Weekly Market Commentary - July 26th, 2025 - Click Here for Past Commentaries

-

Stocks keep hitting fresh highs, supported by trade optimism and solid corporate earnings.

New trade deals signal reduced uncertainty ahead of the August 1 deadline.

A packed week of earnings, Fed policy, and economic data could shake that calm, but the prevailing

trend is upward. With rate-cut pressure intensifying, markets are watching closely for hints of easing,

potentially starting in September.

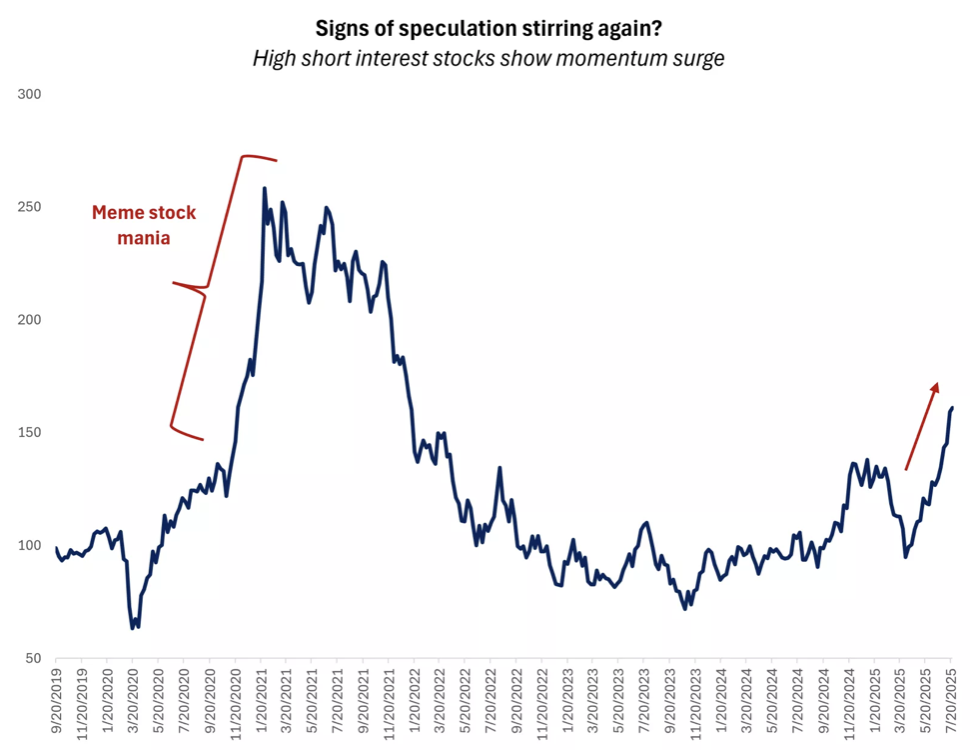

Meme stocks and speculative froth are reappearing, but broader sentiment remains below euphoric levels,

suggesting room before true overheating. With valuations elevated, earnings will likely have to do the

heavy lifting from now on.

We recommend avoiding the temptation to chase speculative investments. Favor quality, diversification and

large-cap/ mid-cap U.S. equities. We think financials, health care, and consumer discretionary look compelling,

while investment-grade bonds offer solid yield opportunities.

-

Summer temperatures are heating up, and so is the stock market. Investors have little to complain about

so far this season, with the S&P 500 climbing steadily and not registering a single move greater than 1%

in either direction for over a month. This stretch of low volatility and consistent gains, including 11

new highs in the past 30 days, has been supported by a backdrop of easing uncertainty and growing clarity

across key policy fronts.

But with a critical week ahead featuring big-tech earnings, a key trade deadline, a Federal Reserve meeting, and the monthly jobs report, the summer's calm may be tested. We think complacency is rising and so is the risk of near-term volatility, but solid fundamentals help support a cautiously optimistic outlook for the rest of the year.

-

Tariffs and trade have been the biggest source of uncertainty this year, triggering a near-20% decline in

stocks in April. But this fog is gradually clearing as more trade deals are announced ahead the U.S.

government's August 1 deadline. Last week's deal with Japan, for example, reduced threatened tariffs from

25% to 15% and included a $550 billion U.S. investment commitment. The deal likely provides a framework

for other major countries as negotiations kick into high gear.

