Weekly Market Commentary - May 10th, 2025 - Click Here for Past Commentaries

-

The U.S. has reached a trade deal with the U.K. and agreed to trade talks with China,

to be held this weekend.

The Federal Reserve left the fed funds rate unchanged this week, as expected, and flagged

risks of higher inflation and unemployment.

Key economic readings related to the services sector, which represents more than 70% of

the economy, were mixed but remain in expansion territory.

-

The U.S. and the U.K. announced a new trade deal on Thursday this week. The announcement marks the

first such agreement for the U.S. since new tariffs were announced on April 2. Both countries

indicated they will continue to negotiate to potentially expand the agreement. Under the terms of

the deal:

- The 10% universal tariff on most imports from the U.K. will remain in effect

- The first 100,000 vehicles from the U.K. will be subject to the 10% tariff rate, beyond which a 25% tariff rate will apply

- U.K. tariffs will be reduced or eliminated on certain U.S. exports, including agricultural products such as ethanol and beef

-U.S. tariffs on imports of U.K. steel and aluminum will be eliminated

The economic benefit of this deal is likely limited, in our view, as the U.K. represented about 4% of U.S. exports and roughly 2% of U.S. imports in 2024, resulting in a U.S. trade surplus. Importantly, the agreement demonstrates that trade talks are progressing, and it could serve as a framework for further negotiations with other trading partners. However, negotiations with countries with which the U.S. has trade deficits could be more challenging.

U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer will meet with China officials to begin trade talks this weekend in Geneva, Switzerland. While the outcome of these meetings is uncertain, and a U.S.-China trade deal would likely be complex and require extensive negotiations, any de-escalation would be positive for the economy and financial markets, in our view. We believe even a temporary reduction in tariffs to allow for further talks could help alleviate some of the recent disruption in trade.

-

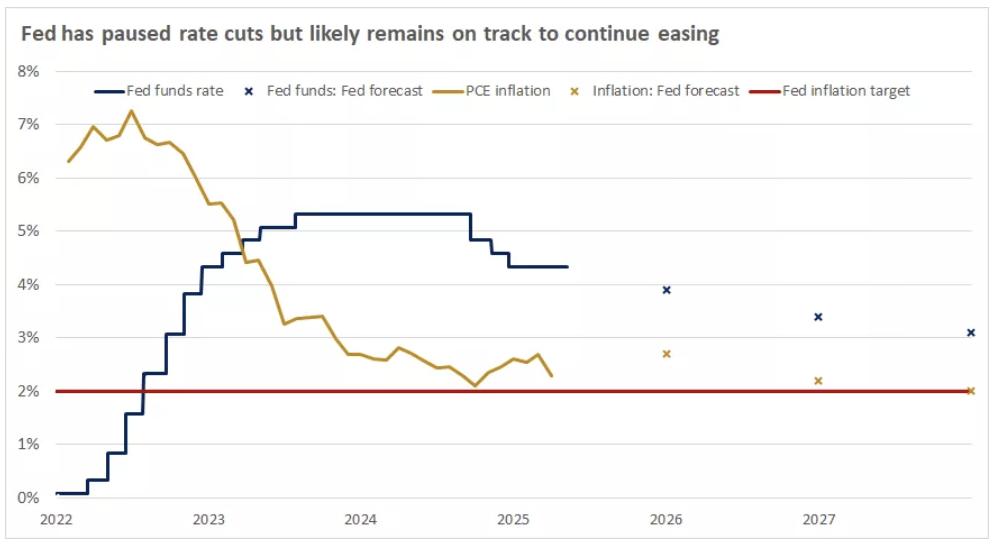

The Federal Open Market Committee (FOMC) concluded its May meeting on Wednesday, with the Fed

maintaining its target range for the federal funds rate at 4.25%-4.5%, as expected. This was

the third consecutive meeting that the Fed held interest rates steady, based in part on

concerns over the potential impact of tariffs. The FOMC updated its statement to reflect its

view that risks to both of its mandates – the potential for higher unemployment and higher

inflation - have risen. As shown in the chart below, the Fed's most recent projection for

the fed funds rate – known as the "dot plot" – laid out expectations for two more cuts this

year. Bond markets are pricing in three cuts this year, likely starting in July, and an

additional cut next year. A healthy labor market, with unemployment low at 4.2%, likely

gives the Fed some flexibility to remain on the sidelines a while longer to assess the

potential impact of tariffs on inflation and the economy.

