Weekly Market Commentary - June 21st, 2025 - Click Here for Past Commentaries

-

The Fed held rates steady, maintaining a wait-and-see stance as it monitors the economic

impact of tariffs and other uncertainties. Economic resilience is holding, but growth

appears to be moderating. Tariff-related inflation pressures may build in the second

half but are expected to be temporary.

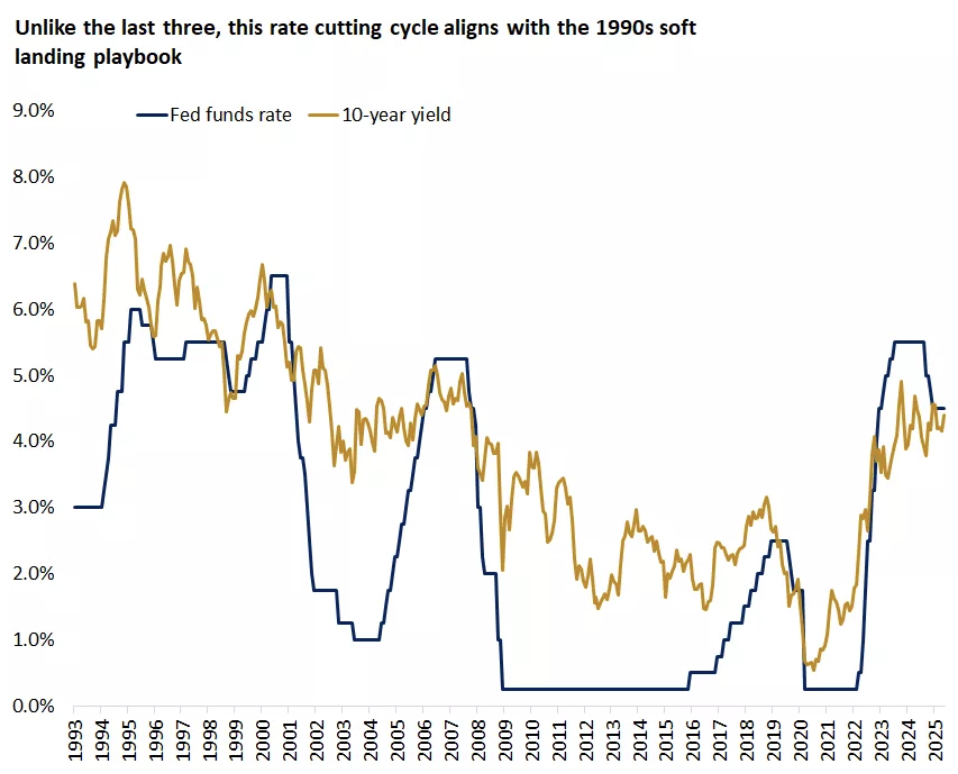

The Fed remains in a gradual easing cycle, more reminiscent of 1995 than the aggressive

cuts seen in past recessions. Geopolitical risks are elevated but have had limited and

manageable effects on markets so far.

Diversified portfolios with international equities exposure and a slight U.S. tilt may

be best positioned for the months ahead.

-

The Federal Reserve held interest rates steady for the fourth consecutive meeting, maintaining

its benchmark rate at 4.25%-4.5%. While the decision was unanimous, the Fed's latest projections

appear to reveal a growing divide: seven officials anticipate no rate cuts this year, while

eight still expect two.

Trade tensions, fiscal policy shifts, and geopolitical risks complicate the Fed’s path forward. With both policymakers and markets likely to remain in wait-and-see mode through the summer, seeking clarity on how these forces will impact the economy, we explore five key questions that could shape the second half of 2025.

