Weekly Market Commentary - May 3rd, 2025 - Click Here for Past Commentaries

-

This past week, markets digested a slew of earnings, economic and labor market data. Overall, the data,

which largely looks back at the first quarter, continues to point to a U.S. economy that came into the

year with solid momentum: Earnings growth has surprised to the upside, GDP growth was negative

(although consumption remains relatively healthy), and the labor market has been resilient and the

unemployment rate remains low.

The key question for the economy and earnings continues to hinge on the direction of trade and tariffs.

We have seen an improvement in tone from the U.S. administration on pursuing trade deals with China and

other trading partners, but concrete progress is likely needed for sustained gains in markets and the

broader economy.

Overall, stock markets have rebounded nicely over the last two weeks with the S&P 500 up about 8%, as

first-quarter data has held up and policymakers seem to be making progress on trade. Keep in mind that

two or three pullbacks are normal in any year, especially as markets digest potentially higher inflation

and softer growth. Nonetheless, we may see better sentiment heading into year-end, as the Federal Reserve

likely lowers interest rates, and earnings growth looks to recover heading into 2026.

-

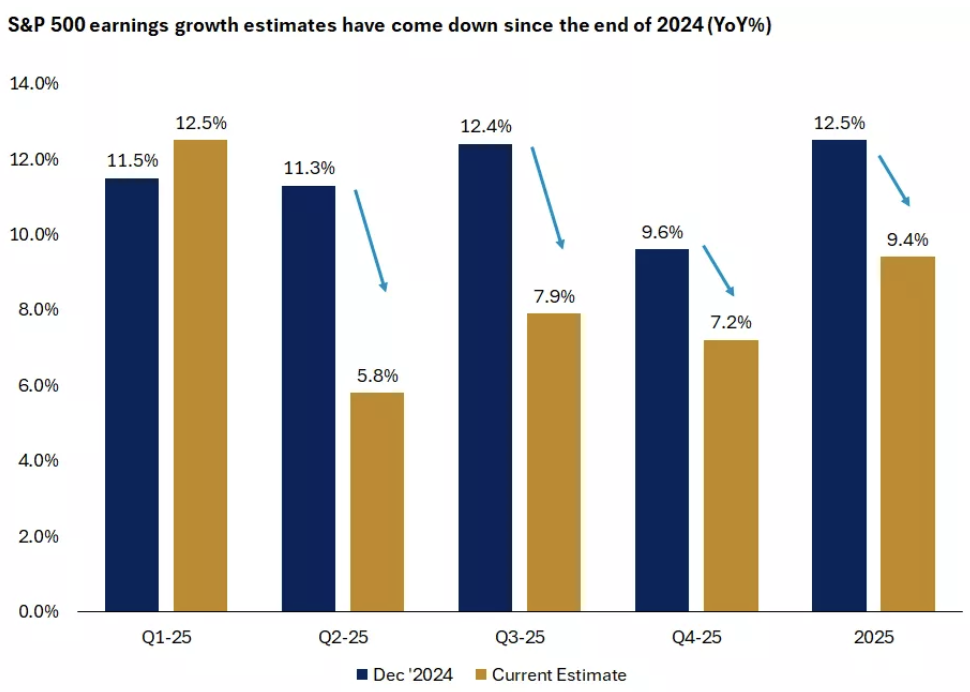

First-quarter corporate earnings season is underway, with about 70% of S&P 500 companies having reported

earnings. Thus far, about 76% of companies have reported positive earnings surprises, above the 10-year

average beat rate of 75%. Earnings growth for Q1 remains on track for 12.5% year over year, above the

11.5% expected at the end of last year.

However, guidance for the second quarter of earnings growth has weakened, as companies point to uncertainty around the consumer and the tariff and trade backdrop. The earnings growth forecast for Q2 has fallen to 5.8%, down substantially from the 11.3% expected at the end of last year.

-

This past week, we heard from large-cap technology companies as well as consumer companies, which gave a

good picture on the broader state of spending and the consumer. Tech giants such as Microsoft and Meta

pointed to continued capital expenditure (capex) spending in artificial intelligence (AI) and datacenter

growth, which was met positively given the uncertain policy backdrop. These two companies alone committed

upward of $152 billion in capital expenditures to support AI capacity, which alleviated concerns of a

capex slowdown.

