Weekly Market Commentary - Nov 8, 2025 - Click Here for Past Commentaries

-

Equity markets pulled back in early November as AI hype hit a valuation speed bump. Corporate earnings remain

strong, AI capex plans unabated; the pullback reflects sentiment and valuation adjustments, not fundamentals.

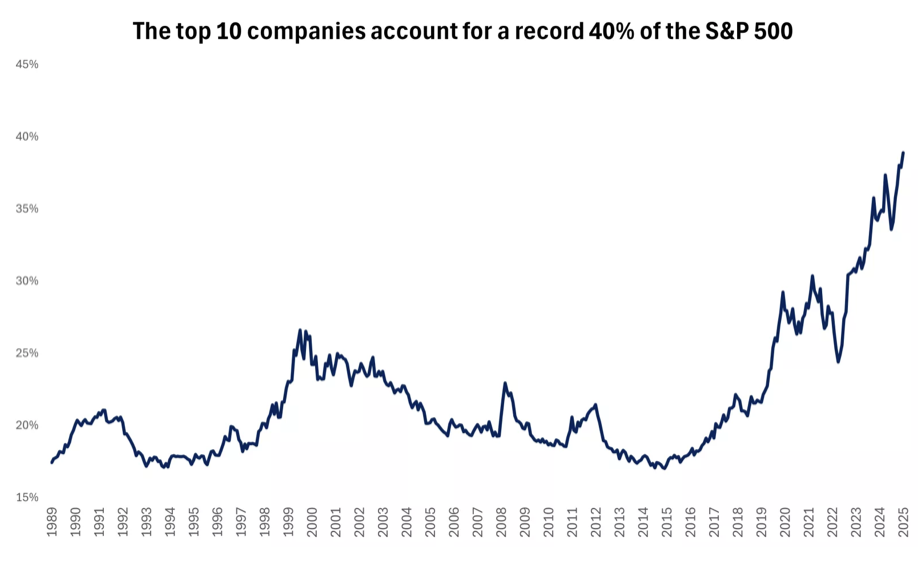

Recent volatility highlights risks of historic market concentration; top 10 stocks >40% of S&P 500 market cap.

Bubble fears rise, but today's tech leaders are profitable, cash-rich, with Fed easing.

AI layoffs are increasing, especially in tech roles, yet still a small percentage of total cuts. AI productivity

gains should spur jobs long-term; near-term adoption may cool the labor market.

Maintain AI/innovation exposure but avoid over concentration. A balanced portfolio across sectors, market caps,

and geographies is key to managing risk and capturing opportunities as market leadership broadens.

November kicked off with a wobble in equity markets, triggered by renewed scrutiny of artificial intelligence (AI) valuations. While enthusiasm for AI continues to fuel innovation and investor interest, it can also amplify volatility, especially when a handful of mega-cap technology stocks dominate index performance.

We remain constructive on AI’s long-term potential to boost corporate profits and drive economic growth through productivity gains, despite possible short-term labor-market disruptions. Still, recent sentiment swings remind us of the risks of over-concentration. In an AI-driven bull market, maintaining portfolio balance across asset classes, geographies, and sectors is critical.

-

Last week's equity-market pullback was sparked by renewed concerns over stretched valuations, following cautious

remarks from two major bank CEOs at a financial services conference. While the fundamentals of the AI story remain

intact, skepticism around high-flying stocks—especially after seven consecutive months of gains in the tech-heavy

Nasdaq—led to profit-taking. In essence, AI excitement has collided with valuation reality, prompting a sector

rotation.

