Weekly Market Commentary - Nov 16th, 2024 - Click Here for Past Commentaries

-

This past week, stock markets gave back some of the robust post-election gains. The S&P

500 was down about 2% for the week, although gains for the full year still exceed 23%,

and the index is up over 1% since U.S. election day.

-

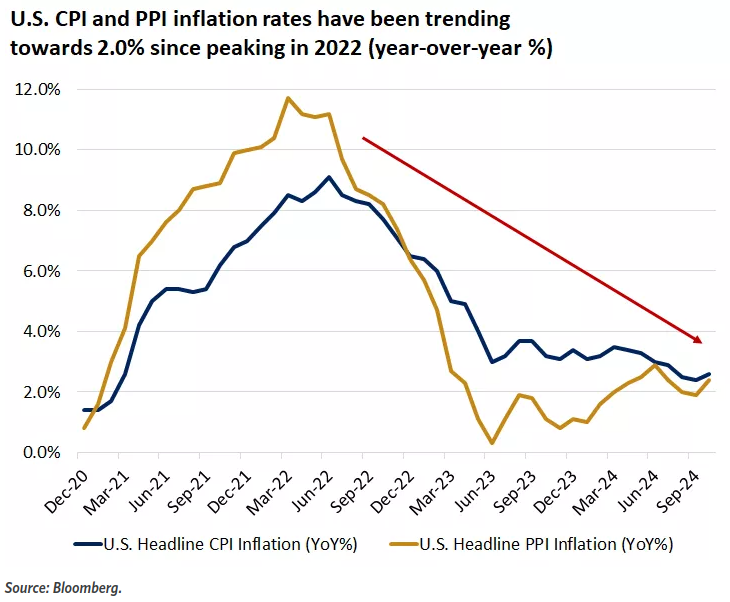

Consumer price index (CPI) inflation data for the month of October was in line with

expectations. While there continues to be a downward trend in inflation broadly, there

are components of prices that remain elevated. Areas like shelter, rent, and even motor

vehicle insurance have not moderated as much or as quickly as expected. Nonetheless, we

continue to see potential for inflation to gradually reach the Fed's 2.0% target in the

months ahead and perhaps settle in the 2.0% - 3.0% range longer-term.

-

The uncertainty around policy, particularly around tariffs, has also sparked some caution in

markets. While tariffs can be a tax on consumers, history shows us that over time the impacts

of tariffs, especially targeted tariffs, tend not to be a long-term driver of inflation.

-

Overall, we are entering a seasonally stronger period for financial markets during the last

couple months of the year. While some of this return may have been pulled forward after U.S.

elections, positive fundamentals continue to underpin the bull market. We would expect policy

uncertainty to spark bouts of volatility in the months ahead, but we believe markets will be

able to climb these walls of worry over time, especially if economic growth remains resilient

and inflation is contained.

-

Inflation was front and center once again last week, with data released on both U.S. consumer

price inflation (CPI) and producer price inflation (PPI) for the month of October. Overall,

while inflation was in line with expectations, there were parts of the inflation baskets that

remained elevated, particularly in services inflation.

In the much-anticipated CPI inflation readings, headline CPI inflation ticked higher to 2.6% year-over-year, versus last month's 2.4%, and core inflation remained steady at 3.3%, both in line with forecasts.* Parts of the inflation basket did move lower last month, including energy, gasoline, certain foods, and new vehicle prices. However, areas like housing and rent prices, and even motor vehicle insurance, remained stubbornly elevated.

Overall, in our view, inflation has made quite a bit of progress since the peak 9.1% year-over-year headline CPI reading in June 2022. However, the last mile toward the Fed's 2.0% inflation target is likely to remain bumpy. We would expect that if economic growth moderates, and the labor market eases further, the persistent services inflation may move lower as well.

However, over time, as the economy reaccelerates, perhaps boosted by some of the new, pro-growth policies that could take hold in late 2025 or early 2026, inflation may ultimately settle in the 2% - 3% year-over-year range. This could still be a welcome outcome for long-term investors, especially if wage gains settle above this level, and there is no return to the post-pandemic spikes in inflation that shocked consumers and the economy in recent years.

-

Perhaps the broader uncertainty for many investors is that, while inflation rates continue

to be generally contained and well below recent highs, there is concern this may reverse if

we see inflationary policies emerge in the year ahead under the new administration.

