Weekly Market Commentary - Sept 28st, 2024 - Click Here for Past Commentaries

-

Stocks hit new record highs again last week, riding the wave of optimism that has

come from the Fed's recent rate cut, ongoing AI enthusiasm, and signs of broadening

leadership underneath the surface of the bull market.

-

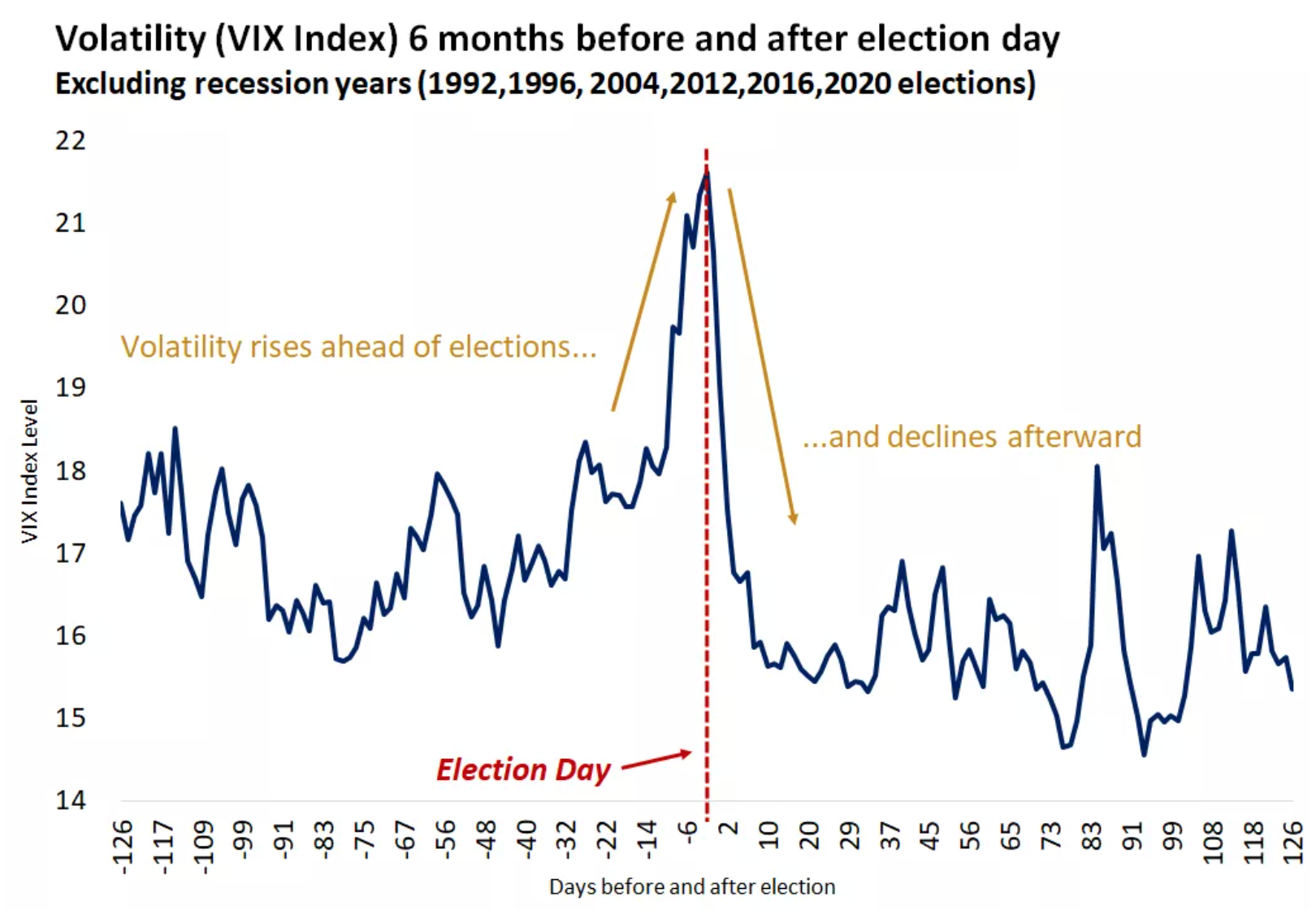

Markets have performed well in the lead up to this year's presidential election.