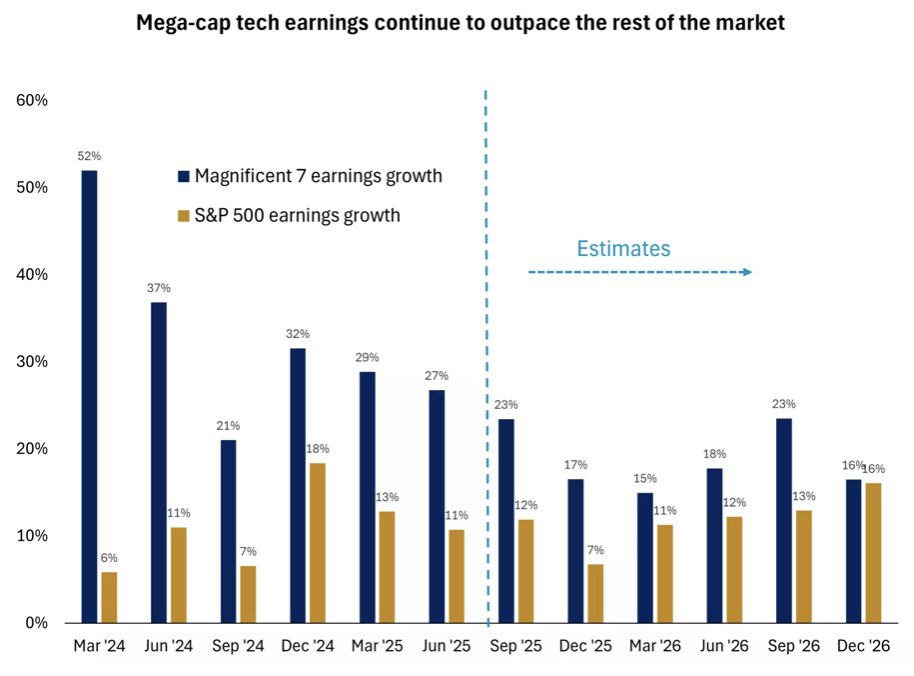

The good news, in our view: Despite the cooling of AI-related hype, corporate fundamentals continue to surprise to the upside. As of Thursday, roughly 85% of S&P 500 companies have reported third-quarter earnings, including five of the Magnificent Seven (Amazon, Apple, Meta, Alphabet, and Microsoft). With 82% beating expectations—above the five-year average of 78%—the index is on track for 12% earnings growth, marking the fourth straight quarter of double-digit gains.

A key driver remains the tech sector, which posted 22% earnings growth. The Magnificent Seven continue to outperform the broader market, with several mega-cap tech firms raising guidance for profits and AI-related spending. We think this investment surge reflects strong customer demand, opportunity, and a strategic imperative: AI is increasingly seen as essential for survival, as emerging competitors pose existential threats.

The upshot: We see no signs of deterioration in earnings, spending plans, or forward guidance. This pullback appears to be a sentiment and valuation adjustment, not a change in corporate fundamentals.

-

Since ChatGPT’s release in late 2022, the Magnificent Seven have soared nearly 190%, lifting the S&P 500 by 75%,

but also creating unprecedented market concentration. Today, the top 10 stocks account for over 40% of the S&P

500’s market capitalization.

At the center of this rally is NVIDIA, the cornerstone of the AI ecosystem, which recently became the first company in history to surpass a $5 trillion market cap. For context, that’s

* larger than five of the S&P 500’s 11 sectors;

* equal to 60% of the entire Russell 2000 small-cap universe;

* half the size of the STOXX 600, Europe’s large-cap benchmark; and

* bigger than Germany’s GDP.

