Weekly Market Commentary - Sept 27, 2025 - Click Here for Past Commentaries

-

U.S. economic growth shows momentum, with Q2 GDP exceeding expectations due to strong consumer spending. August

personal income and spending data also beat forecasts, suggesting continued Q3 growth. A potential U.S. government

shutdown starting October 1 poses a near-term risk, though historical shutdowns have had short-lived economic impacts.

We recommend diversified portfolios in U.S. large-cap and mid-cap stocks and investment-grade bonds. Investors with

significant cash holdings should prepare a list of quality investments for potential market pullbacks.

-

Over the past week, economic data indicated a U.S. economy performing better than expected. The final second-quarter

GDP growth estimate was revised to a robust 3.8% annualized, surpassing forecasts of 3.3%. This exceeds the U.S.

trend growth rate of 1.5% to 2.0%. Notably, consumption, driving about 70% of economic growth, reached a strong 2.5%,

compared to forecasts of 1.7%.

This uptick in consumption continued with better U.S. personal income and spending data for August. Personal income rose 0.4%, exceeding forecasts of 0.3%, while real personal spending, a key measure of consumer spending beyond inflation, also increased 0.4%, surpassing expectations of 0.2%. Overall, the data suggests households and consumers kept spending in Q3.

Looking at Q3 economic growth, data indicates the U.S. economy may grow above 3.0%. The Atlanta Fed's GDP-Now model projects 3.9% annualized GDP growth, supported by 3.4% consumption. This signals sustained above-trend growth from Q2. The Bloomberg Economic Surprise Index also shows a recent uptick, reflecting positive momentum in economic data surprises.

-

As we assess the sustainability of recent U.S. economic momentum, two key factors stand out: labor market health

and inflation trends. These are critical as the Federal Reserve prepares for its next interest-rate decision on

October 30.

The labor market shows signs of cooling, but recent data suggest stabilization. Weekly U.S. initial jobless claims dropped below expectations last week. While the labor market narrative evolves, with the October 3 nonfarm-jobs report as a key indicator, the post-Labor Day spike in jobless claims appears to be an anomaly, not a persistent trend.

On the inflation front, last week's PCE inflation data, the Fed's preferred measure, was released for August. Headline inflation was 2.7% year-over-year, and core inflation was 2.9%, aligning with forecasts. Inflation exceeds the Fed's 2.0% target but remains below their recent 3.0% headline and 3.1% core PCE estimates for 2025.

We expect inflation, especially goods inflation, to rise as companies pass on tariff-induced price increases. However, cooling services inflation, comprising 65% of the PCE basket, may offset this. Tariff-driven inflation should stabilize if tariff rates remain steady.

-

Given the better-than-expected economic data and recent inflation data meeting expectations, investors may wonder

about risks. We highlight two near-term risks:

The market has risen sharply: The S&P 500 has surged over 30% since April lows without a 2%+ pullback. While momentum may persist, corrections are common, and October is historically volatile. With limited data before third-quarter earnings (starting mid-October) and potential U.S. government shutdown headlines, a 5-10% pullback is possible. However, the economy's strength suggests a severe correction is unlikely.

-

U.S. government shutdown likely: The rising probability of a U.S. government shutdown starting October 1 poses

headline and economic risks. A shutdown would occur if Congress fails to pass a continuing resolution or

appropriations bills to fund federal agencies. Nonessential government functions would halt, furloughing workers

and stopping services until funding resumes. Historically, shutdowns cause short-term growth slowdowns but quick

recoveries. However, political rhetoric and headlines could create market uncertainty and slow recent economic

momentum. While not deeply impactful, this political event poses near-term risks.

-

The U.S. economy remains strong, driven by resilient consumer spending. Despite risks like a potential government

shutdown, solid fundamentals suggest these are temporary. Stock markets, up over 30% recently, reflect this

strength.

For portfolio positioning, investors should focus on two factors. First, ensure diversification with overweight positions in U.S. large-cap and mid-cap stocks across growth and value sectors, such as consumer discretionary, financials, and healthcare, plus exposure to U.S. investment-grade bonds for stability during market corrections. Second, if holding significant cash or cash-like instruments, consider equities or bonds to add during a market dip, as cash typically underperforms other assets long-term and may not match inflation.

Consult your financial advisor to confirm diversification and identify opportunities aligned with your long-term financial goals.

-

Final Words: Market indicates greed. Buy Gold and Silver (GLD & SLV ETF's).

Below is last week sector performance report.

Weekly Sector Performance for Sept 22-26, 2025:

$XLE Energy: 3.92%, RSI: 65.22

$XLK Technology: -0.03%, RSI: 65.63

$XLC Communication: -1.04%, RSI: 65.32

$XLY Consumer Discretionary: -0.70%, RSI: 58.32

$XLP Consumer Staples: -1.79%, RSI: 34.77

$XLF Financial: -0.72%, RSI: 54.72

$XLV Health Care: -1.30%, RSI: 45.86

$XLI Industrials: -0.35%, RSI: 53.28

$XLB Materials: -2.19%, RSI: 40.79

$XLRE Real Estate: 0.07%, RSI: 50.10

$XLU Utilities: 2.19%, RSI: 61.78

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

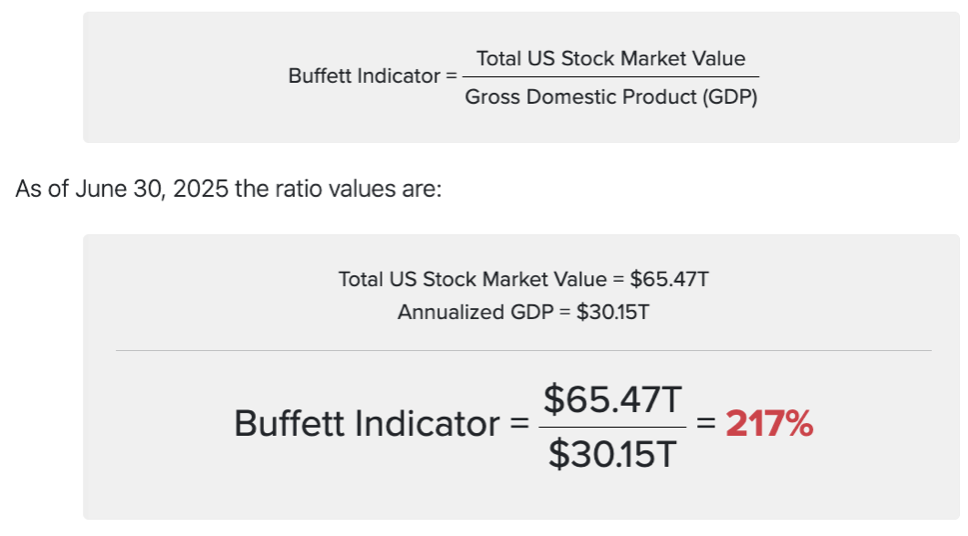

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.