Weekly Market Commentary - Oct 4, 2025 - Click Here for Past Commentaries

-

Government shutdown begins — The U.S. government has shut down, halting nonessential operations and delaying key

economic data releases, such as jobs and inflation reports.

Economic impact limited for now — A prolonged shutdown could hinder growth, but resilient consumer spending and record AI investments should cushion the blow.

Labor market softening — Hiring is slowing, though layoffs remain limited outside the government sector. With official data unavailable, the Fed may rely on weaker private indicators, like ADP payrolls, to focus on the labor market and continue interest rate cuts.

Market resilience persists — Stocks remain strong, led by AI and rate-sensitive sectors. Shutdowns historically have minimal long-term impact, and pullbacks may offer opportunities to add exposure to underrepresented portfolio areas.

-

At midnight on September 30, the U.S. government shut down after lawmakers failed to agree on funding. This halted

nonessential operations, caused widespread furloughs, and paused key public services.

For investors, the suspension of critical economic data, like inflation and employment reports, disrupts market and

Federal Reserve decisions.

Normally, we’d analyze the September jobs report, due October 3. With data delayed, we’re focusing on the economy,

labor market, Fed policy, and financial markets during this period of uncertainty.

-

Since July, economic data have broadly surprised to the upside, driven by:

Resilient consumer spending and heavy AI investment drive strong economic momentum, with the Atlanta Fed estimating third-quarter GDP growth at 3.8%.

Retail sales surged over the past three months through August, hitting the fastest pace since early 2023. Despite a potential delay in the September report due to a shutdown, auto sales exceeded expectations, and the Johnson Redbook Index reported 6% same-store sales growth in September. These private-sector data points remain unaffected by the shutdown.

AI investment in equipment and intellectual property is growing at its fastest rate since the late 1990s internet boom. Major tech firms—Amazon, Google, Microsoft, and Meta—are projected to spend nearly $400 billion on capital expenditures next year, about 30% of total estimated S&P 500 investment.

-

As outlined in *Government Shutdowns and the Markets – 3 Things to Know*, a short-term growth slowdown is expected

during the shutdown, with a quick recovery once funding resumes. Furloughed federal workers, guaranteed backpay, delay

rather than eliminate spending and economic activity. However, businesses reliant on government contracts may face

permanent income loss.

Historical data suggests a 0.1%–0.2% drag on quarterly GDP growth per week of closure. Longer shutdowns increase economic impact and political pressure for resolution. While fourth-quarter growth may slow, it starts from a strong base, with activity likely rebounding in the first quarter, assuming the shutdown lasts weeks, not months.

-

With the official employment report delayed, alternative data like ADP private payrolls gain significance, despite

their loose correlation with government figures. ADP reported a 32,000 payroll decline in September, the third drop

in four months, aligning with cooling trends in official data that have caught the Fed’s attention.

The unemployment rate stays low at 4.3%, but job openings have fallen below the number of unemployed workers for the first time since 2021. Companies hesitate to hire, possibly due to macroeconomic uncertainty, expected AI-driven productivity gains, or both. Layoffs remain low outside the government sector, as firms maintain profitability without aggressive cost-cutting.

Shutdown impact: The administration’s threat to permanently cut federal jobs sets this shutdown apart. The Congressional Budget Office estimates 750,000 nonessential federal employees are furloughed, and some could face impacts if the threat is realized.

Currently seen as a tactic to secure a funding extension, this could, if implemented, hasten federal job contraction and further slow job growth.

-

Last month, the Fed resumed interest rate cuts after a year-long pause, citing labor market softness and manageable

inflation. Most officials view current policy as restrictive and expect gradual rate reductions due to increasing

employment risks.

Shutdown impact: Missing key economic data complicates Fed decisions. With only lower-quality data available, policymakers may struggle to assess the labor market, economic activity, and price trends. If the shutdown continues, last week’s weak ADP payroll report may be the Fed’s only major labor indicator before its next meeting.

We believe the labor market will remain the Fed’s focus, with policymakers easing rates toward a neutral 3%–3.5% range. A prolonged shutdown and potential federal layoffs could heighten pressure for cuts. We expect a rate cut at the October 29 meeting.

If government data resumes and the labor market improves by December, a pause may occur. However, we anticipate rates trending downward through 2026.

