Weekly Market Commentary - June 28th, 2025 - Click Here for Past Commentaries

-

Stock markets made fresh all-time highs last week, with both the S&P 500 and

technology-heavy Nasdaq up about 5% year-to-date.

What is driving this market rally? We highlight three key factors: An easing of geopolitical

tensions (and subsequent lower oil prices), a Fed that continues to signal lower interest

rates are likely (albeit gradually), and the outsized rally in the mega-cap technology sector.

While momentum is likely on investors' side in the near term, there are key catalysts in the

weeks ahead that markets will have to digest. These include tariff and trade updates, the

ongoing debate on a U.S. tax bill, and potentially softer economic data in the quarter ahead.

Markets may experience more bouts of volatility, but we believe the fundamental backdrop for

equities remains intact, and pullbacks can be used as opportunities.

-

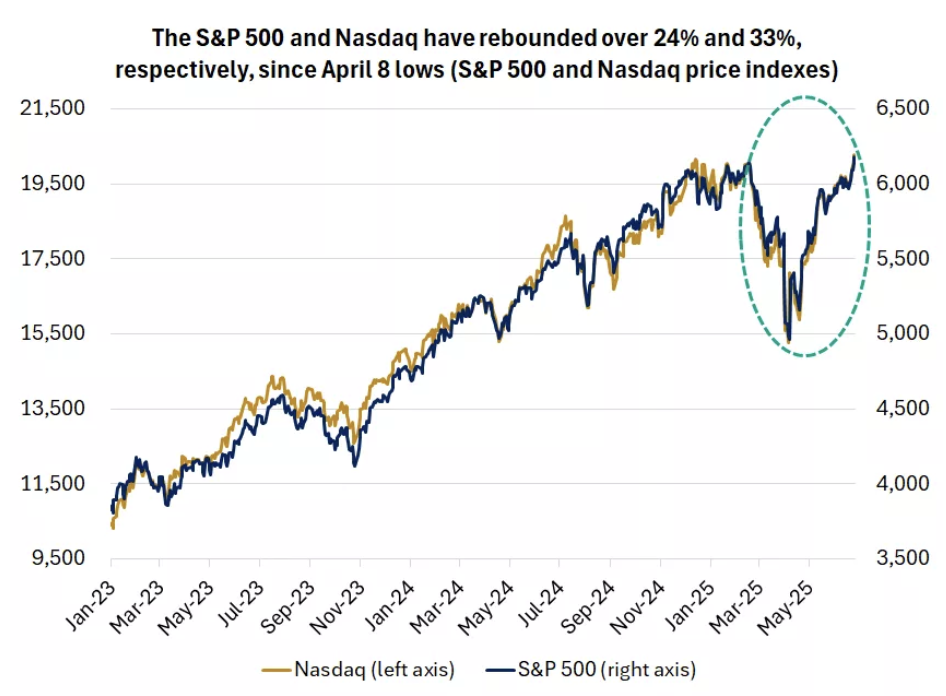

The summer months are here, school is out, and markets seem to be more relaxed as well. This past

week, stock markets staged a summer rally, bringing both the S&P 500 and Nasdaq to fresh