Deals have now been reached with the U.K., Vietnam, Indonesia, Japan, and partially with China, while key partners like the EU, Canada, South Korea, and India remain at the table. Tariffs rates are moving significantly higher from last year, but the worst-case scenarios appear to have been avoided, and the increased clarity can help companies plan and resume investment spending.

-

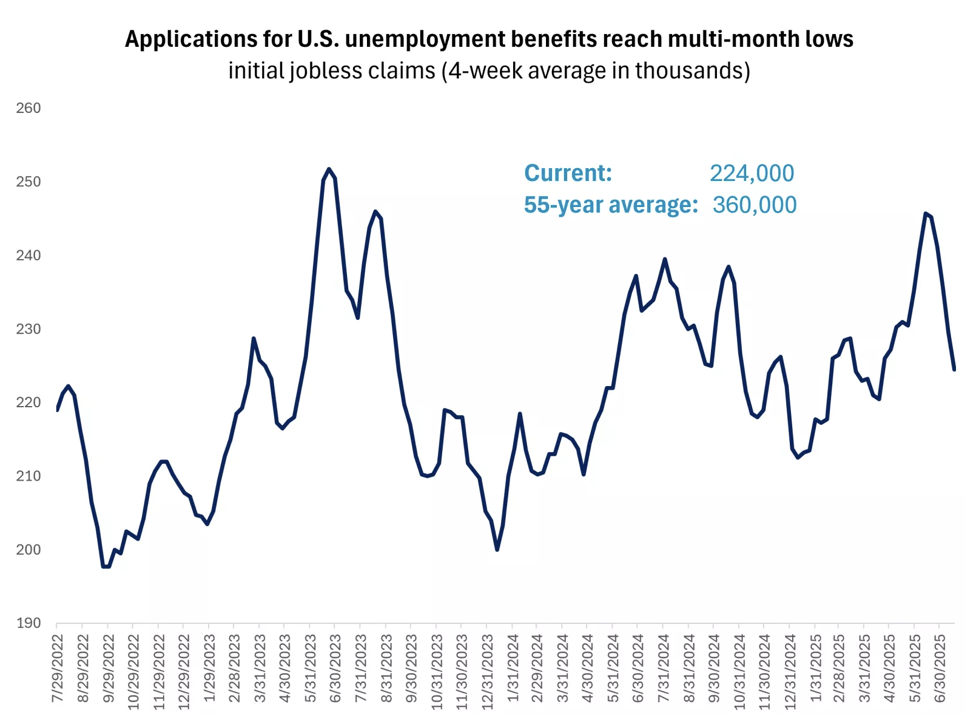

While growth slowed notably in the first half of the year, recent economic data has pushed back against the

stagflation narrative. Initial jobless claims declined, pointing to stable labor-market conditions. Retail

sales rose more than expected in June, showing that consumers keep spending. Inflation, while still a concern,

is contained for now, as the expected rise in consumer and producer goods prices has been restrained by a

decline in services (goods carry a 25% weight in the inflation basket vs. 75% for services).

We suspect this series of market-friendly data may be disrupted in the months ahead as higher tariffs likely impact growth. However, the recent passage of a new tax bill has brought some clarity to fiscal policy. We expect modest fiscal stimulus next year, with tax cuts, increased business investment, and deregulation supporting a pickup in activity. The upshot, in our view, is that while stagflation concerns may rise as the summer ends, the economy appears well-positioned to weather volatility as headwinds likely ease in 2026.