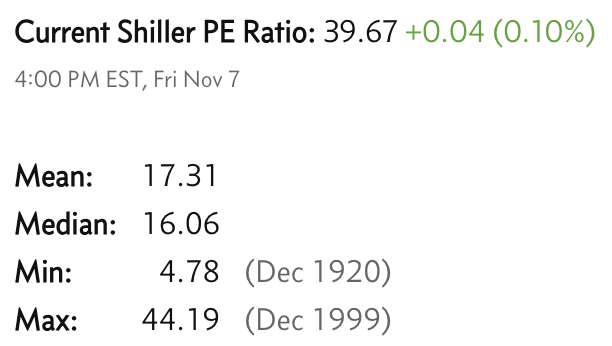

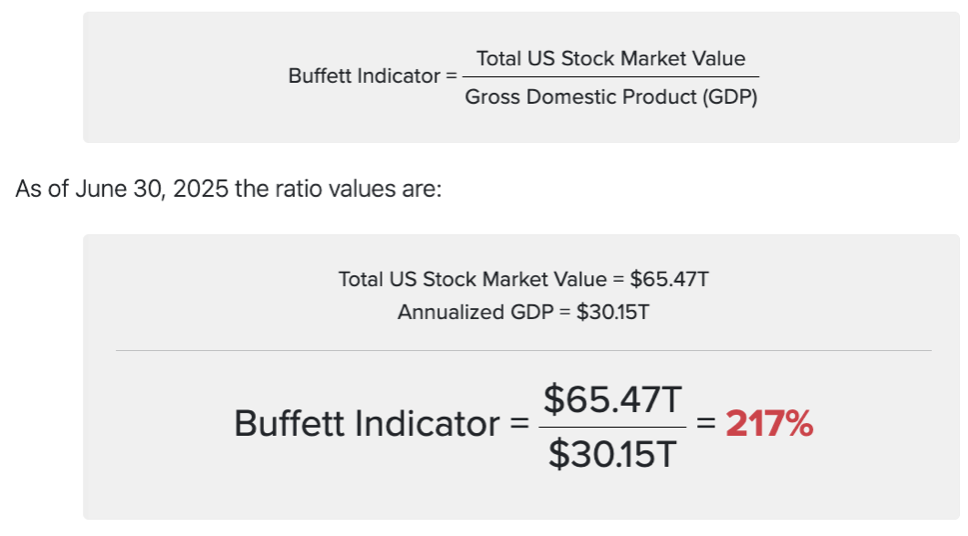

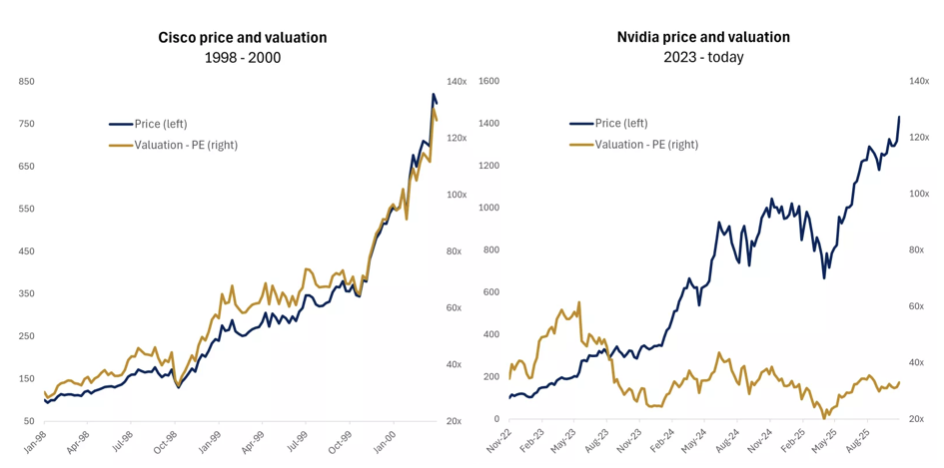

As valuations and concentration rise, comparisons to the dot-com bubble are becoming more frequent.

But there are key differences this time:

Profitability & maturity: Today’s tech leaders are highly profitable with diverse revenue streams. Unlike the speculative startups of 2000, these firms are integrating AI into core operations that already generate substantial earnings.

Spending sustainability: Most mega-cap tech companies fund massive AI investments through internal cash flow, not debt*. Though no longer capital-light, they continue generating strong operational cash, unlike late-1990s telecom firms.

Valuations: While elevated, they are not as extreme as in 2000*. This time, profits—not just expanding multiples—drive the rally. With limited room for further multiple expansion, earnings growth must carry the market forward, suggesting more moderate gains ahead, in our view.

Fed policy: Bull markets don’t die of old age—they’re usually killed by the Fed. Unlike 2000, when rate hikes ended the rally, today’s Fed is cutting rates, providing a supportive backdrop.

Bubbles are typically clear only in hindsight. Even if we’re in an AI-driven bubble, it doesn’t appear near its peak. Rising profits and strong fundamentals counter concerns of irrational exuberance. In fact, third-quarter earnings reinforced the positive AI narrative rather than undermined it.

-

A cooling labor market has emerged as a key shift in this year’s economic narrative, prompting the Fed to resume

rate cuts in September. With official data delayed due to the longest government shutdown in U.S. history,

investors have turned to private sources like ADP and Challenger, Gray & Christmas for insights.

