Weekly Market Commentary - May 17th, 2025 - Click Here for Past Commentaries

-

News on trade policies remained a key driver for markets this past week, with positive

developments in the relation between the U.S. and China and in trade within the tech

sector helping boost stock markets, placing the S&P 500 back into positive territory in 2025.

Markets also gained comfort from the week's hard-economic-data releases, which confirmed

that the actual impact of trade-policy uncertainty on inflation and the economy has

remained contained for now, despite recent soft data demonstrating consumer and business

confidence has taken a hit.

Peak tariff-policy uncertainty appears to have dropped further into the rearview mirror,

with tariffs headed toward our base-case scenario of around 10% - 15% on average in the

U.S. While this range is likely to result in a temporary bump to inflation and moderating

economic growth, we expect an increasing focus on growth-supportive policies later this

year will help avoid worst-case recessionary scenarios.

Since trade negotiations will likely stretch over the course of months, investors should

stay prepared for periodic market volatility. Diversification and rebalancing strategies

can help ensure your portfolio remains designed to deliver performance aligned with what

you're trying to achieve as we navigate the uncertainties ahead. From that starting point,

we continue to recommend overweighting stocks over bonds, with a focus on U.S. large- and

mid-cap stocks.

-

Following what appears to have been productive trade talks in Switzerland, the U.S. and China

announced early last week that they agreed to significantly reduce tariffs for a period of

90 days while the countries work toward a longer-term deal. Tensions between the two had

quickly escalated following the U.S. April 2 tariff announcement, which resulted in the

U.S. placing a 145% tariff on Chinese imports and China placing a 125% tariff on U.S. imports.

During the 90-day period, the U.S. agreed to reduce its tariff on most imports to 30%, which includes a 20% tariff related to the battle against fentanyl. China agreed to reduce its tariff to 10% on most U.S. goods, as well as ease some nontariff trade restrictions, such as on rare-earth minerals. Stock markets rallied sharply, and interest rates rose on the news.

In other trade-related developments, the U.S. administration also last week announced plans to ease trade restrictions related to artificial-intelligence chips, which helps enable trade agreements between U.S. tech companies and other countries. This news, alongside the announced deal between NVIDIA and Saudi Arabia, further improved investor sentiment last week and provided an extra boost to tech-oriented segments of the market, in particular.

While the temporary reprieve between the U.S. and China is just that – temporary – the de-escalating tensions and relaxed trade restrictions demonstrate that there's room for negotiation, and they provide some recognition that the extreme tariffs put in place toward the beginning of April are impracticable if trade is to continue between the countries.