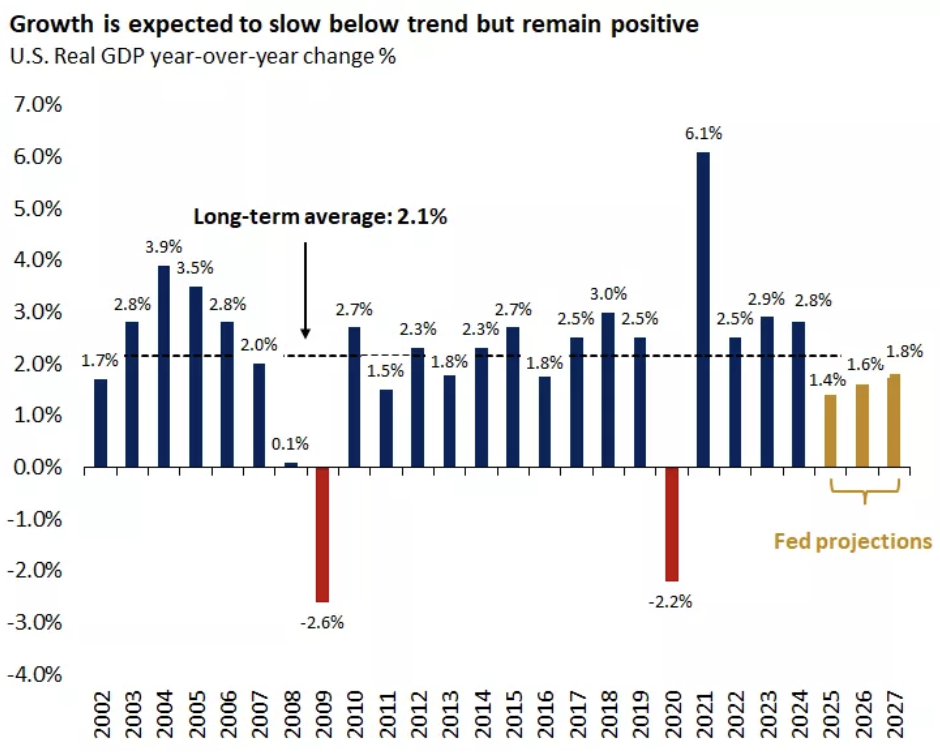

A key reason why the Fed can afford to sit on the sidelines is because the economy continues to chug along. After contracting by 0.2% in the first quarter, GDP is poised for a strong rebound in the second quarter. A tariff-driven surge in imports was a major drag in the first quarter (goods imports rose over 50% in anticipation of higher tariffs), but that effect is expected to reverse.

The Atlanta Fed's real-time GDP estimate points to 3.4% growth in the second quarter1. Averaging the two quarters gives a “good enough” 1.6% growth pace for the first half of the year. Following three years of above-trend growth, a slowdown is not surprising, in our view, especially given lingering macroeconomic uncertainties and still-elevated interest rates. The Fed anticipates modest but positive growth in 2025, followed by a reacceleration in the next two years -- a reasonable expectation, in our view.

