Weekly Market Commentary - July 19th, 2025 - Click Here for Past Commentaries

-

Stock markets continued to gradually move higher last week, with the S&P 500 moving up by

around 1% and reaching a new all-time high. The S&P 500 index is now up over 26% since the April 8 lows.

Markets have been buoyed by positive economic data. Last week, inflation readings for June were in

line with expectations, retail sales surpassed expectations, and corporate earnings growth for the

second quarter remains on pace to exceed forecasts thus far.

Tariffs continue to remain an overhang on markets, with investors in wait-and-see mode ahead of

the new August 1 tariff deadline and potential sector tariffs. However, even as tariff rates have

moved substantially higher since the beginning of the year, inflation has remained contained and

economic growth has held up.

Overall, despite the uncertainty that began earlier this year, markets have been able to climb several

walls of worry, supported by solid economic fundamentals. We may see caution and bouts of volatility

as investors digest a new set of tariff updates in August and head toward the seasonally choppy September

timeframe. Nonetheless, we would expect a more favorable backdrop heading into year-end, as the Fed

considers cutting rates, the new tax bill is in place, and we have more clarity overall on trade and

tariffs.

-

The equity markets continued to grind higher last week, with the S&P 500 and technology-heavy

Nasdaq making fresh all-time highs. Both indexes are now up about 7% to 8% this year thus far.

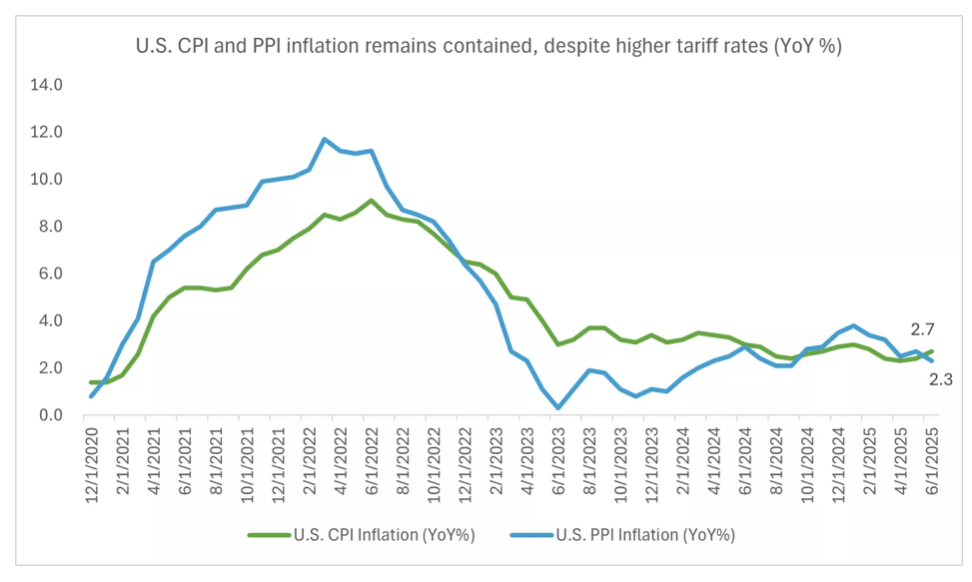

CPI and PPI inflation data in line with expectations for June, despite tariff increases: U.S. consumer price index (CPI) inflation for June came out in line with expectations last week, with headline CPI up 2.7% year-over-year, a tick higher than forecasts of 2.6% and above last month's 2.4% reading. While prices were higher in some categories, including apparel, appliances, and home furnishing, we also saw lower prices in categories like new and used cars.

Producer price index (PPI) inflation, where many investors expected to see tariff increases show up more acutely, came in lower than expectations. Headline PPI inflation was 2.3%, below forecasts of 2.5% and last month's revised 2.7% reading1. In our view, inflation has remained contained thus far, although it could climb toward 3.0% - 3.5% by year-end if tariff rates continue to move higher. Nonetheless, in our view, the impact of tariffs would likely be a one-time step-up in prices, but inflation rates should then start to normalize again toward the Fed's 2.0% target in the year ahead.

