Weekly Market Commentary - Sept 20, 2025 - Click Here for Past Commentaries

-

Rate cuts have returned, with the Fed implementing its first 25 basis point (0.25%) reduction in 2025, responding

to a concerning U.S. labor market slowdown. This proactive move, despite elevated inflation, was well-received by

markets, likely anticipating further cuts. However, vague FOMC signals about future policy, with members differing

on timing and extent, may spur market volatility as investors analyze growth, labor, and inflation data to predict

Fed actions. Continued soft labor-market trends should pressure the Fed to cut rates further, with one to two

additional cuts expected this year and next, barring inflation surprises. Lower rates and tax cuts should boost

growth through 2026, especially as trade war impacts fade, supporting corporate earnings and favoring U.S.

large- and mid-cap stocks. Conversely, we no longer favor overweighting longer-dated U.S. government bonds,

as markets have priced in rapid Fed easing, pushing 10-year Treasury yields to the lower end of our 4%-4.5%

forecast range.

-

After nearly a year on the sidelines, the U.S. Federal Reserve Bank cut interest rates by 25 basis points (0.25%)

this week, a move widely anticipated by markets and nearly unanimously supported by FOMC voters, with only new

Fed board member Stephen Miran dissenting for a larger 50 basis point (0.5%) cut.

The decision to ease policy was driven by growing concerns at the central bank about a weakening U.S. labor market. The FOMC press statement noted increased "downside risks to employment," signaling worries that a further slowdown in hiring or rise in layoffs could trigger a recession.

Recent labor-market trends are concerning. The three-month average of private nonfarm payrolls has slowed to 29,000, a level typically seen during or just before recessions. Job openings are now below the number of unemployed Americans for the first time in nearly a decade (excluding the pandemic shock), and the unemployment rate continues to rise.

-

However, some payroll weakness reflects a sharp slowdown in net U.S. migration, and firms' cautious hiring approach

shows few signs of increased layoffs. Growth data are more upbeat, with this week's retail-sales report indicating

resilient consumer spending and GDP tracking a 3.3% annualized gain for Q3, per the Atlanta Fed's models.

The Fed doesn't believe a recession is imminent but wants insurance against weakening conditions. This proactive stance explains strong domestic equity market performance before and after the Fed meeting. The interest-rate-sensitive Russell 2000 index, up 8.3% over the past month, hit a new all-time high since November 2021, outpacing the S&P 500 and Nasdaq.

-

The Fed unanimously cut rates this week, but views on future policy diverge. The median FOMC forecast predicts two

additional 25-basis-point cuts this year. However, 40% of the committee expects no easing at the October and December

meetings. By the end of 2026, the fed funds target range varies from 2.75% to 4%.

Fed Chair Powell provided little explicit guidance on the policy outlook during his press conference, signaling that the central bank would assess conditions meeting by meeting and let data guide future steps. He noted that any interest rate paths projected by FOMC members were possible.

This lack of guidance is understandable, as forecasting the impact of this year’s trade and tariff policy shifts is challenging. Powell admitted that "forecasters are a humble bunch, with much to be humble about." These shifts could affect both Fed goals, potentially causing higher inflation and a weaker labor market, complicating the central bank’s balancing act.

However, this ambiguity may lead to market volatility around major growth, labor market, and inflation data releases in the coming months, as investors gauge whether the data supports further rate cuts. Monthly data can be noisy, amplifying these movements, especially with major indexes near record highs. Volatility has been low since the "Liberation Day" tariff announcement spike earlier this year, but it could rise if data send mixed signals about the Fed’s next steps.

-

Markets expect upcoming data to justify further easing. Investors see a 90% chance of interest-rate cuts in

October and December, undeterred by the Fed's ambiguous messages.

We expect further weak labor-market reports to prompt the Fed to ease, with at least one more 25 basis point cut this year and possibly two if softness persists. We also anticipate one to two rate cuts in 2026, bringing rates to 3%-3.5%, easing the economic drag from high interest rates.

