Weekly Market Commentary - Nov 23rd, 2024 - Click Here for Past Commentaries

-

Stocks are on track to finish the year strong, while solid fundamentals provide a

supportive backdrop heading into 2025. But with optimism growing, it may be prudent to

consider potential curveballs and how investors can position themselves to prepare.

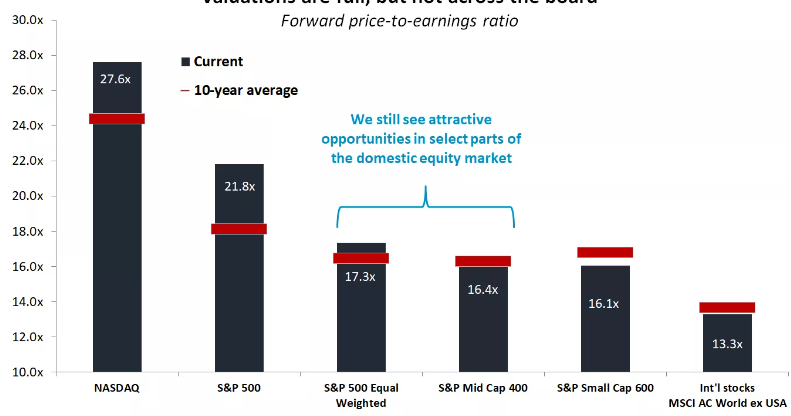

Valuations are elevated relative to history, largely reflecting the dominance of the

mega-cap technology stocks. However, that is not the case across the board, as many

parts of the equity market trade in line with or at a discount to their 10-year average.

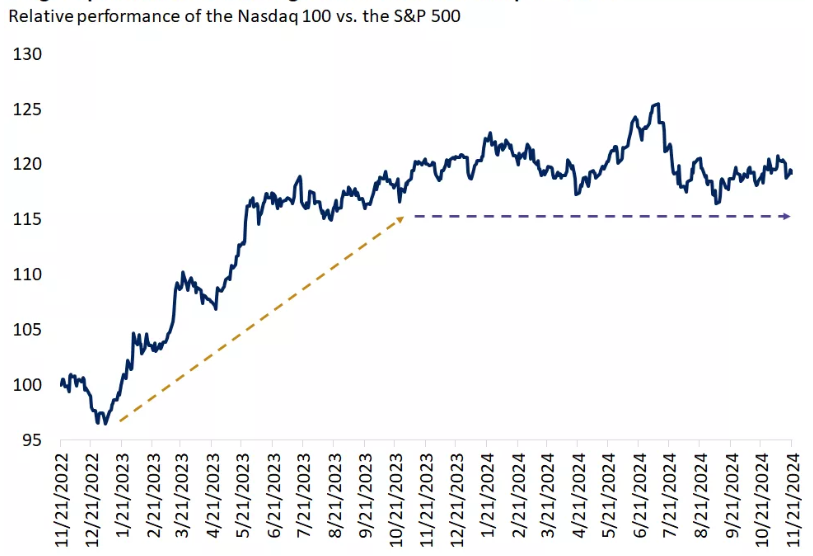

NVIDIA's results and stock reaction highlight the headwind of high expectations. The

tech sector appears to be going through a period of consolidation to digest its outsized

gains over the last two years, but other sectors have stepped up to fill the gap.

Tariffs are likely to be a source of uncertainty if implemented, as they may lead to a one-off

increase in prices, though there are several ways that the impact could be blunted.

To fortify portfolios against these risks, investors may look to ensure they have an appropriate

allocation to value-style investments, along with small- and mid-cap companies that generate a

greater share of their revenue in the U.S. and could be relative beneficiaries of stronger domestic

growth and lower tax rates.

-

Finding flaws in this year's market performance is no easy task, as it continues to deliver strong

returns with low volatility. Last week's gain added to the near-25% rally in the S&P 500, keeping

stocks on track for a solid finish to the year. This positive momentum heading into 2025 is

underpinned by a resilient consumer, rising corporate profits, and the start of a rate-cutting cycle,

conditions that will likely persist in the quarters ahead. But with optimism growing, it may be

prudent to consider potential curveballs and how investors can position themselves to prepare.

-

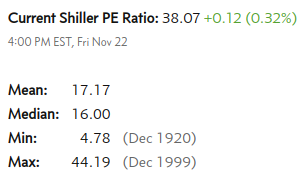

Stock-market valuations have little explanatory power of forward one- and two-year returns, but

they are a much better predictor of the average rate of return over the next 10 years. The higher

the starting point of the price-to-earnings ratio (P/E), the more muted the next 10-year returns.

And vice versa: the lower the current valuations, the higher the future long-term returns.

Currently, the forward P/E for U.S. large-cap stocks is almost 22, which is 30% above its long-term

historical average, suggesting that investors should moderate their expectations. In each of the last

two calendar years in 2023 and 2024, valuations have expanded by more than 10%, helping juice market

returns2. But to repeat that feat in 2025 might be a tall order. The only time over the past 30 years

that we've had three consecutive years of sizable valuation expansion was in the late 1990s leading

up to the tech bubble, a period we would want to avoid replicating.