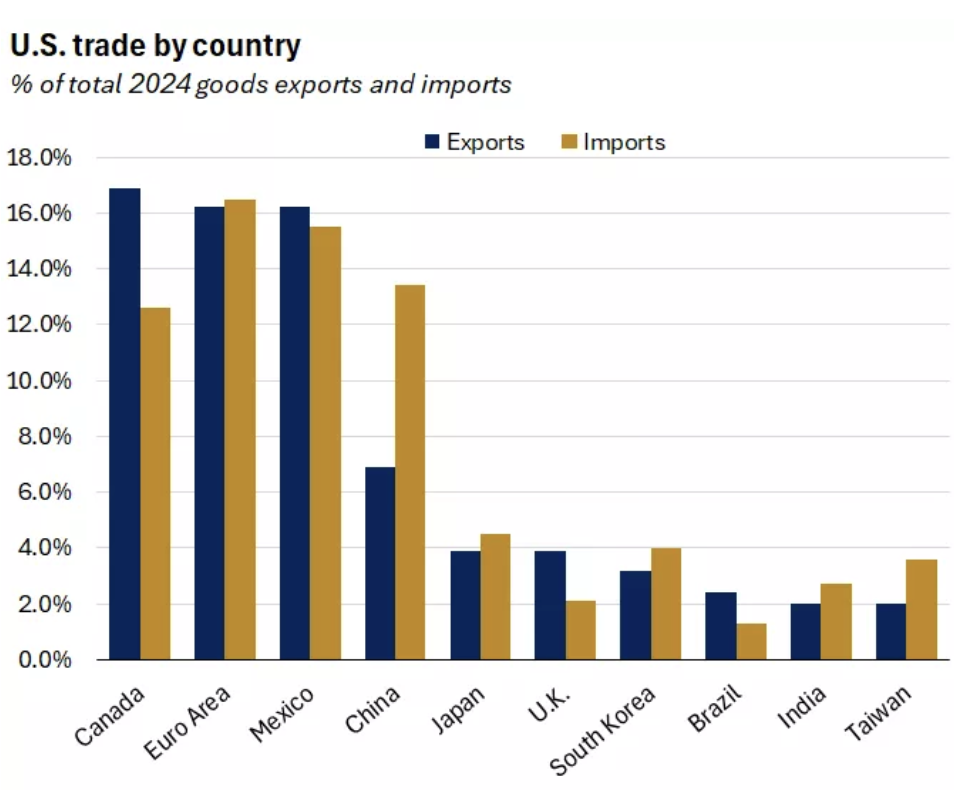

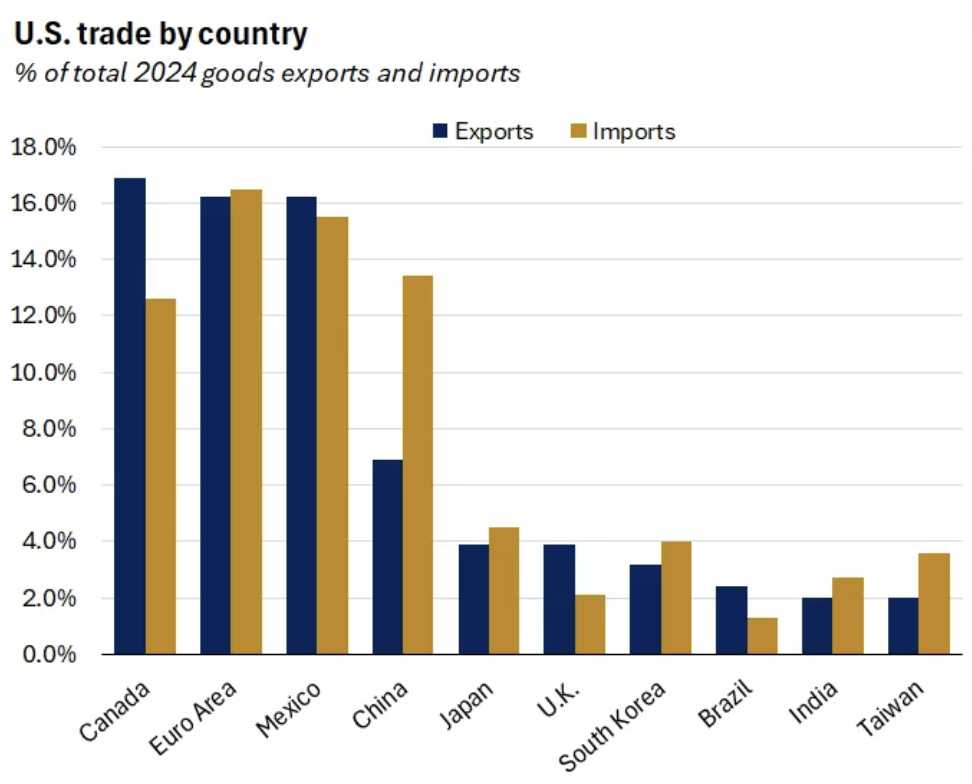

The short-term truce is also particularly meaningful since it's between the U.S. and one of its largest trading partners with which it has a sizeable trade deficit, making a deal more complex, particularly when compared with the previously announced deal with the United Kingdom. For example, about 13% of U.S. imports are sourced from China, compared with the 2% that come from the U.K. From an export perspective, about 7% are sent to China, compared with 4% that go to the U.K.

