Weekly Market Commentary - Nov 9th, 2024 - Click Here for Past Commentaries

-

The decisive U.S. election outcome cleared a source of uncertainty for the markets,

with stocks posting their best ever post-election rally. Republicans have a strong

mandate winning the presidency, Senate, and possibly the House. While campaign-trail

pledges don't always translate into policy, there are potential market implications

from the shift in the balance of power.

-

The likelihood of tax cuts and deregulation may boost economic growth further,

supporting corporate profits and the rally in stocks. But tariffs and debt concerns

may push rates up and pressure bonds, acting as an offset. The Fed cut interest rates for

the second time this cycle and continues to view its policy as restrictive. However, strong

growth and possibly looser fiscal policy next year may lead the Fed to move more slowly,

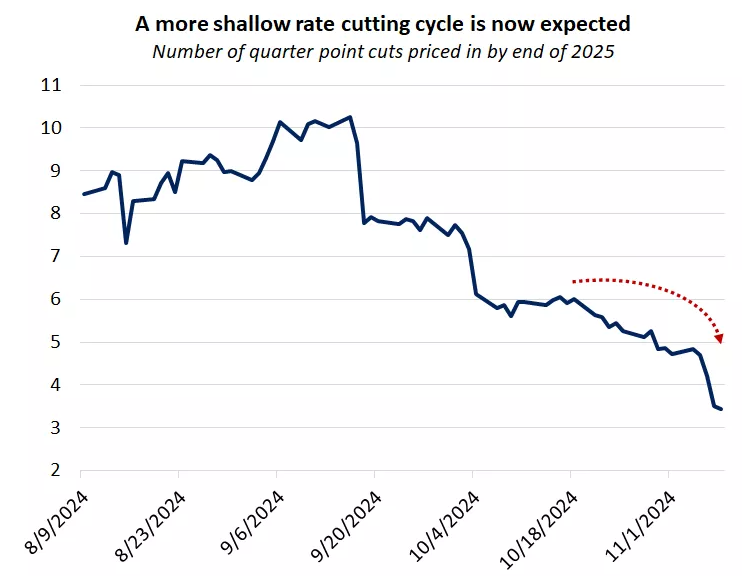

with markets starting to price in a shallower rate-cutting cycle.

-

Leading into the election, equity- and bond-market volatility had been rising, following

historical patterns for election years. With results now known, the election uncertainty

is removed from the list of investors' worries. Volatility quickly subsided, and stocks

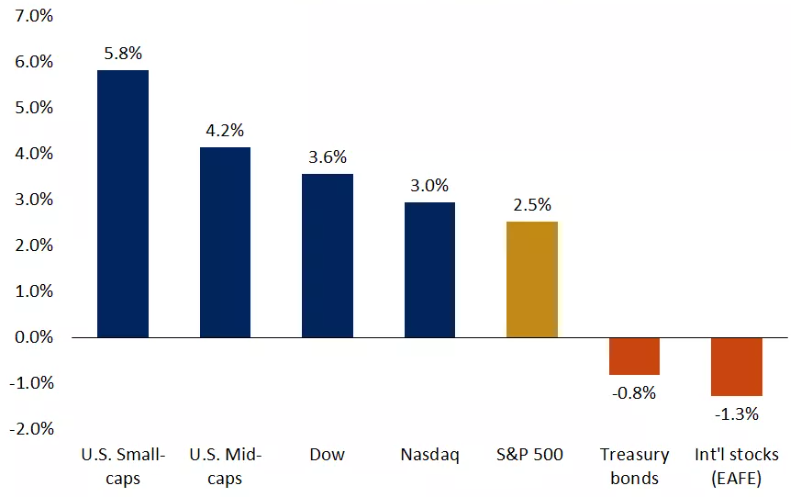

saw their best ever post-election rally with the S&P 500 rising 2.5%.

