Weekly Market Commentary - Oct 26th, 2024 - Click Here for Past Commentaries

-

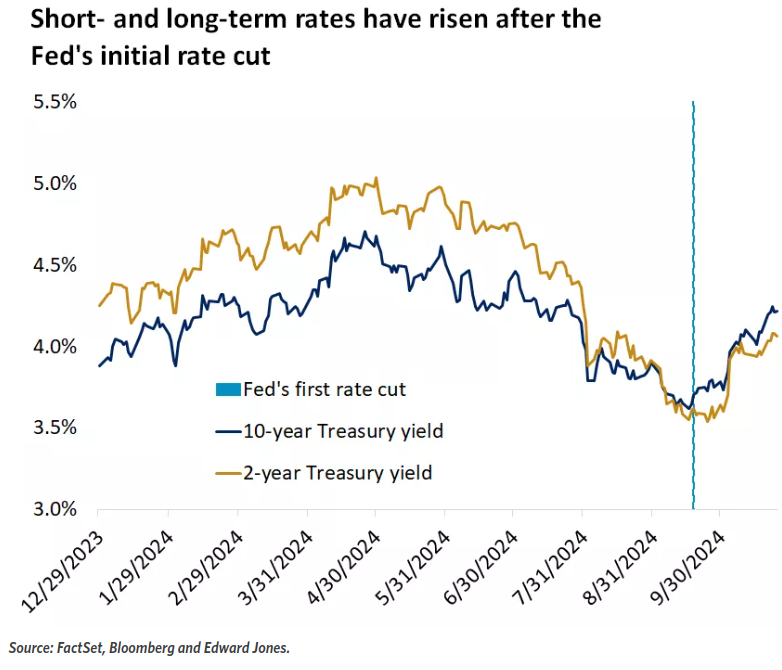

The stock market's six-week streak of gains was interrupted last week, as rising bond yields

started to attract investors' attention. Just over a month has passed since the Fed kicked

off a new easing cycle, cutting its policy rate by a larger-than-typical half a percentage

point. Yet, during that time, both 2- and 10-year Treasury yields have climbed, challenging

the prevailing narrative.

-

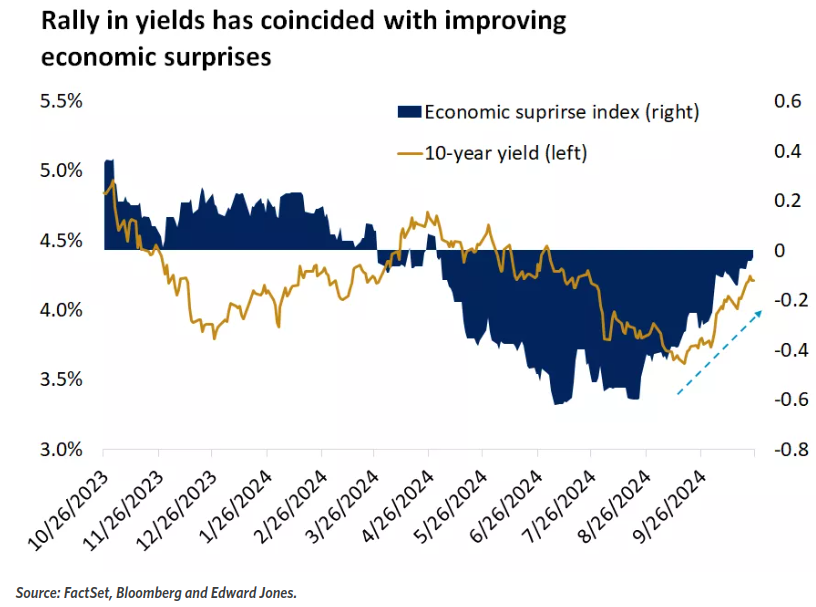

Over the past month economic surprises have improved, coinciding with the rise in rates.

September's job gains were the strongest in six months and unemployment dropped, easing

concerns about the state of the labor market. Moreover, the robust growth in retail sales

has helped push the Atlanta Fed's real-time GDP estimate for the third quarter to 3.4%1.

If realized, this would mark the second consecutive quarter of above-average growth,

dispelling fears of a near-term recession that arose when the Sahm-rule was triggered

by rising unemployment.

