Weekly Market Commentary - Nov 2nd, 2024 - Click Here for Past Commentaries

-

The U.S. presidential election is now just days away, on Tuesday, November 5, and the

race between the two candidates remains tight. We may not know the results of the election

immediately – it could take days before the counting is finalized – and this may create temporary

uncertainty for investors, which could mean some form of market volatility is likely.

-

The data points to an economy that may be moderating but is still squarely positive. Earnings

growth for the third quarter is on track for 5%, slightly above expectations of around 4%

growth at the start of the quarter. For the full year, earnings growth is expected to be

about 9%, which is well above last year's 1% growth rate. The jobs report for October came in

below expectations, but these figures were skewed by last month's hurricanes and labor strikes.

We believe the labor market is moderating but not showing signs of collapsing.

-

Overall, the softening in the macroeconomic data also likely means that the Federal Reserve

remains on track to lower interest rates in both November and December this year. This

combination of lower rates and an economy that remains resilient has historically been positive

for stock markets broadly. In our view, investors can continue to lean into any bouts of market

volatility, election-related or otherwise, to diversify or add quality investments in line with

long-term strategic allocations in stocks and bonds, as we believe the economy will benefit as

uncertainty from the election is lifted and growth potentially reaccelerates.

-

Third-quarter earnings season for S&P 500 companies is well underway, and the results have

been modestly positive thus far. The expectation heading into the quarter was that corporate

earnings would grow about 4% year-over-year, below the forecast of about 7.5% at the end of June.

With about 70% of S&P companies having reported already, third-quarter growth looks on pace for

about 5% thus far, which is slightly above the lowered expectations.

This past week many mega-cap technology stocks reported earnings, including Google, Microsoft, Meta, Apple and Amazon. Overall, the trends were mixed. While almost all the companies beat expectations for revenue and earnings growth, the guidance for next quarter and outlook on spending sparked volatility for some of the stocks. Companies like Microsoft and Apple offered guidance that was below analyst expectations, while others like Meta talked about increased spending on artificial intelligence (AI), which investors worried may weigh on profit margins. There is still investor scrutiny around when these companies will realize meaningful returns on AI spending, as well as when there will be wider adoption of the technology. In our view, we believe AI is still in the early innings of a multiyear growth and adoption phase, and over time should benefit sectors beyond technology, including health care, financial services, and manufacturing.

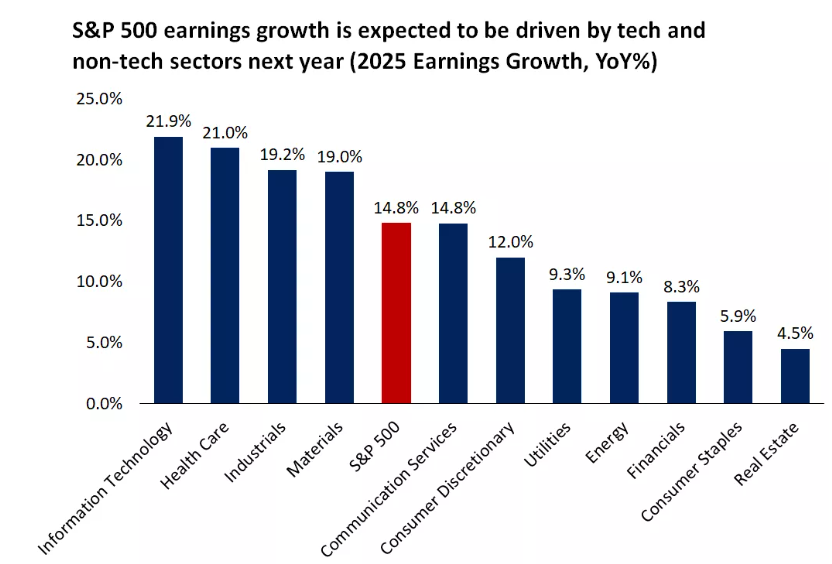

More broadly, we believe earnings growth should be positive and a driver of returns both this year and through 2025. Earnings growth for this year is on track for about 9% annually, well above last year's 1% growth rate. For 2025, we see the potential for double-digit earnings growth, especially as interest rates moderate and inflation remains in the 2% range, both of which should support household consumption and corporate spending.

-

The other major datapoint released last week was the U.S. nonfarm-jobs report for the month of

October. The total new jobs came in well below expectations, with 12,000 jobs added versus

forecasts of 100,000.* The last two months were also revised lower by 112,000, although they

were still relatively healthy at 78,000 and 223,000. The average monthly jobs added this year

are now at about 170,000, below last year's average of 250,000 but still above the long-term

average of 148,000.

In addition to U.S. elections next week, the November Federal Reserve meeting is also on deck for Wednesday and Thursday. Given the weaker-than-expected jobs report and downward revisions, we believe the Fed is squarely on track to cut rates next week by 0.25%. In fact, markets are now pricing in higher probabilities of rate cuts at both the November and December Fed meetings.