On the other hand, companies more exposed to tariffs and consumer spending seemed to express caution. Amazon and Apple, for example, provided soft guidance and weaker sales in China, citing the tariffs and trade uncertainty as a key driver.

We also heard from consumer companies such as McDonald’s, which saw negative same-store sales and pointed to a decline in traffic. The fast-food chain joined other food service companies such as Starbucks and Chipotle, which have all pointed to softer consumer demand, particularly among low-income consumers.

Overall, earnings growth for the first quarter has remained resilient. While we may see further downward revisions to the quarters ahead, we expect earnings growth to remain in the low or mid-single-digit range for 2025 and to potentially rebound in 2026.

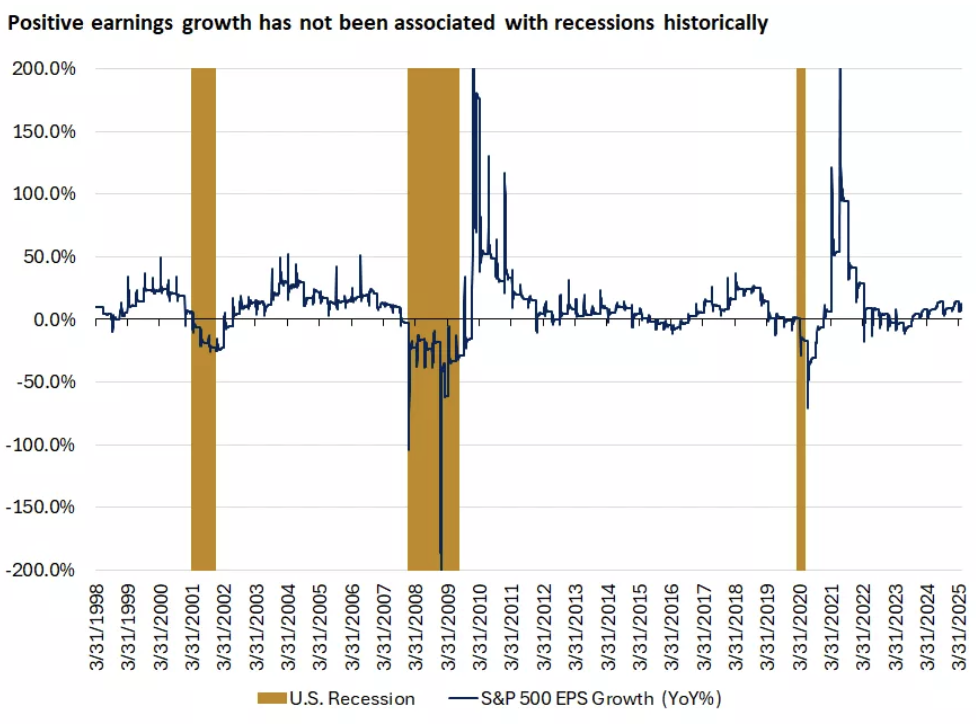

We have already seen meaningful downward revisions to the second quarter, as well as lowered expectations for Q3 and Q4. The expectation for corporate earnings growth for 2025 remains at about 9.5% annually. While this may be revised somewhat lower, historically, if earnings growth is positive, we have not experienced recessionary environments in the U.S.

