Weekly Market Commentary - Oct 12th, 2024 - Click Here for Past Commentaries

-

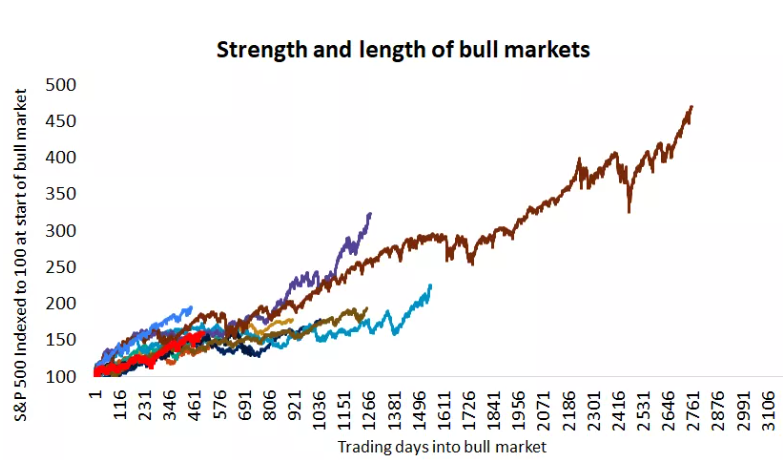

U.S. large-cap stocks increased 24% in the first year after the October 2022 low and gained

another 35% in the second year, which wrapped up last week. While the combined 60% gain

may seem excessive at first glance, it is right in line with the historical average of

the past 11 bull markets going back to 1957.

-

Geopolitical uncertainty and the U.S. election might be sources of short-term volatility,

but history offers reasons for optimism. The average duration of the last 11 bull markets

has been nearly five years, with most of them (eight out of 11) making it to the end of

the third year2. This suggests that the current bull might still be in its early or middle phase.

However, year three might not be a smooth ride. Returns tend to moderate, with stocks advancing

only half the time, while in the other half stocks pulled back to catch

their breath.

-

The third-quarter earnings season kicked off last Friday, with some of the big U.S. banks

reporting better-than-expected results. Consensus expects earnings for the quarter to

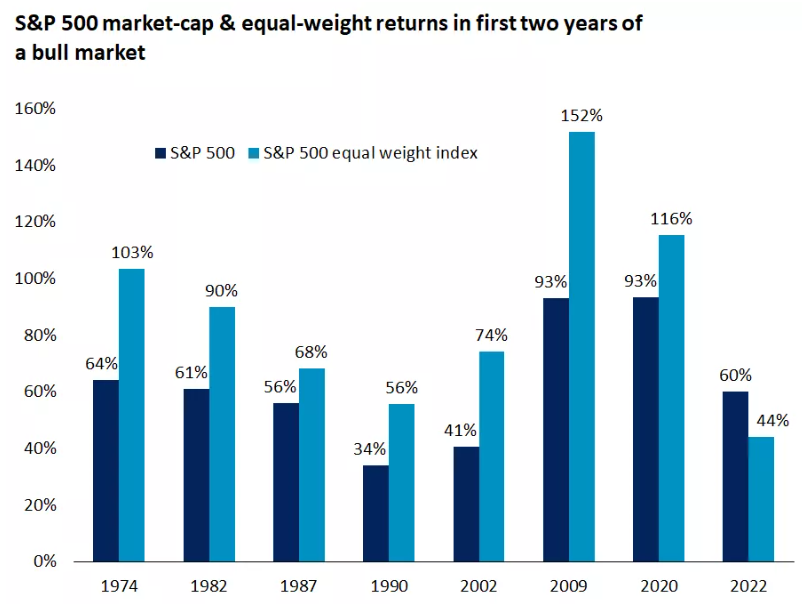

grow 4.2%, the fifth consecutive quarter of growth. A key trend to watch is whether

an expected slowdown in earnings of the Magnificent 7 group of stocks coincides with

a pickup in earnings growth from the rest of the market, or the S&P 493. If that happens,

leadership will continue to broaden, with cyclical sectors and value-style investments

starting to make up some of the lost ground. Backed by a resilient economy, we project

corporate profits to rise again next year, but possibly less than the 15% earnings

growth analysts have penciled in, which appears a bit optimistic.