The good news for investors with well-diversified portfolios is that even though valuations are

elevated relative to history, that largely reflects the dominance of the mega-cap technology stocks

and is not the case across the board. The equal-weighted S&P 500, which assigns the same weight to

all stocks in the index and is a better representation of the "average" stock, trades only at a

slight premium to its 10-year average P/E, while mid-, small-cap and international stocks trade at

or below their long-term valuations2. Given the solid fundamental backdrop, we continue to find

attractive long-term opportunities in areas that have been left behind since the bull market started

two years ago.

-

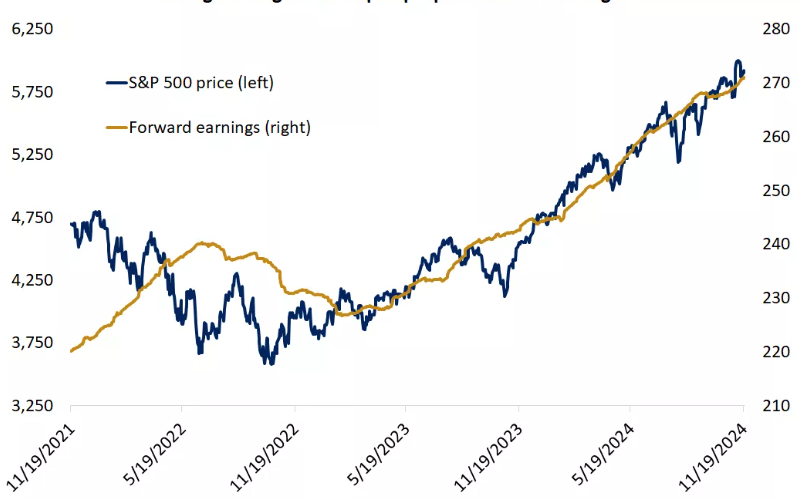

Additionally, valuations have been only part of the market story, with corporate profits

contributing to the returns and on track to accelerate from no growth in 2023 to 9% this year

and possibly 10% - 15% in 20252. And unlike the tech bubble, the tech darlings exemplified by

the Magnificent 7 group of companies are highly profitable with strong balance sheets. The

upshot is that valuations in aggregate are not stretched in our view, but investors may want to

diversify away from the S&P 500's high concentration, as the starting point implies muted returns

over the next decade.

-

All eyes were on NVIDIA last week, as the world's most valuable company, which carries a $3.6

trillion market capitalization, reported its quarterly results1. Like past quarters, the company

experienced strong demand, with sales almost doubling from a year ago and exceeding estimates by

6%. However, the fourth-quarter guidance underwhelmed, indicating the company's revenue growth

will slow to roughly 70%2. While this rate of growth would be the envy of any company, the mild

investor disappointment highlights how the bar of expectations is high, and the ability to meet

that is becoming harder.

AI growth remains robust, and spending is poised to continue, as more companies embrace the technology of generative models to drive productivity, which will likely be a multiyear adoption process. However, the tech sector appears to be going through a period of consolidation to digest its outsized gains over the last two years and is no longer the leader it once was. Relative to the S&P 500, the tech-heavy Nasdaq 100 peaked in July and has been moving sideways since. But other sectors have stepped up, with financials and industrials carrying the torch. This broadening of market leadership is a healthy development, in our view, for the sustainability of the market rally.

-

While there is excitement about the potential of pro-growth policies from the new administration

next year, there are also concerns about the broad deployment of tariffs and an aggressive stance

to immigration, which may be inflationary. President-elect Trump has pledged a 60% tariff on all

imports from China and a 10% universal tariff on imports from other countries. For perspective,

last year, imports from China totaled $421.4 billion and other goods imports totaled $3.1 trillion,

or 11% of GDP.

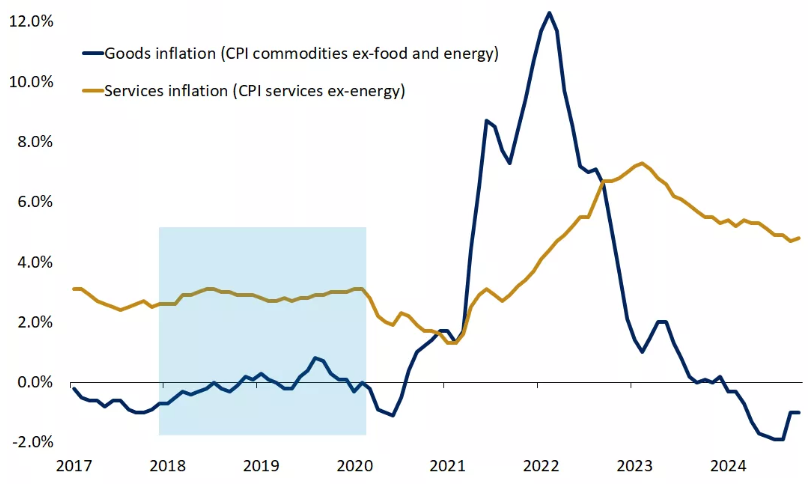

If passed on, the increase in prices on imported goods and materials acts as a tax on consumers, triggering a one-time price adjustment and potentially weighing on economic growth. During the first Trump administration, tariff and trade tensions were a source of volatility for equities throughout 2018. And on the flip side, a trade truce helped stocks rally in 2019. Given the inflationary pressures the last three years, investors will be wary of any signs that price pressures are reaccelerating.