-

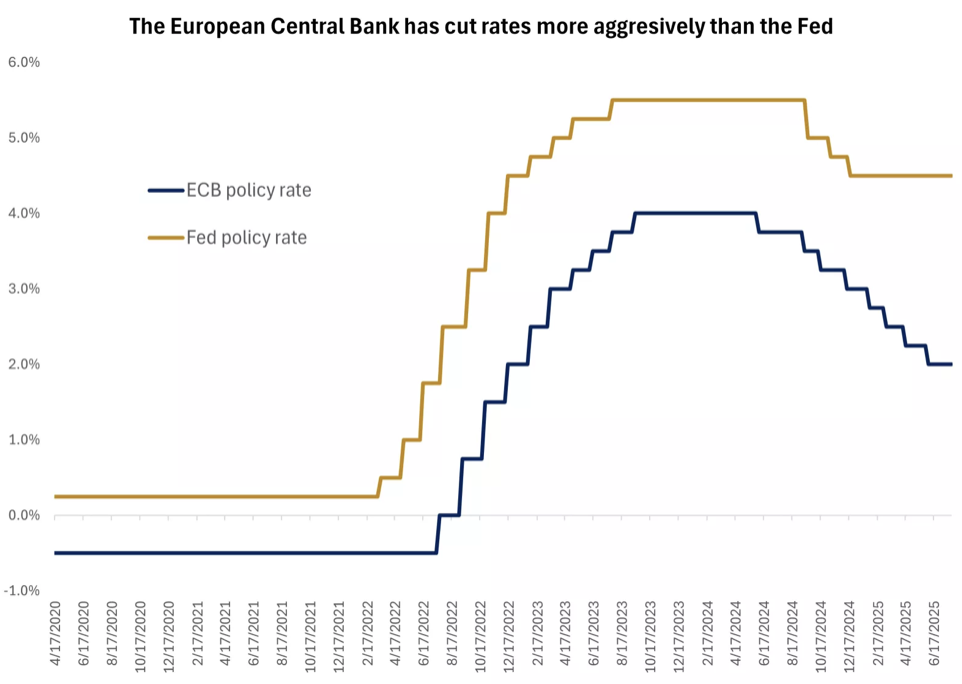

The White House has ramped up pressure on the Fed to lower interest rates, pointing to other central

banks that have cut rates more aggressively. For context, the European Central Bank just paused its

rate-cutting campaign after having lowered rates by 2% over the past year vs. the Fed's 1% move. With

Jerome Powell's terms ending next year and the president eager to announce his replacement soon, concerns

about Fed independence are on the rise.

We would note that there are several checks and balances in place to allow the Fed to make decisions based on economic grounds rather than political pressure. First, the president’s nominee would need to be confirmed by the Senate, and a polarizing or unqualified candidate could be rejected, as it has happened with other nominations in the past. Second, while the Fed Chair is an influential voice, decisions require a majority vote among the 12 voting members of the FOMC.

Given the resilient economic data and upside risks to inflation, the Fed is likely to hold rates steady again when it meets this week. But if clarity on the tariffs improves after August 1, a September cut is possible, with Powell potentially hinting at that at the Fed's annual Jackson Hole meeting on August 21-23. We expect one to two cuts in the second half of 2025, followed by additional easing in 2026 as the Fed moves slowly toward a neutral rate (around 3%-3.5%). From a market perspective, a measured and gradual easing cycle can still lead to good market outcomes if the economy holds up, as it did in the mid-'90s.

-

Finally, investors may also be picking up on some positives coming out of ongoing trade negotiations. For

example, last week the administration announced it may be loosening export restrictions, which would allow

companies like NVIDIA to sell certain AI semiconductor chips into China once again. In addition, companies

like Apple have sought deals on rare earth magnets, which are essential for manufacturing electronics, with

companies outside of China. And ongoing deals and negotiations with countries like Vietnam and Indonesia

should also help secure alternative supply-chain options outside of China. The focus by the administration

on trade and tariffs thus may, over time, help open economies to U.S. goods, diversify supply chains, and

lower tariff and non-tariff barriers.