With the fed funds rate at 4.33% and the Fed's preferred measure of inflation – personal consumption expenditure (PCE) - at 2.3%, monetary policy is likely restrictive, as a neutral policy rate is typically about 1% above inflation. While tariffs could lead to higher prices in the near term, the impact is unlikely to result in sustained inflation, in our view. We continue to expect the Fed to target the 3.5% - 4.0% range for the fed funds rate later this year, as we laid out in our 2025 Outlook. Once the Fed likely resumes easing, lower interest rates should reduce borrowing costs for individuals and businesses, which would be supportive of the economy and corporate earnings, in our view.

-

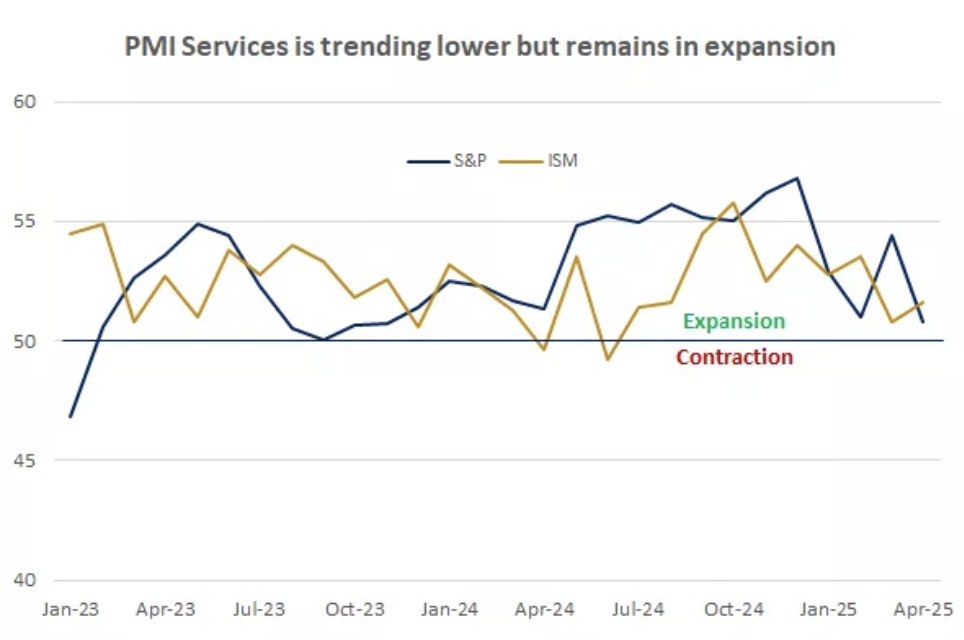

The S&P U.S. Services Purchasing Managers' Index (PMI) fell to 50.8 in April but remained above

the key 50.0 mark reflecting expansion. Uncertainty over government policies, particularly trade,

weighed on demand and business expectations.

The Institute for Supply Management (ISM) Services PMI was stronger than expected for April, rising to 51.6, from 50.8 in March, indicating expansion for the tenth consecutive month. Employment was a key driver behind the increase, rising to 49.0, though still reflecting contraction, but up from 46.2 in March. Business activity was the main detractor, falling to 53.7, from 55.9.

The services sector, accounting for roughly 72% of the economy, has been slowing but remains in expansion territory, as shown in the chart below. Most services sectors tend to be less exposed to tariffs, which generally apply to goods rather than services. However, services can still be impacted by trade tensions if consumers pull back on U.S. services, potentially due to weaker sentiment.

-

U.S. stocks have posted solid gains in recent weeks, with large- and mid-cap stocks recovering

much of their earlier sell-off as trade tensions have eased, the labor market has remained healthy,

and companies have posted better-than-expected earnings. While earnings growth is forecast to slow

in the quarters ahead, we expect lower interest rates and pro-growth policies, such as deregulation

and tax cuts, to help support the economy. Further easing in trade tensions could improve sentiment

among consumers, businesses and investors, though trade deals with countries with which the U.S.

has trade deficits, including some that are sizable, may be more challenging.

Looking ahead, we continue to favor U.S. large- and mid-cap stocks, which appear well-positioned to benefit from a healthy U.S. labor market, potential additional easing in trade tensions and pro-growth policies. The financial sector could benefit from less exposure to tariffs due to its domestic orientation and service focus. Health care is also less affected by tariffs, and valuations are not extended relative to history. Both sectors could also be beneficiaries of tax reform and deregulation.