-

While the looming trade-related uncertainty will continue to weigh on the behaviors of consumers

and businesses for a bit longer and may cause additional periods of market volatility, peak policy

uncertainty appears to have dropped further into the rearview mirror. And while tariffs remain

higher than at the start of the year, the reduced tariffs help avoid potential worst-case

recessionary scenarios. Tariffs appear to be headed toward our base-case scenario of

around 10% - 15% on average in the U.S., which we expect would result in a potentially

short-lived rise in inflation and moderating but still positive economic growth for the year.

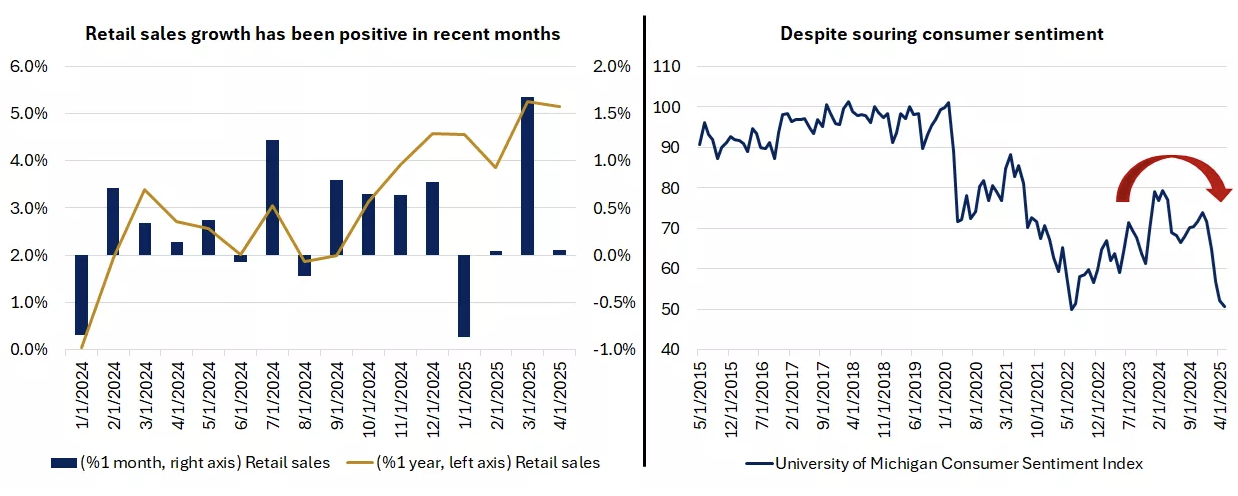

Markets also gained comfort from the week's hard-economic-data releases – a combination of inflation, labor-market, and retail-sales data – which confirmed that the actual impact of trade-policy uncertainty on inflation and the economy has remained contained for now, despite various recent soft-data points, such as sentiment surveys, demonstrating that the uncertainty has weighed on consumer confidence and created challenges for corporate planning this year.

