Weekly Market Commentary - Oct 5th, 2024 - Click Here for Past Commentaries

-

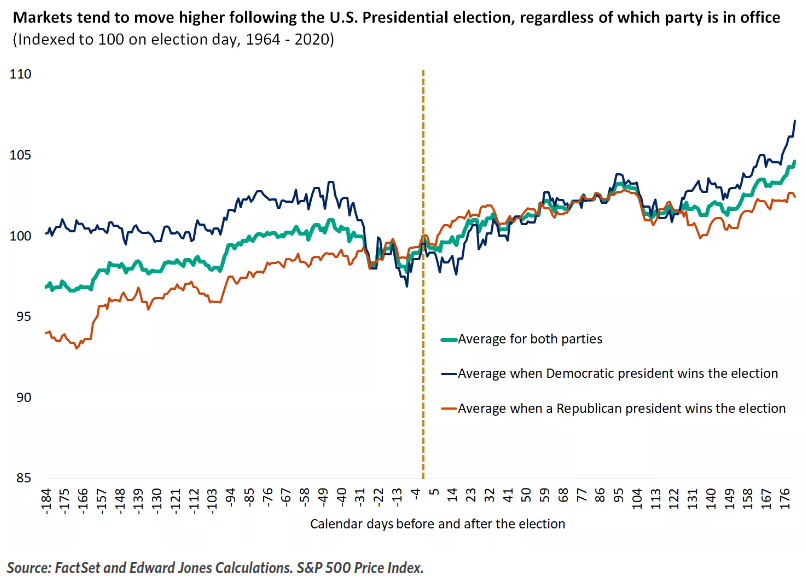

After a strong first three quarters of the year, with the S&P 500 up over 19%, stock

markets began the fourth quarter on a volatile note. This was in large part because

of elevated uncertainty around four key areas: The U.S. labor market, port strikes on t

he East Coast, tensions in the Middle East, and the looming U.S. presidential

election.

-

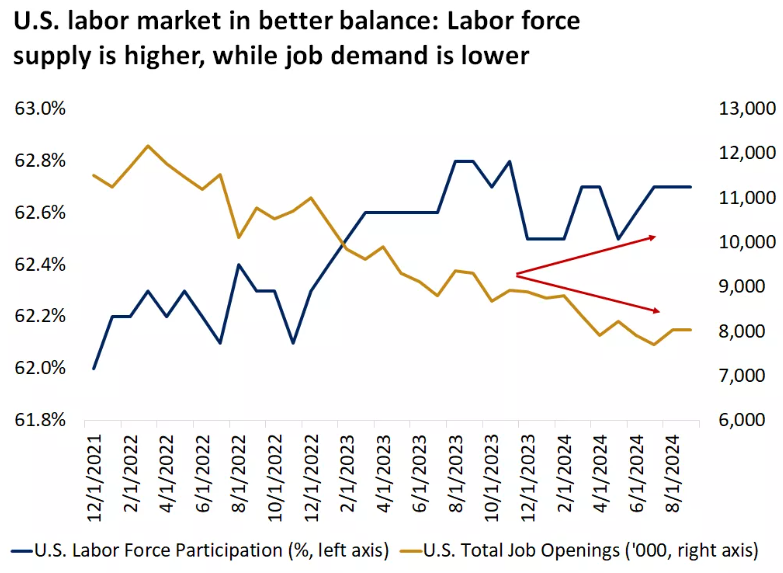

The U.S. nonfarm-jobs report for September indicated that not only did jobs added well-exceed

expectations, coming in at 254,000 versus forecasts of 150,000, the unemployment rate also

ticked lower, from 4.2% to 4.1%. Last month's total jobs added was also revised higher,

from 142,000 to 159,000. We expect this to be revised soon.

-

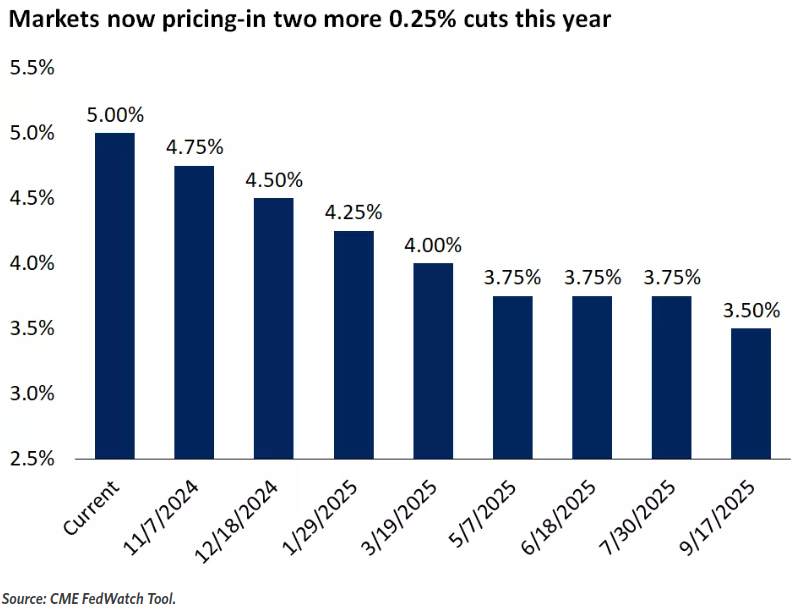

After the labor-report data was released, markets immediately reacted, pushing Treasury bond

yields sharply higher and pricing in rate cuts of 0.25% rather than 0.5% for either the

November or December meeting this year.

