Weekly Market Commentary - Jan 17, 2026 - Click Here for Past Commentaries

-

Markets are shrugging off a barrage of geopolitical and policy headlines, showing little stress despite noise around Fed independence, foreign policy, and affordability initiatives.

Fundamentals remain in control: low energy prices, moderating inflation, solid growth, and broadening earnings continue to anchor market stability.

Economic momentum looks durable, likely supported by resilient consumer spending, a stabilizing labor market, and a sizable $100–$150 billion tax-refund boost ahead.

Market leadership is broadening, with cyclicals, small- and mid-caps, and international equities outperforming as the bull market rotates.

The news has been relentless since the start of the new year. Between ramped-up geopolitical tensions, fresh threats to Fed independence, and policy proposals aimed at affordability, investors have had much to digest. Yet despite the noise, stocks have barely flinched, maintaining remarkable calm.

We explore the tug-of-war between headline volatility and enduring fundamental strength—and why the latter is winning. Four pillars of resilience continue to anchor markets. But first, here’s a look at what has hit the tape so far in 2026.

-

Rather than chasing daily headlines, we think investors are better served by focusing on economic and corporate fundamentals, the more durable drivers of returns. The backdrop for equities remains favorable in 2026, in our view, supported by four key pillars:

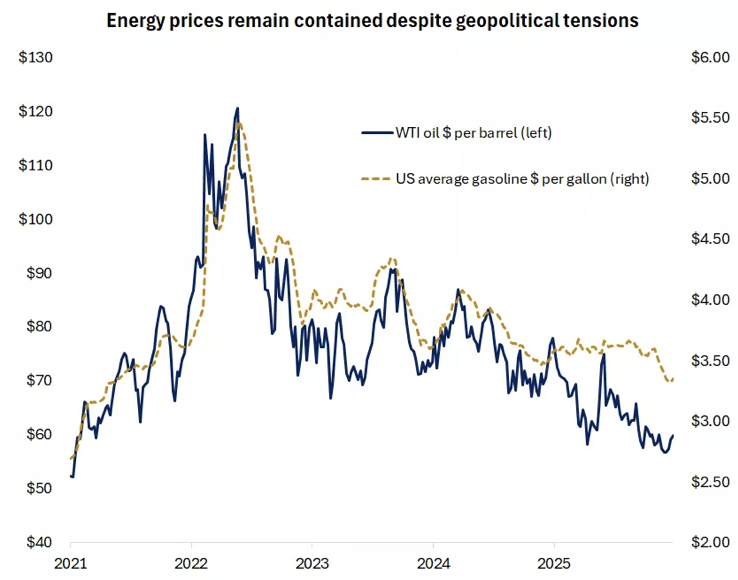

Low energy prices and a long history of markets overcoming geopolitical shocks

History shows that geopolitical events tend to have short-lived effects on economic activity and market performance. The primary transmission channel from geopolitics to financial markets is typically energy prices.

While crude briefly rose on fears that a U.S. strike on Iran could disrupt supply, gains quickly reversed after the administration signaled it would hold off for now. At around $60 per barrel, WTI sits near five-year lows, and U.S. gasoline prices remain muted at roughly $3.35 per gallon, a meaningful tailwind for consumers.

Even if tensions re-escalate, we think any resulting spike in prices is likely to be contained. The International Energy Agency (IEA) continues to project that the global oil market will be oversupplied in 2026, with record surplus driven by rising OPEC+ output outpacing modest demand growth. An environment of ample supply can help provide a natural buffer against geopolitical shocks and limit the risk of sustained energy-driven inflation.