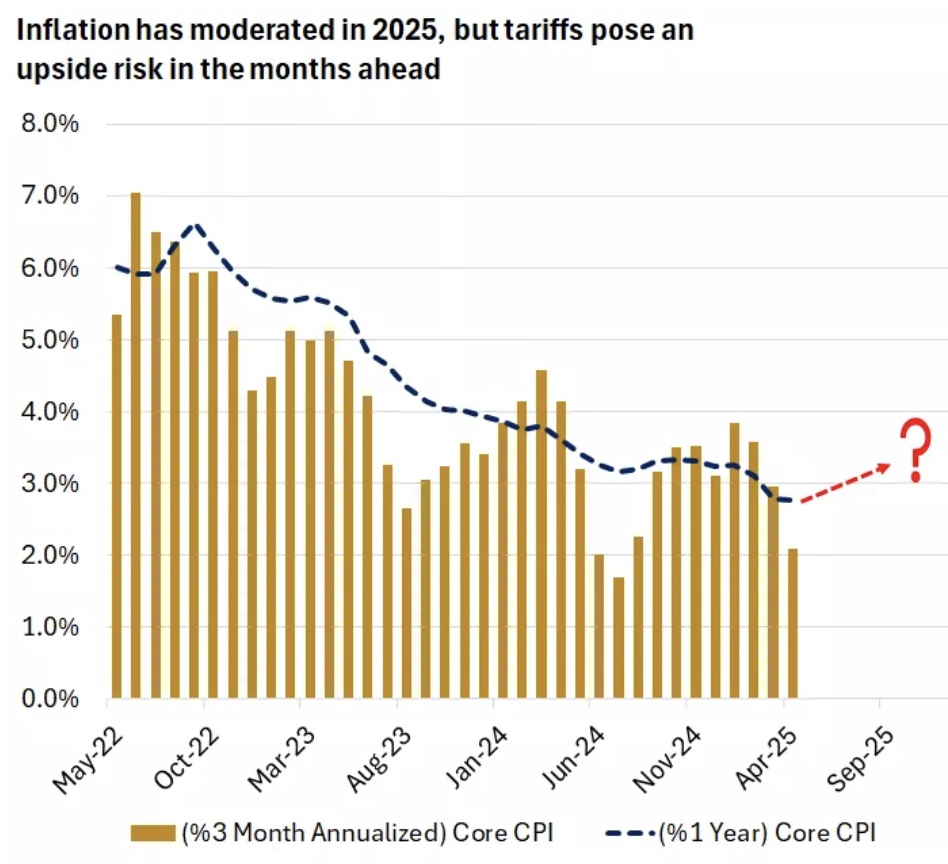

Headline consumer price index (CPI), which represent a basket of goods and services bought by consumers, rose by 0.2% in April, with shelter causing the majority of the monthly increase. The 2.3% rise from a year ago is down from the March reading of 2.4% and the smallest increase since February 2021. Core CPI, which removes more volatile food and energy prices, rose by 0.2% in April and 2.8% on a 12-month basis, holding relatively steady from the previous month. These data were largely lower than consensus estimates and demonstrated moderation over a three-month period.

Turning toward wholesale price inflation, which could provide an indication where consumer prices may trend in the months ahead, the producer price index (PPI) unexpectedly dropped in April. Headline PPI dropped 0.5%, while core PPI, which also removes food and energy prices, dropped 0.4%. Headline PPI was 2.4% higher and core PPI was 3.1% higher over a 12-month period, both lower than the previous month's data.

-

Retail sales were higher by 0.1% over the month, but below expectations for 0.3% growth. On a

positive note, growth in March was revised higher from 1.4% to 1.7%. The retail-sales control

group, which removes more volatile items like gasoline, motor vehicles, and building material,

dropped by 0.2%, demonstrating some weakness.2 Consensus estimates were for there to be slight

growth. On the labor front, initial jobless claims were 229,000, in line with expectations

and relatively level with recent trends.2 Continuing claims also held relatively steady.

Soft economic data, on the other hand, have recently been a focus for markets, not only because they can provide an indication of where actual consumer spending and economic growth (hard data) may head in the future, but also because they've already displayed weakness. The University of Michigan's index of consumer sentiment, for example, has dropped sharply in the wake of tariff-policy uncertainty and inflation worries, down nearly 30% since January. May's preliminary data released last week indicate confidence has declined slightly further, though most consumer surveys occurred before the announced pause on tariffs between the U.S. and China. Nonetheless, at a level of 50.8, consumer sentiment remains at the lowest it's been since June 2022.

-

Given the weakness within soft economic data recently, it isn't surprising retail sales softened

relative to the previous month, particularly if consumers made purchases earlier than they would

have otherwise in hopes of avoiding higher tariffs. Zooming out, we'd note retail sales were

over 5.1% higher than a year ago, which, together with solid household balance sheets, rising

wages, and steady labor markets, provide a supportive backdrop for the consumer-driven U.S.

economy.

