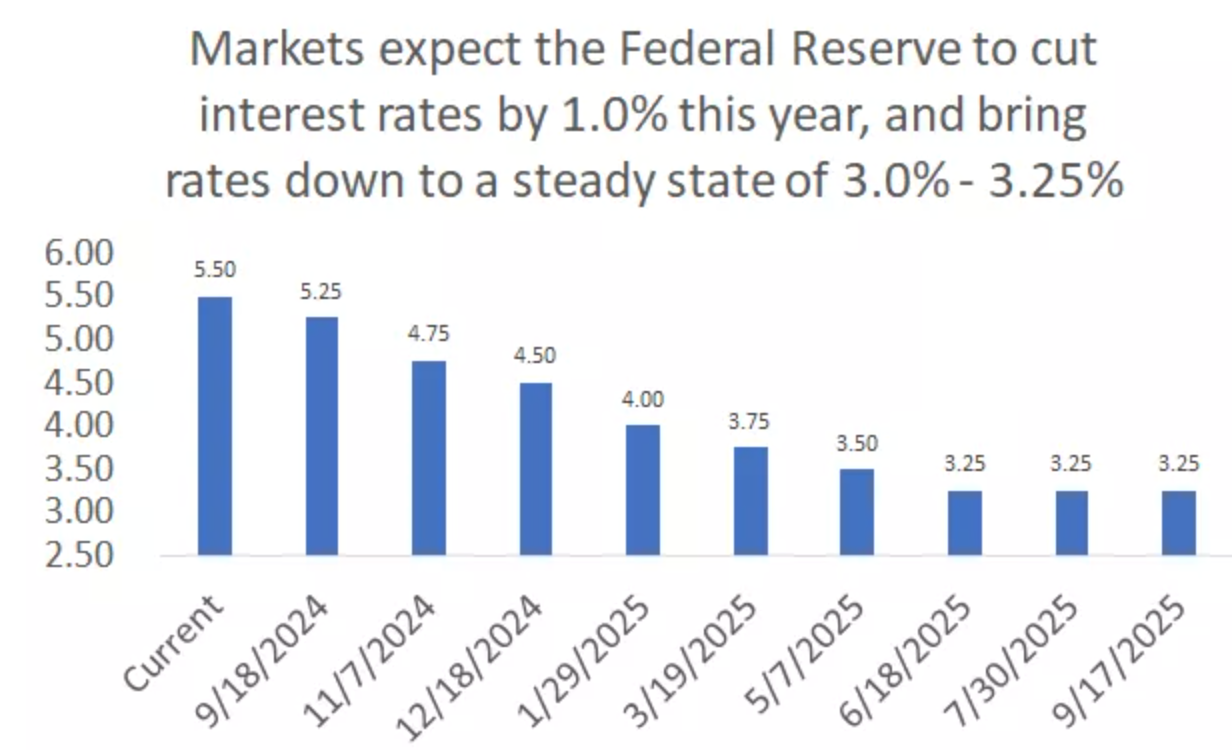

Markets now turn their attention to the path of the Federal Reserve, and how

recent softer labor market data, combined with softer inflation readings,

could impact potential interest rate cuts. While we still believe the Fed

will begin its rate-cutting cycle Sept. 18 with a 0.25% rate cut, the

probability of a 0.50% rate cut has increased, given the recent softening

economic data. The Fed will also provide an updated set of economic projections

and a new "dot plot," which outlines FOMC (Federal Open Market Committee)

members' best guess at future rate cuts as well. We believe the Fed will

be ready and willing to support the labor market and could set the stage

for potential outsized rate cuts as needed.