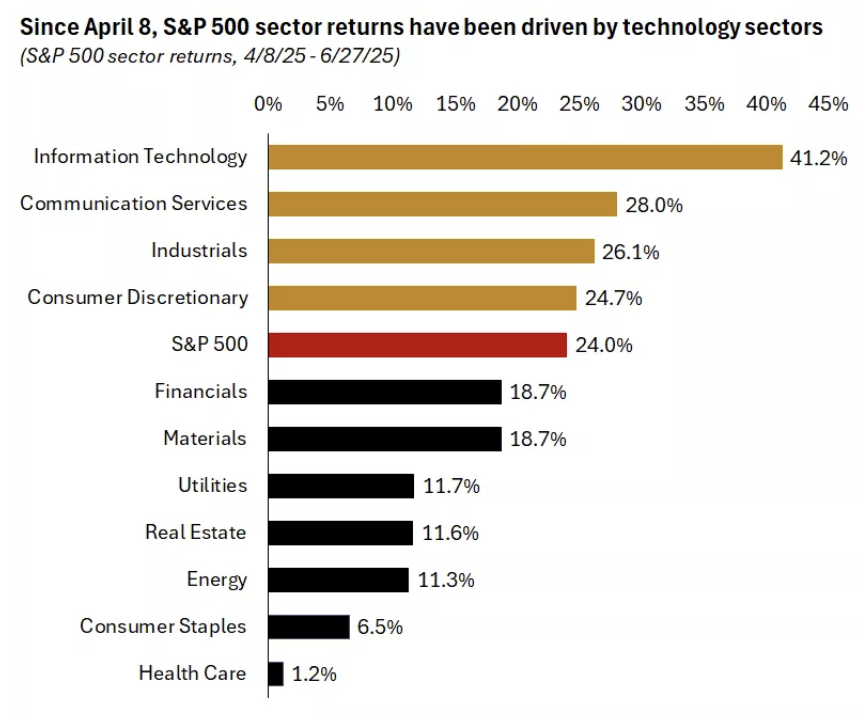

all-time highs. In fact, since the lows on April 8, the S&P 500 is up about 24%, while the

technology-heavy Nasdaq is up about 33%.

Over the weekend of June 21-22, conflict in the Middle East escalated, as the U.S. launched airstrikes against three of Iran's nuclear-enrichment facilities. This was a surprise strike and came in the midst of Israel and Iran's ongoing conflict that began on June 13.

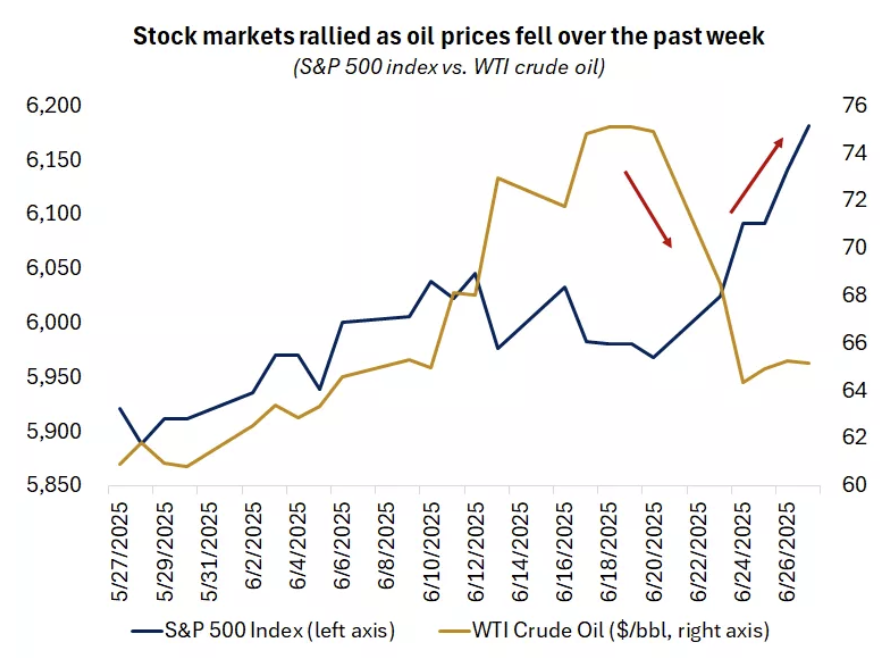

However, in recent days there has been notable de-escalation in the conflict. While Iran retaliated against the U.S. at its base in Qatar, there were no casualties and no material damage. Of note, Iran thus far has not targeted oil infrastructure or the critical Strait of Hormuz (which is a passageway for about 20% of global oil consumption), and thus disruption to oil flows has been minimal.

As a result of the easing geopolitical tensions, oil and energy prices have fallen substantially over the last week. For example, U.S. WTI crude oil, which had risen over 20% in June to $75 per barrel, fell about 13% last week down to around $65 per barrel. This move lower in oil prices is not only supportive for consumers as we head into the summer driving season, but also a positive for keeping inflationary pressures contained. The fall in oil and energy has appeared to support market sentiment in recent days as well, helping drive equity markets toward new highs.