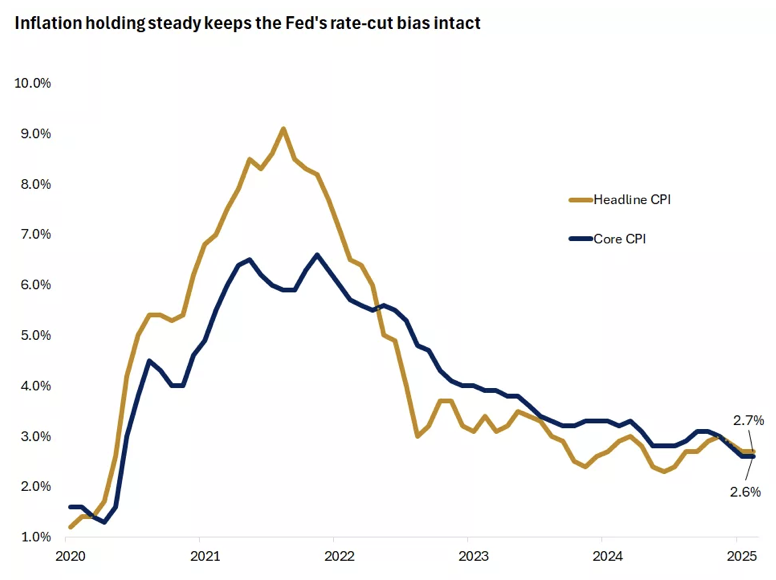

Moderating inflation gives the Fed room to ease gradually

Economic data remains noisy in the aftermath of last year’s government shutdown, but the December inflation readings delivered welcome news. Both headline and core CPI held steady at 2.7% and 2.6%, easing fears of an upside surprise. While we don't think this is enough to prompt a rate cut at the January meeting, if price pressures remain subdued as data distortions clear, it could set the stage for another cut later this spring.

Despite political pressure and the criminal investigation into Fed Chair Powell, we continue to believe that the path for monetary policy will be guided by trends in the labor market and inflation. Powell has not been charged, and any attempt to remove him would face significant legal hurdles and a lengthy process. His term expires in May, and he has reiterated his commitment to defending the institution’s independence.

Importantly, whoever becomes the next chair (with Kevin Warsh and Kevin Hassett viewed as frontrunners) will still hold just one vote on a 12-member committee. Five votes belong to a rotating group of regional Fed presidents selected by their local reserve banks. These structural safeguards make it difficult for any individual to dramatically shift the policy stance.

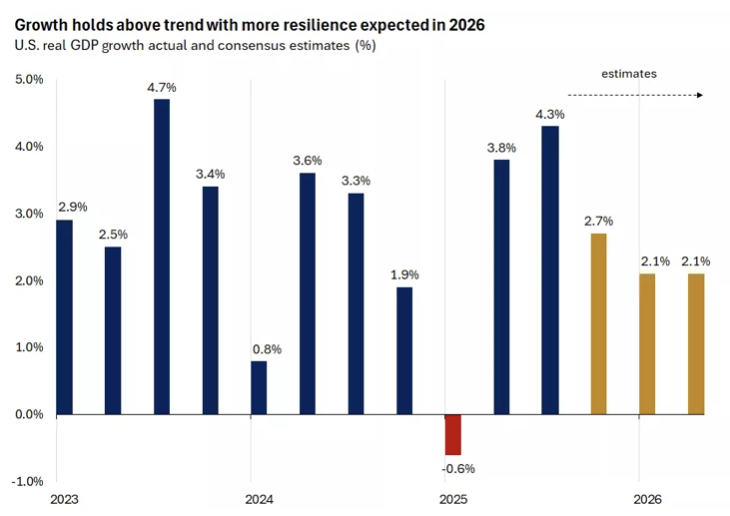

Economic growth remains solid

The U.S. economy is coming off a strong stretch of momentum. Real GDP rose 3.8% in the second quarter and 4.3% in the third, with estimates pointing to another 2%+ expansion in the final quarter of 2025. A favorable swing in net exports likely provided a temporary boost late last year, but the core engine of the economy, consumer spending, is proving resilient, in our view.

We think that resilience should continue into early 2026. Households are set to receive $100 billion–$150 billion in additional tax refunds due to last year’s tax bill, which enacted retroactive cuts that were not reflected in 2025 withholding. This over-withholding reversal appears poised to create a meaningful spending tailwind. At the same time, jobless claims are historically low, and December’s drop in the unemployment rate suggests the labor market may be stabilizing after a period of softness.