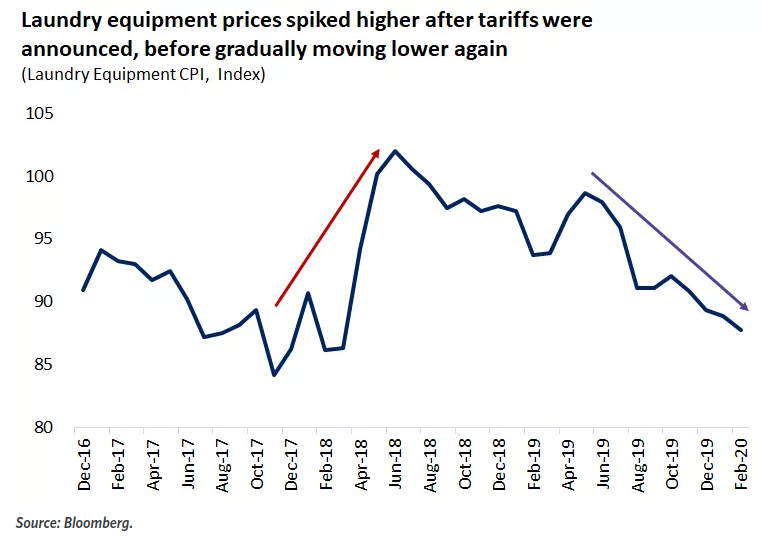

One area that investors point to as a source of potential inflation is tariff policy. While on the surface, imposing tariffs – whether across-the-board tariffs or escalation on Chinese tariffs – is considered a tax on households and a potential source of inflationary pressures, there may be offsetting factors to support consumers:

One-time impact to prices: Generally, when tariffs are imposed on goods, these tend to have a one-time impact to the price of the imports. Unless there is a retaliation or ongoing escalation in tariffs, the price increase will be a step-function higher and then pause there. Inflation, as we know, is a comparison of prices from a month ago or a year ago. All else equal, once a one-time tariff is implemented, after a month or a year, the rate of comparison will again be zero.

History tells us that prices over time return to normal: One real-world example of the impact of tariffs on goods is the washing-machine example that occurred back in January 2018. The administration had imposed tariffs of 20% - 50% on large residential washing machines, which expired in 2023. After a brief surge in prices, consumer prices on these goods fell, and tariffs had no noticeable effect longer-term. In this example, foreign washing-machine producers like LG and Samsung also decided to move some manufacturing to the U.S. over time. While this may not always be the outcome, tariffs can spark some diversification of global supply chains as well.

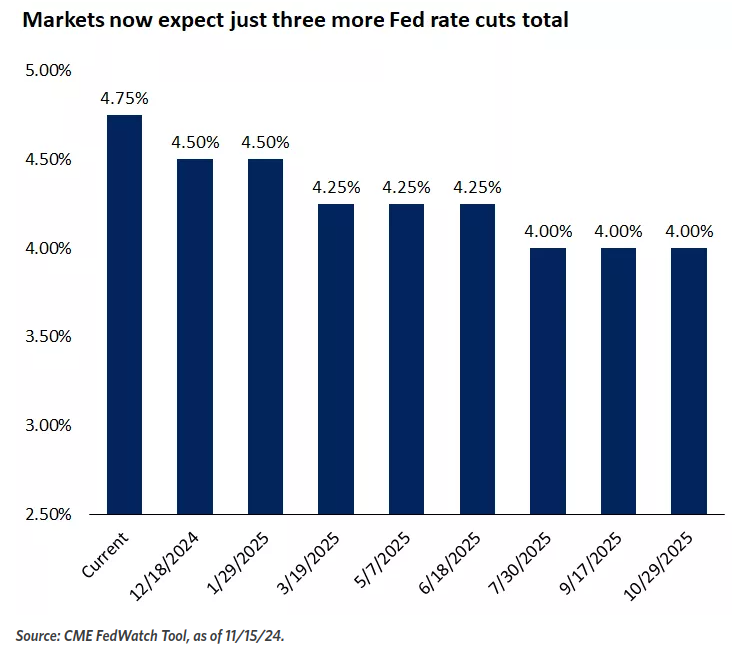

Fed Chair Jerome Powell also spoke to the Federal Reserve Bank of Dallas last week, and his comments indicated a more gradual approach to rate cuts. Powell noted that the U.S. economy remains resilient, and the labor market, while slowing a bit in October, remains healthy, with a 4.1% unemployment rate that is well below historical averages.