That said, it'll take time for the impact of higher tariffs and weakened sentiment caused by policy uncertainty to filter through hard data more fully, given the likelihood that many businesses were front-loading inventory or delaying purchases to avoid tariffs and/or may decide to absorb some or all the price increases they're experiencing to help maintain their competitiveness in the eyes of consumers.

While final trade policies and their ultimate impact remain a key risk, we expect that a greater focus on growth-supportive policies in the months ahead will help avoid worst-case recessionary scenarios. The Federal Reserve is currently on hold, keeping monetary policy in a restrictive stance as it awaits more clarity for now. But we continue to believe a couple rate cuts remain likely this year, though not until the back half. In a speech last week, Fed Chair Jerome Powell reiterated the Fed's commitment to a 2% inflation target and keeping longer-term inflation expectations anchored, which they appear to be at this time, allowing the Fed some flexibility to ease policy if job markets were to meaningfully soften.

-

Stock markets, particularly within the U.S., have traveled quite the volatile path in a relatively

short period of time. U.S. large-cap stocks approached — but narrowly avoided — bear-market territory,

dropping 19% from February’s peak to mid-April’s low before making an impressive climb back into

positive territory for 2025 as of last week.2 While the path to a new peak still lies ahead,

the market's recent performance demonstrates that by trying to avoid the worst days in the market,

you could miss some of the best. We'd also note that globally diversified portfolios have travelled

a smoother path this year when compared with that of U.S. stocks, given the outperformance of

bonds and international stocks.

But the key for goal-oriented investors is to remain focused on what you can control. Set a well-diversified investment strategy based on your goals, using rebalancing strategies to help ensure your portfolio remains designed to deliver performance aligned with what you're trying to achieve as we navigate the uncertainties ahead. We recommend incorporating diversification across international and domestic markets; incorporating stocks of various sizes, styles and sectors; and adding bonds of various maturities and credit quality, according to your personal goals and risk tolerances.

Using your goal-focused strategic allocations as a starting point, we recommend overweighting stocks over bonds, with a focus on U.S. large- and mid-cap stocks in particular, which could help your portfolio benefit from the relative strength of the U.S. economy while maintaining an emphasis on higher-quality stocks in this environment. And within higher-quality U.S. bond allocations, we recommend overweighting intermediate- and long-term bonds, particularly as the 10-year Treasury interest rate ticks back toward the upper end of the 4% - 4.5% range we expect this year.

-

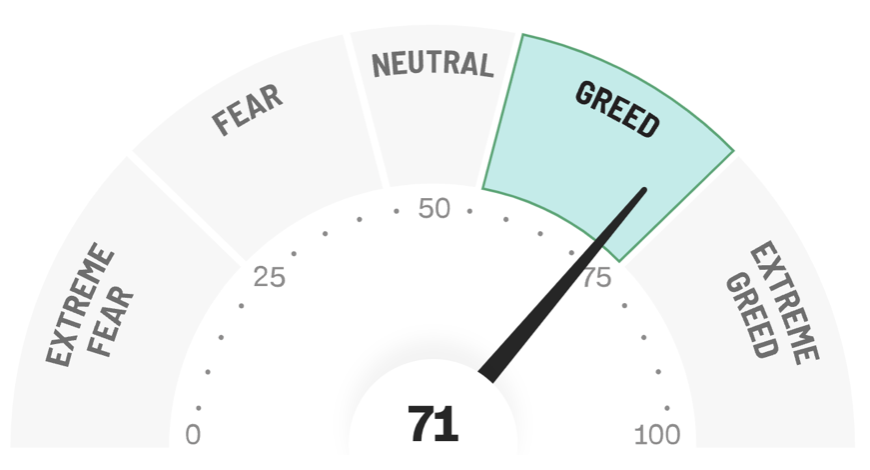

Final Words: Market indicates greed again. Buy Gold and Silver (GLD & SLV ETF's).