-

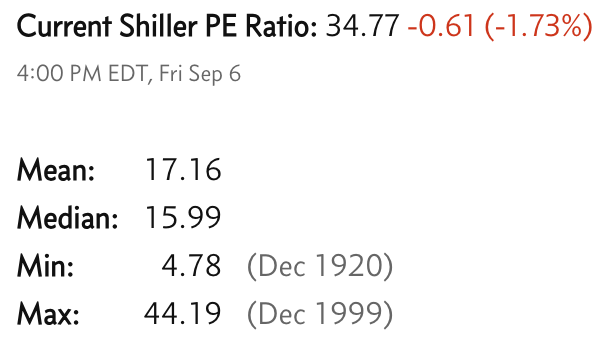

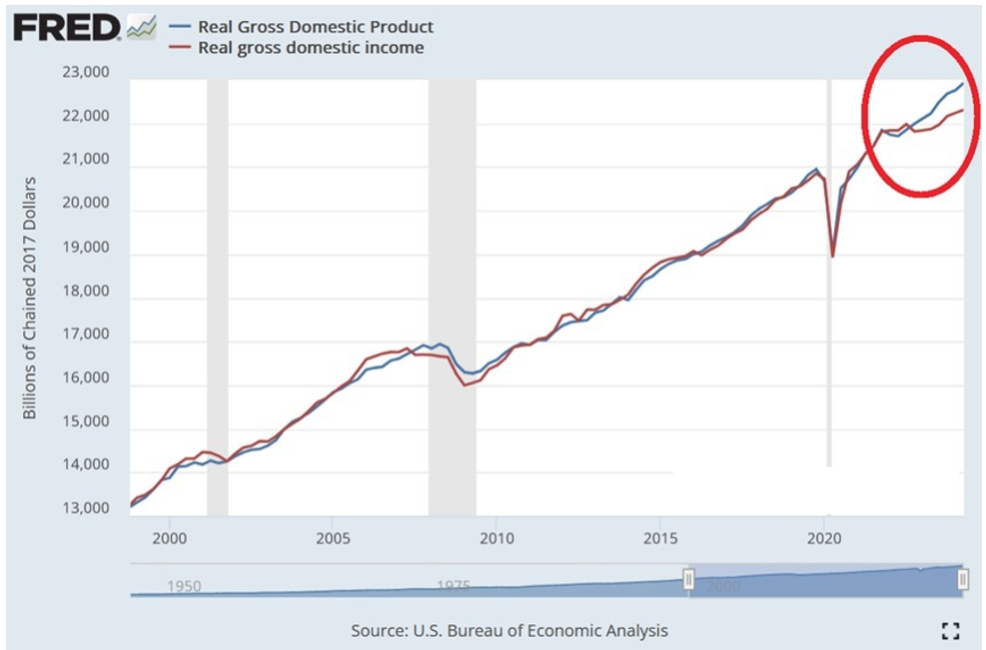

Overall, markets have had a strong run this year through the end of August, with

the S&P 500 up about 18% during that time frame. We are now entering a seasonally

choppy period for markets in September and October, followed by U.S. elections

on Nov. 5. Given the uncertainty in the economic (and political) environment,

we could perhaps see a correction in markets materialize in the typical 5% to

10%+ range in the weeks ahead. Below is GDP analysis.

-

The U.S. labor market data last week could be summed in on word: weakening.