-

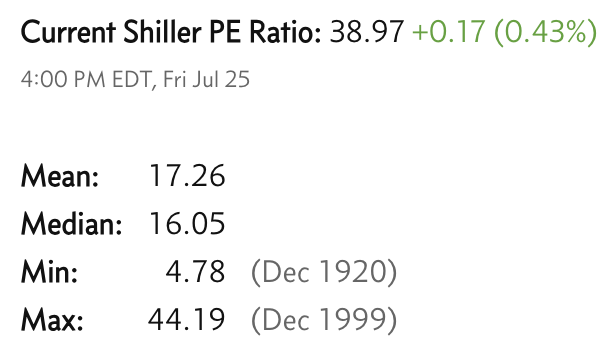

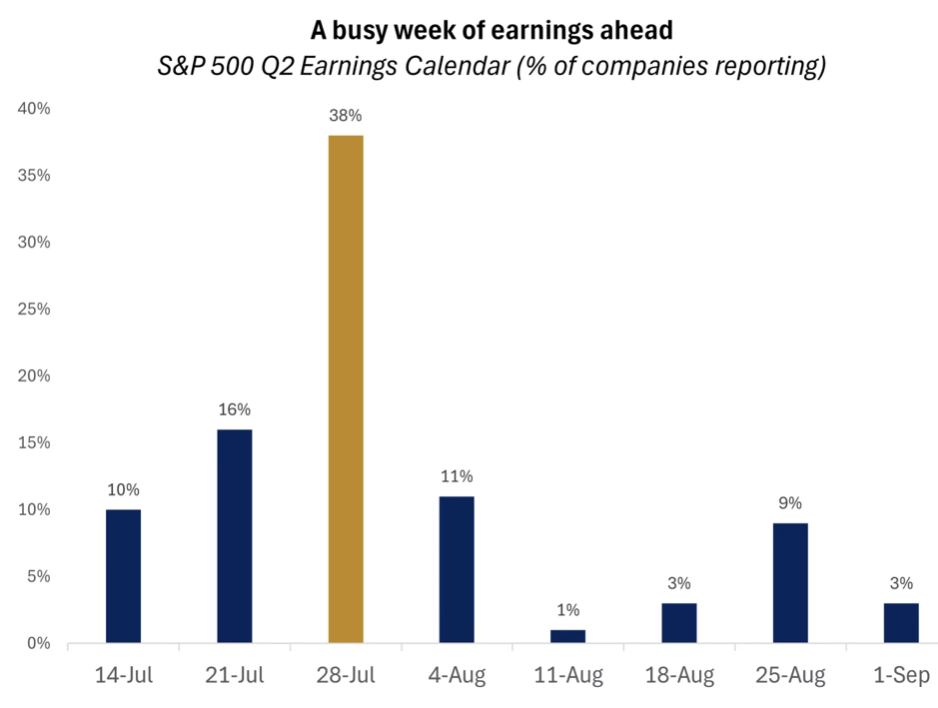

Valuations have had their run over the past three months, with the S&P 500 forward price-to-earnings ratio

rising to over 22 times, the highest since 2021. Now it is the earnings' turn to drive further gains.

This week will be the busiest of this earnings season, with almost 40% of the S&P 500 companies reporting

results, including many among the Magnificent 7 (Microsoft, Meta, Apple, Amazon).

So far, the second-quarter earnings season is off to a good start. Of the companies that have reported, 83% are beating estimates, exceeding expectations by 7%. As a result, the expected S&P 500 earnings growth rate for the quarter has been revised up to 5.5%, from 4% just a few weeks ago. Banks have been a bright spot, underscoring consumer health and credit stability.

However, in our view, investors can still feel comfortable that the worst-case scenario – high tariff rates, no positive outcomes from trade negotiations, and runaway inflation – is not likely to play out. In addition, as we look toward the end of the year and into 2026, we would expect prices and inflation to stabilize again, the Fed to lower interest rates, and some stimulus from the U.S. tax bill to kick in.

The Magnificent 7 companies are expected to remain top contributors. Earnings from the group are projected to grow 14% vs. the 3% expected for the S&P 500's remaining 493 companies. Strong artificial intelligence (AI) demand remains a key driver, while the weaker dollar is providing an additional tailwind for earnings. With roughly 40% of S&P 500 revenues derived from international markets, currency-translation effects and increased competitiveness for U.S. exporters are likely to boost profits. Technology and industrials are two sectors that potentially stand to benefit the most given their high foreign revenue exposure.

-

As it often happens when risks begin to fade, complacency starts to emerge. Meme-stock mania appears to be

making a comeback with some retail traders reigniting interest in heavily shorted stocks, driving big price

swings that are often disconnected from fundamentals and can reverse violently. This behavior could be a sign

of froth. However, a broader measure of investor sentiment based on the AAII survey (American Association of

Individual Investors) indicates that we appear to be still far from the euphoria that tends to show up at

market peaks.

-

Record highs typically confirm strength, in our view, not signal imminent reversals. And market internals

help support this notion. Equities are outperforming bonds, cyclical stocks are outperforming defensives,

high-yield spreads are tight, and market-based inflation expectations appear to point to stable inflation

over the longer term.

Still, any deviation from the expected path, whether in trade talks, earnings or Fed decisions, could stir volatility. Seasonality also cautions against overconfidence, as late summer and early fall tend to bring more market turbulence. A run-of-the-mill pullback or correction is inevitable, though difficult to time. We think investors will be best served by avoiding the temptation to chase speculative investments and by doubling down on appropriate diversification across asset classes, styles and sectors. We recommend overweighting U.S. large- and mid-cap equities, and we see opportunities in financials, health care and consumer discretionary. For those seeking income, we think seven- to 10-year investment-grade bonds that currently yield around 5% offer compelling value relative to recent history.