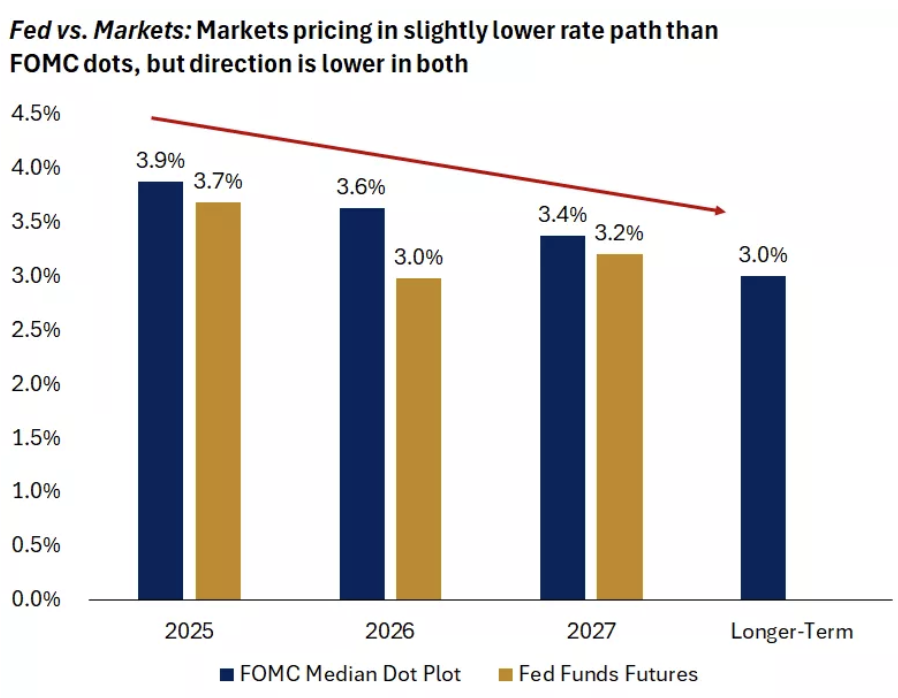

A second reason that stocks have rallied is likely around the prospects of lower interest rates by year-end. The Federal Reserve at its June 17-18 meeting outlined potentially two rate cuts in 2025 in its updated "dot plot," or best estimate of the fed funds rate. It also continues to show ongoing rate cuts in 2026 and 2027, with a longer-term fed funds rate of 3.0%, well below today's 4.25% - 4.5% rate.

