Weekly Market Commentary - Sept 21st, 2024 - Click Here for Past Commentaries

-

The Fed lowered its policy rate last week for the first time in four years.

The larger-than-typical 0.5% cut signals a critical turning point in the

monetary-policy cycle and a commitment to not fall behind the curve.

-

Cyclical, mid-cap and high-quality dividend-paying stocks may start to close the

gap with mega-cap tech. Bonds will continue to benefit from lower rates over time,

and investors should pay attention to the reinvestment risk of having an oversized

allocation to cash investments.

-

The Fed delivered on what markets have been hoping for and anxiously anticipating

over the past two years. Interest rates were cut by a larger-than-typical 0.5%,

signaling a critical turning point in the monetary-policy cycle. In response,

stocks set new record highs, and the S&P 500 extended its year-date gains to

near 20%

-

After the most aggressive tightening campaign in 40 years and the second-longest pause

in history with rates in restrictive territory, the Fed cut its policy rate last week

for the first time in four years.1 Instead of the typical quarter-point move (0.25%),

the Fed opted to lower rates by a larger half a percentage point (0.5%), taking the

policy target range down to 4.75%-5.0% from 5.25%-5.5%.

The drop in the consumer price index (CPI) from a peak of 9.1% in June 2022 to 2.5% in August has given policymakers greater confidence that inflation is moving sustainably toward 2%. At the same time, the increase in the unemployment rate from 3.4% to 4.2% is a reminder that the Fed has a dual mandate, not only to achieve price stability but also maximum employment. As a result, the focus has now shifted from inflation to employment

-

It was that focus on the labor market that led the Fed to cut by 0.5%, a decision

that was not unanimous, as Governor Bowman dissented in favor of a smaller cut –

the first dissent by a governor since 2005. While the larger cut was a surprise

to most economists, the bond market was pricing in about a 60% chance of that

happening the days before the Fed meeting.

-

Chair Powell suggested that a cut might have occurred in July if the Fed had the

jobs data for that month in hand (the July jobs report was released on 8/02, two

days after the 7/31 Fed decision). That said, Powell made clear that 0.5% cuts

are not the norm, and smaller cuts remain the baseline for the upcoming meetings.