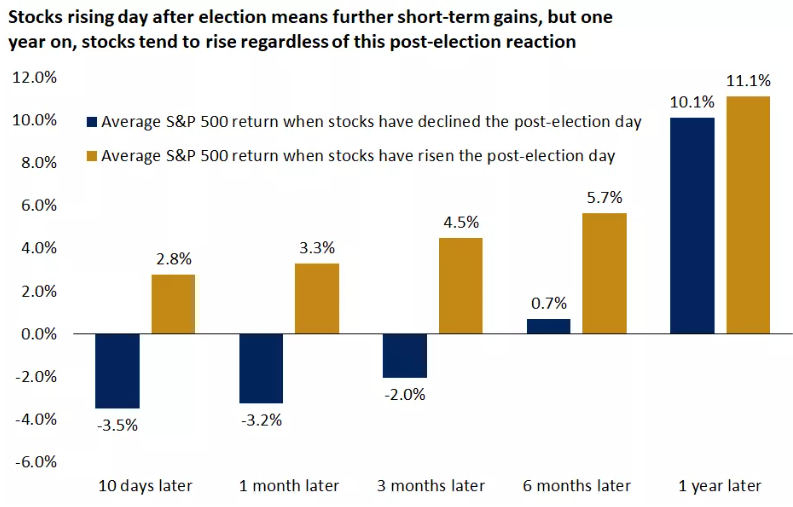

We would caution that markets tend to overact the day after the election, and it wouldn’t be surprising if some of the initial optimism fades in the coming days. However, history shows that further gains are often the norm. Since 1930 there have been 23 elections prior to the current one, with equities rising on the day after in nine instances. In all cases, the S&P 500 was higher 10 days later and remained higher three months afterward in seven cases.

A big part of Trump's economic campaign promises has been the extension of the 2017 Tax Cuts and Jobs Act (TCJA) provisions, which would otherwise be sunset in 2026. In addition to extending the individual tax rates, a Republican administration could also push to cut the corporate tax rates, which, in combination with deregulation initiatives, may revive corporate spending and boost economic growth. That potential boost would come at a time when the economy is already growing at a brisk pace. This scenario would benefit domestic, cyclical and smaller-cap companies, which are the ones that popped the most following the election outcome. The financial services sector was a standout, with regional banks rising 10% under the hopes of lighter banking regulations, lower capital requirements, and an easier merger-and-acquisitions environment.

-

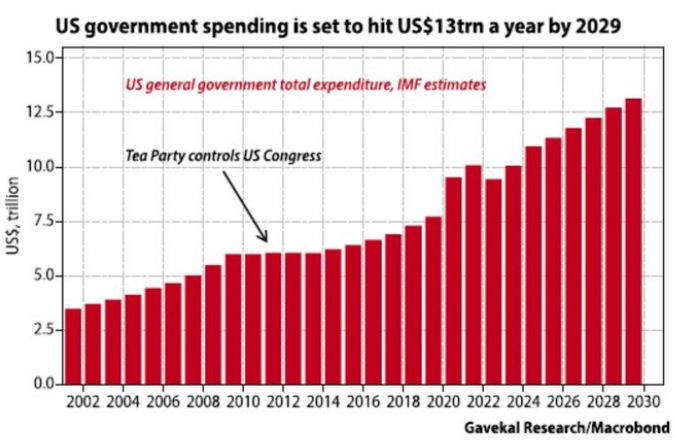

The flip side of any new fiscal initiatives is that they would come at a cost. The extension of

the existing tax cuts alone is estimated to increase deficits by nearly $5 trillion through 2034,

adding to the government debt, which currently stands at about 100% of GDP. A further jump in debt,

together with tariffs and an aggressive approach to immigration, could lead to higher inflation and

higher interest rates. Of course, the threat of blanket tariffs could be a negotiating tactic, and,

even if implemented, the effect may not be felt in 2025. However, given the inflationary pressures

of the last three years, investors will be wary of any signs that inflation is reaccelerating.

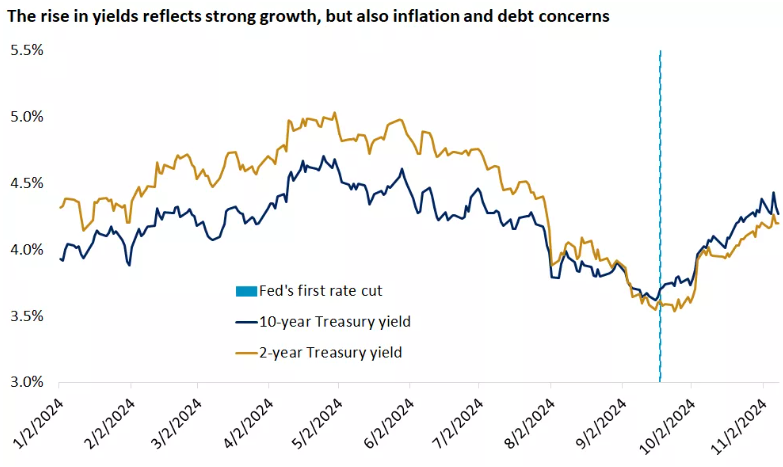

Reflecting these concerns and the potential for faster economic growth were government bonds,

which were under pressure last week, with the 10-year Treasury yield spiking to a four-month high

before easing after the Fed meeting.

