Weekly Market Commentary - Jan 24, 2026 - Click Here for Past Commentaries

-

Last week brought another barrage of geopolitical headlines, as President Trump threatened to raise tariffs on several European trade partners.

This flare-up was fortunately short-lived, and markets quickly turned their attention back to core economic data and earnings reports.

This week's Fed meeting will be in focus, with the central bank expected to leave rates unchanged for now but cut again later this year.

Meanwhile, a flurry of earnings reports should provide the latest litmus test on AI companies' profitability, while highlighting the extent of earnings pickup across broader economic segments.

The prospect of improving growth, falling interest rates, and strong corporate profitability should drive a broadening in market leadership this year, supporting the case for a diversified portfolio.

-

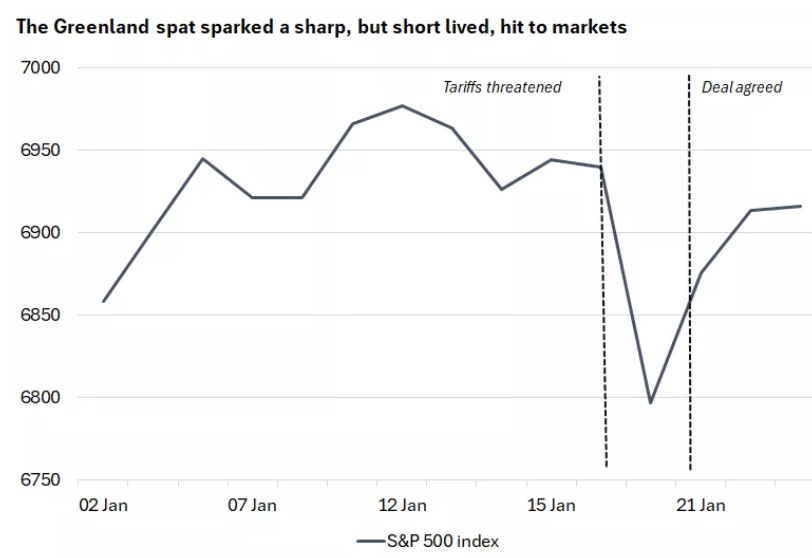

President Trump's push to acquire Greenland escalated last week. The president threatened to raise tariffs on eight European trading partners by 10% on February 1 unless a deal was in place to buy the island, with this penalty increasing to 25% by June.

The news hit markets hard as investors questioned the short-term implications for growth and inflation, and longer-term geopolitical ramifications for NATO and global security.

The S&P 500 registered its largest single-day drop since the "liberation day" tariff announcements in April last year, with assets that typically benefit from a risk-off move—U.S. government bonds and the dollar—also selling off. This represented a brief return to the "sell-U.S." narrative seen at times in 2025.

The quick emergence of a deal addressing U.S. security interests in Greenland, while seemingly not impacting local sovereignty, helped equity markets rebound. This turnaround highlights the importance of not overreacting to the barrage of geopolitical headlines, although the short-lived spat sent some important signals, in our view.