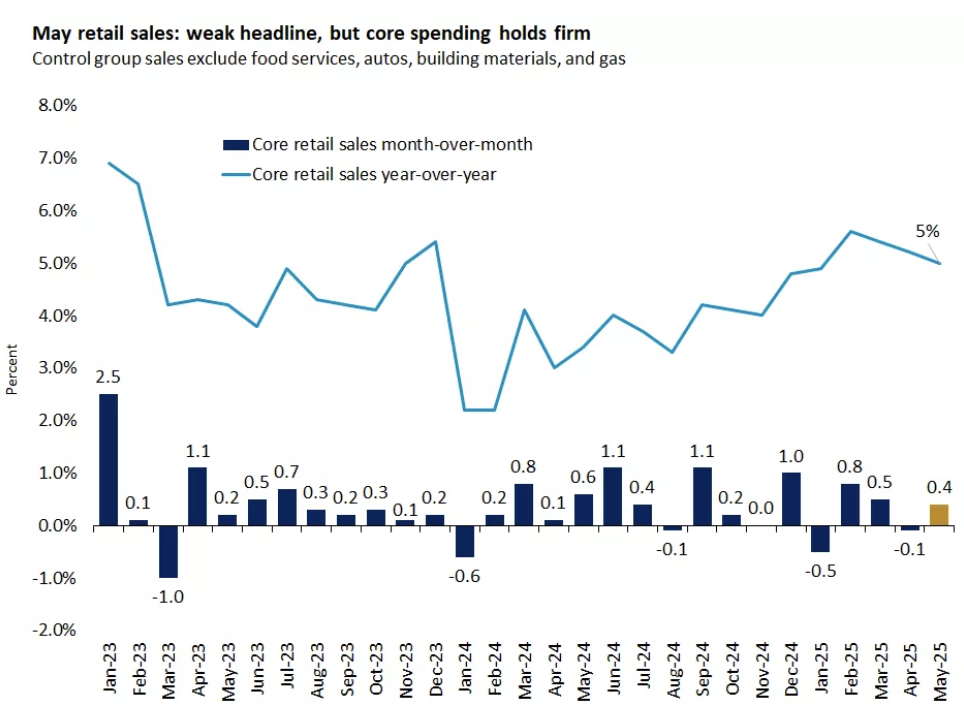

We’re watching the labor market and consumer spending closely for signs of strain. Consumer spending, which accounts for nearly 70% of GDP, showed mixed signals in May. Headline retail sales fell 0.9%, suggesting some pullback. However, this largely reflected a payback from a pre-tariff buying surge, especially in autos. The core or control-group sales, used in GDP calculations, rose 0.4% month-over-month and 5% year-over-year, indicating consumers are still spending, albeit more cautiously.

So far, tariffs have had a limited impact on inflation. Core PCE—the Fed’s preferred inflation gauge—hit a four-year low in April and is expected to come in at 2.6% for May. Many companies have relied on pre-tariff inventory or absorbed cost increases to help avoid hurting demand.

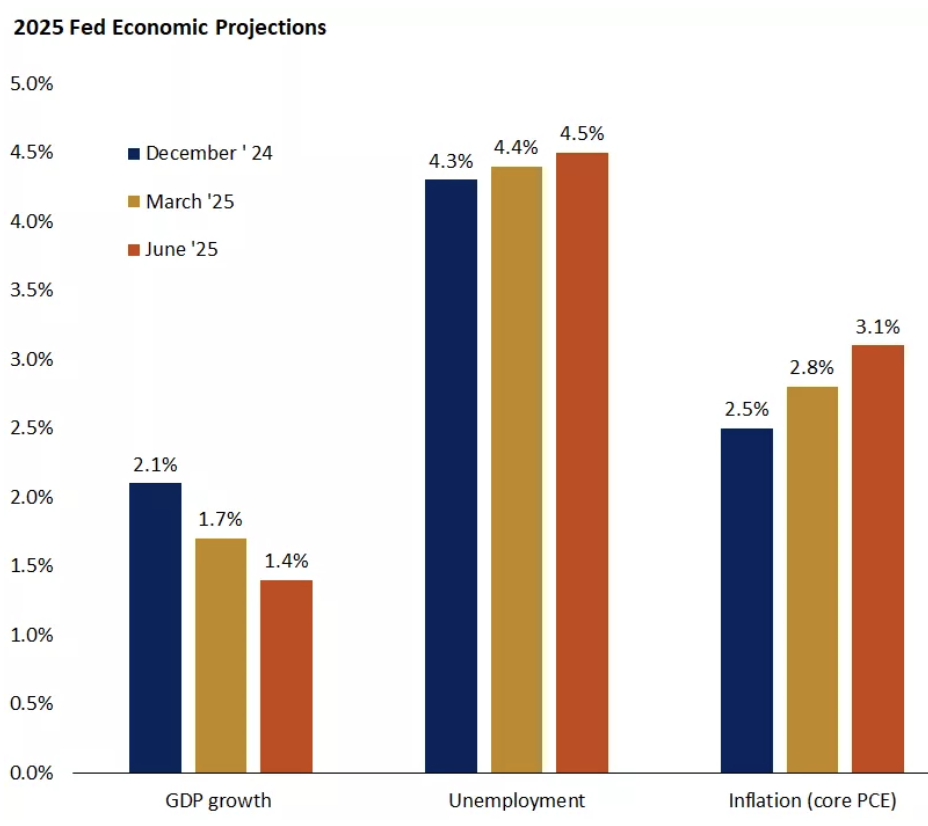

However, as inventories deplete and new goods arrive under the higher-tariff regime, price increases are likely, in our view. Several firms have already announced price hikes starting in June. This is a key reason why the Fed revised its 2025 inflation forecast upward, from 2.8% to 3.1%. As Fed Chair Powell noted, “someone has to pay,” though the extent of consumer passthrough remains uncertain due to the complex supply-chain dynamics. Producers, importers and sellers will likely all be making pricing decisions before the product reaches the consumer.