Stocks were higher again last week, notching the sixth weekly gain in the last seven,

with an impressive gain of 11% just since early August.

-

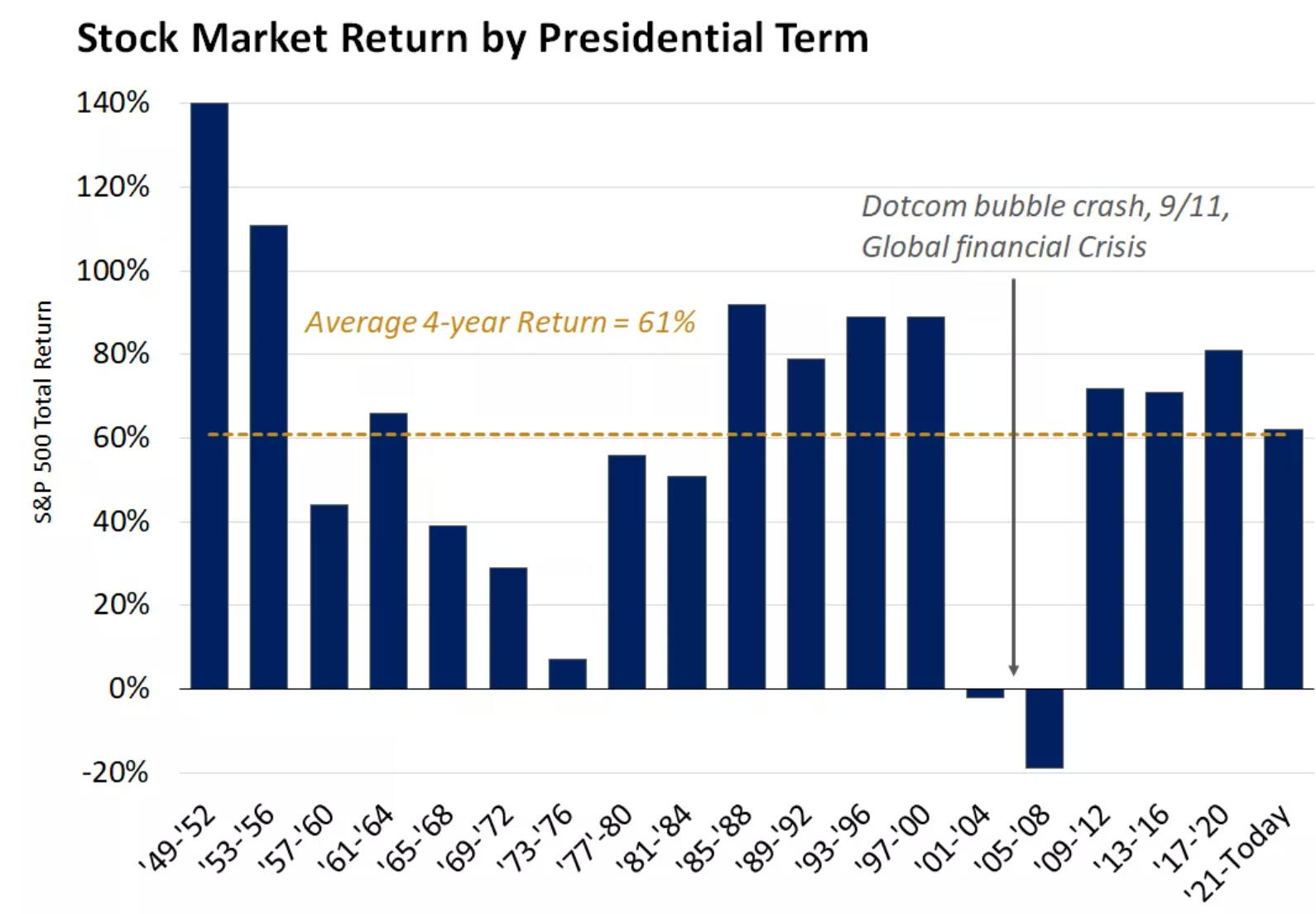

Over the past 80 years, in the one month leading up to presidential elections, the

stock market was positive for that month in only slightly more than half the years.

