Weekly Market Commentary - Nov 1, 2025 - Click Here for Past Commentaries

-

Markets rallied strongly in October, shaking off typical Halloween uncertainties to approach record highs.

This bullish trend persists despite a more hawkish Federal Reserve, which cautioned investors against assuming

a December rate cut is certain. Though this led to a bond market sell-off, rates are still expected to trend

lower. In a pivotal moment, a high-stakes meeting between Presidents Trump and Xi eased U.S.-China trade tensions,

reassuring investors about this key relationship.

Investors remain resilient amid a looming government shutdown that could become the longest on record. While this might break political gridlock in November, stalemate could heighten market vulnerability. Corporate earnings exceed expectations, boosting profitability confidence. Though major tech results were mixed, the AI sector shines.

October saw increased volatility but impressive gains overall. Heading into November, expect bumps as market fatigue emerges after the rally.

Triggers spooked mkts Halloween week: Trump's Asia trade tour, hawkish Fed, high tech earnings exp. But bumps aside, narket rally stays scare-proof for now.

-

The Fed cut interest rates again last week, as widely expected, with the fed funds target range now at 3.75%-4%,

some 150 basis points (1.5%) off its peak. The central bank used high rates over recent years to tame the outbreak

in post-pandemic inflation, with "tight" monetary policy helping weigh on price pressures. However, recent rate cuts

can be viewed as the Fed easing its monetary policy as it becomes more concerned with slowing labor market dynamics.

This does not mean the Fed is stepping on the gas, adding significant stimulus to the economy. Instead, we should

think of policy as moving into cruise control, with rates reaching more "neutral" settings.

The Fed also announced that it would halt its reduction of its holdings of U.S. government bonds in December. It bought vast quantities of bonds from investors after the pandemic to help lower longer-term interest rates and stimulate growth. In recent years, it has been slowly unwinding this "Quantitative Easing" and now judges that bond holdings are back to normal levels. The market had anticipated this announcement, and the change had a minimal impact on bond markets.

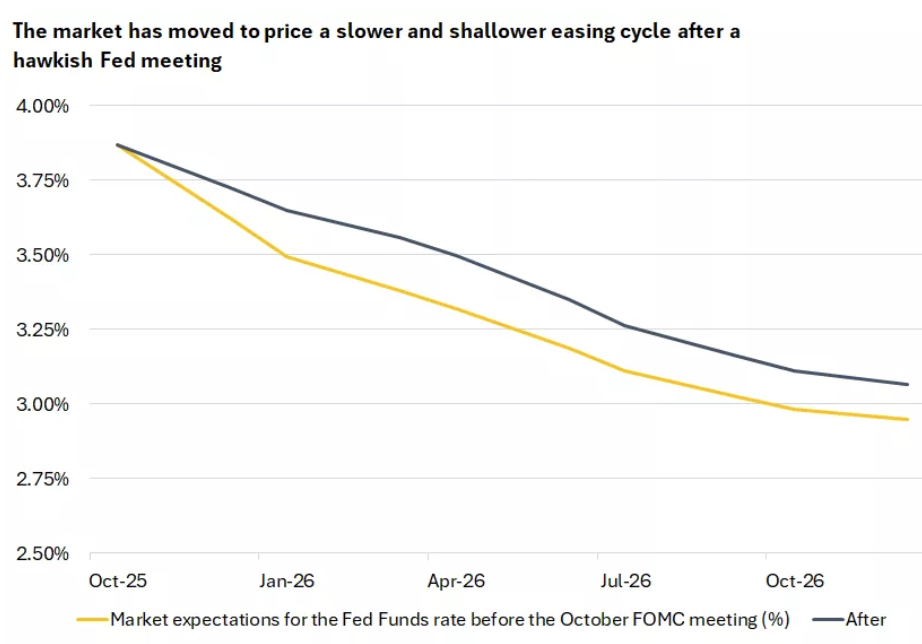

The Fed's signals around future policy generated bigger bumps. Fed Chair Powell was clear that a rate cut at the next Fed meeting was far from guaranteed, with the Fed's rate-setting committee clearly split on next steps. Some are making a case to pause in the face of a data blackout during the government shutdown, while others remain concerned about cutting amid still above-target inflation. The latter prompted Kansas City Fed President Schmid to dissent on the October rate cut, with Dallas Fed President Logan echoing these sentiments.