-

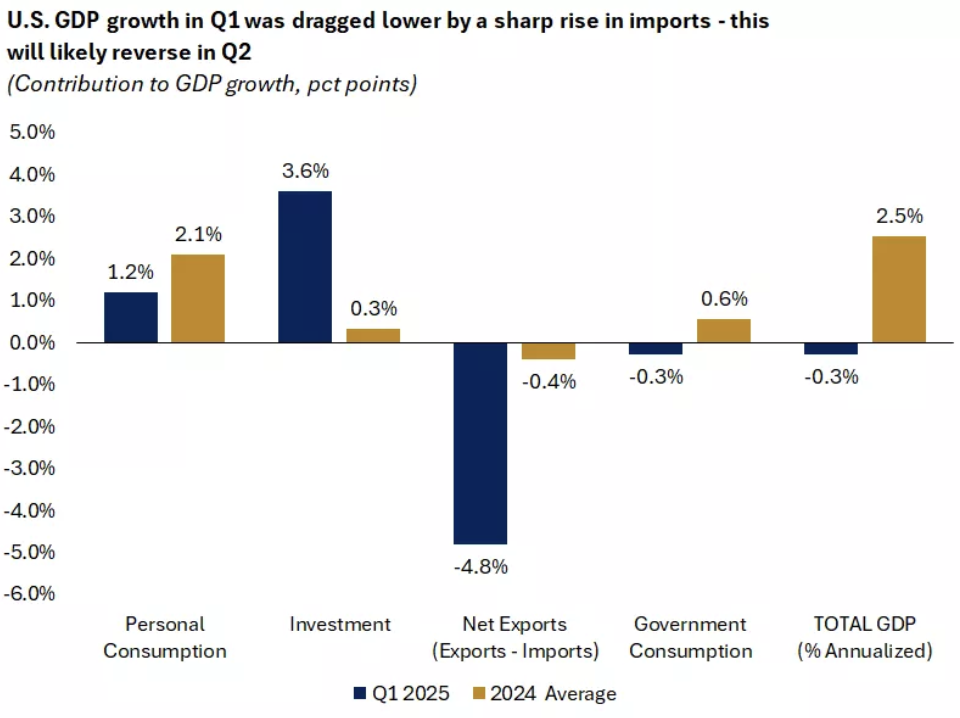

First-quarter economic growth came in weaker than expected in the U.S., as gross domestic product (GDP)

growth fell by -0.3% in Q1 versus an expectation of -0.2%. This was driven largely by a surge in

imports — the biggest in nearly five years — as companies purchased goods in anticipation of higher

tariff rates.

However, the sharp rise in imports was offset by resilient consumption and corporate investment. Personal consumption rose by 1.8% in the first quarter, down from 4% in Q4 but still above forecasts of 1.2%. Similarly, business investment climbed by 21.9%, as corporations spent on equipment ahead of potentially higher prices from tariffs.

We believe the decline in first-quarter GDP will likely reverse in Q2 as the huge surge in imports reverses in the weeks ahead, bringing second-quarter GDP to a positive figure. More broadly, we would expect U.S. GDP growth to soften this year from the 2.8% annual growth rate in 2024. In a base case — where tariffs remain around 10% or less with most trading partners, elevated in key sectors and negotiated somewhat lower with China — we would expect GDP growth to be in the 1.5% range this year.

However, there is a tail risk that tariffs remain elevated across key trading partners and particularly with China. In this case, we could see a mild recession emerge, as inflation rises and consumption cools. However, we would not expect a deep or prolonged recession, particularly as the Fed may be able to lower interest rates more meaningfully. In either tariff scenario, growth may rebound in 2026 if the Fed is able to cut rates in the back half of 2025 and progress is made on tax reform and deregulation. This should support both consumer and corporate spending broadly.