We saw this earlier in the week in the job openings data, which fell to

around 7.7 million, the lowest level of the year, as well as in the ADP

private employment data, which indicated new jobs added of just 99,000,

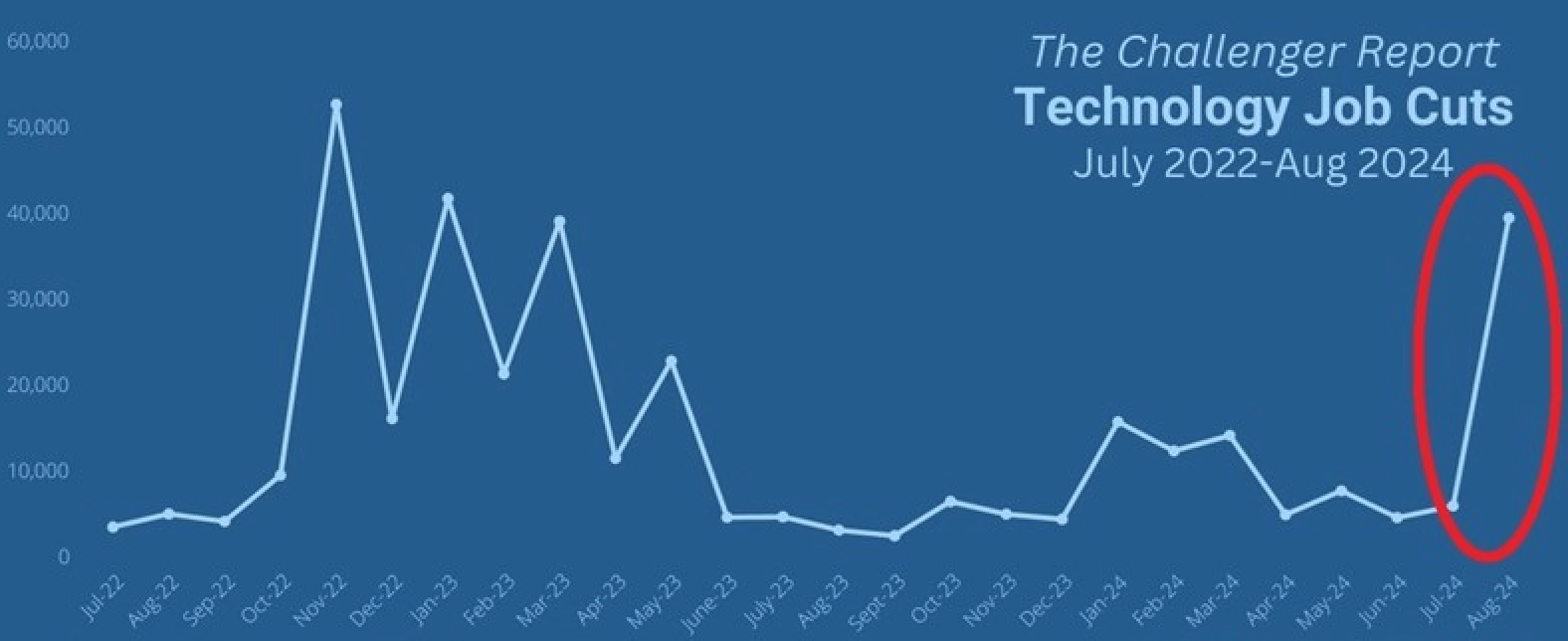

also at the lowest level since 2021.1 And perhaps the most anticipated

labor market report of the week was the U.S. nonfarm jobs report, which

reflected a similar weakening trend. New jobs came in at 142,000, below

the expected 165,000, and the past two month's figures were revised lower

by 86,000, bringing the three-month average job gains to a more subdued

116,000, well below the average of around 334,000 over the past three

years. Below is tech job cuts chart.

-

Underneath the surface, there were notable shifts in sector trends for new

jobs as well. The manufacturing sector was particularly weak, losing 24,000

jobs, versus expectations of losing 2,000. This comes as the ISM Manufacturing

survey data last week also indicated that the U.S. manufacturing sector remained

in contraction. Meanwhile, the sectors with the largest jobs gains were in the

services economy, including leisure and hospitality, education and health services,

and government sectors. But job growth in all three of these areas was lower than

the gains we saw last year, signaling perhaps that peak job growth even in services