-

Along with the strong economic data, markets have had to absorb a mild upside surprise in

inflation, leading to expectations for a more gradual and shallower rate-cutting cycle

than anticipated at the September Fed meeting. In response, bond markets have slightly

repriced future rate paths. Another outsized rate cut is no longer expected, and

the odds of a November quarter-point rate cut have fallen from 100% to 90%. By the

end of 2025, markets now expect the Fed policy rate to be 3.5%, up from 2.9% a

month ago.

-

One of the reasons the U.S. economy continues to defy expectations for a slowdown is the

notable uptick in productivity, a trend not observed in other major economies. The

adoption of new technologies and promising innovations such as artificial intelligence

(AI) have the potential to increase the long-term growth rate of the U.S. A more productive

economy could sustain higher growth without fueling inflation, justifying a higher steady

state for interest rates relative to the last economic expansion.

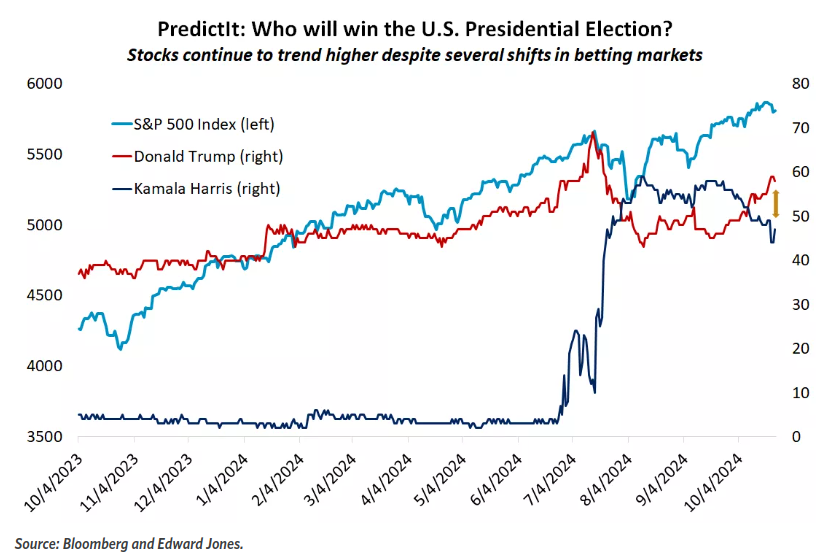

The election appears incredibly close, but as the odds of Trump winning edge up in the betting markets, investors are deliberating the potential impact of additional trade tariffs. Economic theory suggests that tariffs would be inflationary. However, in practice there are many moving pieces that affect how the additional cost might flow through to the consumer. Part of the increased cost could be eaten by retailers, and the potential weakening of foreign currencies relative to the U.S. dollar could make them cheaper.

-

Recent rate volatility in the U.S. Treasury market reached its highest since last December,

with the 10-year yield climbing from around 3.60% to 4.20%1. As the Federal Reserve lowers

rates over time to ease policy and normalize conditions, we estimate the fair value of the

10-year yield to be between 3.5% and 4.0%. In the near term, yields could temporarily overshoot

toward 4.5%

Our base-case scenario remains a "soft landing," where the economy shifts from rapid growth to slower expansion without entering a recession. In this scenario, the Fed can normalize policy at a measured pace. Recent data have fueled hopes for a "no landing" scenario, in which case growth does not slow and the Fed is forced to keep rates high for longer. Despite the strong September jobs report, broader labor-market trends suggest that employment conditions are cooling. As wage growth moderates and consumer spending softens, overall growth will likely slow.

Despite some bumpiness along the way, inflation will likely reach the Fed's 2% target in 2025. Housing inflation, the largest component of the CPI basket, remains elevated but will likely normalize, as suggested by real-time rent data for newly signed leases. A gentle slowdown in economic growth and employment will also help ease price pressures in the services sector.