Within investment-grade bonds, we see value in the seven- to 10-year maturity space, which can lock in higher yields for longer if the Fed is poised to cut rates in the back half of the year. Bond prices also typically rise when interest rates fall, and vice versa, with intermediate-term bonds being more sensitive than short-term bonds, offering the opportunity for higher values. Fed purchases of Treasury bonds to replace maturing holdings on its balance sheet could also help support prices.

-

Final Words: Buy safety such as VOO and growth such as VGT. Balance.

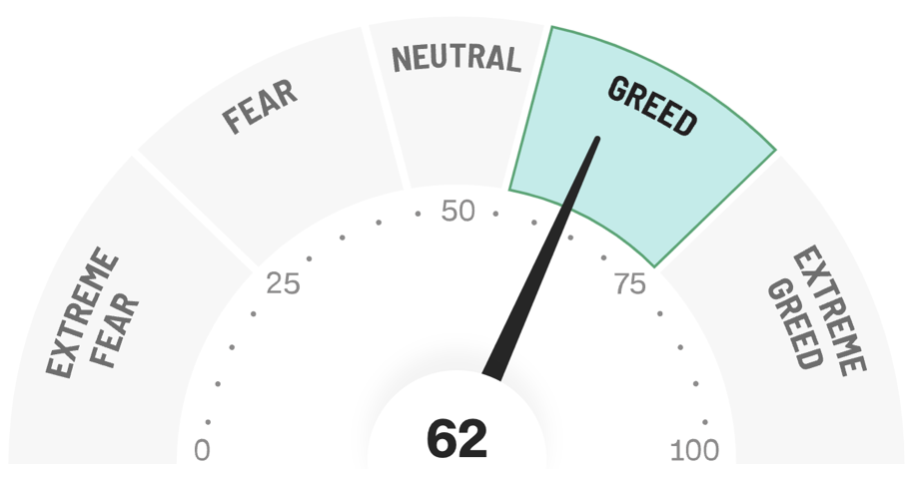

Below is CNN Greed vs Fear Index, pointing at 'Greed' is back.

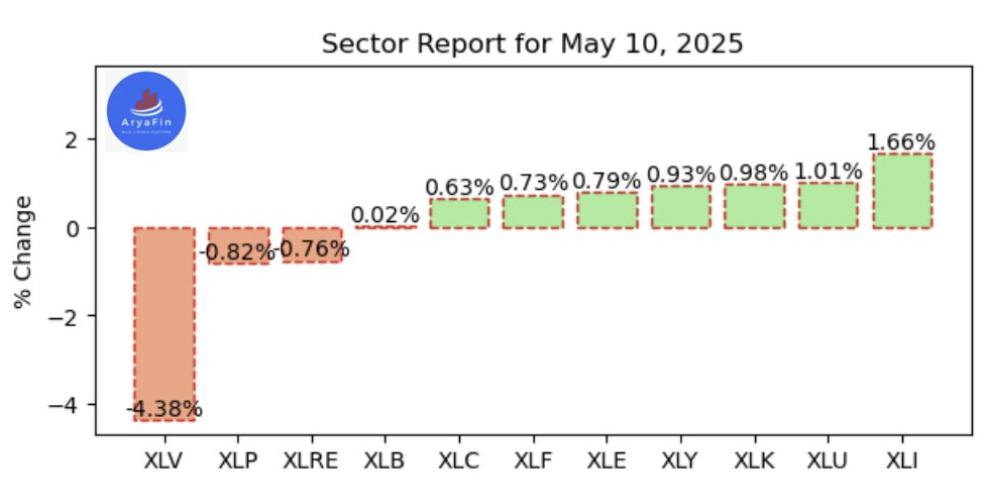

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

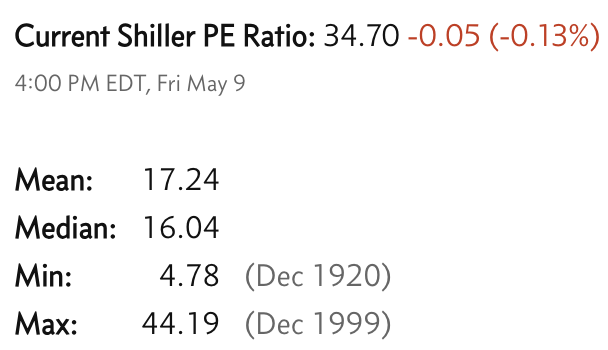

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.