-

Given that the jobs report also indicated that wage growth remains somewhat elevated at

4.0% year-over-year, the Fed likely remains on high alert for inflationary pressures

reemerging as well.1 Overall, we continue to see the Fed gradually bringing interest

rates down toward the 3.0% - 3.5% range through next year, which should be supportive

of both consumer and corporate spending.

-

The agreement between dock workers and port operators calls for a wage hike of 62% over

six years, raising average wages from $39 per hour to about $63 per hour over the

life of the contract. Inflation is real.

-

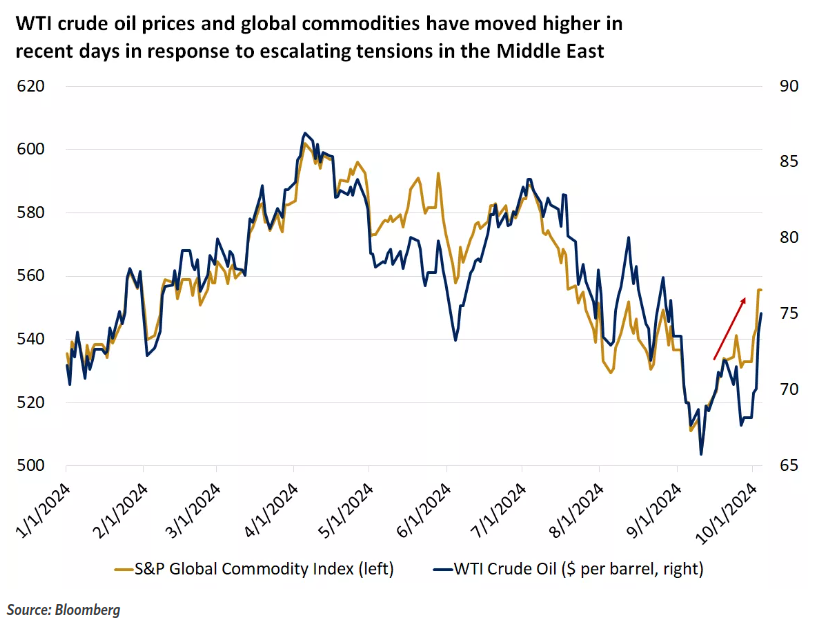

Geopolitical tensions also escalated in the Middle East early this week, as Israel

faced an Iranian missile strike and deliberated retaliation. From a market perspective,

the immediate response to the escalation was a rise in oil and commodity prices, as

well as a rise in safe-haven assets, such as gold and Treasury bonds, and a sharp

move higher in the VIX volatility index.

-

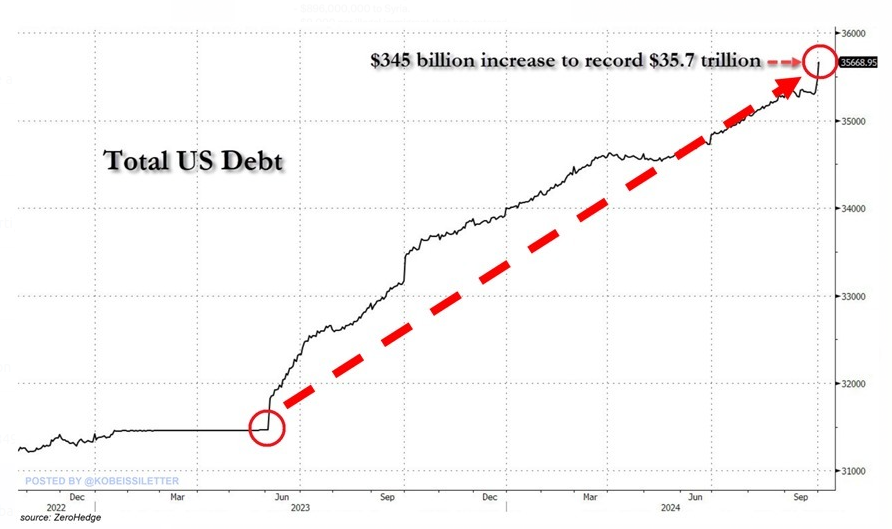

US public debt has jumped $345 billion over this week hitting another record of $35.7

trillion. Since June 2023, federal debt has surged by a MASSIVE $4 trillion, or 14%. Over

the same time period, US GDP is up just $1.5 trillion, or ~6%. In other words, the national

debt has outpaced the economic growth by 2.7 TIMES over the last 16 months. Outside of the

pandemic crisis, US federal debt has never grown so rapidly.