However, from the election through year-end, the market was positive during that

period in all but three years. It's worth pointing out that the largest post-election

(through year-end) gains occurred in (in descending order): ´20, '52, '60, '04, '80,

'72, '16, '96, '76, '92. This is composed of five Republican wins and five Democrat

wins, reflecting the fact that markets have taken their direction more consistently

from broader fundamental conditions than from political parties.

-

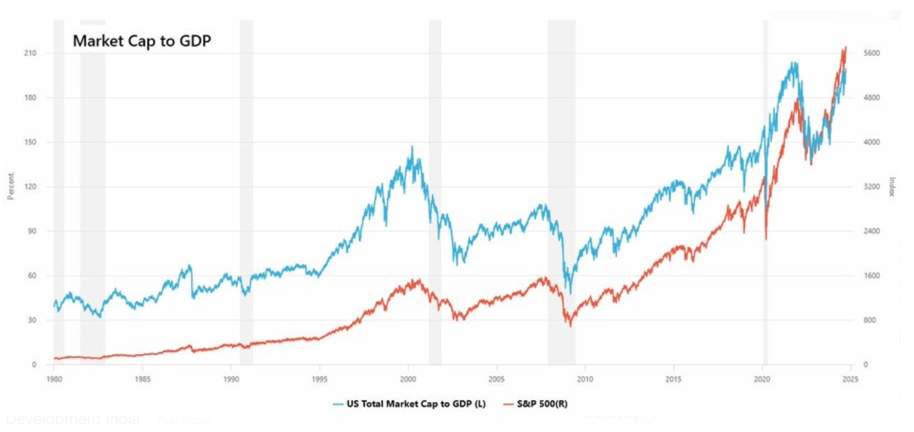

Buffett Indicator : Market Cap to GDP is at record levels at 199.79. It takes the

total value of all stocks (market cap) divided by GDP. A reading greater than 100

implies the market is overvalued. Currently it is nearly 200, the highest in history,

implying a bubble. Market is at the top and Buffett is selling.

-

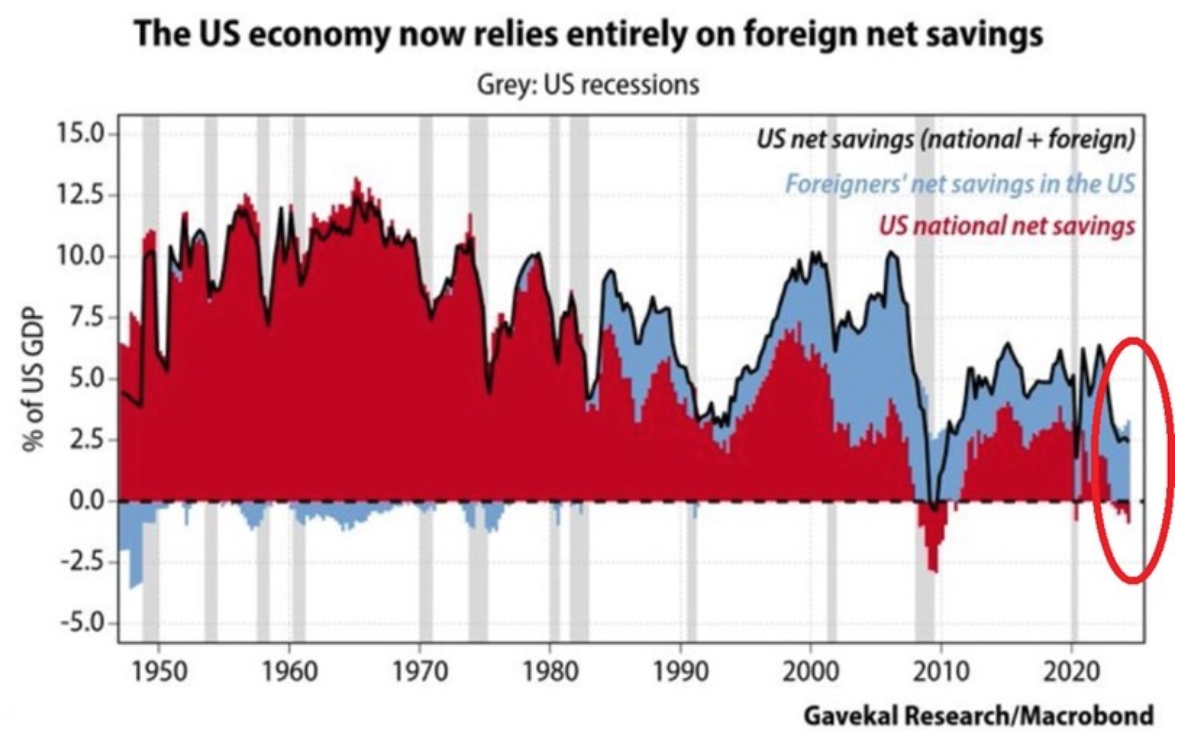

Americans are officially out of savings: US net savings as a % of GDP by households, businesses,