Two dynamics could disrupt this easing. First, an employment reacceleration could reduce the need for precautionary cuts, especially with inflation above target. Second, a significant inflation surge in coming months could hinder rate cuts. So far, U.S. firms have absorbed tariff costs, with limited pass-through to consumer prices. This could accelerate in 2025, creating challenging inflation headlines for the Fed.

-

In government bond markets, we believe most upside from interest-rate cuts is now fully priced in. The rapid

easing cycle expected by investors has driven a rally in U.S. government bonds recently, with the 10-year Treasury

yield at the lower end of the 4%-4.5% range we anticipated through 2025.

Within investment-grade bond portfolios, we are removing our recommended overweight in duration (longer-term interest-rate risk). Lingering inflation risks may limit the Fed's ability to cut rates quickly, especially if labor-market data rebound. Fiscal strains are pushing longer government bond yields higher, and these concerns are unlikely to fade soon.

In equity markets, we remain constructive despite potential volatility, which could offer buying opportunities. Falling interest rates and tax cuts suggest a supportive monetary and fiscal policy shift over the next 12 months, boosting U.S. growth. This could be aided by reduced trade-policy uncertainty and tariff effects.

We favor U.S. large- and mid-cap stocks, particularly quality and cyclical stocks that may benefit from lower interest rates and broader market leadership beyond mega-cap technology. We recommend overweight positions in consumer discretionary, financials, and healthcare sectors.

Your financial adviser can align your investments with your goals, time horizon, and risk tolerance.

-

Final Words: Market indicates greed. Buy Gold and Silver (GLD & SLV ETF's).

Below is last week sector performance report.

Weekly Sector Performance for Sept 15-19, 2025:

$XLE Energy: -0.09%, RSI: 51.69

$XLK Technology: 2.97%, RSI: 72.51

$XLC Communication: 1.76%, RSI: 78.65

$XLY Consumer Discretionary: 1.16%, RSI: 67.12

$XLP Consumer Staples: -1.17%, RSI: 39.22

$XLF Financial: 0.84%, RSI: 60.65

$XLV Health Care: -0.59%, RSI: 52.68

$XLI Industrials: 1.02%, RSI: 56.34

$XLB Materials: -0.93%, RSI: 49.35

$XLRE Real Estate: -1.18%, RSI: 48.45

$XLU Utilities: -0.64%, RSI: 52.43

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

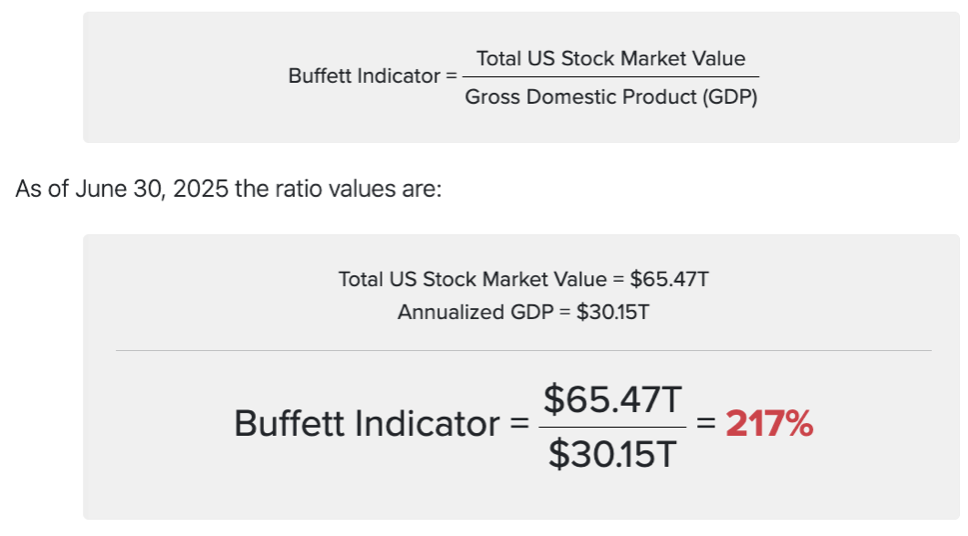

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.