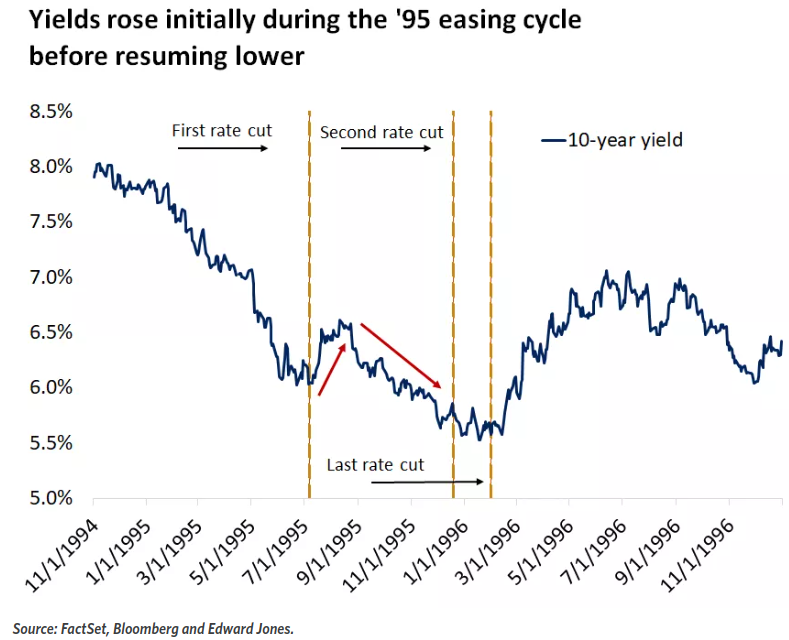

While there is debate about the pace, the Fed will likely continue to cut rates through 2025 to remove some of its restriction. Even after the initial 0.5% cut, the real Fed policy rate (after adjusting for inflation) remains near the highest of the past 20 years1. Whenever the Fed has cut rates in the past, it has pulled yields lower across the curve. That was also the case in the mid-1990s soft-landing example. Initially, the 10-year yield rose 0.6% following the Fed's July 1995 rate cut, but the downtrend resumed, and by October yields were making new lows for the year.

-

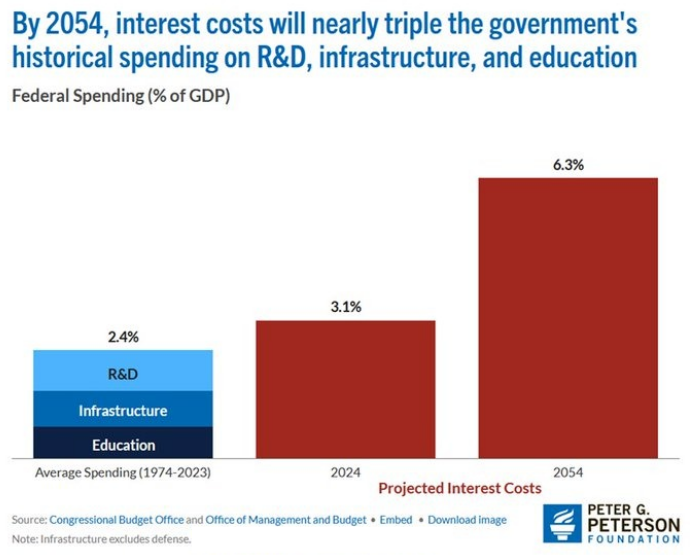

US net interest costs as a share of GDP are set to reach 6.3% by 2054, the highest on record.

This will be more than DOUBLE the 3.1% projected for the Fiscal Year 2024.

To put this into perspective, interest costs will nearly triple the government's average historical

spending on R&D, infrastructure, and education COMBINED. Interest payments have reached $1.1

trillion over the last 12 months, exceeding defense spending for the first time.

At the current pace, interest will soon be the largest expense in the Federal budget,

surpassing Social Security.

-

Stock market concentration has rarely been so extreme: The top 10 US companies now account for

18% of global stock market capitalization, the most since the early 1970s.

Over the last 15 years, this share has TRIPLED.

To put this into perspective, even at the the 2000 Dot-Com bubble peak, the top 10 firms'

weight was 14%, or 4 percentage points lower.

At the same time, the top 5 US companies reflect 15% of global stocks' market value, the most

since the data began tracking in the 1970s. A few key US stocks effectively ARE the stock market.

-

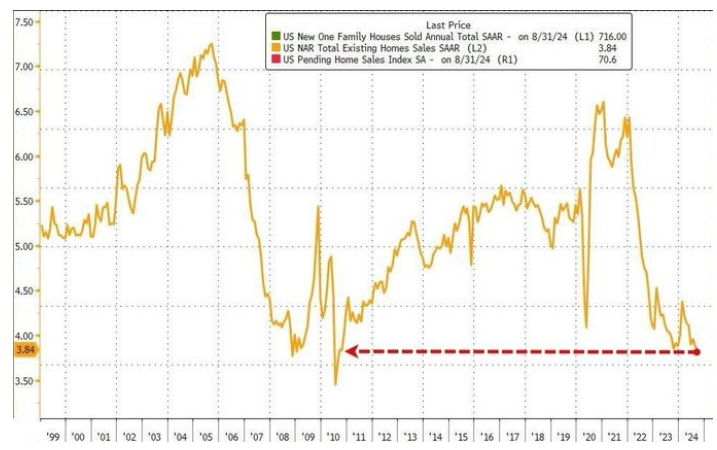

September existing home sales fell 3.5% year-over-year to the lowest level since 2010. Existing