Ahead of these signals, markets had been very confident the Fed would cut in December, with pricing in short-term money markets implying a more than 90% chance of a third consecutive 25 basis point (0.25%) move. This likelihood has since fallen to around 60%, with investors still narrowly betting on further easing, but cognizant that this is far from a done deal. The ripples were also felt in Treasury markets. The 10-year U.S. government bond sold off after the meeting, pushing yields up around 10 basis points (0.1%) to 4.08%. The impact was also apparent in the interest-rate-sensitive small-cap equity sector, with the Russell 2000 selling off on this news.

While the Fed was likely looking to provide a jolt to market expectations around cuts that had probably moved too far in recent weeks, the outlook for interest rates remains lower, in our view. While a cut in December cannot be taken for granted, we continue to expect the fed funds rate to fall through 2026, with policy likely to settle around the 3.5% mark.

-

The Fed's concerns around flying somewhat blind during the government shutdown are reasonable, in our view. Absent

this funding gap, we would have seen the first estimate of third-quarter GDP this week, with this the latest of a

host of high-profile reports delayed.

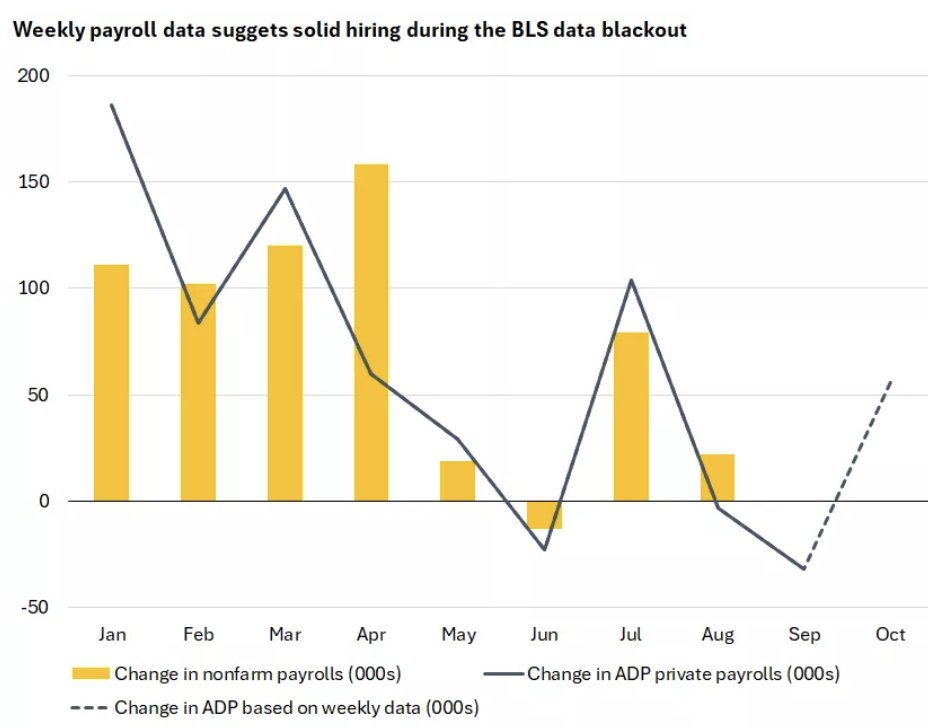

We think the good news is that private-sector data appears to be hinting at some underlying resilience. State-level

data on initial unemployment insurance claims show few signs of concerning spikes, while ADP has started to

release weekly updates on private-payroll data, with these showing steady, if still slow, gains in hiring

through October around the 60,000 mark.