-

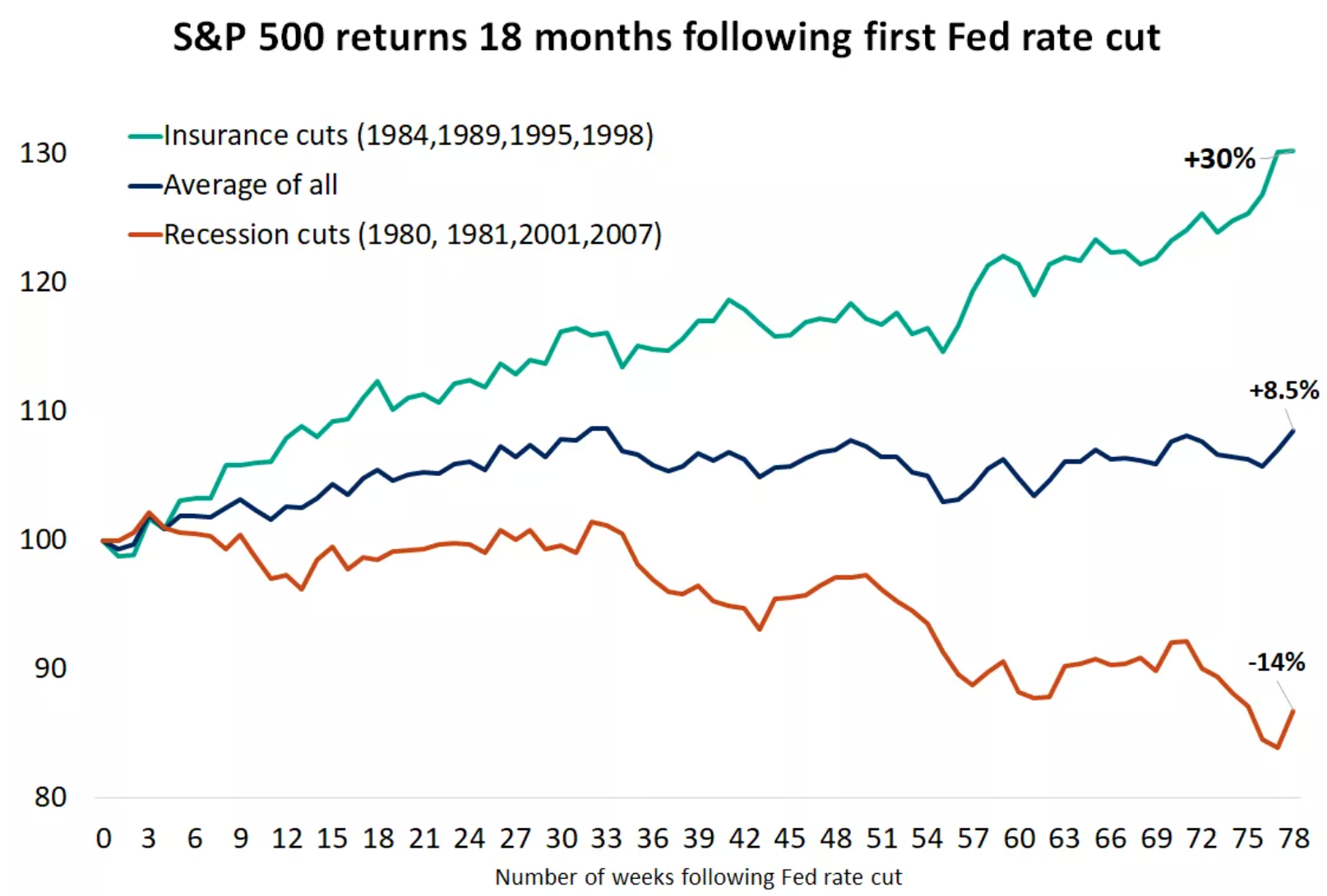

From a market perspective, the lesson from history is that equities' response to

rate cuts depends on the state of the economy. The start of a rate-cutting cycle

that coincides with no recession has historically led to strong equity returns six,

12, and 18 months after the first rate decline.3 Examples of such instances are the

cycles that started in 1984, 1989, 1995 and 1998. On the other hand, rate cuts in

response to economic weakness and recession have been accompanied with losses, as

in 1981, 2001 and 2007.