Bottom line: Volatility remains a risk and uncertainty hasn’t vanished, but greater clarity appears to be emerging. The prevailing trend is upward, and tactical pullbacks should be viewed as buying opportunities, in our view, especially with rate cuts and fiscal support expected next year.

-

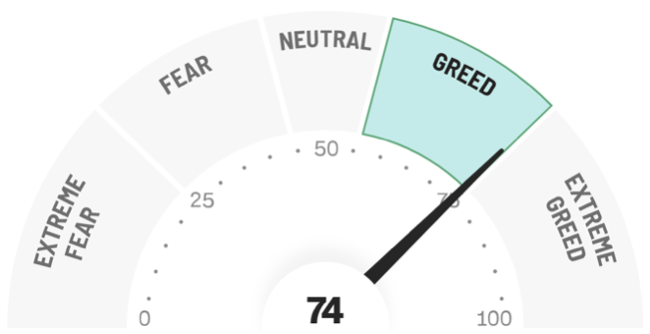

Final Words: Market indicates Extreme Greed. Buy Gold and Silver (GLD & SLV ETF's).

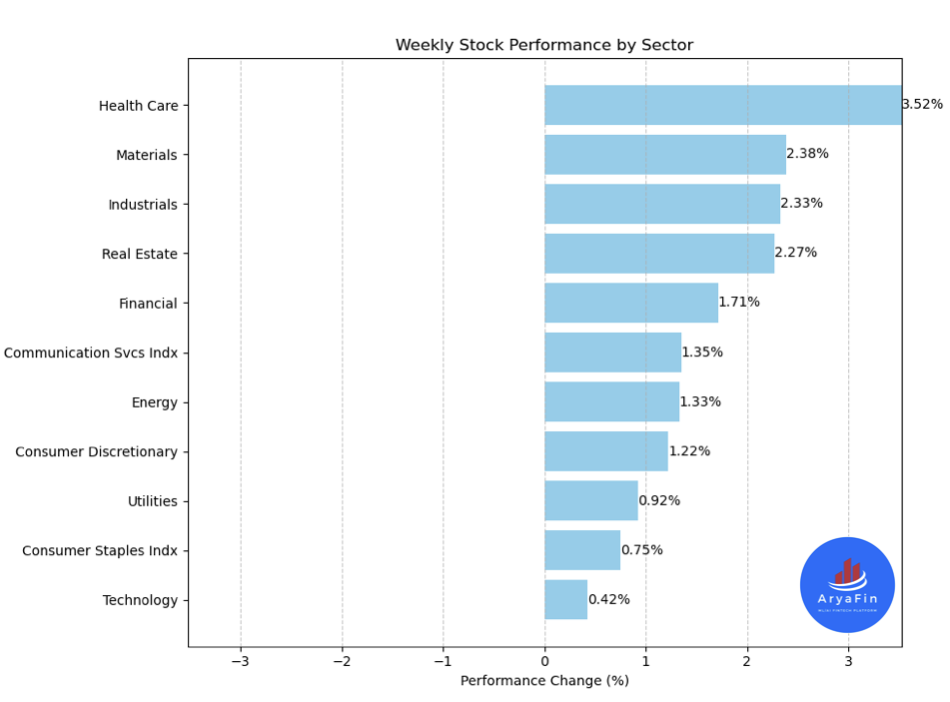

Below is last week sector performance report.

Weekly Sector Performance for July 21-25, 2025:

$XLE Energy(Change: 1.33%), (RSI: 53.25)

$XLK Technology (Change: 0.42%), (RSI: 70.72)

$XLC Communication (Change: 1.35%), (RSI: 57.77)

$XLY Consumer Discretionary (Change: 1.22%), (RSI: 61.20)

$XLP Consumer Staples (Change: 0.75%), (RSI: 53.01)

$XLF Financial (Change: 1.71%), (RSI: 64.30)

$XLV Health Care (Change: 3.52%), (RSI: 56.92)

$XLI Industrials (Change: 2.33%), (RSI: 74.54)

$XLB Materials (Change: 2.38%), (RSI: 62.23)

$XLRE Real Estate (Change: 2.27%), (RSI: 65.13)

$XLU Utilities (Change: 0.92%), (RSI: 64.32)

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.