-

Retail sales surpassed forecasts, indicating the consumer remains healthy: U.S. retail sales for

June were another sign that the consumer continues to spend. Overall retail sales climbed by 0.6%

for the month, well above forecasts of 0.1% and last month's -0.9% reading. Consumers spent on

autos and auto parts, as well as some apparel and food services. However, there were declines in

home furnishing and appliance categories, perhaps reflecting the higher prices in these areas.

Keep in mind that in the U.S., consumption contributes about 70% to GDP, and these retail sales

figures point to household consumption that appears to be holding up well; and

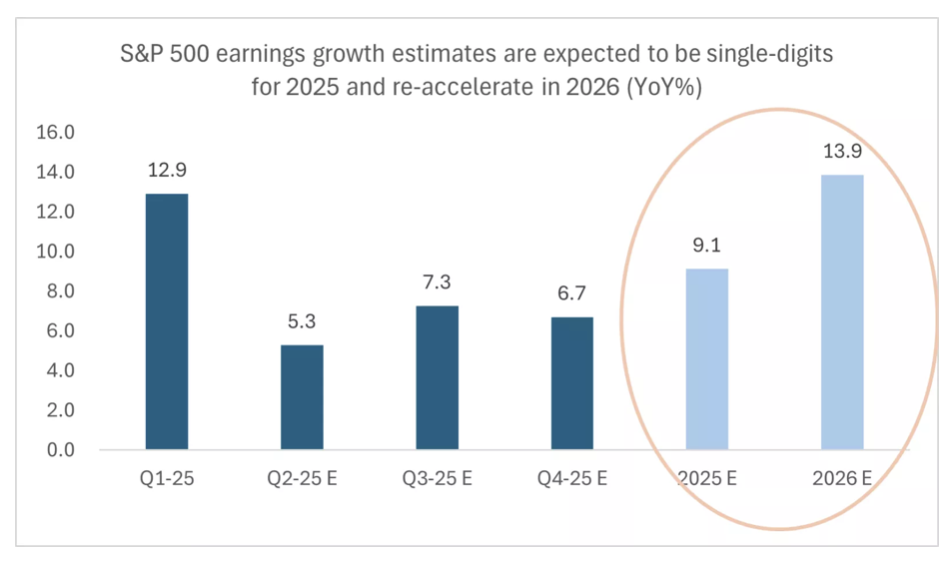

S&P 500 earnings growth for the second quarter thus far remains on pace to beat expectations: The second-quarter corporate earnings season began in earnest last week, and thus far companies have beaten expectations. About 12% of companies have reported earnings, and of these, 86% have exceeded forecasts, well above the 10-year average of 75%. Among these, financial companies have offered the largest upside surprises thus far. We have heard from big banks like J.P. Morgan and Goldman Sachs, which have pointed to higher trading revenues and better-than-expected capital markets activity.

While it is early in earnings season still, keep in mind that the bar was reset lower over the last few months, with second-quarter earnings growth expectations falling from about 11% annually at the start of the year to 5% at the end of June. In our view, second-quarter earnings growth is likely to exceed the lowered bar, and full-year earnings are likely to end in the mid- to high-single-digit range. Given the potential for lower interest rates and more clarity around tariffs, we also see a potential re-acceleration of corporate earnings in 2026, with double-digit earnings growth likely.

-

Tariffs and trade continue to remain a cloud over investors and the markets. The U.S. administration

has pushed back its trade deadline to August 1 on most of its global trading partners, creating another

source of uncertainty for investors.

Ahead of this, the administration has announced a small number of deals, including deals with the U.K. and Vietnam, a framework for trade with China, and ongoing negotiations with countries like Indonesia, India and the European Union.

