Weekly Market Commentary - Oct 18, 2025 - Click Here for Past Commentaries

-

After a six-month rally, the S&P 500 faces challenges from U.S.-China trade tensions, the U.S. government shutdown,

and concerns about regional banks' credit quality. Rising VIX and a shift to safe-haven assets like U.S. Treasuries

signal investor fatigue. However, Federal Reserve rate cuts, strong corporate earnings, and supportive fiscal

policies suggest a solid foundation for 2026, preventing a deep bear market. Investors should use volatility to

rebalance, diversify, and add quality investments at better prices. Consult your financial advisor to align

investments with long-term goals.

After a 35% rally in the S&P 500 without a 5%+ pullback, stock market gains may pause. Several headwinds loom. We outline three:

Ongoing uncertainty around tariffs and trade, U.S. government shutdown:

Recent tariff disputes between the U.S. and China, driven by China's rare-earth mineral export controls, have eased slightly. President Trump noted that 100% tariffs on Chinese goods are likely unsustainable and confirmed a meeting with President Xi later this month in South Korea. These developments reduce fears of a worst-case tariff scenario. Despite the U.S. government shutdown, the October 24 CPI report is expected to show headline inflation rising to 3.1% annually from 2.9%. Escalating tariffs may push goods inflation higher, but stabilizing tariff rates could moderate inflation next year.

The U.S. government shutdown entered its third week, with repeated failed Senate votes to fund the government through November 21. In 2018, a 35-day shutdown, the longest in history, reduced quarterly GDP growth by 0.4%, per the CBO. Despite this, U.S. economic growth remains strong, with third-quarter annualized growth over 3.0%. The Atlanta Fed GDP-Now tracker estimates 3.9% growth this quarter, above the 1.5%–2.0% long-term trend. However, a prolonged shutdown could increase economic damage in the fourth quarter, disrupting markets, economic data transparency, and agencies like TSA and air-traffic control.

New concerns about small regional banks emerged last week, focusing on loan fraud losses at Zions Bank and Western Alliance tied to the same investment funds. Despite a sharp decline in the KRE regional-bank index, there’s little evidence of widespread credit issues among larger banks and consumer finance firms. Five of eight S&P 500 diversified banks reporting third-quarter earnings beat expectations. Default rates are low, banks are well-capitalized, and if these losses are isolated, the sector’s weakness may be short-lived. Still, investors will likely monitor this space closely as the economic cycle matures and risks from speculative transactions rise. Recent volatility underscores the need for diversified, quality investments in stocks and bonds.

Signals from bond markets and the VIX volatility index indicate fatigue in the ongoing rally as markets digest uncertainties around tariffs, the U.S. government shutdown, and small regional-bank credit quality concerns. The VIX, Wall Street's fear gauge, climbed above 20 after months in the mid-teens. Markets saw larger one-day and intraday swings, with the S&P logging its first 2% single-day drop since April on October 10. A bid for safe-haven assets emerged, with U.S. Treasury yields falling and prices rising. The 2-year Treasury yield hit its lowest level since 2022 last week, reflecting growing market and economic uncertainty.

-

While the market rally may face challenges due to trade uncertainty, the U.S. government shutdown, and emerging

credit concerns, we don't expect a pullback to become a deep bear market. Favorable factors for 2026 include Federal

Reserve interest rate cuts, a supportive U.S. tax bill for capital expenditures and R&D, and sustained corporate

earnings growth.

Third-quarter earnings season is underway, with 12% of S&P 500 companies reporting, 85% exceeding expectations. Forecasts predict 2025 earnings growth at 10.5%, accelerating to 13% in 2026. While technology and AI sectors have driven earnings this year, broader sector leadership is expected in 2026.

-

In our view, investors can use market volatility to take three actions: 1) Rebalance: As equity markets rally,

portfolios may become equity-heavy. For example, a 60% equities, 40% bonds portfolio may now be skewed. Rebalancing

aligns with desired risk levels. 2) Diversify: Given the rally in sectors like technology and AI, diversify into

underperforming areas with catch-up potential by trimming winners or adding new funds. 3) Add quality

investments: During corrections, prepare a list of quality investments aligned with your strategy to capitalize

on lower prices. While dollar-cost averaging is effective, opportunistic investing may also be beneficial.

Markets may be volatile ahead, but economic fundamentals remain sound. Use pullbacks to rebalance, diversify, or invest.

-

Final Words: Market indicates fear. Buy VOO, VGT, Gold and Silver (GLD & SLV ETF's).

Below is last week sector performance report.

Weekly Sector Performance for Oct 13-17, 2025:

$XLE Energy: 0.89%, RSI: 40.84

$XLK Technology: 2.38%, RSI: 56.85

$XLC Communication: 1.90%, RSI: 47.99

$XLY Consumer Discretionary: 2.48%, RSI: 47.91

$XLP Consumer Staples: 2.09%, RSI: 56.81

$XLF Financial: 0.04%, RSI: 40.35

$XLV Health Care: 0.82%, RSI: 61.54

$XLI Industrials: 1.22%, RSI: 46.84

$XLB Materials: 1.19%, RSI: 42.12

$XLRE Real Estate: 3.34%, RSI: 55.24

$XLU Utilities: 1.52%, RSI: 68.03

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

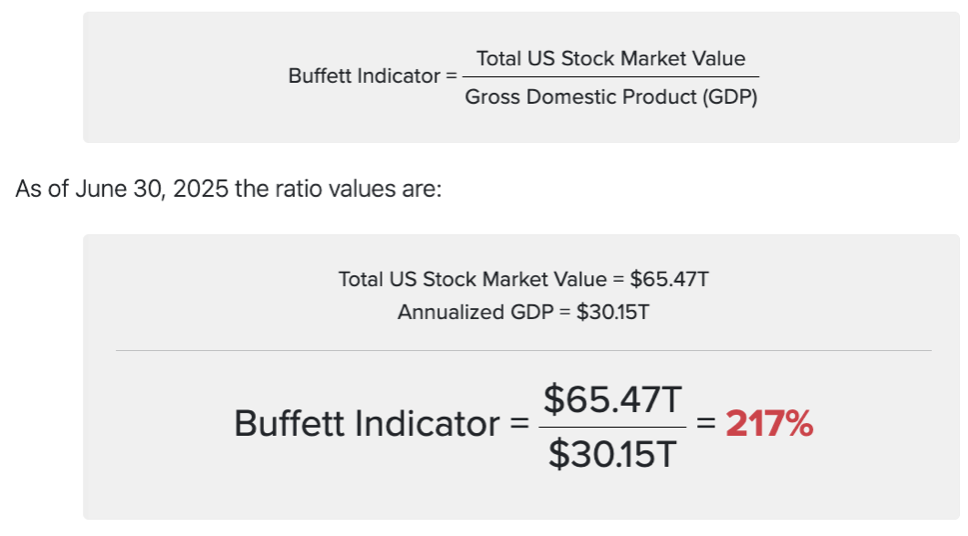

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.