After two consecutive months of job losses, ADP reported a modest increase of 42,000 private payrolls in October, suggesting some stabilization. However, the broader trend still points to a slowdown.

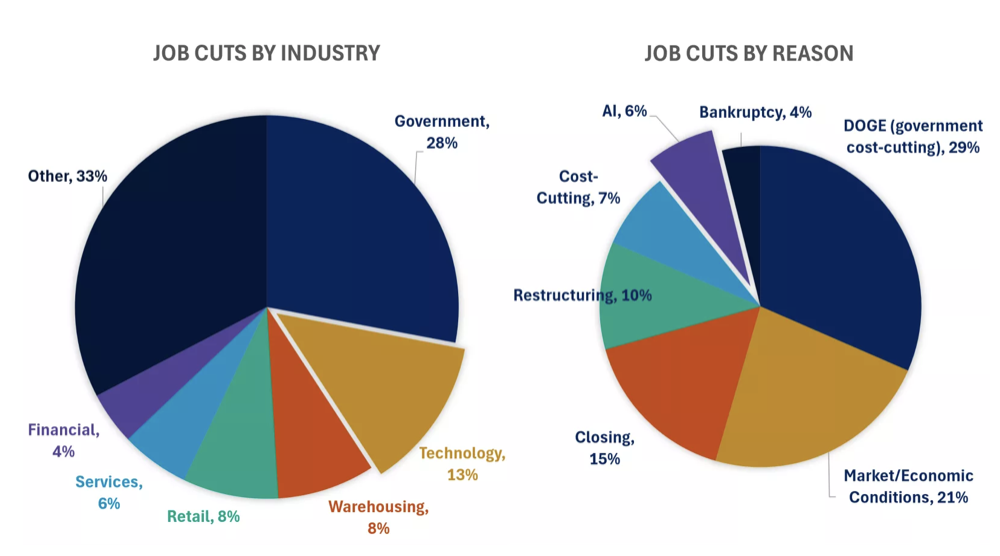

Adding to last week’s risk-off sentiment were new headlines about layoffs. Outplacement firm Challenger, Gray & Christmas noted a sharp rise in job-cut announcements in October, nearly triple the number from a year earlier. According to Challenger, while cost-cutting was the most frequently cited reason, AI emerged as the second-most common factor for October. Year-to-date, AI has been linked to 6% of announced layoffs. Though notable, this remains a relatively limited driver compared to government-related cuts and reduced federal funding.

Still, early research suggests a connection between AI adoption and rising unemployment in certain sectors. A study by the St. Louis Fed found that occupations most intensively adopting generative AI, such as computer and mathematical roles, have seen the largest increases in unemployment. For instance, software developer job openings have dropped 75% from their post-pandemic highs. In contrast, personal service roles like child care providers and hairdressers, which are less exposed to AI disruption, have remained relatively stable.

In our view, as with previous waves of technological innovation, some job displacement is likely during the early stages of AI adoption. However, history shows that productivity gains from disruptive technologies tend to boost overall economic activity, ultimately increasing labor demand and creating new job opportunities across the economy.

-

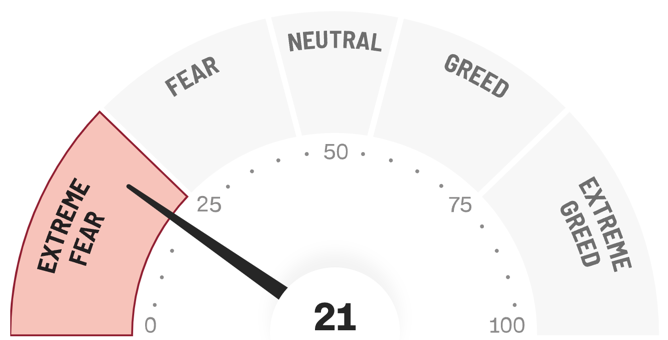

We view November's recalibration in sentiment as an uncomfortable but healthy reset following a historic rally

since the April lows. AI enthusiasm appeared overextended but is likely not over, as fundamentals remain

supportive. We continue to expect robust tech earnings and relative U.S. economic strength, supported by

falling interest rates, moderate fiscal support, easing trade tensions, and sustained innovation investment.