-

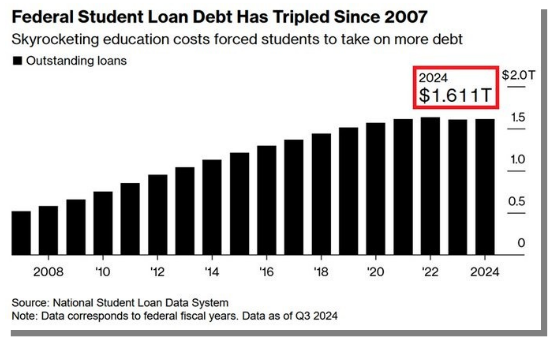

Federal student loan debt hit $1.61 trillion in Fiscal Year 2024, near the highest on record.

Since 2007, US student debt has TRIPLED, according to the National Student Loan Data System.

~10 million borrowers, accounting for over 25% of the total, were behind on their student loan payments this year.

After years of interest free student loans, borrowers are struggling to pay back their debt.

-

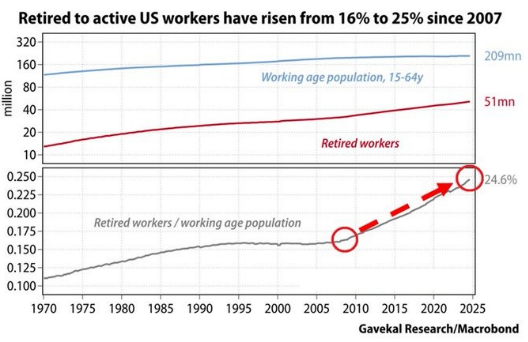

The ratio of retired Americans relative to the working-age population rose to 25% in 2024, the most on record.

Over the last 14 years, this percentage has risen from 16% as the number of retired workers has increased much faster

than people in the workforce. During this time, the number of retired individuals has risen by 45% whereas active

worker count is up just 7%. The US population is rapidly aging which will put even more pressure on Social Security

spending in the future.

-

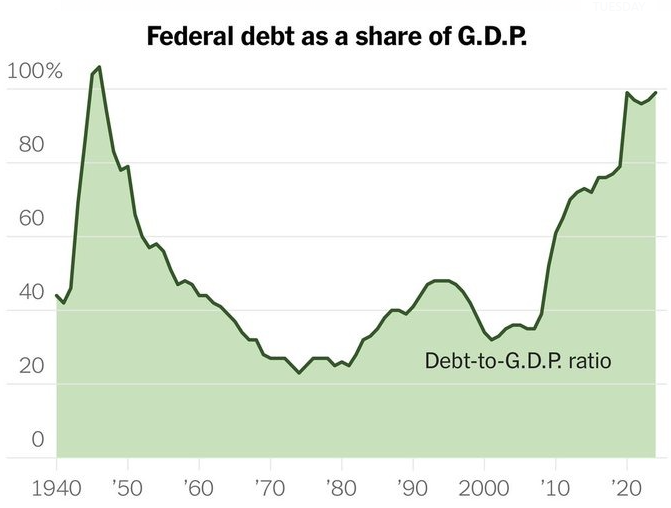

Within 2 years, the U.S. National Debt is projected to be larger than the GDP for the first time since the

start of World War 2.

-

THE NUMBER OF MULTIPLE JOBHOLDERS IN THE US HIT A NEW RECORD. US multiple jobholders hit a MASSIVE 8.7 MILLION in September.

Over the last 4 years, the number has jumped by over 3 million. This comes as full-time jobs are falling while part-time

jobs hit near a record high.

-

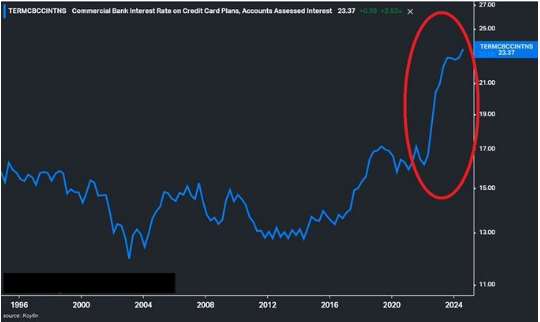

US credit card interest rates hit 23.4% in August, a new record. Over the last 2 years, rates have soared by 7 percentage points.