-

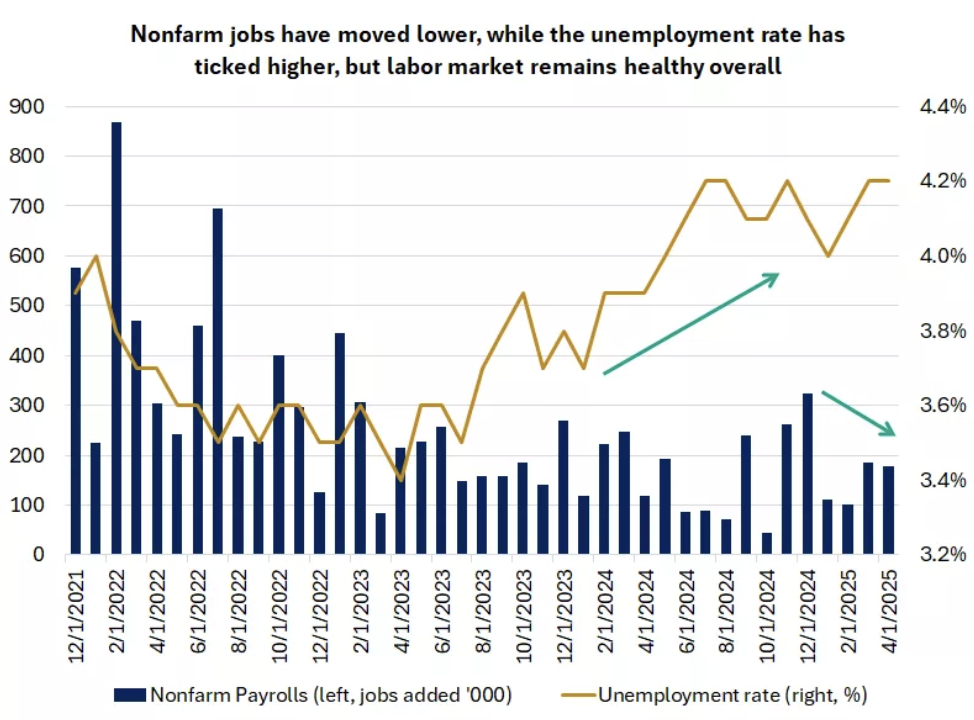

Finally, the U.S. labor market continues to show signs of resilience. The April nonfarm jobs reports

released on May 2 indicated 177,000 jobs added, above the expected 138,000. While March’s figures were

revised lower by 43,000, the three-month average of job gains was still healthy at around 155,000.

The unemployment rate remained steady at 4.2%, in line with expectations. Unemployment has moved gradually higher from the 2023 low of 3.4% but remains well below long-term averages of 5.7%.

Also of note, the average hourly earnings rate ticked lower to 3.8% annually, below the expected 3.9%. Wage growth can be a good indicator for services inflation broadly, which may be moving lower. Wages have also outpaced inflation for nearly two years now, which means households are continuing to see positive real wages, also supportive of consumption.

While the labor market continues to show resilience, keep in mind that it tends to be a lagging indicator. If tariffs push inflation higher and the economy softens, we may see some deterioration in the labor market in the months ahead as companies increase layoffs. But given that the U.S. jobs data started from a position of strength, this should help keep the labor market orderly, even if it softens from here.

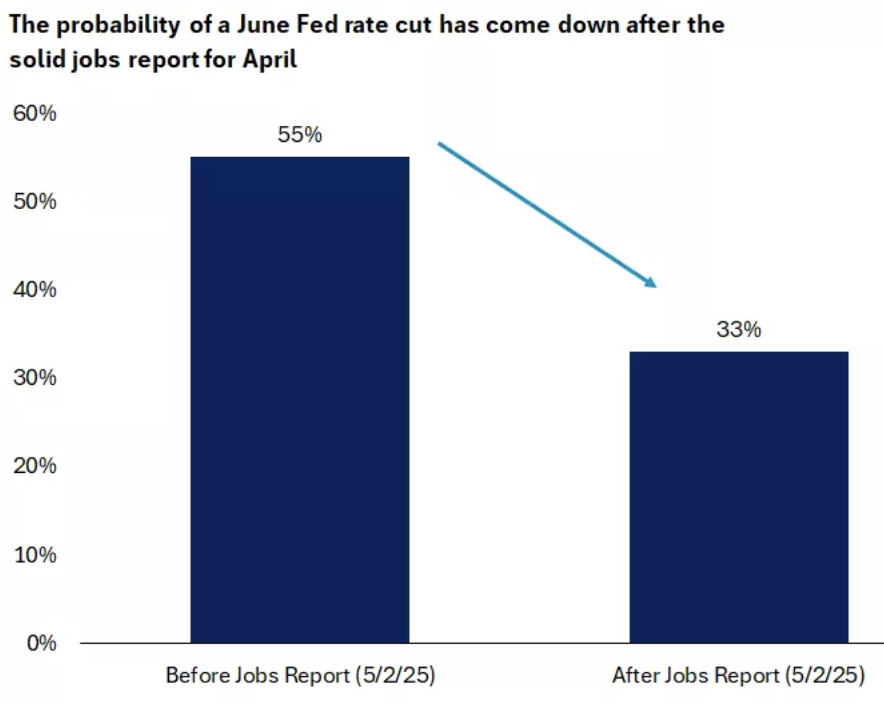

The healthy job market also likely creates less urgency for the Fed to cut interest rates. The Fed is watching inflation and the labor market closely and will be more inclined to move rates lower when it sees clearer signs of a slowdown, especially in the labor market. While we expect the Fed to cut rates this year, this will likely happen in the back half of the year, after the impact of higher tariffs and slowing consumption has weighed more on economic growth and the jobs market. In fact, after the resilient Friday jobs report, markets are pricing in three Fed interest rate cuts instead of four, and the probability of a June rate cut has declined from 55% to about 33%, according to the CME FedWatch Tool.