-

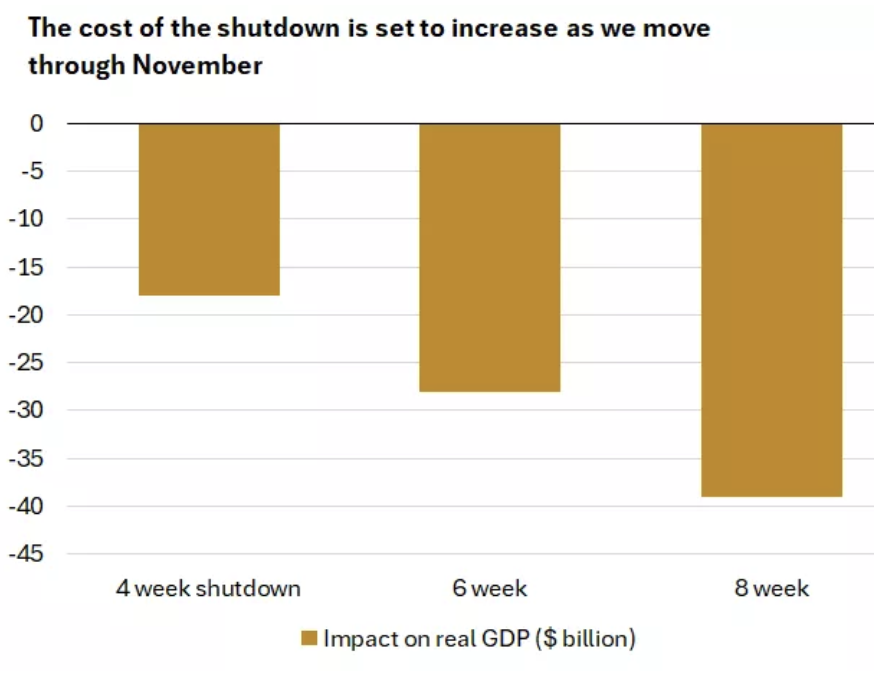

The economic impact of the shutdown continues to build as federal workers and contractors go longer unpaid,

government services are interrupted, and 40 million Americans face interruptions to SNAP benefits. The Congressional

Budget Office has attempted to put hard numbers on these impacts. It argues that the shutdown has already taken

around 1% off annualized fourth-quarter GDP growth, with this effect rising to 1.5% by mid-November and 2%

closer to the end of the month. In dollar terms, this would equate to nearly $40 billion.

With the shutdown soon to be the longest on record, the hope, in our view, is that these building disruptions motivate a break in the Congressional gridlock. For now, the market continues to seemingly look through this political dysfunction, although we think this resilience might be tested the longer the shutdown drags on.

-

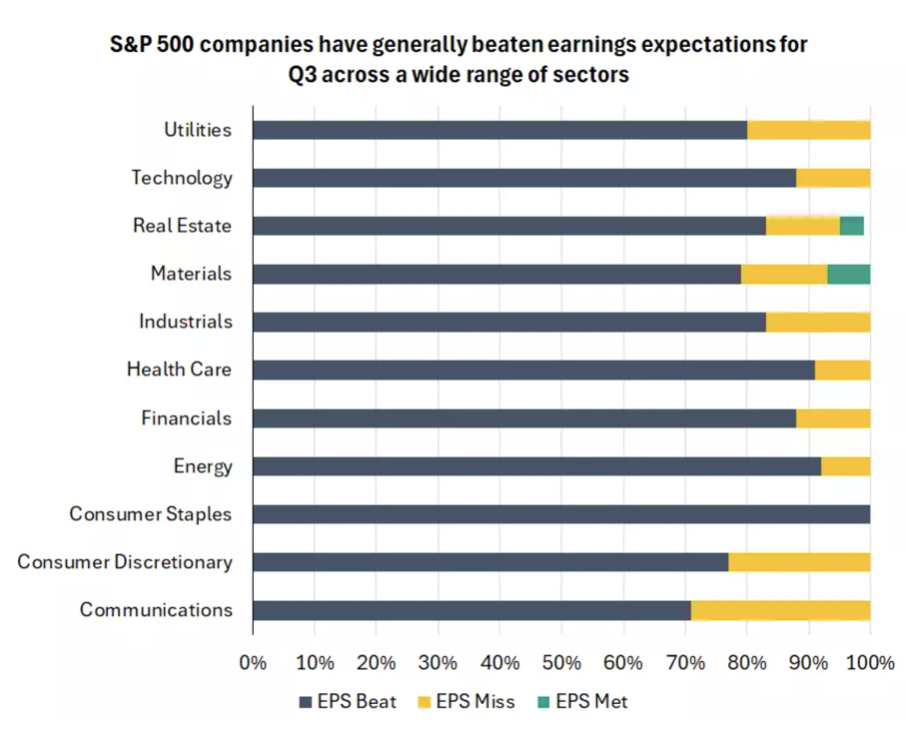

Corporate profitability looks to be providing another marker of resilience in the U.S. economy. Around two-thirds

of S&P 500 companies have now reported, and the vast majority of these companies delivered stronger-than-expected

earnings. These upside surprises suggest that companies continue to perform well in the face of higher tariffs

and slower growth.