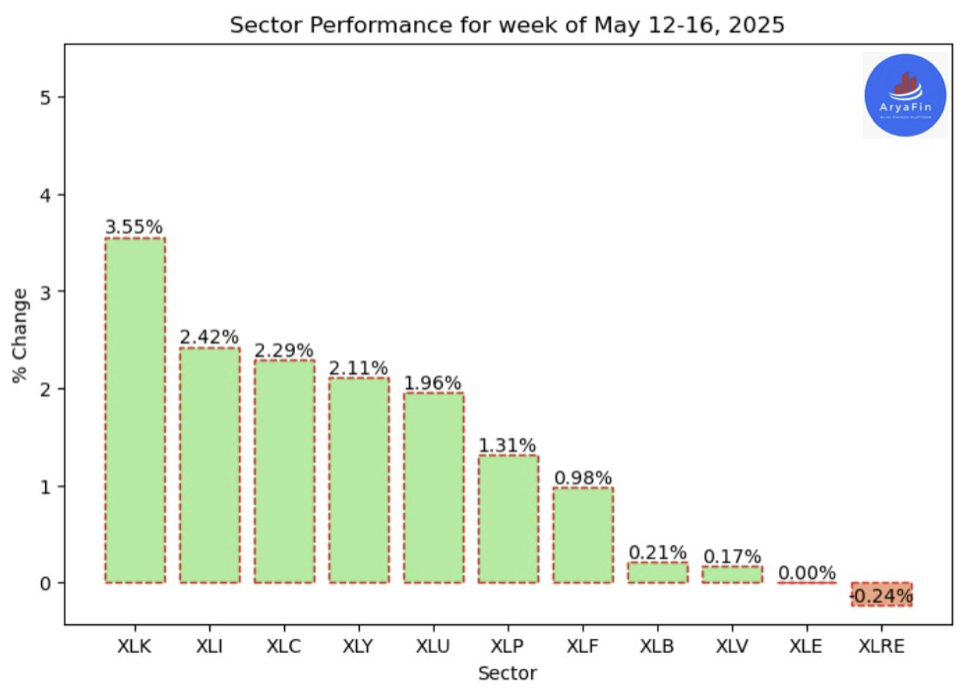

Below is last week sector performance report.

Top 11 Sector Performance for week of May 12-16, 2025

$XLRE The Real Estate Select Sector SPDR Fund -0.24%

$XLE Energy Select Sector SPDR Fund 0.00%

$XLV Health Care Select Sector SPDR Fund 0.17%

$XLB Materials Select Sector SPDR Fund 0.21%

$XLF Financial Select Sector SPDR Fund 0.98%

$XLP Consumer Staples Select Sector SPDR Fund 1.31%

$XLU Utilities Select Sector SPDR Fund 1.96%

$XLY Consumer Discretionary Select Sector SPDR Fund 2.11%

$XLC Communication Services Select Sector SPDR Fund 2.29%

$XLI Industrial Select Sector SPDR Fund 2.42%

$XLK Technology Select Sector SPDR Fund 3.55%

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

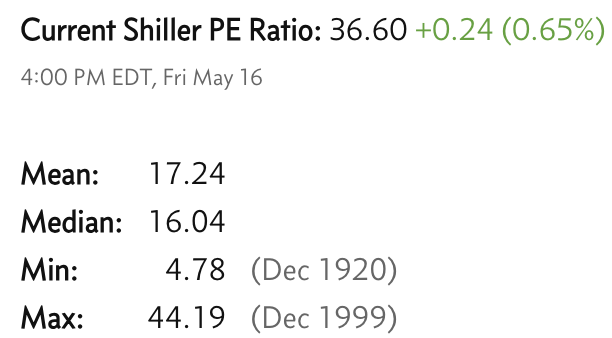

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.