The Fed Chair also noted that U.S. economic growth is "by far the best of any major economy in the world." This notion of U.S. exceptionalism has also played out in stock markets, with the S&P 500 outperforming other country and global-market indexes thus far in 2024.

Given this resilience, Powell also noted that "the economy is not sending any signals that we need to be in a hurry to lower rates." This sparked some concern in markets that the Fed may not be cutting rates as much as previously thought. However, the forecasts for the total number of Fed rate cuts had already come down ahead of Powell's comments and after U.S. elections last week. After Powell's comments, the probability of a December rate cut again moved lower, according to the CME FedWatch tool.

In our view, the Fed is likely to bring the fed fund rates from the current 4.75% to 3.5% - 4.0% next year. The good news is that the Fed is cutting rates not because the economy is faltering, but because inflation has moved well below its current 4.75% policy rate. It can gradually bring its policy rate down to a less restrictive and more neutral level, which over t ime should be positive for both consumers and corporations.

-

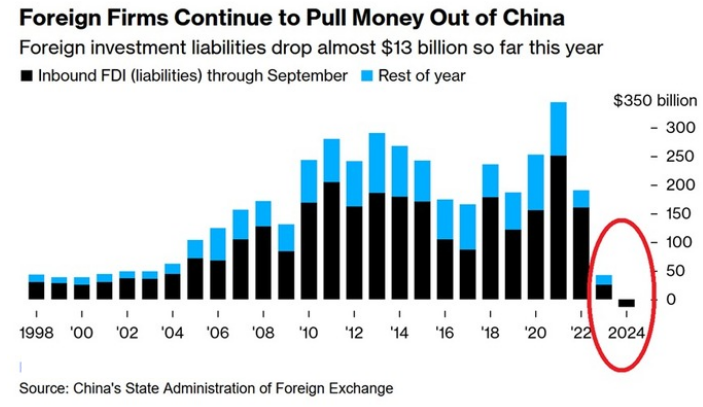

Investors are pulling money out of China for the first time in 30+ years. In Q3 2024, investors

have withdrawn $8.1 billion from China, according to recent data. Year-to-date, investors have

withdrawn a total of $12.8 billion from China, the most since at least 1998.

This puts China on track to experience its first annual net outflow in foreign direct investments

since at least 1990, when the data began. The Chinese economy is now facing its largest slowdown

since the 2008 Financial Crisis.

-

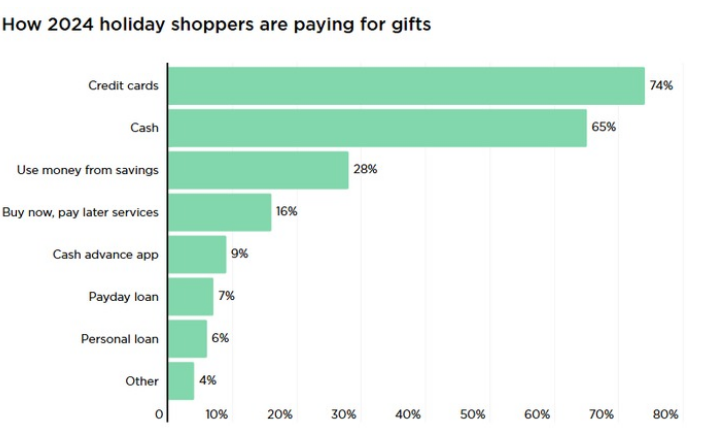

28% of credit card users in the US are still paying off LAST YEAR'S holiday shopping.

Average credit card balances are now 6.9% higher than last year and more than 20% higher than 2 years ago.

83% of Americans are expected to purchase gifts during the holiday season this year, spending $925 on average.

That’s more than 217 million Americans spending over $201 billion, compared to $184 billion in 2023.

Also, 49% of Americans plan to spend money on flights and hotels for the holiday season, spending $2,330 on average.

That’s more than 128 million Americans spending nearly $300 billion on these travel costs.