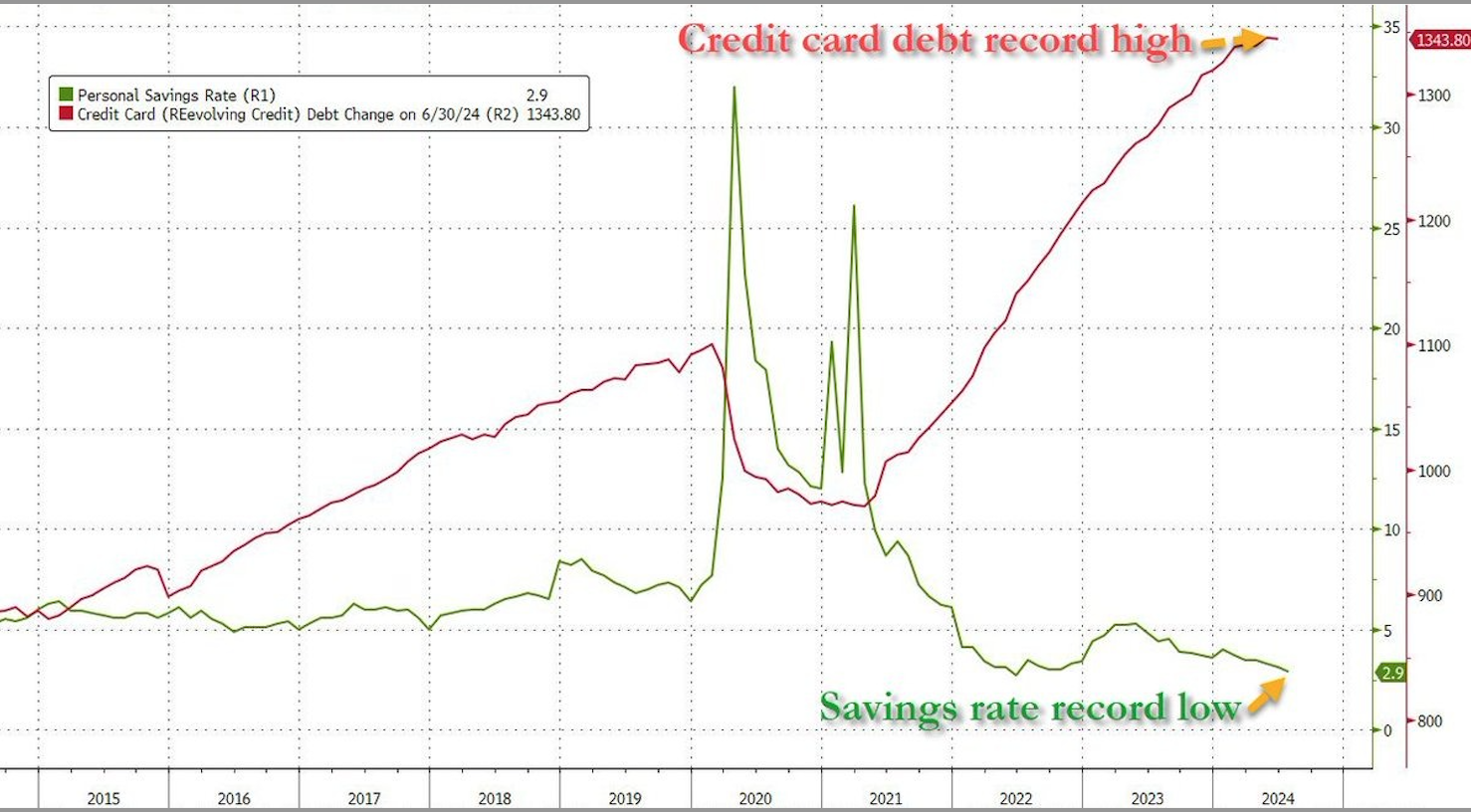

sectors may be behind us. Alarming is saving vs. credit card debt.