On the trade front, the Supreme Court is expected to rule this month on the legality of tariffs imposed under the International Emergency Economic Powers Act (IEEPA). If these tariffs are struck down and refunds are issued, it would likely add another short-term boost. However, we don't expect any material change in trade policy, as the administration is likely to rely on alternative authorities to levy similar tariffs, limiting the impact. In the meantime, the effects of last year’s trade uncertainty continue to fade, and additional bilateral deals are coming through; notably, Taiwan’s tariff rate on goods imported to the U.S. is set to fall from 20% to 15% following an agreement reached last week.

Overall, the combination of resilient consumer activity, tax-refund support, a stabilizing labor market, and easing trade uncertainty keeps the growth backdrop constructive through 2026, in our view.

Corporate earnings remain one of the strongest pillars of market support

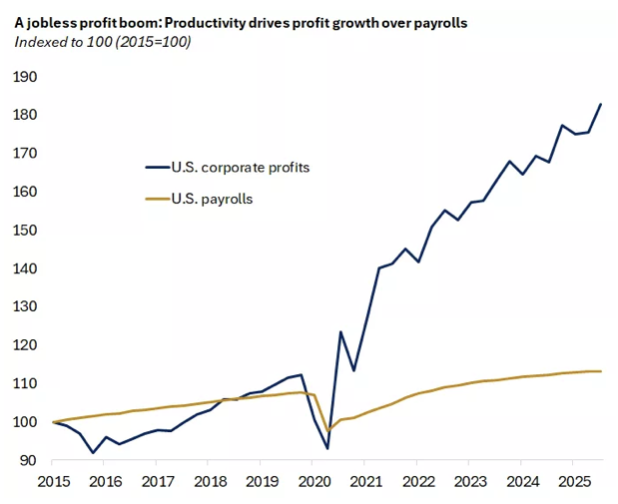

Corporate earnings remain one of the strongest pillars of market support. While rising valuations contributed modestly to last year’s 16% gain in the S&P 500, earnings growth did most of the heavy lifting. The index now appears on track to deliver its 10th consecutive quarter of year-over-year profit growth, with fourth-quarter estimates calling for an 8% increase.

Importantly, the outlook continues to improve. Over the past six months, 2026 consensus earnings estimates have been revised higher, pointing to nearly 15% EPS growth over 2025, with all 11 sectors expected to contribute. The fact that profits have accelerated without a meaningful increase in headcount highlights rising productivity, in our view, with technological adoption helping fuel what increasingly looks like a “jobless profit boom.”

Banks unofficially kicked off earnings season last week. Results were broadly solid, though shares pulled back after a strong December. Higher expense guidance, partly driven by heavy investment in technology upgrades, added some pressure, as did concerns around the proposed 10% credit-card interest-rate cap. Such a cap, versus current average rates of 20%–25%, would pose a material headwind to card lenders and may lead to a pullback in credit availability. That said, implementing such a cap would require an act of Congress, where appetite appears limited. Stepping back, the broader backdrop for financials remains constructive. A pickup in M&A activity, ongoing deregulation, and improving loan growth all point to healthy earnings momentum ahead, in our view.