Partly overshadowed by the election, the Fed cut rates for the second time this cycle, bringing its policy rate to 4.5% - 4.75%. As highlighted in the post-meeting press conference, policymakers will not react to any campaign policy proposals until they are implemented, and Chair Powell continues to view current interest rates as restrictive. But even as the plan remains for policy rates to gradually move toward neutral, the stronger economic and inflation data in recent months suggest that there is no urgency with the pace of rate cuts. Looser fiscal policy next year may lead the Fed to move more slowly than it otherwise would. And this is now reflected in the bond market, which, after the election result, is pricing in a shallower rate-cutting cycle, projecting three additional rate cuts expected by the end of next year instead of about six expected a month ago. Because the gap between the fed funds rate and inflation remains wide, we think that there is scope for rates to decline further, but possibly toward 3.5% - 4.0% instead of the 3.0% - 3.5% that we previously expected.

Major economic trends that were in place before the election are likely to continue, and investors may want to avoid the urge to change strategies or portfolios because of the election. U.S. companies will be able to adapt to different policies as they have done successfully in the past, and global forces will continue to exert outsized influence.

That said, the potential for tax cuts (personal and corporate) and deregulation may provide an additional tailwind to the theme of broadening market leadership, which has started to take shape since the start of the third quarter. Value-style investments and cyclical sectors, along with small- and mid-caps, have been left behind since the start of the bull market in October 2022 and have room to catch up as the rally broadens beyond tech. We would highlight our overweight on U.S. mid-cap stocks and the industrials sector as two ideas that may benefit from pro-growth policy. On the other end, trade wars, the threat of tariffs, and the potential for a stronger dollar may weigh on international developed-market equities, which we have an underweight on in our opportunistic asset-allocation guidance.

In isolation, the potential policy shifts are seemingly positive for equities but negative for bonds. A likely Republican sweep may bring fiscal concerns back to the forefront amid growing deficits and elevated debt. However, we think the recent rise in yields offers another opportunity to extend the maturity of fixed-income portfolios ahead of lower rates on cash investments. As discussed, a slower pace of Fed rate cuts is possible if inflation proves persistent, but we think that yields are currently attractive and at the high end of their potential range. Repositioning into intermediate- and long-term bonds where appropriate can help lock in the high yields for longer, as CD rates will likely continue to move lower in lockstep with the Fed's policy rate.

-

US job openings fell by 420,000 in September, to 7.44 million, the lowest since January 2021.

US available job vacancies significantly missed expectations of 8.00 million.

Since the March 2022 peak, job openings have now declined by 4.74 million or 39%.

In effect, the ratio of job vacancies to unemployed workers fell to 1.1, below pre-pandemic levels.

Furthermore, data has now been revised DOWNWARD in 15 out of the last 20 months, the highest

frequency in at least 15 years.

-

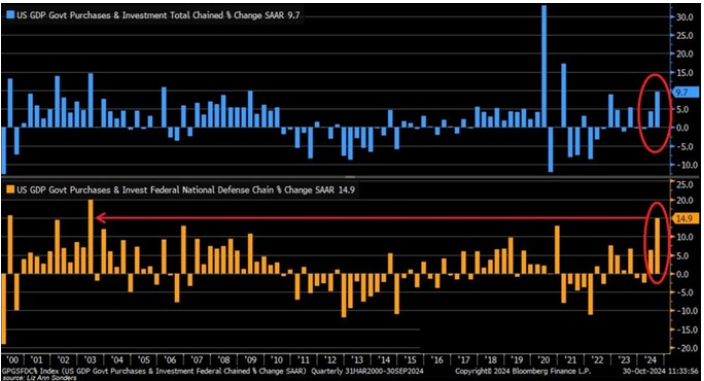

Federal government spending spiked 9.7% in Q3 2024 from the previous quarter, marking the largest jump since Q1 2021.