home sales fell to a seasonally adjusted, annualized rate of 3.84 million units, the slowest

pace since October 2010. First-time buyers made up 26% of purchases, matching an all-time low.

Meanwhile, the median sales price rose 3% in September compared to last year's data, to $404,500.

At the current pace, available inventory would last 4.3 months, the longest in more than 4 years,

according to Zerohedge. The housing market is stalling.

-

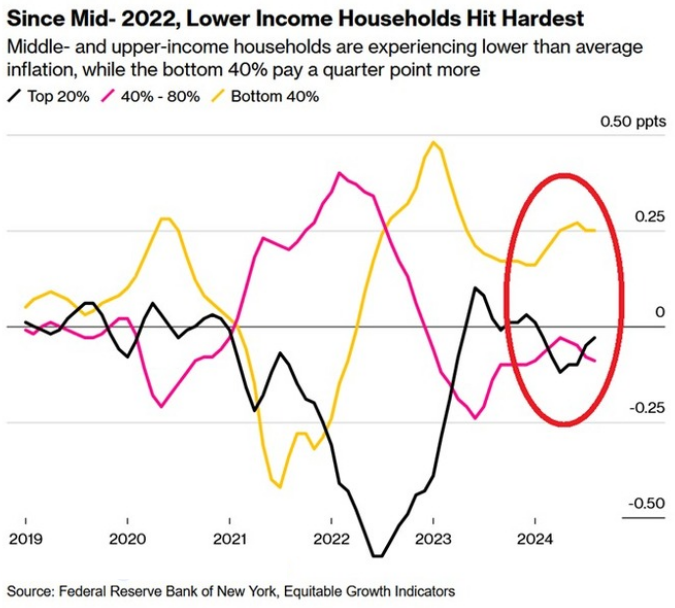

Lower-income households are experiencing HIGHER inflation:

The bottom 40% of households by income are now experiencing inflation that is 25 basis points

higher than the national average, according to a Fed study.

In 2022, these households saw inflation that was 50 basis points above the national average.

This is primarily due to housing and food accounting for a larger share of their expenses.

Meanwhile, the top 20% of households by income have been experiencing lower inflation than the

national average since 2021. Basic necessities have never been more expensive.

-

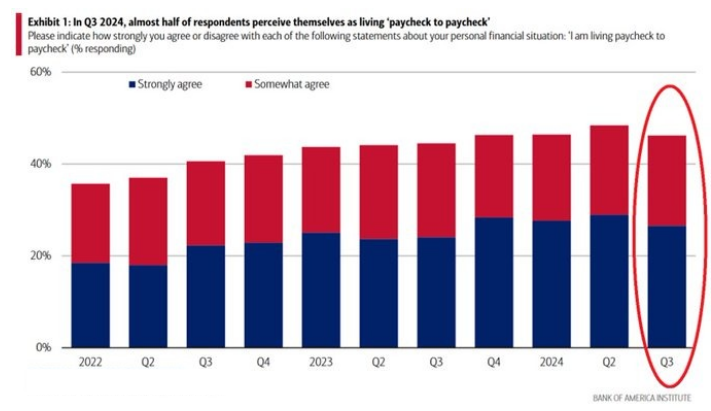

Nearly 50% of US consumers perceive themselves as living "paycheck to paycheck," according to a BofA study.

By comparison, in Q1 2022, this percentage was at ~37%.

Cost of living has increases are primarily at blame, particularly in food and housing.

Food prices in the US reached a new all-time high in September and are up 22.5% since 2021.

While we have had a period of disinflation, prices are still rising.

Inflation has left many Americans struggling.