-

Overall, stock markets have rebounded nicely over the last two weeks, with the S&P 500 up about 8% and

the tech-heavy Nasdaq up about 11%. On a year-to-date basis, the S&P 500 is now down about 3%, while

the Nasdaq is down about 7%.

The better market sentiment has been driven by solid first-quarter economic and earnings data, and the

administration softening its tone on trade and tariffs. For sustainable progress from here, we would

likely need to see more concrete evidence of trade deals with China and other trading partners.

Nonetheless, keep in mind that volatility is normal. In any given year, two to three pullbacks are

likely — especially in a year when we have elevated uncertainty around tariffs, inflation and economic

growth. However, given that we do not expect a deep or prolonged recession ahead, we continue to view

periods of volatility as opportunities to rebalance, diversify or add to portfolios across sectors and

asset classes.

Sectors such as financials and health care are less exposed to tariffs and may do well if policymakers make progress toward tax reform and deregulation. And within investment-grade bonds, we see value in the seven- to 10-year maturity space, especially if the Fed is poised to cut rates in the back half of the year. While uncertainty remains elevated this year, as we look toward 2026, we could see a better backdrop emerge for financial markets. This could come from not only more concrete trade deals and details, but also a Fed that is on track with rate cuts, policymakers making progress toward tax reform and deregulation, and earnings growth that is poised to re-accelerate — all supportive of improved market sentiment.

-

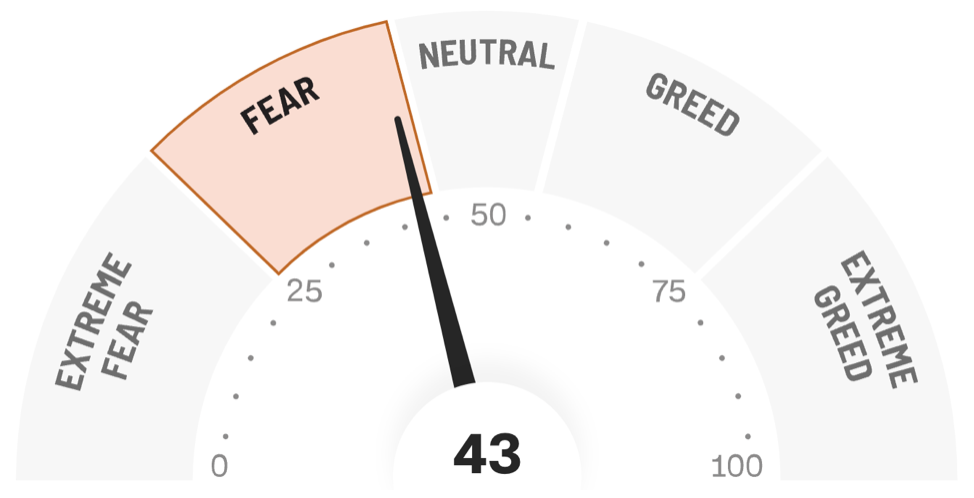

Final Words: Markets are down and fed is going to cut

interest rate, greed warranted. Buy safety such as VOO and growth such as VGT. Balance.

Below is CNN Greed vs Fear Index, pointing at 'Fear'.

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

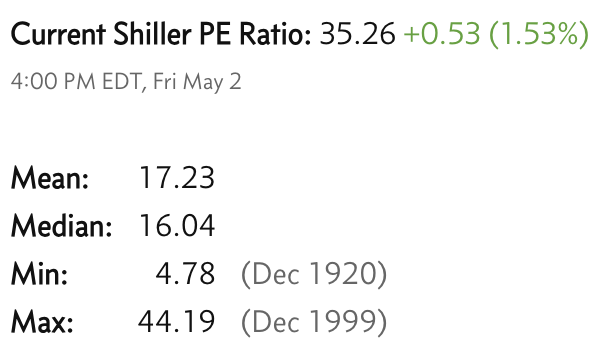

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.