-

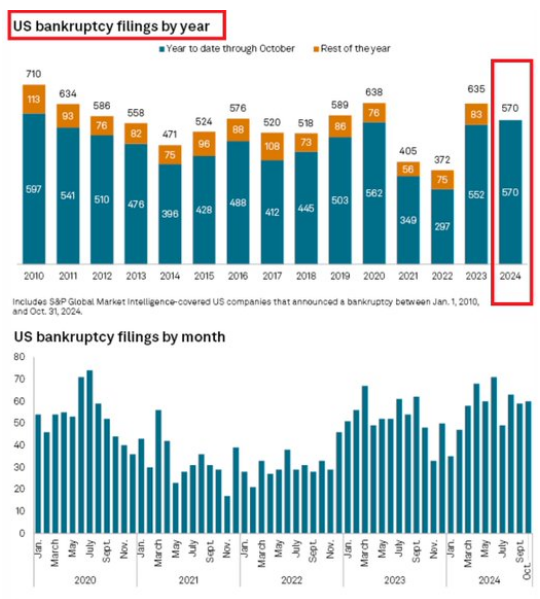

US large bankruptcies hit 570 year-to-date, the most since since 2010, a year after the Financial Crisis.

In October, September and August 60, 59 and 63 filings were recorded, respectively.

Bankruptcies are at crisis levels

-

US debts:

National debt: $36 trillion

Personal debt: $25.6 trillion

Mortgage debt: $20.5 trillion

Student loan debt: $1.7 trillion

Credit card debt: $1.3 trillion

-

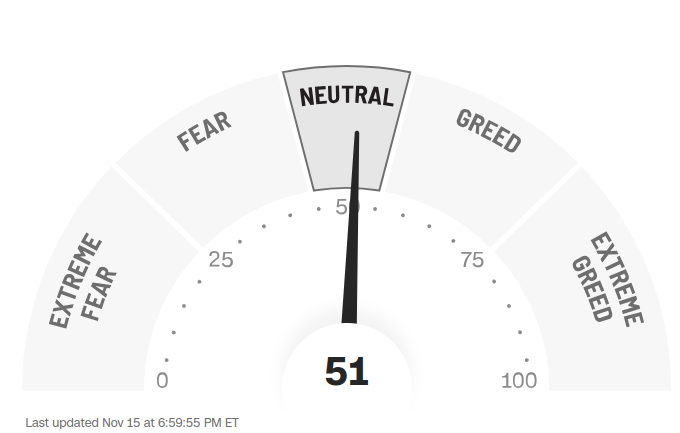

Final Words: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'neutral' while global political turmoil is at peak.

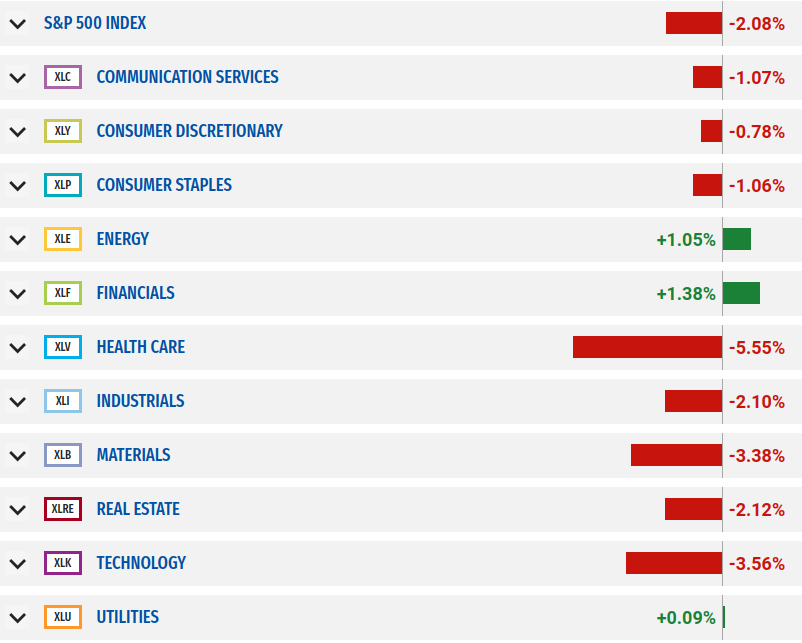

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

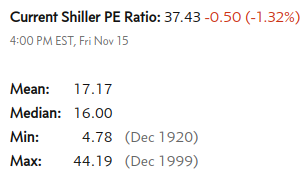

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.