With the average effective tariff rate now around 15%, the highest since 1936, we expect some upward pressure on goods prices. Still, services inflation may remain stable, and the overall inflation bump could prove temporary. The Fed is on alert but expects inflation to normalize in 2026.

-

With the economy resilient and inflation concerns lingering, the Fed will likely take the

summer off as it waits for more clarity before making any changes to its policy. But that

doesn’t mean the easing cycle is over.

Despite diverging views, the median dot plot still reflects expectations for two rate cuts in 2025. For 2026, officials now project just one cut (down from two), and another in 2027, implying a shallower path than in March and slightly more cautious than market expectations. Still, the gap is not wide: markets see a 3.2% rate by the end of 2026 versus the Fed’s 3.6%.

In our view, higher inflation and a gradual uptick in unemployment put policymakers in a tough spot. But we think the fog should begin to lift after summer. The Fed’s bias remains toward eventually moving from restrictive to neutral policy. A slow, shallow rate-cutting cycle—similar to the mid-1990s—could yield better market outcomes than the aggressive, recession-driven cuts seen in 2001, 2008 and 2020.

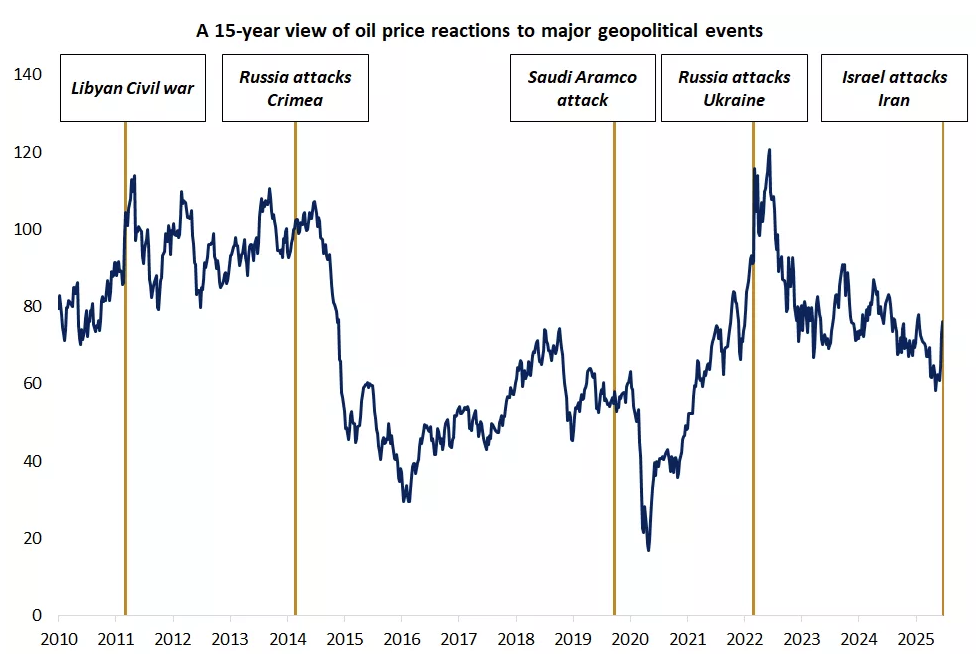

The geopolitical escalation with the Israel-Iran conflict and the growing risk of U.S. involvement adds another layer of uncertainty for the Fed. The main economic transmission channel is energy: A spike in oil prices can raise inflation expectations and actual inflation.

While the conflict’s trajectory is uncertain, history offers some reassurance. Over the past 15 years, similar events have not led to sustained oil-price rallies or lasting market disruptions. Structural changes in the U.S. economy also appear to help. The U.S. has been a net petroleum exporter for several years, and energy spending as a share of GDP has declined, thanks to efficiency gains and a shift toward services.