-

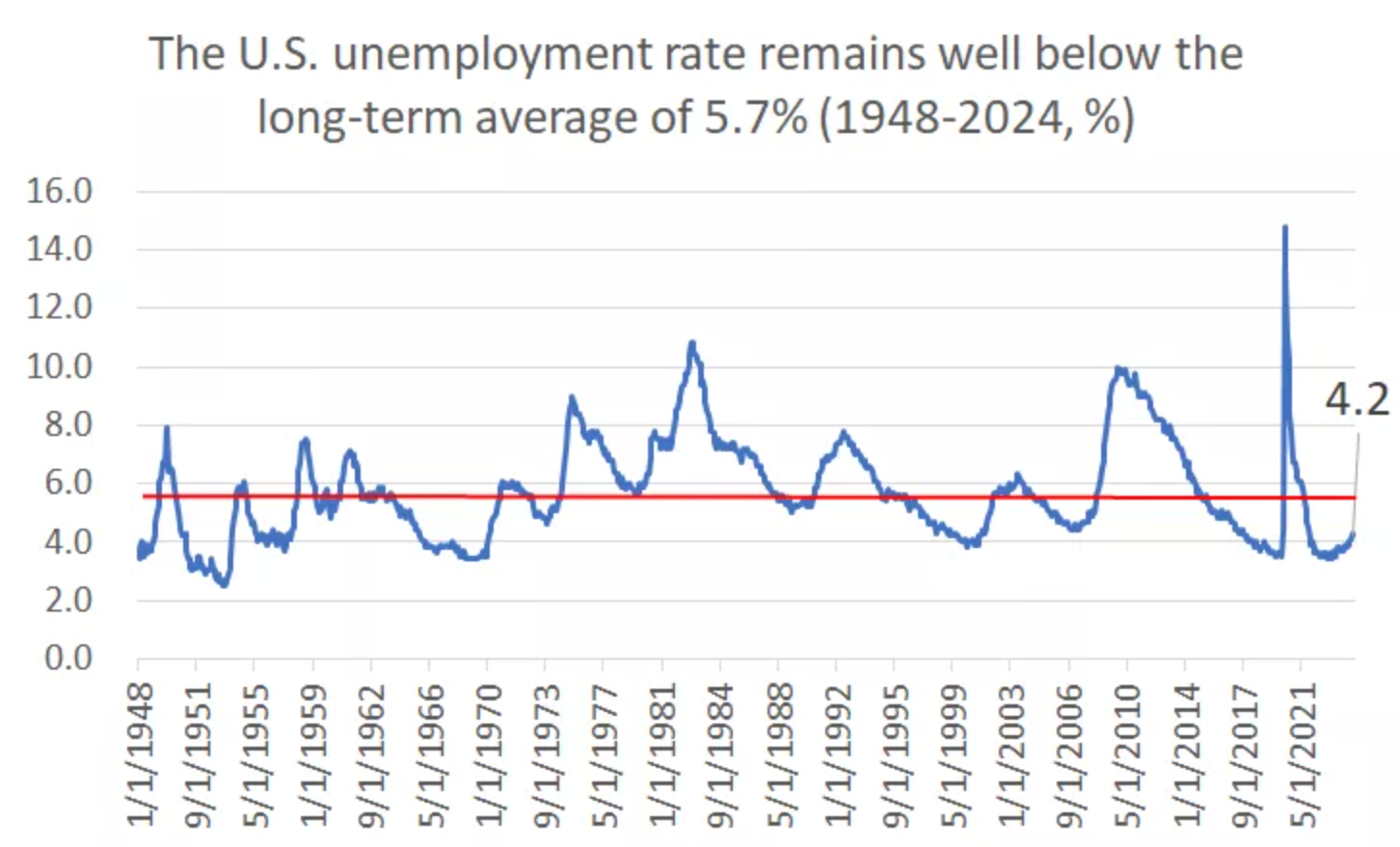

There were, however, some silver linings in the U.S. jobs report. The unemployment rate,

for example, did tick lower from 4.3% to 4.2%. While this is still above last year's

lows of 3.4%, the unemployment rate remains well below the long-term average of a U.S.

unemployment rate of 5.7%. Also, the unemployment rate has moved higher in large part

because new entrants have come into the workforce, not because layoffs or job losses

have climbed meaningfully. Finally, although the 142,000 jobs added last month were

below expectations, they do remain in line with the 10-year pre-pandemic average of

around 180,000. This to us indicates that while the labor market is softening, we

are not yet at negative job growth or recession-like levels.

-

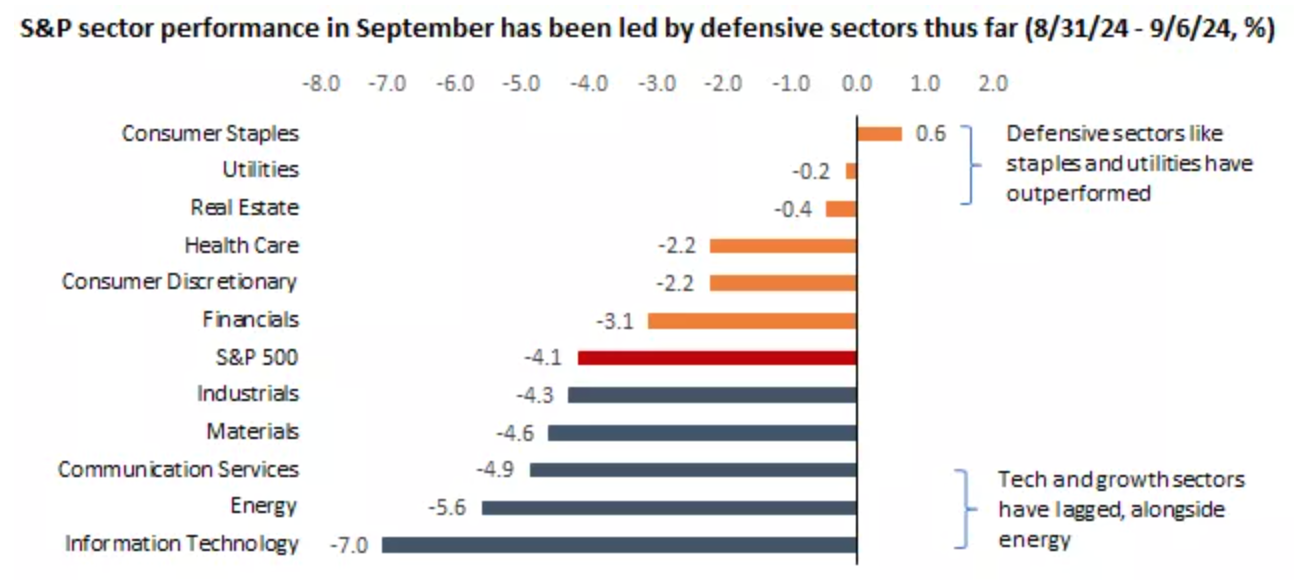

Thus far, for September, we have already seen about a 4% pullback in the S&P 500.