-

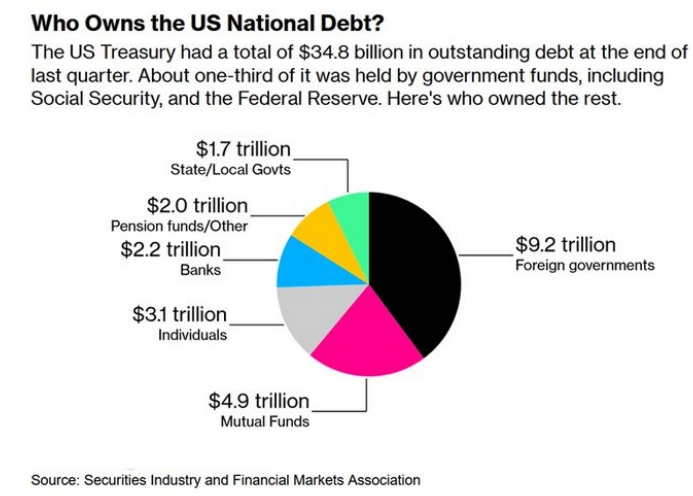

The US Treasury had $34.8 trillion in outstanding debt at the end of Q2 2024, of which ~33% was

held by government funds such as Social Security and the Fed.

$9.2 trillion, or ~26%, was owned by foreign governments, with the most held by Japan and subsequently China.

$4.9 trillion, or an equivalent of 14%, was in possession of mutual funds and $3.1 trillion by individuals.

Banks and pension funds owned $2.2 trillion and $2.0 trillion, respectively.

Meanwhile, US federal debt has jumped $300 billion over the last 3 weeks and hit a new record of $35.8 trillion.

We will soon see $40 trillion of US Federal debt.

-

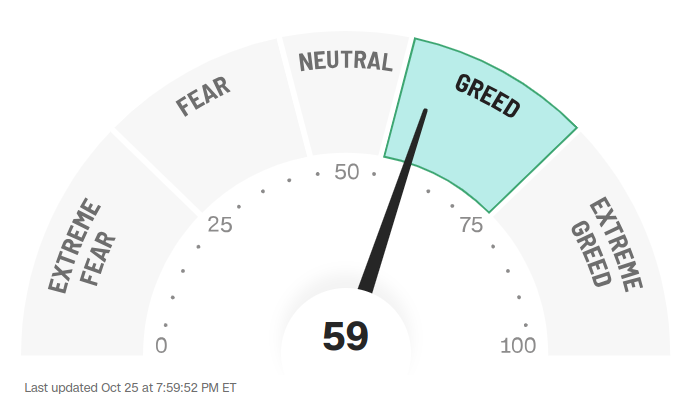

Final Words: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'greed' while global political turmoil is at peak.

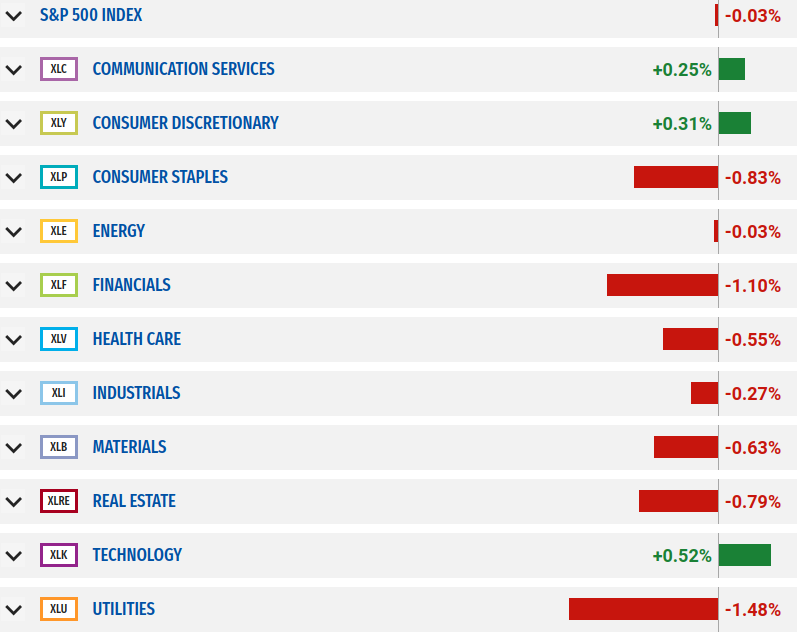

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

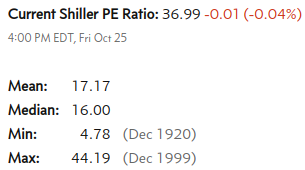

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.