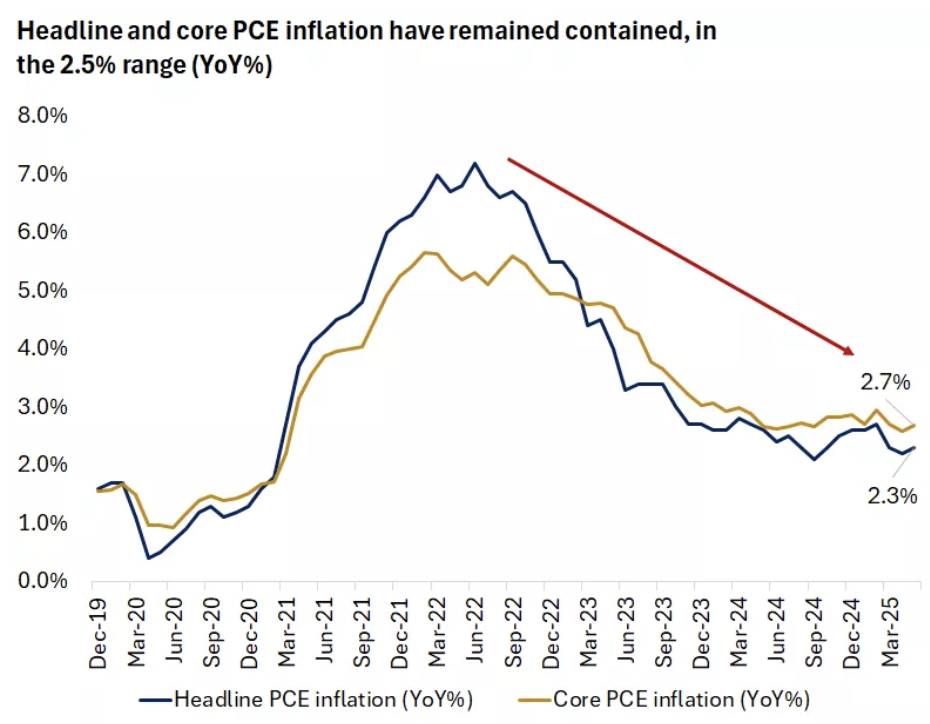

The recent data is also supportive of the Fed poised to cut rates, in our view. As noted above, oil and energy prices have moved sharply lower in recent days, which helps support lower headline inflation. We also have seen inflation readings thus far that are in line or below expectations and remain contained. Last week's personal consumption expenditure (PCE) inflation data for the month of May also helped affirm this trend. Headline PCE inflation was in line with expectations at 2.3% year-over-year, while core PCE inflation was a tick higher than forecasts at 2.7% but remains contained.

-

Finally, recent consumption measures appear to point to softening as well. Retail sales for May

came in below expectations on a headline basis, and last week's personal spending data for May

turned negative as well.1 These datapoints indicate some potential softening in consumer spending

in recent weeks.

Taken together, a contained inflation backdrop with some signs of a softer consumer would imply a Fed that is more likely to cut rates, in our view. In addition, while the news flow around trade and tariffs have been generally more benign, with headlines on a trade framework with China in place, there is still uncertainty, which could weigh on consumption. This came through last week as the administration announced that trade discussions with Canada were ending, and markets fell a bit on the news.

Markets are now pricing in two or three rate cuts in 2025, according to CME FedWatch. And Treasury yields across the curve have moved lower, with both 2-year and 10-year yields well below highs from earlier this year. These moves lower in interest rates are positive for consumers and corporations and supportive of better stock-market sentiment broadly.

The third driver behind the summer rally is perhaps a renewed momentum in the technology and growth parts of the stock market. In fact, while the broader S&P 500 is up about 24% since the April 8 lows, growth sectors like technology, communication services and consumer discretionary are up well beyond this in some cases.

In our view, mega-cap technology stocks delivered during first-quarter earnings season. These companies not only reaffirmed their outsized capital expenditures on AI and infrastructure, but also were largely able to outperform revenue and earnings expectations, even in the face of tariff uncertainty and restrictions in China. In addition, technology and growth sectors led to the downside during the April tariff-induced sell-off, and thus were also on the radar of investors as markets began to recover.

We believe that technology and AI sectors continue to deliver robust revenue and earnings growth, and we recommend investors continue to hold an equal-weight position in these areas. However, given the recent strong rally in the space, valuations have once again crept higher in tech sectors, and we would expect the pace of gains to moderate. We believe investors can complement tech and growth investments with sectors like health care and financials, which we think offer better valuations and the potential for catch-up if economic and earnings growth re-accelerates in the year ahead.

-

Overall, markets seem to have been energized with a dose of summer animal spirits, and momentum in the

near term appears to be on investors' side. However, we know that stocks don't move higher indefinitely,

and there are several potential catalysts on the horizon that may create some temporary indigestion for

investors. These include ongoing tax and trade negotiations, the passing of a U.S. tax bill, and the

potential for some cooling in economic growth sparked by higher tariff rates.

We saw just late in the week that the stock market rally faded as the U.S. administration announced it was ending trade discussions with Canada over a digital services tax. There may be further updates to this trade negotiation and others over the next couple weeks that may spark similar market uncertainty and volatility.

Nonetheless, we believe investors can use any volatility or pullbacks as opportunities to position portfolios by diversifying, rebalancing, or adding quality investments at better prices. We recommend overweight positions in U.S. large-cap and mid-cap equities, with exposure to both growth and value sectors. We also believe international equities deserve an allocation in portfolios, albeit with a modest underweight versus U.S. holdings. And finally, within U.S. Treasuries and investment-grade bonds, we continue to see value in the seven to 10-year maturities, especially as the Fed, in our view, remains poised to move interest rates gradually lower.