However, the sectors that have outperformed most are consumer staples and utilities,

both considered defensive sectors that can hold up well in a period of economic slowdown.

-

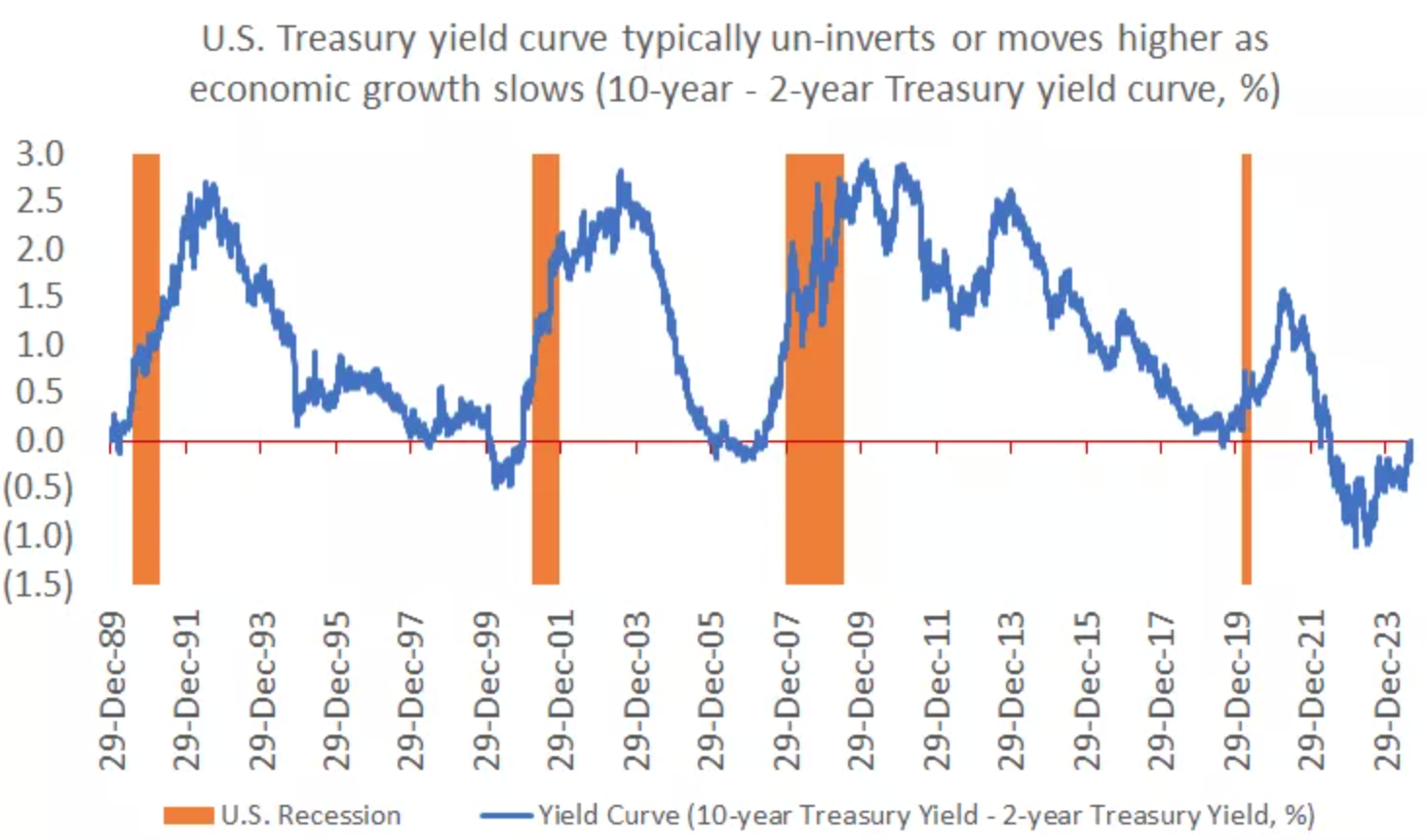

More recently, we have seen Treasury yields across the board move lower, in response to

weaker labor market data as well as the potential for Fed rate cuts. Notably, the yield

curve (10-year Treasury yield minus 2-year Treasury yield) has turned positive in recent

days after remaining in negative territory since mid-2022. This un-inversion of the yield

curve, however, tends to occur as the Fed is poised to cut rates and when the economy

is softening.