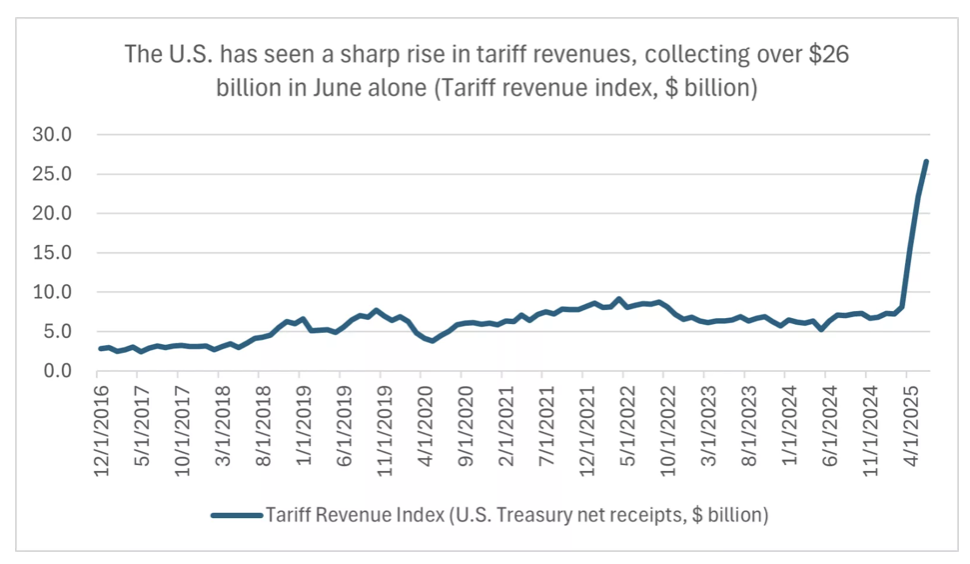

Nonetheless, average tariff rates have already moved meaningfully higher on U.S. imports, as the administration has implemented blanket 10% tariffs, with higher tariffs on China and certain sectors like steel and aluminum and autos. This has increased the average tariff in the U.S. from about 2.4% to about 20.6%, the highest since 1910, according to the Yale Budget Lab. This has also resulted in higher tariff revenues collected by the U.S. Treasury, including almost $27 billion in June.

-

Despite tariff rates rising, however, we have not yet seen a meaningful impact on inflation, or an outsized

impact on consumption or the economy. There could be a number of reasons for this, such as

- Higher tariff rates have been absorbed across a number of constituents, including by exporters across the supply chain, by corporations absorbing the higher costs, and some costs being passed to the end consumer;

- Many companies have likely stockpiled inventories ahead of tariffs, or even at a 10% tariff rate, and thus can continue to sell goods to consumers at steady price levels; and

-

Third, we have also seen oil and energy prices move lower this year, with WTI crude oil largely in

the $60 - $70 range, for example, which has also helped support lower prices at the pump for

consumers and lower energy costs for companies.

-

Finally, investors may also be picking up on some positives coming out of ongoing trade negotiations. For

example, last week the administration announced it may be loosening export restrictions, which would allow

companies like NVIDIA to sell certain AI semiconductor chips into China once again. In addition, companies

like Apple have sought deals on rare earth magnets, which are essential for manufacturing electronics, with

companies outside of China. And ongoing deals and negotiations with countries like Vietnam and Indonesia

should also help secure alternative supply-chain options outside of China. The focus by the administration

on trade and tariffs thus may, over time, help open economies to U.S. goods, diversify supply chains, and

lower tariff and non-tariff barriers.

-

Overall, stock markets appear to have overcome the peak fear and uncertainty that emerged in early April

around the threat of sharply rising tariffs. Since then, we have seen tariff increases get delayed and

inflation and economic data remain resilient.

As we look ahead, we would not expect markets to continue to move in a straight line higher, especially as we head toward the seasonally choppy months of August and September. Markets will also have to digest additional tariff headlines as the August 1 deadline approaches. This may mean new and even higher tariff rates for many trading partners, and we may see corporations and export partners less willing to absorb these higher costs. Thus, prices may rise, and consumption could cool in the second half of the year. All these factors could spark bouts of volatility in the weeks ahead.

However, in our view, investors can still feel comfortable that the worst-case scenario – high tariff rates, no positive outcomes from trade negotiations, and runaway inflation – is not likely to play out. In addition, as we look toward the end of the year and into 2026, we would expect prices and inflation to stabilize again, the Fed to lower interest rates, and some stimulus from the U.S. tax bill to kick in.

We thus believe investors can use pullbacks and volatility to position for a more stable backdrop and re-acceleration of growth in the year ahead. We favor U.S. large-cap and mid-cap stocks, and we recommend sectors across growth and value, including consumer discretionary, financials, and health care. Your financial advisor can help ensure your investments are aligned to your unique goals and risk preferences, and help you navigate through the headlines and walls of worry that may lie ahead.