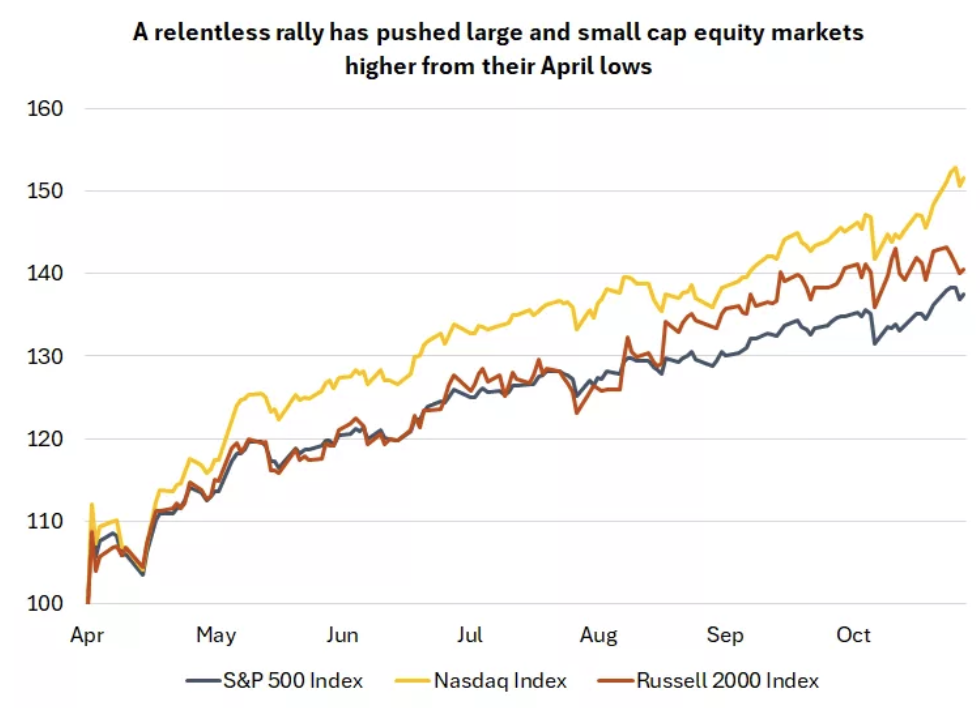

Meanwhile, positive signals in the AI trade propelled large-cap equity indexes to new record highs by week's end. Earnings from mega-cap tech firms were mixed, with Microsoft shares down on underwhelming results earlier this week and investors balking at Meta's AI investment plans—partly funded by debt—sending shares tumbling.

Better news from Apple and Amazon at week's end pushed shares higher, with the latter gaining over 10% in Friday's session. These moves drove the Nasdaq and S&P 500 to new records, with the rally from April lows now nearing 40%.

Amid this euphoria, the AI bubble question persists. Fed Chair Powell rejected it post-meeting, citing robust real earnings and business models among major players, unlike dot-com bubble firms. Long-term, tech companies must show massive sector investments continue driving strong fundamentals to justify lofty market expectations.

-

We saw volatility spike in October, but the market rally ended the month largely unscathed. Moving into November,

we remain mindful that further spikes in volatility are possible given uncertainty over the timing of Fed cuts,

an ongoing shutdown, and signs of fatigue in what has been a relentless market run.

However, while bumps are possible, we remain optimistic on the outlook. From a macroeconomic perspective, we see scope for improved economic activity through 2026, likely helped by less restrictive interest rates, a series of personal and corporate tax cuts, and an easing drag from trade-policy disruptions.

Meanwhile, from a market perspective, the surge in AI-related investment looks like it has further to run, in our view, extending this positive catalyst for large technology companies, while we think smaller firms should benefit from the combination of tax cuts, lower interest rates, and improving growth.

With these dynamics in mind, we continue to prefer overweight equity markets and underweight government bonds.

With investors already pricing in interest-rate cuts, government bond yields have fallen substantially this year despite this week's uptick, and there looks to be limited scope for further rally in these expectations, in our view, absent much worse-than-expected economic news.

From an equity perspective, we continue to think there is significant value in holding a well-diversified portfolio. We prefer overweights to large-cap U.S. equities, given their exposure to the AI trade; to mid-cap U.S. stocks; and to international equities via small- and mid-cap developed-market stocks, as well as emerging-market equities.