-

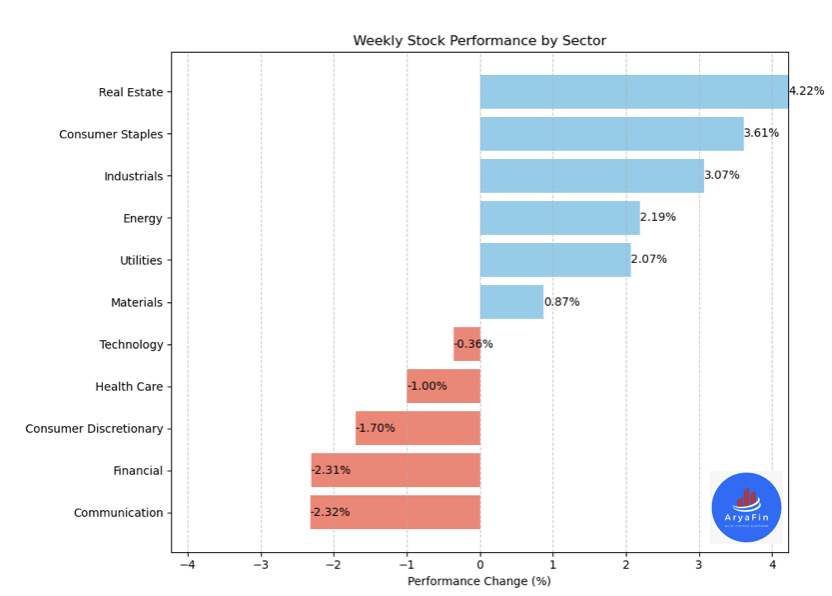

The market leadership rotation that began in November has only accelerated in the early weeks of 2026, sending a distinctly pro-cyclical signal. Small- and mid-caps, value stocks, international equities, and cyclical sectors such as materials, industrials, and consumer discretionary are outperforming—a stark contrast to the narrow, mega-cap-led leadership of the past three years. The common thread across these areas, in our view, is that they tend to benefit most from an improving economic outlook and the prospect of Fed easing.

A natural question is whether these rotations can persist, particularly given that AI is diffusing across the broader economy and the tech sector is still expected to deliver the strongest earnings growth within the S&P 500. Ultimately, earnings will need to confirm the broadening trend, in our view. But we do not think it’s too late for investors to lean into diversification and bolster exposure to areas that may be underrepresented in portfolios. We see compelling opportunities in U.S. mid-caps, international developed small- and mid-caps, and emerging-market equities, while within the U.S. we continue to favor industrials, consumer discretionary, and health care.

The upshot, in our view: as long as economic resilience endures, the bull market is likely to continue, with healthier rotation in leadership helping to ease valuation concerns. Broader policy and geopolitical uncertainty may trigger bouts of volatility, but we think investors will be best served by distinguishing between headline noise and developments that may genuinely alter economic or earnings trajectories.

-

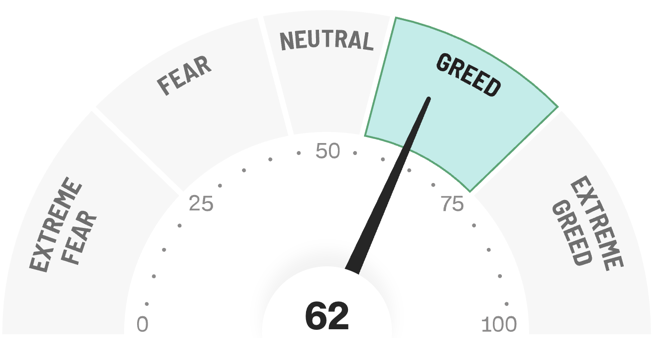

Final Words: Market indicates greed.

Below is last week sector performance report.

Weekly Sector Performance for Jan 12-16, 2026:

$XLE Energy: 2.19%, RSI: 62.44

$XLK Technology: -0.36%, RSI: 51.72

$XLC Communication: -2.32%, RSI: 39.19

$XLY Consumer Discretionary: -1.70%, RSI: 54.11

$XLP Consumer Staples: 3.61%, RSI: 70.04

$XLF Financial: -2.31%, RSI: 46.73

$XLV Health Care: -1.00%, RSI: 50.29

$XLI Industrials: 3.07%, RSI: 72.75

$XLB Materials: 0.87%, RSI: 71.05

$XLRE Real Estate: 4.22%, RSI: 70.96

$XLU Utilities: 2.07%, RSI: 54.42

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

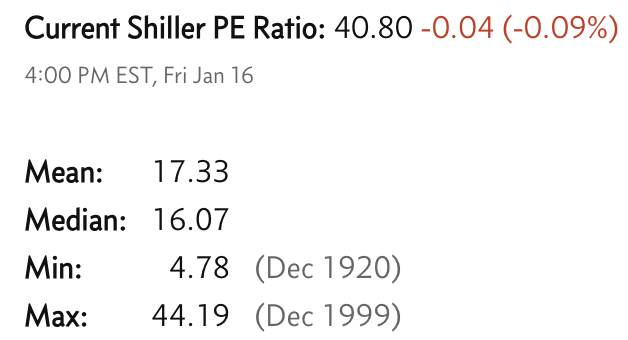

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.