Thus, we maintain a slight overweight to U.S. large-cap equities, though with a slightly reduced allocation

to reflect valuation concerns.

AI remains a powerful long-term growth engine, but investors should avoid overconcentration in a single theme. We believe a balanced approach is key. We recommend broadening exposure to sectors, asset classes, and regions poised to benefit from rising productivity and a potential global growth reacceleration. Opportunities include companies in industrials, consumer discretionary, and health care, as well as those in the mid-cap space.

At the same time, we view global diversification as another hedge against concentration risk. International small- and mid-cap stocks, as well as emerging markets, have gained momentum this year amid a more favorable global economic outlook and a softening U.S. dollar. While the dollar has stabilized recently, it likely remains vulnerable to downside risks from fiscal and political uncertainty and the Fed’s rate-cutting cycle, factors that could further support international equities. Valuations remain attractive, in our view, especially relative to their U.S. counterparts. Emerging markets, in particular, tend to outperform during Fed easing cycles and offer meaningful exposure to global tech innovation.

Stay invested with appropriate exposure to AI and innovation; we think these are durable themes. But avoid overexposure. Diversification, in our view, remains your best defense in a concentrated and fast-evolving market.

-

Final Words: Market indicates extreme fear. Buy VOO, VGT, and GLD (Gold).

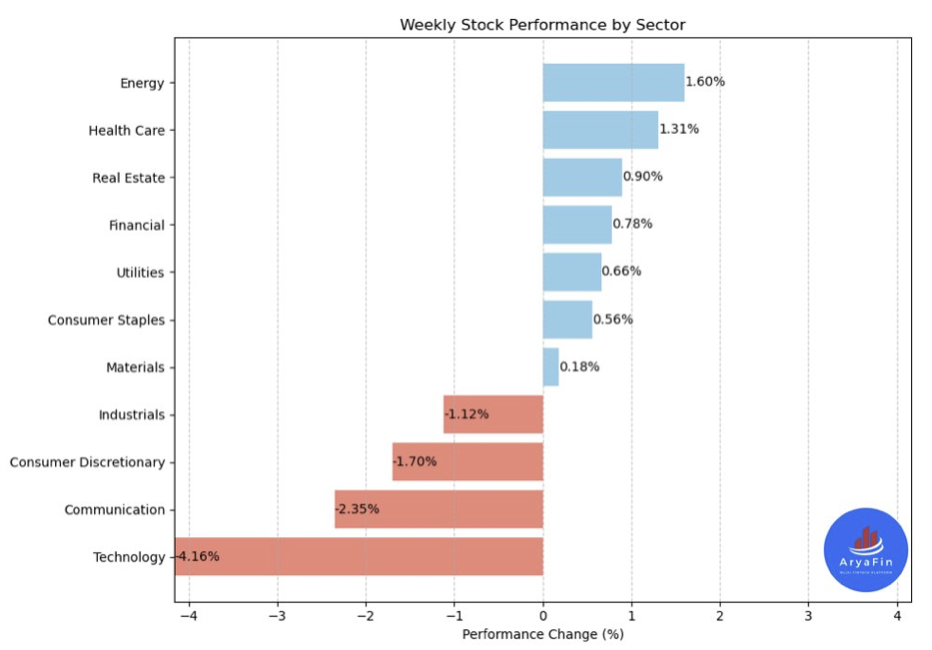

Below is last week sector performance report.

Weekly Sector Performance for Nov 3-7, 2025:

$XLE Energy: 1.60%, RSI: 58.46

$XLK Technology: -4.16%, RSI: 47.55

$XLC Communication: -2.35%, RSI: 37.36

$XLY Consumer Discretionary: -1.70%, RSI: 47.66

$XLP Consumer Staples: 0.56%, RSI: 41.84

$XLF Financial: 0.78%, RSI: 50.11

$XLV Health Care: 1.31%, RSI: 64.99

$XLI Industrials: -1.12%, RSI: 49.14

$XLB Materials: 0.18%, RSI: 40.05

$XLRE Real Estate: 0.90%, RSI: 46.77

$XLU Utilities: 0.66%, RSI: 52.15

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.