and the government have been negative for 6 consecutive quarters. In other words, Americans

are producing much less than they consume. Since 1947, there were only two other times when

savings were negative, in 2008 and 2020. This comes after the US government's deficit hit

$2.1 trillion over the last 12 months with spending reaching $6.9 trillion. At the same time,

the personal savings rate fell to 2.9%, the second lowest since 2008. National savings are at

crisis levels. Meanwhile, as of Sept 27th, 2024, equity market is at alltime high.

-

India’s gold imports rose to $10.06 billion in August, a new all-time high. This is the

equivalent of 131 tonnes of gold, the 6th-highest monthly volume on record. Demand has

soared after import duties on gold were reduced by 9 percentage points to 6% by the Indian.

-

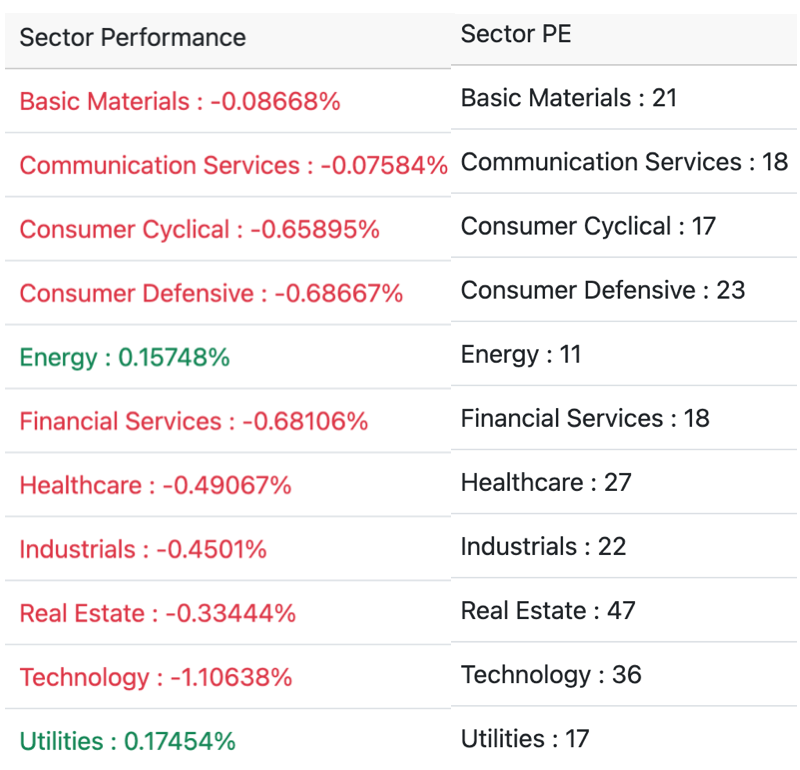

Word of Caution: Markets are at the alltime high and fed is cutting

interest rate, caution warranted.

Below is our daily sector performance report - warrants caution.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

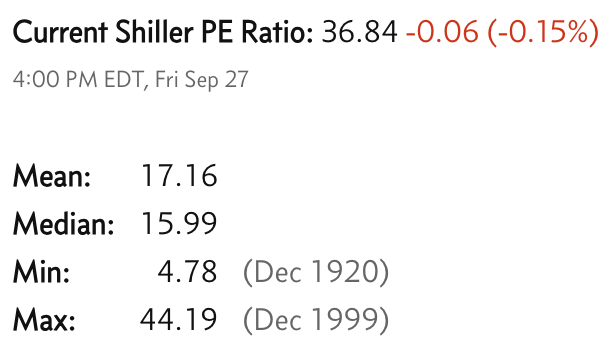

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.