-

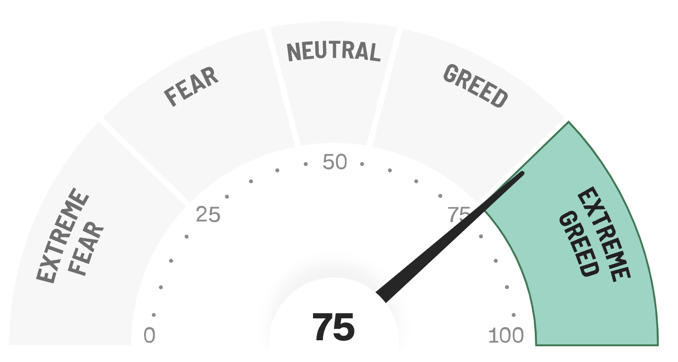

Final Words: Market indicates Extreme Greed. Buy Gold and Silver (GLD & SLV ETF's).

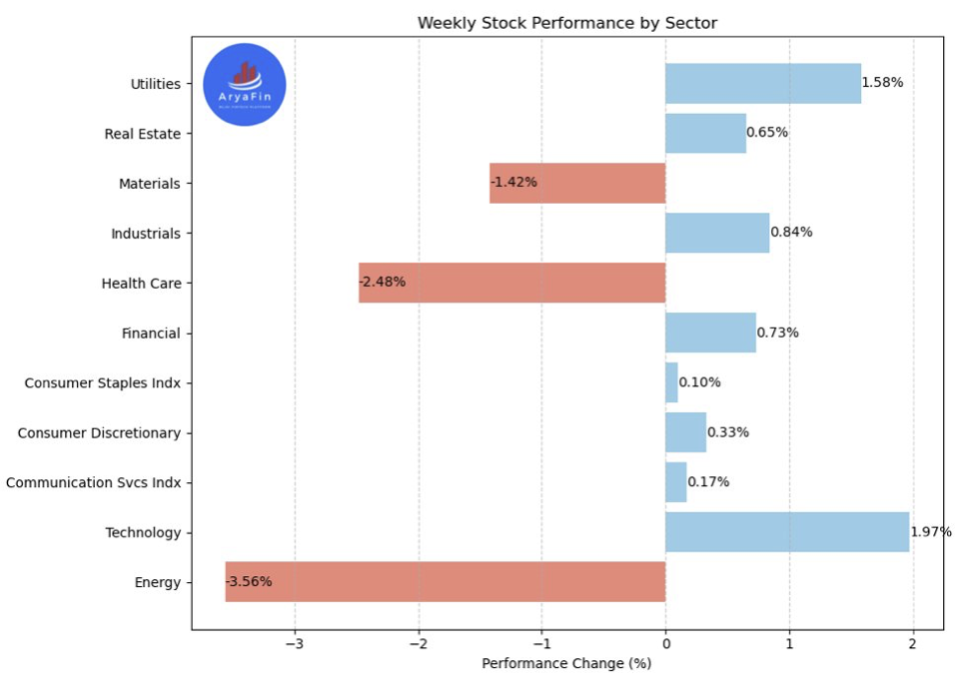

Below is last week sector performance report.

Weekly Sector Performance for July 14-18, 2025:

$XLE S&P Energy (-3.56%)

$XLK S&P Technology (1.97%)

$XLC Communication (0.17%)

$XLY S&P Consumer Discretionary (0.33%)

$XLP S&P Consumer Staples (0.10%)

$XLF S&P Financial (0.73%)

$XLV S&P Health Care (-2.48%)

$XLI S&P Industrials (0.84%)

$XLB S&P Materials (-1.42%)

$XLRE S&P Real Estate (0.65%)

$XLU S&P Utilities (1.58%)

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

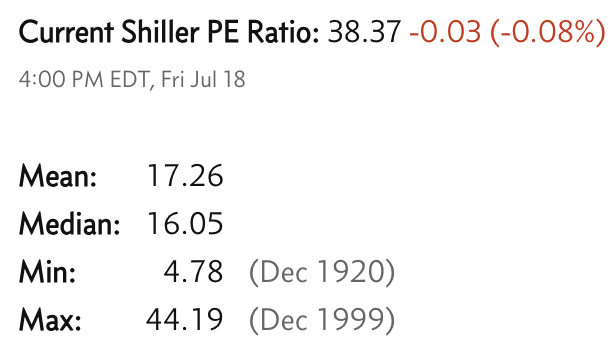

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.