-

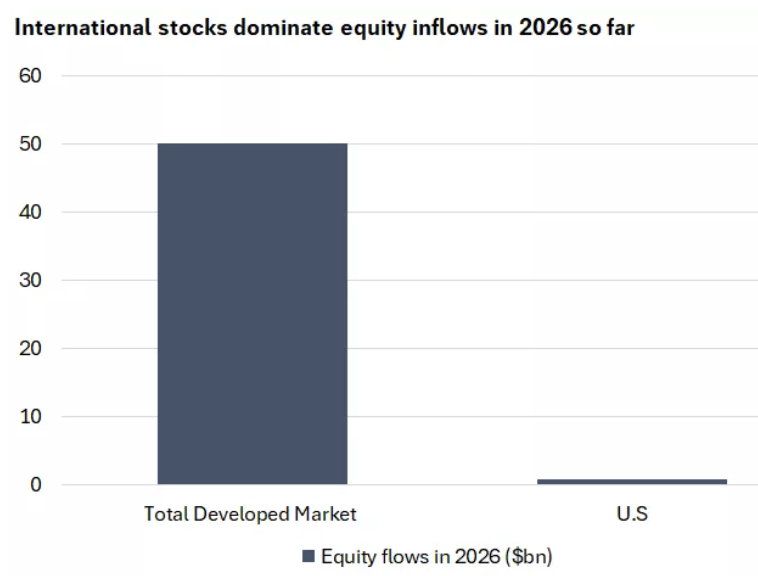

The dollar was a big loser, with its sell-off persisting even after a tentative agreement on Greenland was announced. The greenback finished the week 1.2% lower against a trade-weighted basket of currencies, its worst week since last June.

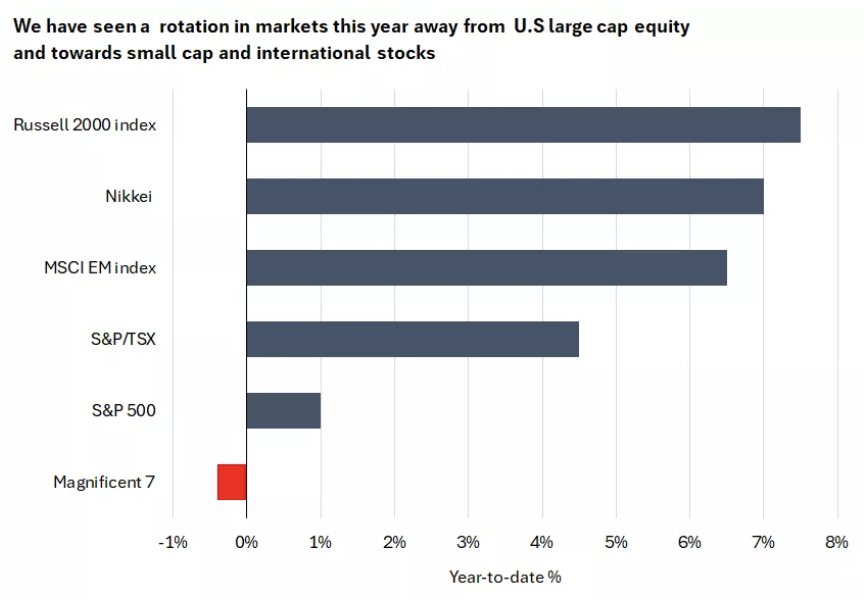

These moves underline the sensitivity of this currency to policy volatility, in our view. While market speculation over a fire sale of U.S. assets looks overblown to us, there are signs of international investors diversifying portfolios. Fund flows into Europe and Japan have so far this year significantly outpaced those into U.S.-listed equities, which account for less than 2% of total inflows into developed market equities this year.

-

We continue to recommend that investors hold positions in international developed small- and mid-cap equities and emerging market equities to diversify portfolios, take advantage of broadening international earnings growth, and potentially benefit from mild dollar weakness.

Meanwhile, gold was the big "winner" from this week's headlines. A price spike extended its year-to-date rally to 15%, adding to last year's 65% gain*. We believe small allocations to gold can provide useful diversification benefits, explaining its appeal amid rising policy and geopolitical uncertainty over the past year. However, we remain cautious on the near-term outlook due to the significant price rise in a short period.

-

It didn't take long for Greenland headlines to be replaced by a more familiar focus on economic and corporate fundamentals last week.