US consumers now have a record $1.36 trillion in credit card debt and other revolving credit meaning they pay a

massive $318 billion annual interest. To put this into perspective, Americans paid just half of that in 2019 at ~$160 billion.

Meanwhile, credit card serious delinquency rates are at 7%, the highest level since 2011.

-

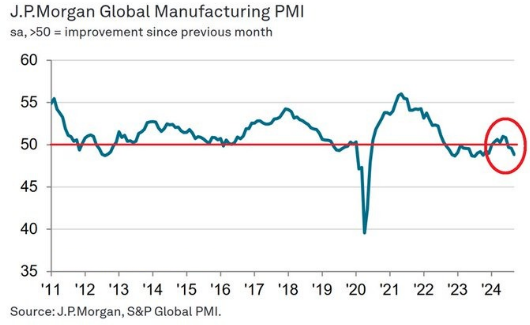

The Global Manufacturing PMI index fell to 48.8 points in September, down from 49.6 in August, marking the 3rd

straight monthly contraction. 4 of the 5 index components shrunk last month including output, new orders, employment,

and stocks of purchases. Furthermore, new export orders declined at the fastest rate in 11 months.

This implies that global trade volumes could be decreasing now by 3-4% year-over-year.

Meanwhile, manufacturers' business optimism fell to a 22-month low, suggesting a grim outlook for the next few months.

-

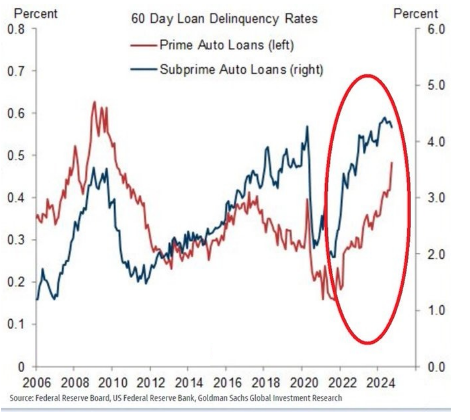

Auto loan delinquency rates keep on rising in the US:

Subprime auto loan delinquency rates just crossed above 4% for the first time on record.

The 60-day delinquency rate for subprime auto loans has more than DOUBLED in just 3 years.

Delinquency rates now exceed both 2008 and 2020 levels.

At the same time, prime auto loan delinquencies spiked to their highest since 2011.

Meanwhile, car insurance costs skyrocketed 15% in the first half of 2024 to an average of $2,329,

the most on record.

-

While September CPI inflation is at 2.4%, inflation is much higher in many basic necessities:

1. Car Insurance Inflation: 16.3%

2. Transportation Inflation: 8.5%

3. Homeowner Inflation: 4.9%

4. Car Repair Inflation: 4.9%

5. Rent Inflation: 4.8%

6. Hospital Services Inflation: 4.5%

7. Food Away From Home Inflation: 3.9%

8. Electricity Inflation: 3.7%

Core CPI inflation is now at 3.3% and rising for the first time in 18 months. Meanwhile, 258,000 Americans filed for unemployment this week ALONE.

-

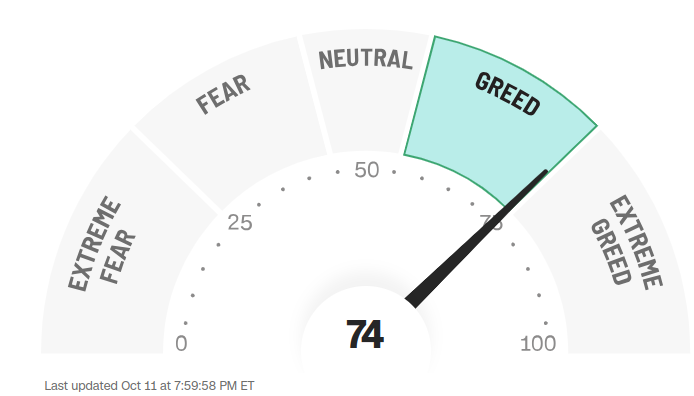

Word of Caution: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'extreme greed' while global political turmoil is at peak.

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

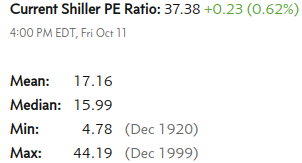

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.