-

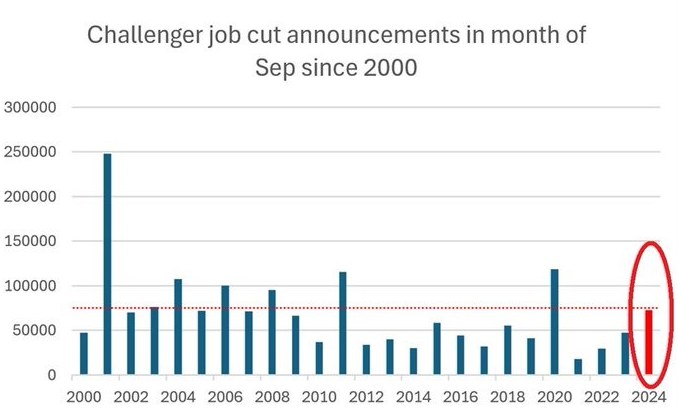

US job cut announcements are rising: US employers announced 72,821 job cuts in September

posting a 53% year-over-year increase, according to Challenger, Gray and Christmas data.

The number of layoffs last month marked the third-largest September since the 2008 Financial Crisis.

In Q3 2024 alone, companies announced 174,597 job cuts, 19% higher than 146,305 seen in Q3 2023.

Year-to-date announced layoffs are now at a massive 609,242, nearly TRIPLE the 2022 number.

Cost-cutting has been the major reason for corporate layoffs.

-

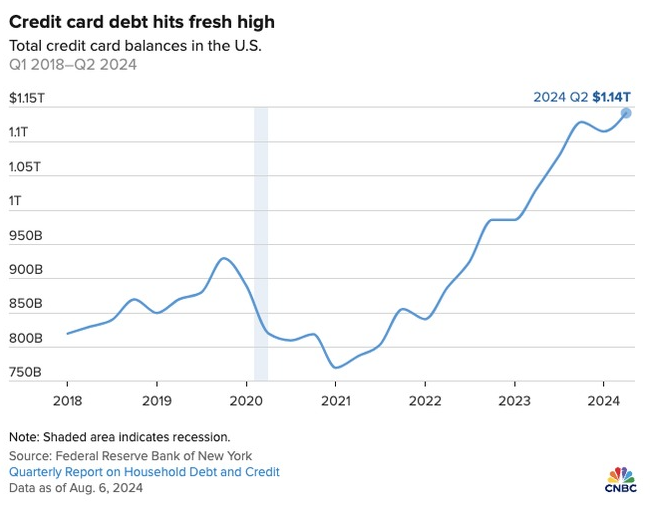

Americans now owe a record $1.14 trillion on their credit cards, per the Fed

-

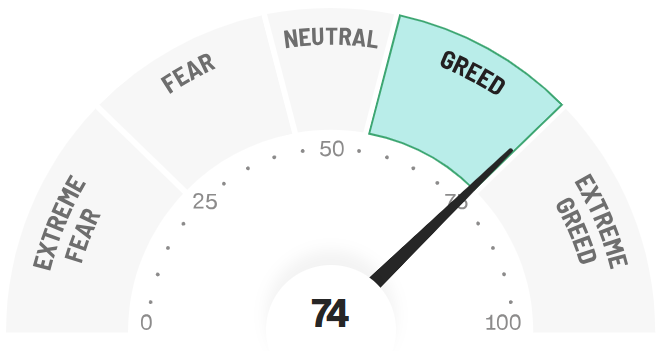

Word of Caution: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'extreme greed' while global political turmoil is at peak.

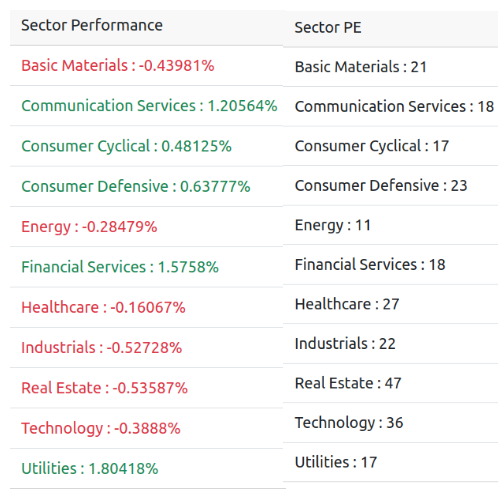

Below is our daily sector performance report - warrants caution.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

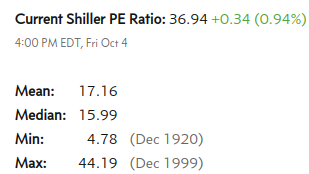

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.