-

Markets ended the third quarter strongly, with the S&P 500 up nearly 8%, the Nasdaq up 11%, and the Russell 2000

rallying 12%. Despite the government shutdown, investor sentiment remains resilient, with the S&P 500 hitting three

more all-time highs, totaling 31 this year.

Two key forces drive this strength:

1. AI innovation tailwinds: Rapid AI development fuels market leadership, with semiconductor stocks leading gains, supported by increased data center and AI investment.

2. Cyclical momentum from lower rates: With the Fed easing, rate-sensitive sectors like consumer discretionary, small- and mid-cap equities, and emerging markets are rebounding.

Shutdown impact: Historically, government shutdowns have minimal lasting effect on equities. Of 20 shutdowns since 1976, stocks were positive during half and higher three to six months later. Investors know shutdowns rarely alter broader economic or market trends.

However, with U.S. stocks up 35% since April without significant pullbacks, markets may face profit-taking as shutdown uncertainty grows. A temporary data blackout could add short-term volatility.

Still, corporate profits remain strong, with margins near record highs, suggesting productivity gains. As third-quarter earnings begin, consensus expects double-digit profit growth for the fourth straight quarter.

-

Driving at night with headlights off is unsettling, but swerving in panic rarely helps. Likewise, abrupt

investment changes during a government shutdown may be unwise.

We believe a growing economy, rising corporate profits, and declining interest rates support a positive stock

market outlook. Volatility will occur, but we view market pullbacks, especially those driven by shutdown fears,

as buying opportunities.

We favor U.S. large-cap AI stocks but suggest using pullbacks to diversify into underrepresented areas like U.S.

mid-caps and cyclical sectors, given AI stocks' multiyear outperformance.

-

Final Words: Market indicates neutral. Buy Gold and Silver (GLD & SLV ETF's).

Below is last week sector performance report.

Weekly Sector Performance for Sept 22-26, 2025:

$XLE Energy: -3.35%, RSI: 49.79

$XLK Technology: 2.11%, RSI: 70.12

$XLC Communication: -1.51%, RSI: 52.68

$XLY Consumer Discretionary: -0.77%, RSI: 52.12

$XLP Consumer Staples: 0.09%, RSI: 37.23

$XLF Financial: -0.26%, RSI: 52.13

$XLV Health Care: 6.88%, RSI: 71.30

$XLI Industrials: 1.20%, RSI: 59.76

$XLB Materials: 1.15%, RSI: 48.64

$XLRE Real Estate: 0.48%, RSI: 52.78

$XLU Utilities: 2.42%, RSI: 70.62

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

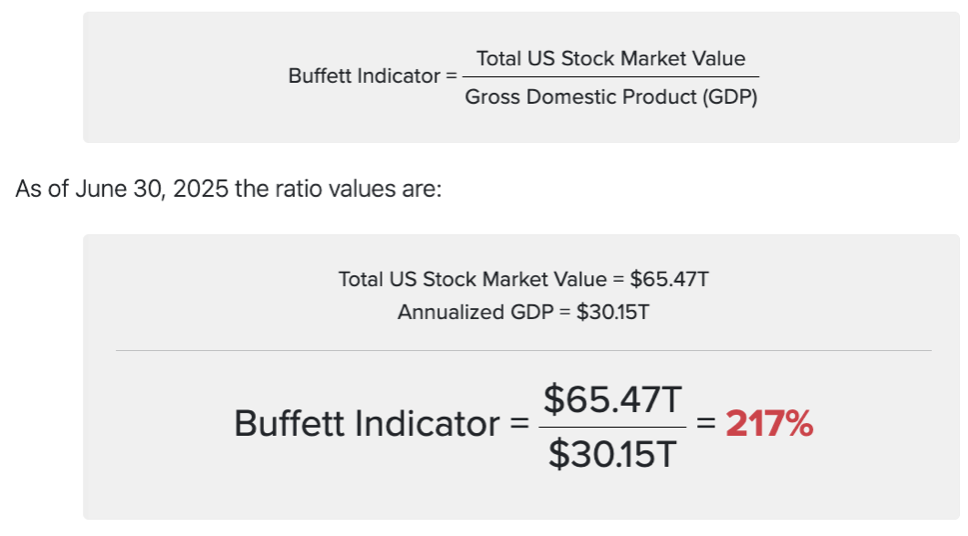

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.