-

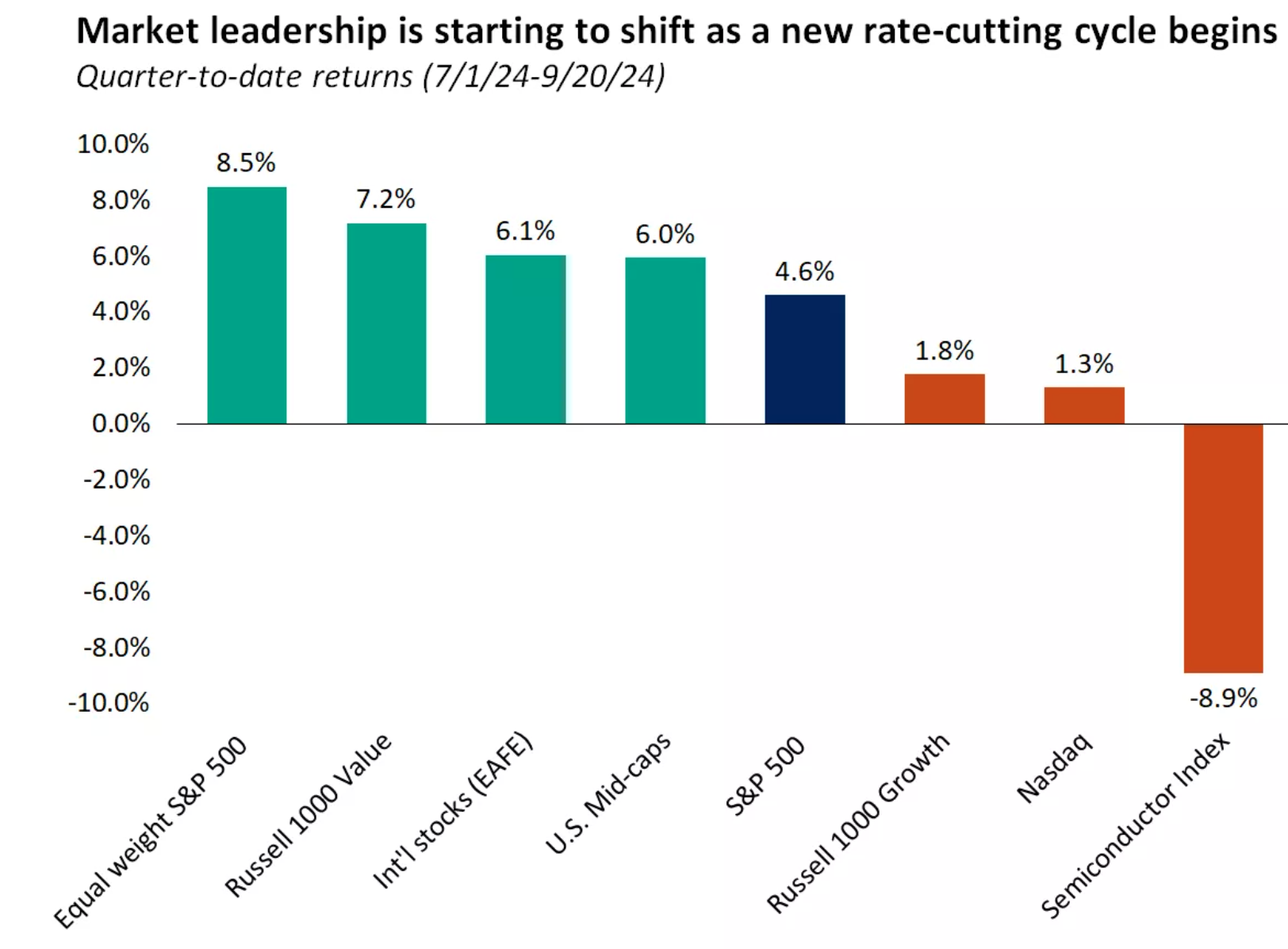

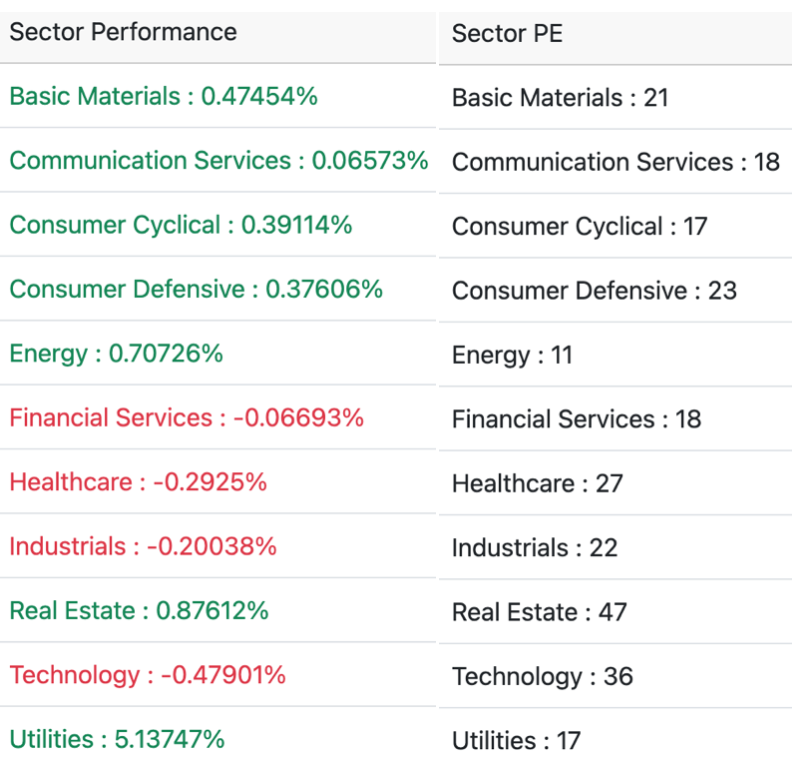

With rates destined to decline in the coming years, areas of the market that have been