This was driven by a 14.9% jump in defense expenditures, the largest jump in 21 years.

Since 2020, government expenditures have risen 30% and hit a new record of $5.04 trillion.

Federal spending has been one of the largest contributors to GDP growth over the last 2 years.

The government has now contributed to economic growth for 9 consecutive quarters, with Q3 posting the

largest addition over the past year.

-

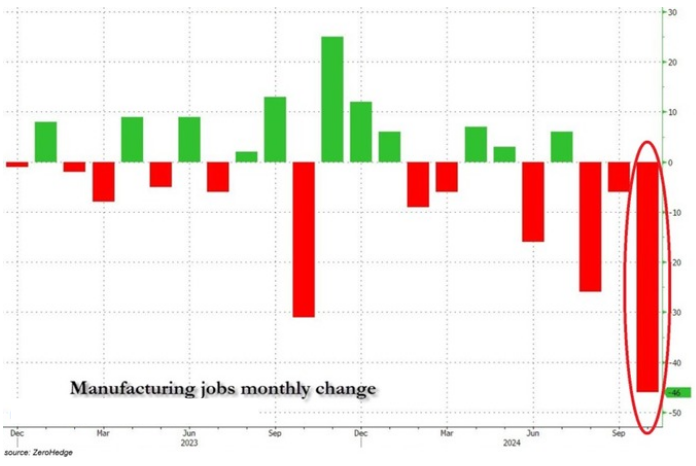

The US economy shed 46,000 manufacturing jobs in October, the biggest drop since April 2020.

Manufacturing jobs have declined in 4 out of the last 5 months by a total of 88,000.

In effect, manufacturing payrolls reached their lowest level since July 2022 and are in a clear downtrend.

This comes as total private jobs plummeted by 28,000, the most since December 2020.

Interestingly, government jobs have been rising and are now up 40,000 over the same timeframe.

-

The ISM manufacturing PMI index shrank further in October, down from 47.2 to 46.5 points.

The index materially missed expectations of 47.6 points.

US manufacturing has now contracted in 22 of the last 23 months, extending the second-longest downturn in history.

Meanwhile, prices paid spiked to 54.8 points from 48.3 last in September, marking the 9th month of expansion out of the last 10.

-

Prices in China fell for the sixth consecutive quarter in Q3 2024, the longest streak since 1999.

This is 3 times longer than during the 2008 Financial Crisis when deflation lasted for 2 quarters.

Even as China has rolled-out pandemic like stimulus, deflationary pressures have persisted.

Producer prices have are now down for 2 straight years as domestic demand remains suppressed.

Meanwhile, the Chinese real estate market continues to trend lower after an 80%+ drop from its peak in the HY sector.

The Chinese economy is struggling.

-

It is estimated that government spending will DOUBLE and hit $13 TRILLION by 2029.

Meanwhile, the US posted the third largest budget deficit in its entire history of

$1.8 TRILLION in Fiscal Year 2024.

-

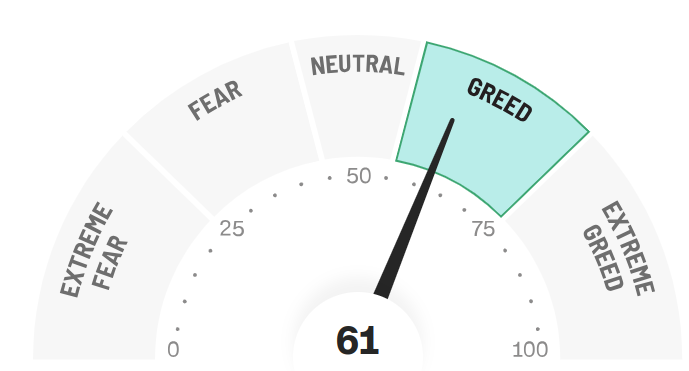

Final Words: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'greed' while global political turmoil is at peak.

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

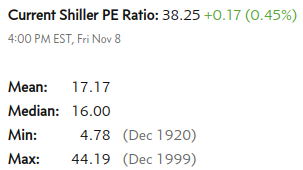

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.