Beyond the 2024 meetings, we would expect the Fed to continue to bring rates toward a more neutral level, although perhaps at a more measured pace, given that it will be mindful of not stoking inflation along the way. In our view, the terminal rate, or ending policy rate, will likely be around 3.5%, which implies about six rate cuts total from the current 5.0% fed funds rate.

Historically, if the Fed is cutting rates for the right reasons -- i.e., inflation has moderated and central banks want to gradually move rates to less restrictive territory -- this is a good backdrop for financial markets. In our view, there is opportunity both for equity and bond investors, especially if the economy holds up and corporate default rates remain low.

-

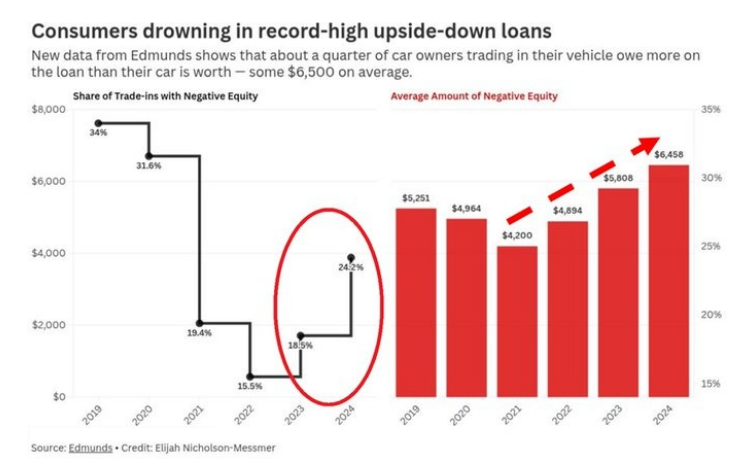

The car market bubble: ~33% of Americans who financed their cars now owe more on their

loans than the vehicle is worth. This represents 31 million auto-loan accounts registered by

the Consumer Financial Protection Bureau. Making things worse, used vehicle prices in the US

have dropped by ~22% over the last 3 years. Additionally, 24.2% of vehicles traded-in had

negative equity in 2024, the most in 4 years according to Edmunds. These borrowers owed an

average of $6,458 more than their car was worth when they traded it in, the most on record.

-

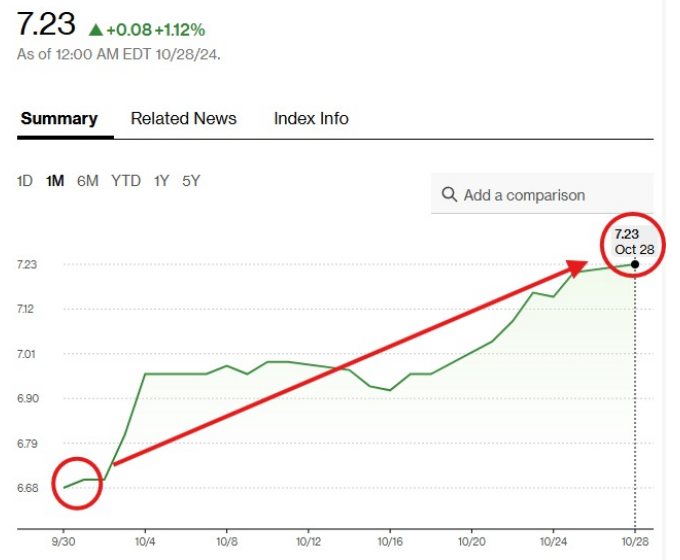

Mortgage rates are skyrocketing: The average interest rate on a 30-year mortgage just jumped

another 8 basis points yesterday alone. Homebuyers can now expect an average interest rate

of 7.23%, up sharply from 6.70% seen just 1 month ago. In Q3 2024, the median US home sold

for $420,400 which means a mortgage payment with 20% down would be $2,343/month. Including

taxes and insurance, homebuyers can now expect to spend over $3,000/month. In other words,

homebuyers are now spending over 50% of their post-tax income on home payments.

-

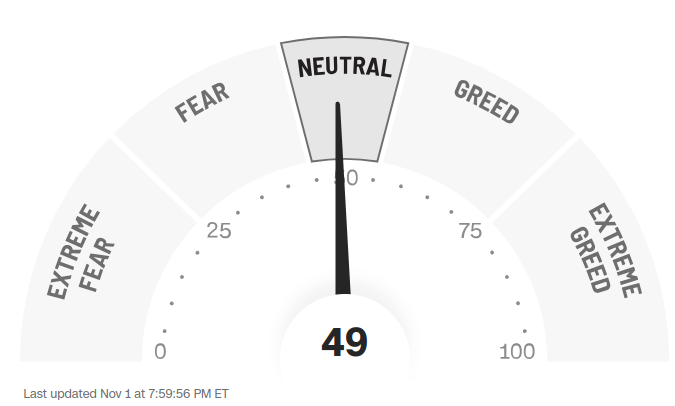

Final Words: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'neutral' while global political turmoil is at peak.

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

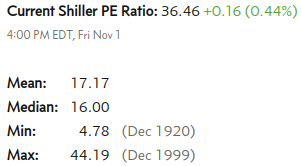

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.