punished from the Fed's aggressive tightening campaign could be the ones that stand

to benefit the most. So far in the third quarter we have seen a subtle change in

market leadership toward more balance than over the past year. While the shift

in Fed policy has helped lift stocks broadly, it is a mix of defensive and

cyclical sectors that have led the charge (real estate, utilities, financials,

industrials), rather than the usual suspects (tech, communication services

and consumer discretionary). In fact, the Nasdaq over the past three months is

trailing the market-cap and equal-weighted S&P 500, growth is underperforming

value, and semiconductors, a group that has delivered stellar results over the

past year, is bucking the market trend and posting modest losses.

-

In the fixed-income space, the implications from a pivot to rate cuts are

wide as well. The 2- and 10-year Treasury yields rose modestly after the

Fed's outsized rate cut, possibly reflecting an easing in recession risks.

Yet, bond yields remain near the lows for the year, and the path of least

resistance is likely lower ahead. This pattern is reflected in the

consistently positive returns for investment-grade bonds 12 months

following the start of a Fed rate-cutting.

-

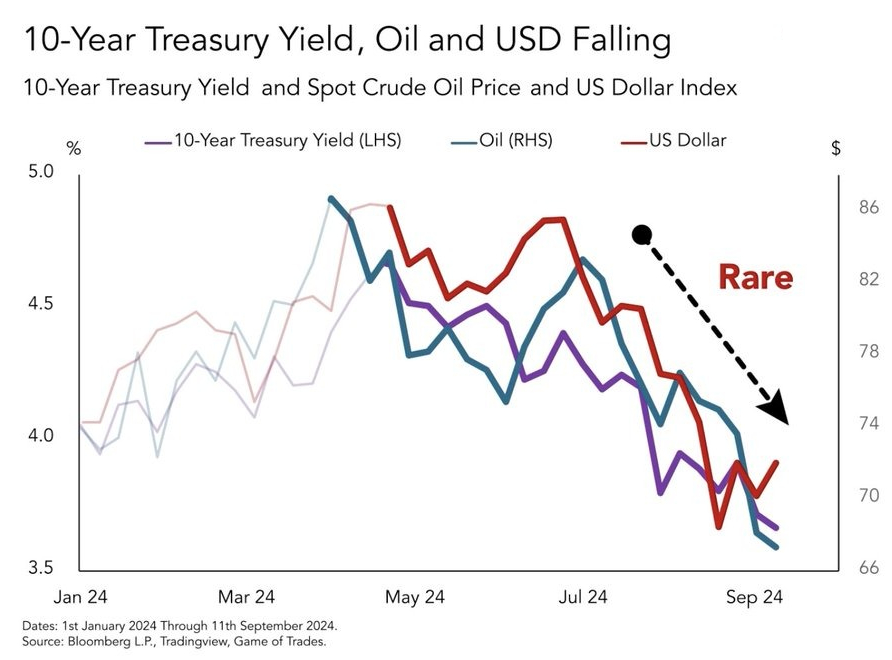

US Dollar, Oil price, Bond yields are all crashing together, rare but true.