-

Crude oil prices hit new lows of the year: The S&P Global Commodity index has also hit

new lows of the year, driven in part by WTI crude oil prices, which are now around $68

per barrel. The sell-off in oil and commodities also reflects the fears of a demand

slowdown globally, particularly in the Chinese market, which has been plagued with weakening

consumer and economic growth.

-

Fed will likely cut rates by 0.25% at the September 18 FOMC meeting, bringing the fed funds

rate to 5.0% – 5.25%. If market conditions deteriorate substantially between now and the

Fed meeting, a 0.50% rate cut may become more likely.

-

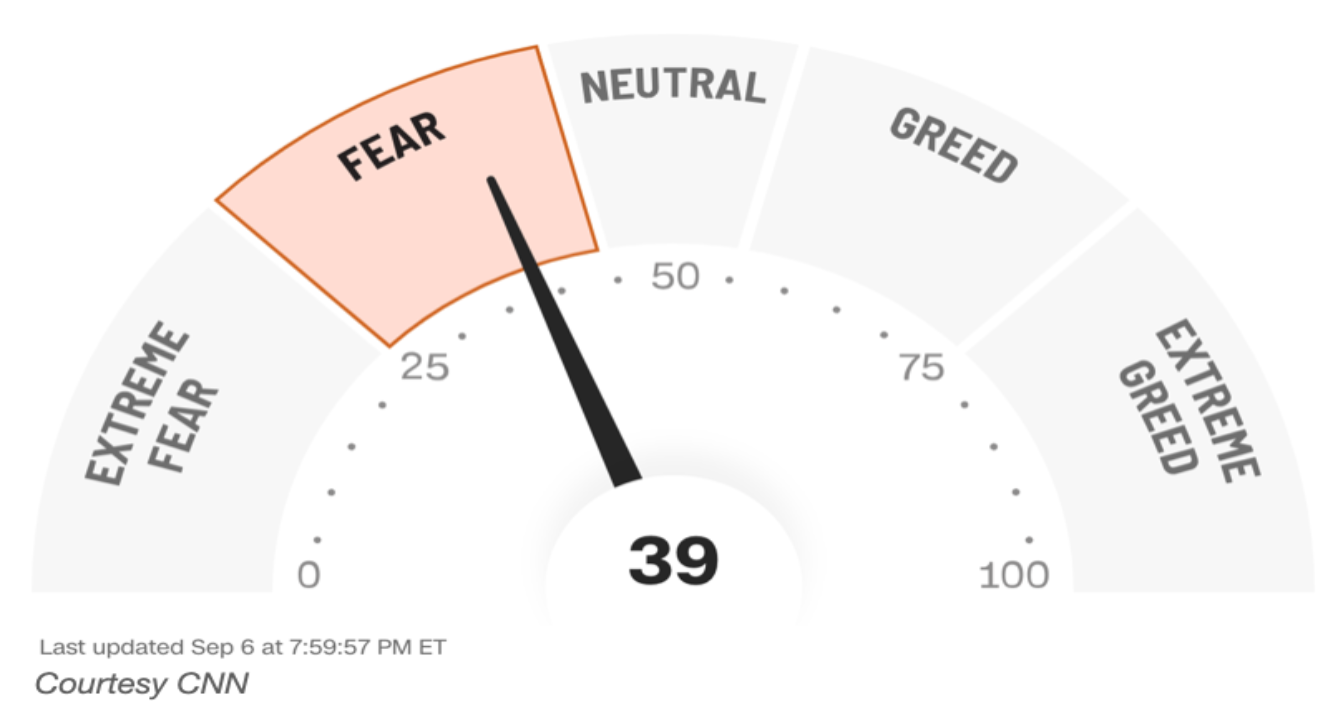

Word of Caution: Markets are clearly expressing more caution across

asset classes, perhaps rightfully so after a strong rally and weakening economic

data. CNN Business Fear & Greed Index is at 39 as of Sept 6th 2024.

Below is our daily sector performance report - warrants caution.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.