-

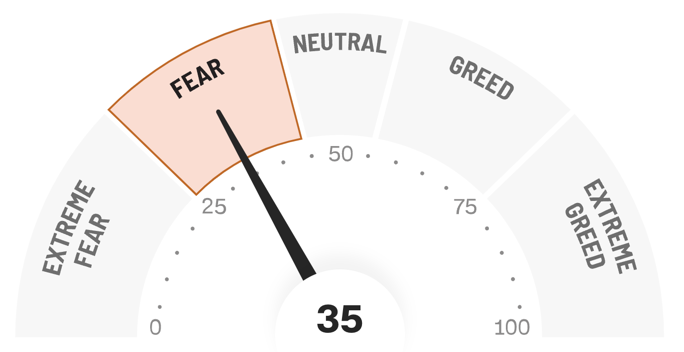

Final Words: Market indicates fear. Buy VOO, VGT, and GLD (Gold).

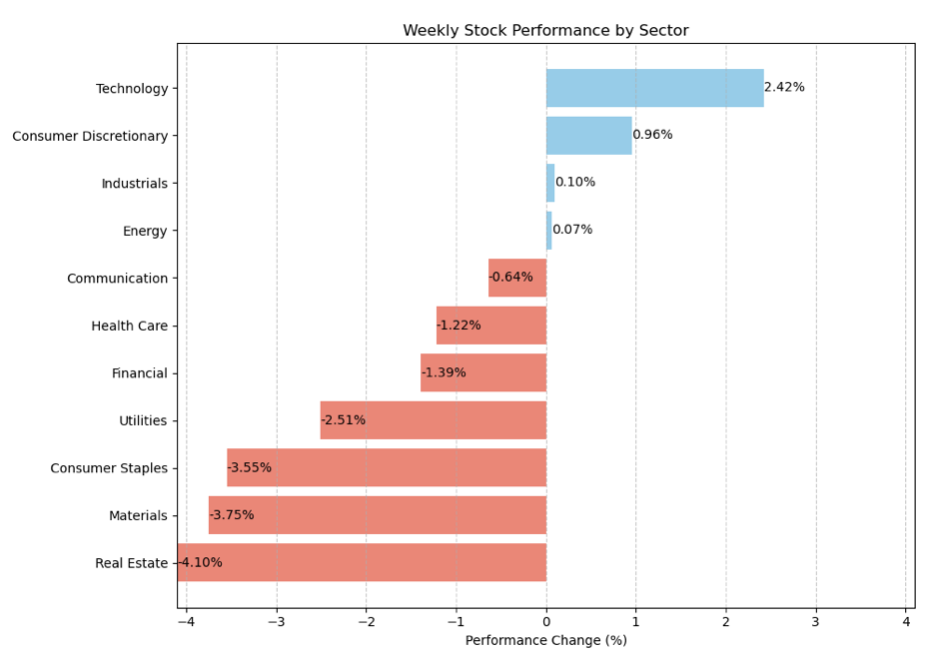

Below is last week sector performance report.

Weekly Sector Performance for Oct 27-31, 2025:

$XLE Energy: 0.07%, RSI: 51.56

$XLK Technology: 2.42%, RSI: 66.74

$XLC Communication: -0.64%, RSI: 46.40

$XLY Consumer Discretionary: 0.96%, RSI: 54.52

$XLP Consumer Staples: -3.55%, RSI: 32.01

$XLF Financial: -1.39%, RSI: 44.50

$XLV Health Care: -1.22%, RSI: 56.76

$XLI Industrials: 0.10%, RSI: 55.32

$XLB Materials: -3.75%, RSI: 33.69

$XLRE Real Estate: -4.10%, RSI: 39.44

$XLU Utilities: -2.51%, RSI: 46.81

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

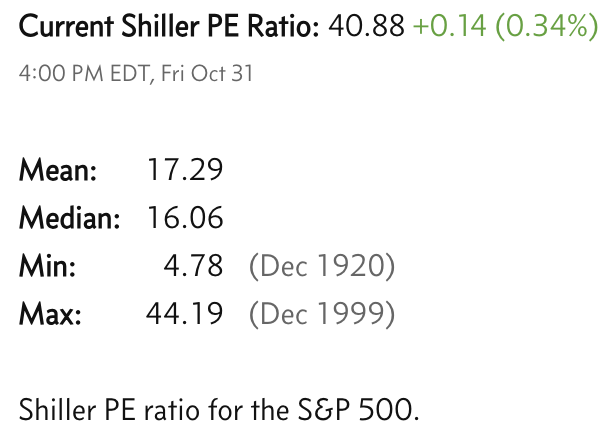

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.