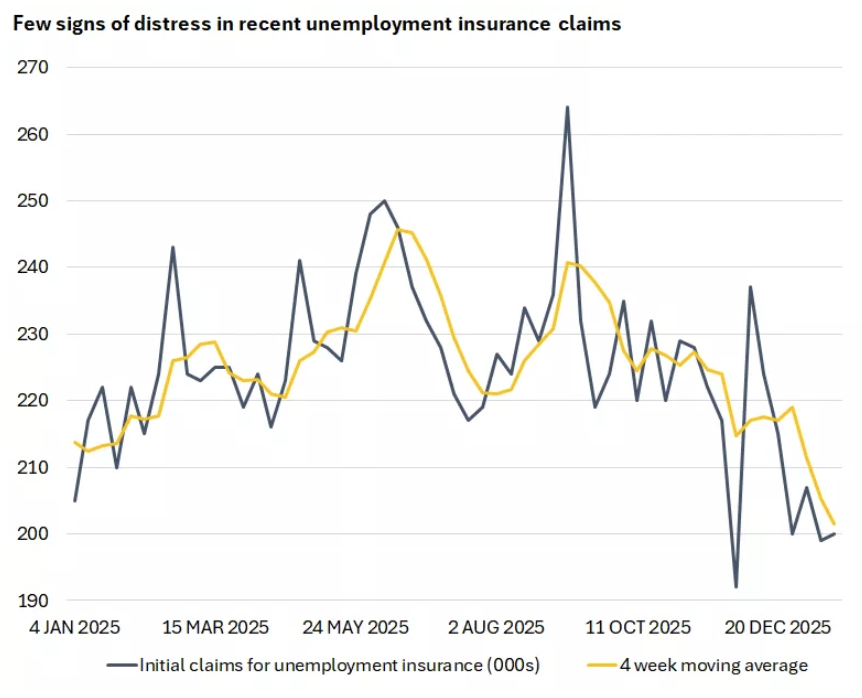

A raft of macroeconomic data pointed to a solid U.S. economic backdrop, with initial unemployment insurance claims remaining low, consumer confidence reaching a five-month high, and consumer spending data indicating another strong gain through the end of 2025.

-

For the Fed, set to meet this week, these data will likely encourage the view that the economy remains in solid shape, despite the labor market deceleration over the past year. The central bank has already hinted at staying on hold in January, following three consecutive rate cuts in the second half of 2024, and we think a cut this week would be a huge surprise.

With policy widely expected to remain on hold, investors will listen carefully for hints on the future path of interest rates. We suspect the central bank will keep its cards close to its chest, preferring to wait for more labor market and inflation data before signaling next steps. We think Fed Chair Powell will underline this data dependence in his press conference, but subtle hints on the FOMC's views on growth and inflation will be important to gauge.

-

We continue to think the direction for interest rates remains lower. Most FOMC members were inclined to lower rates further in 2026 back in December, based on their interest-rate forecasts, especially with the current level of rates still thought to be modestly restrictive on the U.S. economy. Signs of gradual cooling in inflation as tariff pressures fade, and a still-sluggish labor market, should keep the central bank in easing mode in 2026, in our view. We think one or two 25 basis point (0.25%) cuts are most likely.

Otherwise, earnings season has already kicked off, with around 80% of early reporters in the S&P 500 beating profit estimates so far, similar to the rate seen in the last earnings season. However, the release calendar will intensify this week, with high-profile mega-cap technology companies—Meta, Apple, Tesla, and Microsoft—all due to report.

We expect these results to provide the latest litmus test of the translation of heavy AI investment into revenue growth and profits. Markets have shown signs of rotation away from some of these names this year, with the "Magnificent 7" stocks broadly flat on the year so far, in contrast to better performance from other large-cap companies and significantly better small-cap stocks. Still, the technology sector is expected to deliver the strongest earnings growth across the S&P 500 this year, even if the gap with other sectors is seen narrowing.

-

Alongside a health check on the AI story, we believe it will be important to look for confirmation that an improving economic backdrop and declining interest rates are translating into rising profitability across broader market segments. The outperformance of smaller companies and pro-cyclical sectors this year suggests that investors are becoming increasingly confident in their earnings potential, in our view.

In our view, last week provided another example of the importance of focusing on fundamentals despite the overwhelming barrage of geopolitical headlines.

We remain constructive on the outlook for stocks and see potential for broadening market leadership this year, likely helped by improving growth, lower interest rates, and strong corporate profitability.

We think a diversified portfolio is best placed to navigate these cross currents, and we prefer maintaining exposure to large-cap stocks and the AI theme, complemented by mid-cap U.S. equities and international equities, to provide access to potential broadening in earnings growth at home and abroad.