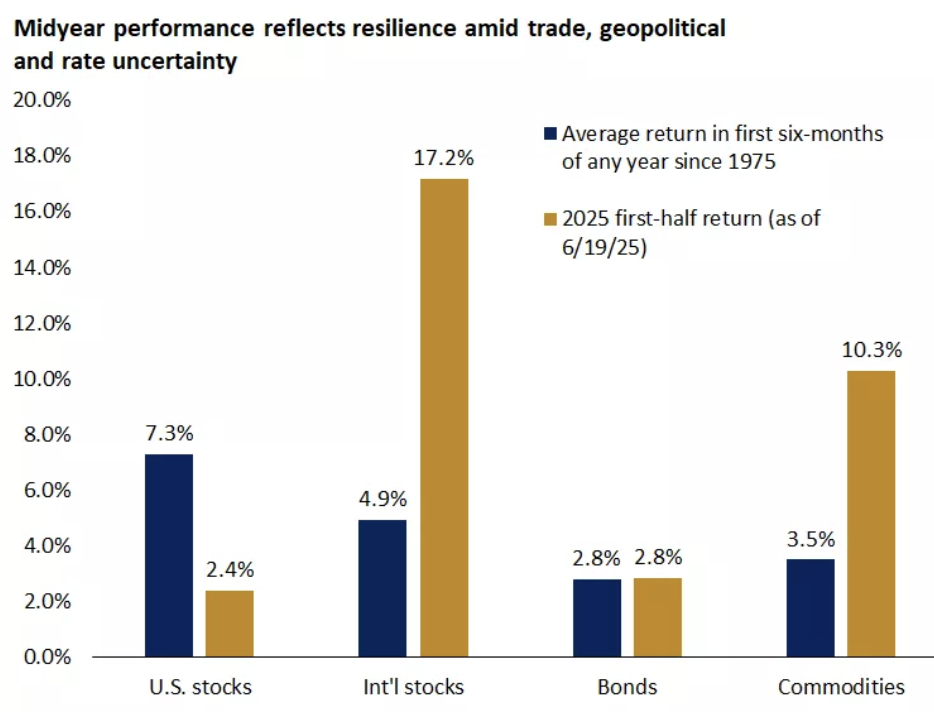

Diversification will likely remain the name of the game this year amid a patient Fed, policy, and geopolitical uncertainties. After a 20% rally from the April 8 lows, equity markets may get choppier in the near term. Still, well-diversified portfolios have held up nicely, even as U.S. stocks fell out of favor and long-term bond yields briefly spiked in the first half of the year.

Despite worries about government debt and Fed policy, bond yields have stayed rangebound. As rates likely remain high for longer, bonds will continue to offer attractive income and may still partially help offset equity volatility. However, long-term rates may not fall as quickly as short-term rates, even when the Fed resumes easing, potentially steepening the yield curve. That’s why we favor investment-grade bonds with seven to 10-year maturities over longer tenures.

In equities, any clarity on tariffs and a potential U.S.-dollar relief rally could spark a rotation back into U.S. assets. Still, we see value in international markets—an area many investors remain meaningfully underweight relative to global benchmarks. Within the U.S., we expect the broadening of market leadership to continue, with opportunities in financials and health care. We recommend maintaining a balance between growth- and value-style investments.

-

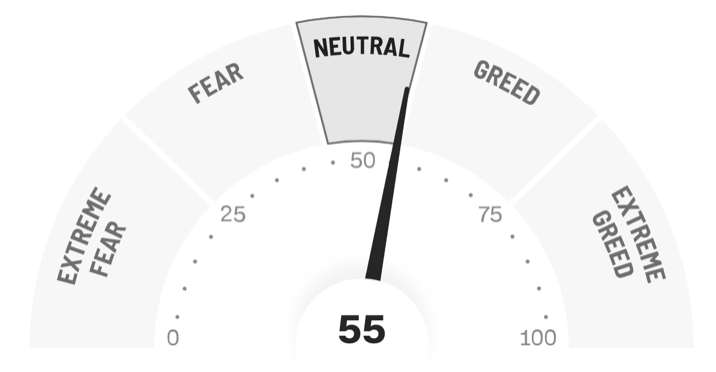

Final Words: Market indicates neutral. Buy Gold and Silver (GLD & SLV ETF's).