Like in the case of Canada, Mexico, Europe, and China in 2018, the punitive tariffs with trading partners could be a starting point for negotiations to force other countries to make concessions on trade. But even if a universal tariff is applied, there are several ways that the impact could be blunted. A depreciation of other currencies relative to the U.S. dollar can make the foreign goods less expensive, exporters and retailers might not fully pass through the additional cost, and trade patterns and supply chains may shift to avoid tariffs. Fed research suggested that U.S. tariffs during 2018-2019 contributed to an increase in inflation by 0.1%-0.3% and reduced economic growth by 0.3%-0.5%. The impact could be larger this time as the scope of trade actions is broader. But the threat of tariffs should not be viewed in isolation, as it is part of a broader policy mix that could support domestic growth.

The upshot is that tariffs have the potential to lead to a modest one-off increase in prices and are unlikely to be an ongoing source of inflation that would force the Fed to resume rate hikes. Prices for goods were deflating in 2018-2019 prior to the tariffs, as they are this year, and the trade war with China pushed goods inflation only to modestly positive territory. We think it is the outlook for services inflation, which accounts for 61% of the CPI weight vs. 18.5% from goods, that will be the key driver of inflation in the year ahead.

Elevated valuations in parts of the equity market, high index concentration, and trade uncertainty could all be curveballs that trigger higher volatility. But well-diversified portfolios are designed to spread risk, while certain asset classes that comprise them may benefit from upcoming policy shifts.

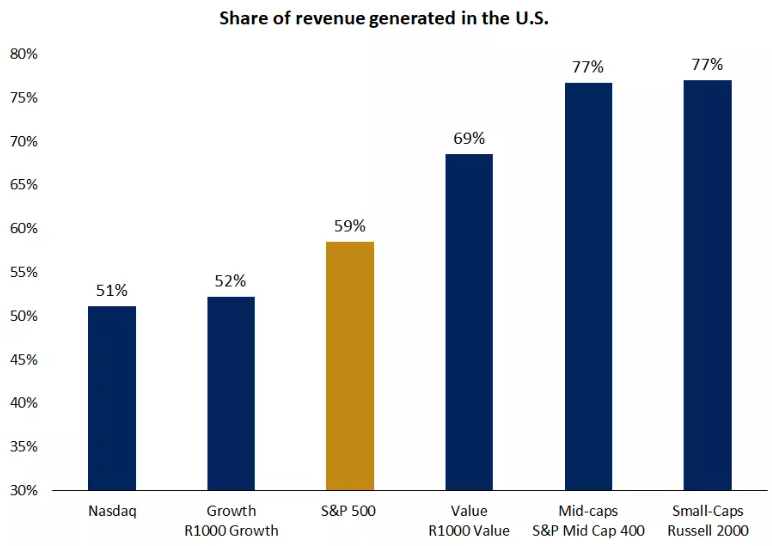

Value-style investments, along with small- and mid-cap companies, generate the greatest proportion of their revenue from the U.S. and could be relative beneficiaries of stronger domestic growth and lower tax rates. These are also the areas of the market that carry cheaper valuations and are expected to see their earnings accelerate the most after a two-year lull. On the other hand, the larger multinationals, including the mega-cap tech stocks, have more exposure to China and could be more sensitive to trade headlines. Even though their earnings continue to outpace the rest of the market, the gap is expected to narrow in the quarters ahead.

In our view, the economic and market fundamentals provide a supportive backdrop heading into 2025, pointing to a solid handoff to the new year. While it may not be a smooth ride, we believe equities have the potential to build on their strength as market leadership continues to evolve.

-

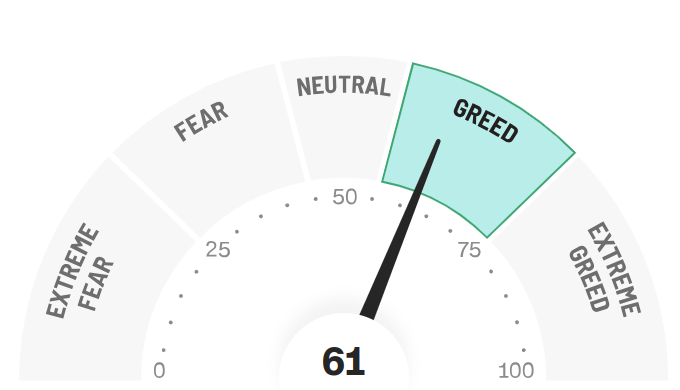

Final Words: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'greed' while global political turmoil is at peak.

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.