-

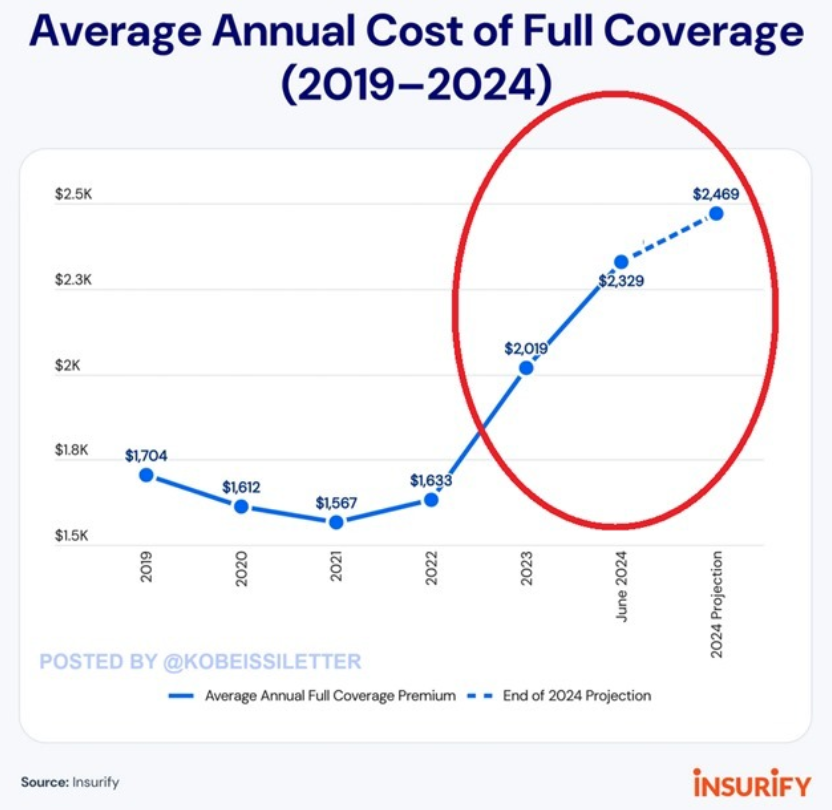

US car insurance costs spiked by 15% in the first half of 2024 to $2,329, the most on

record. The average annual car insurance cost for full coverage has is up 49% since 2021.

Average premiums are set to hit $2,469 in 2024, marking an annual increase of 22%,

according to Insurify. In California, car insurance rates could rise by more than

50% in 2024 driven by continued inflationary pressures, severe storms, and wildfires.

Meanwhile, vehicle maintenance and repair costs have jumped ~38% over the last 5 years.

Car ownership has never been more expensive & fed thinks inflation is in control.