Summer can be a great time to relax and recharge, but it is also a great time to review investments to help ensure you are on track to meet your long-term financial goals. We suggest reaching out to your financial advisor, if you haven't already, for a midyear check-in on your personal investment and asset-allocation strategy.

-

Final Words: Market indicates Greed. Buy Gold and Silver (GLD & SLV ETF's).

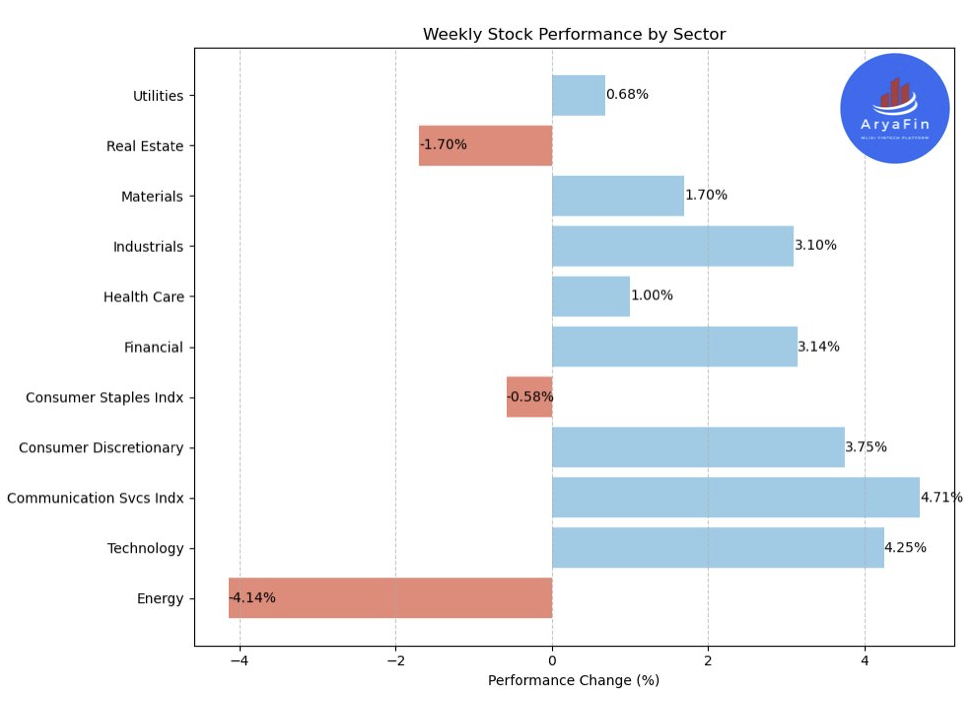

Below is last week sector performance report.

Top 11 Sector Performance for June 23-27, 2025:

$XLE S&P Energy Select Sector Index (-4.14%)

$XLK S&P Technology Select Sector Index (4.25%)

$XLC Communication Svcs Sel Sector Indx (4.71%)

$XLY S&P Consumer Discretionary Sel Sector In... (3.75%)

$XLP S&P Consumer Staples Sel Sector Indx (-0.58%)

$XLF S&P Financial Select Sector Index (3.14%)

$XLV S&P Health Care Select Sector Index (1.00%)

$XLI S&P Industrials Select Sector Index (3.10%)

$XLB S&P Materials Select Sector Index (1.70%)

$XLRE S&P Real Estate Select Sector Index (-1.70%)

$XLU S&P Utilities Select Sector Index (0.68%)

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

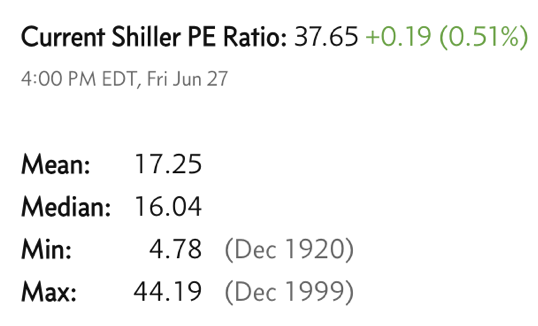

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.