-

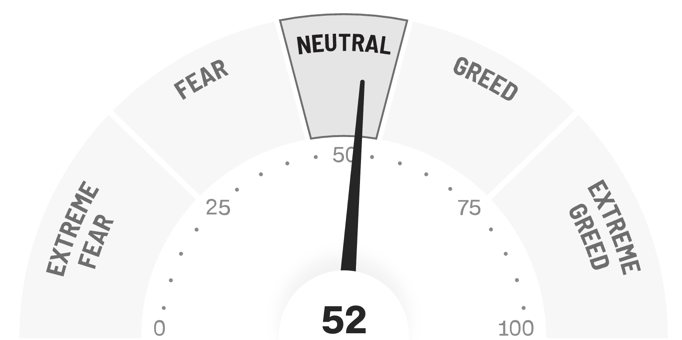

Final Words: Market indicates Neutral. New Buy Copper (ICOP)

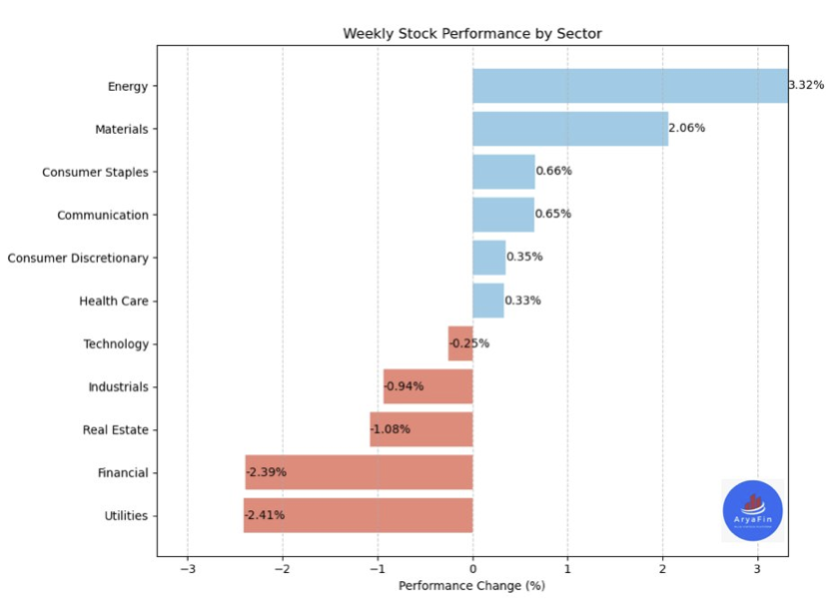

Below is last week sector performance report.

Weekly Sector Performance for Jan 19-23, 2026:

$XLE Energy: 3.32%, RSI: 69.23

$XLK Technology: -0.25%, RSI: 50.76

$XLC Communication Services: 0.65%, RSI: 53.38

$XLY Consumer Discretionary: 0.35%, RSI: 55.91

$XLP Consumer Staples: 0.66%, RSI: 72.41

$XLF Financials: -2.39%, RSI: 38.04

$XLV Health Care: 0.33%, RSI: 55.36

$XLI Industrials: -0.94%, RSI: 58.90

$XLB Materials: 2.06%, RSI: 74.27

$XLRE Real Estate: -1.08%, RSI: 53.77

$XLU Utilities: -2.41%, RSI: 44.49

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

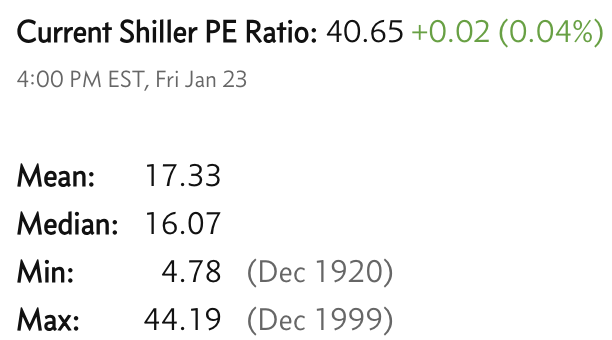

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.