-

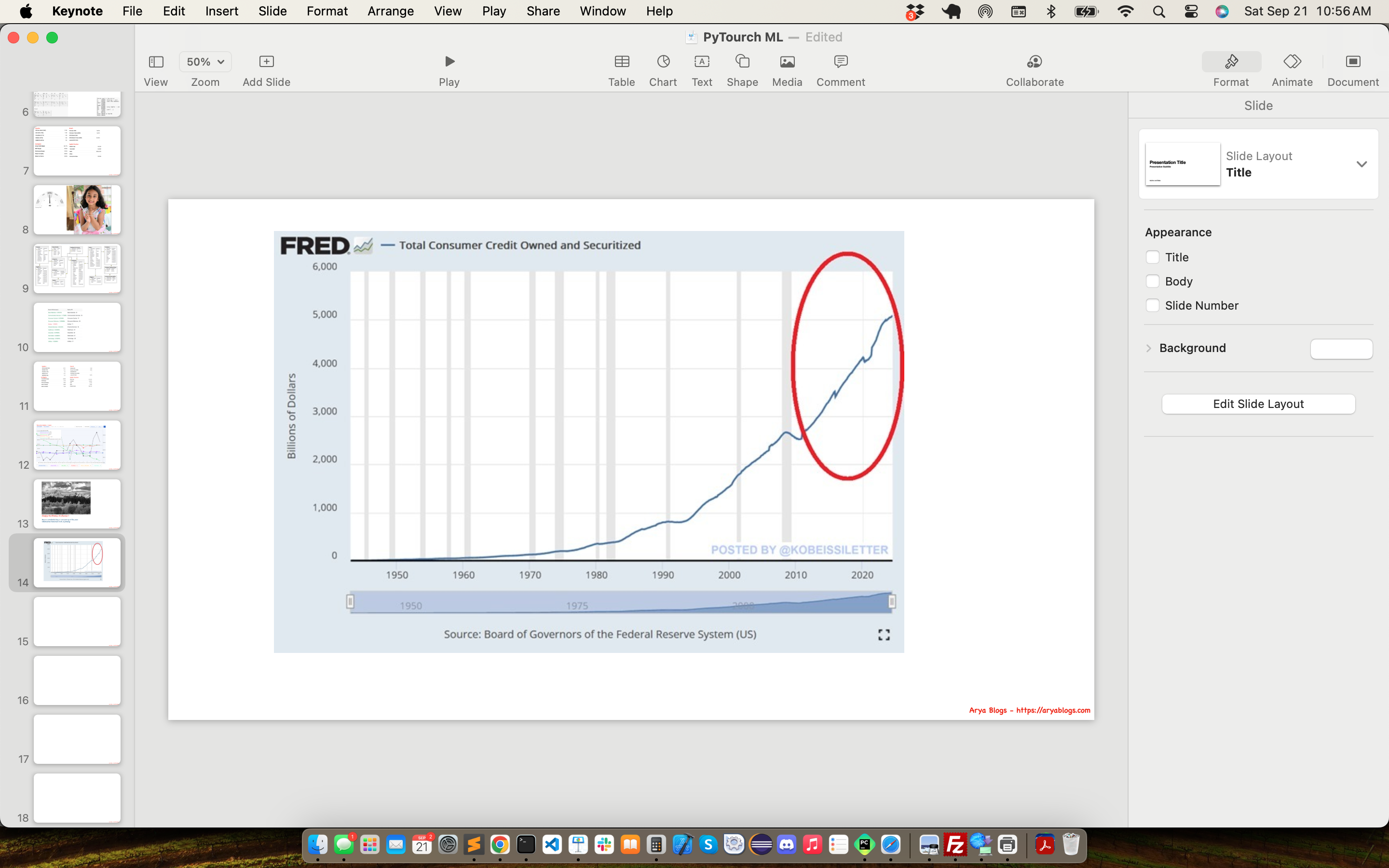

Total consumer credit jumped by $25.5 billion in July and reached a new all-time high of

$5.1 trillion. This marked the largest jump since November 2022 and the 11th straight

monthly increase. Total consumer debt has DOUBLED in 14 years. Revolving debt, which

includes credit cards, jumped by $10.6 billion and also hit a new record of $1.4 trillion.

Non-revolving credit rose by $14.8 billion and is just $2 billion below the January peak

of $3.73 trillion. Meanwhile, the share of credit card debt delinquencies soared to 9.1%,

the highest level in 12 years.

-

With U.S. debt now at $35.3 trillion, the cost of paying the interest on all that borrowing

has soared recently and now averages out to $3 billion a day.

-

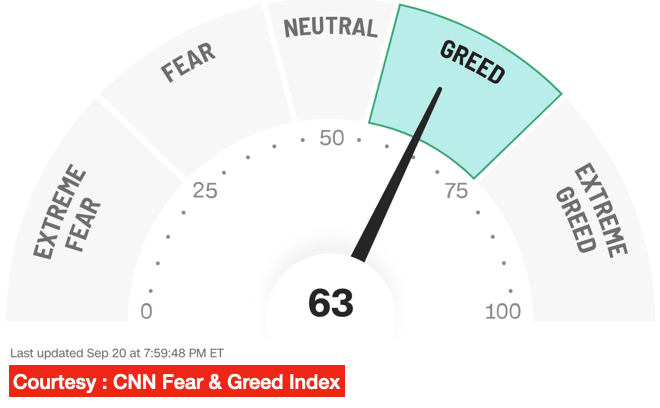

Word of Caution: Markets are at the alltime high and fed is cutting

interest rate, something is not right with this equation. If companies are doing so

well, why layoffs are everywhere? CNN Business Fear & Greed Index is shown below.

Below is our daily sector performance report - warrants caution.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

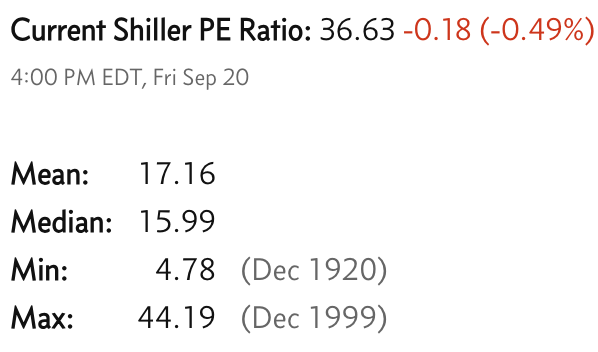

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.