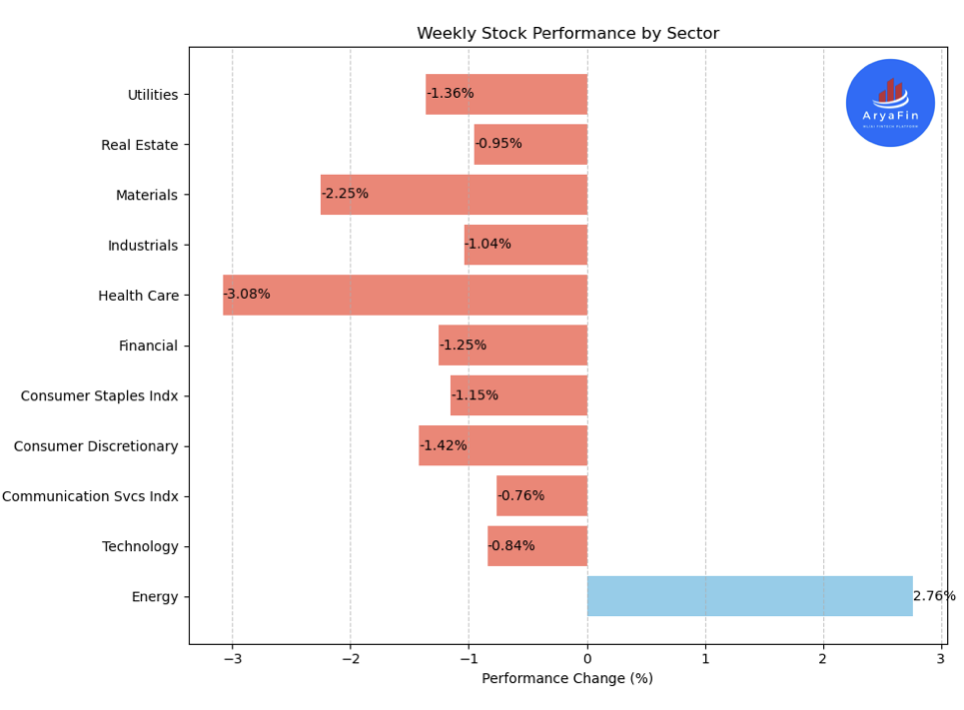

Below is last week sector performance report.

Top 11 Sector Performance for June 16-20, 2025:

$XLE S&P Energy Select Sector Index: 2.76%

$XLK S&P Technology Select Sector Index: -0.84%

$XLC S&P Communication Services Select Sector Index: -0.76%

$XLY S&P Consumer Discretionary Select Sector Index: -1.42%

$XLP S&P Consumer Staples Select Sector Index: -1.15%

$XLF S&P Financial Select Sector Index: -1.25%

$XLV S&P Health Care Select Sector Index: -3.08%

$XLI S&P Industrials Select Sector Index: -1.04%

$XLB S&P Materials Select Sector Index: -2.25%

$XLRE S&P Real Estate Select Sector Index: -0.95%

$XLU S&P Utilities Select Sector Index: -1.36%

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

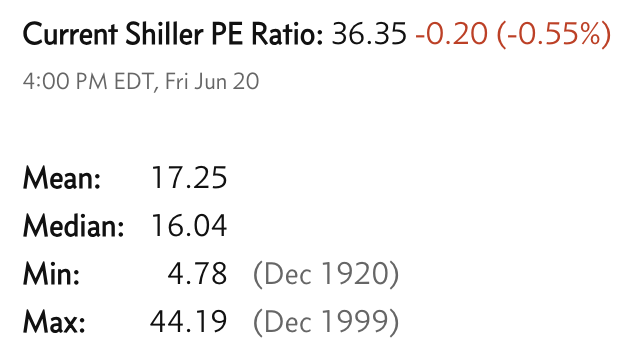

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.