Weekly Market Commentary - Dec 7th, 2024 - Click Here for Past Commentaries

-

As we head into year-end and the holiday season, investors have many reasons to cheer.

The stock market has been making record highs, and bond markets still offer favorable yields.

Perhaps most importantly - and underpinning the solid financial markets - is that the U.S.

economy continues to grow at or above trend, with no signs of recession on the horizon.

This past week, data continued to point to a resilient economy and labor market. The new

orders components of the ISM manufacturing and services PMI – often leading indicators of

economic growth –were both in expansion territory for November.

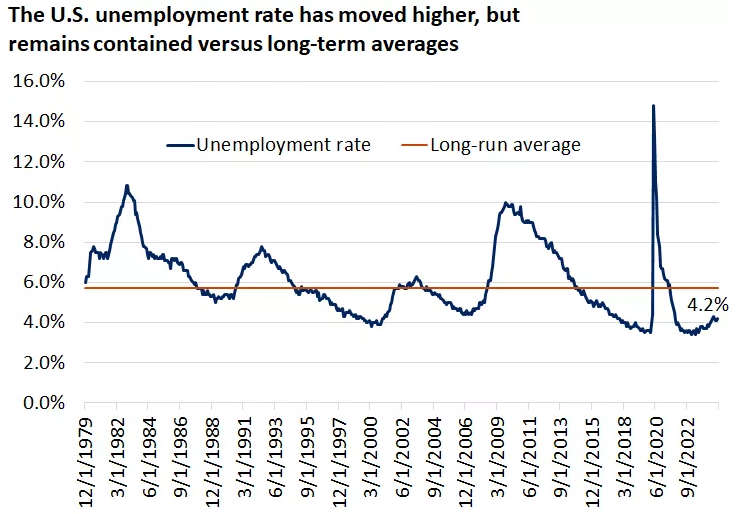

The U.S. labor market also pointed to a rebound in the November data. New jobs added

were 227,000, above expectations for 220,000, and last month's weaker data was revised

somewhat higher. More broadly, the unemployment rate ticked higher to 4.2% but remains

well below long-term averages of around a 5.7% unemployment rate in the U.S.

Overall, the fundamental backdrop for financial markets remains intact, and the U.S.

economy appears poised to achieve the elusive "soft landing" (modest slowdown but still

growing at or above trend). As we look toward 2025, we would expect consumers to be supported

further by lower interest rates and wage growth that exceeds inflation rates.

Despite potential policy uncertainty and market volatility ahead, we continue to believe

that pullbacks can offer opportunities for investors, especially because we don't see

the economy slipping into a downturn for now.

-

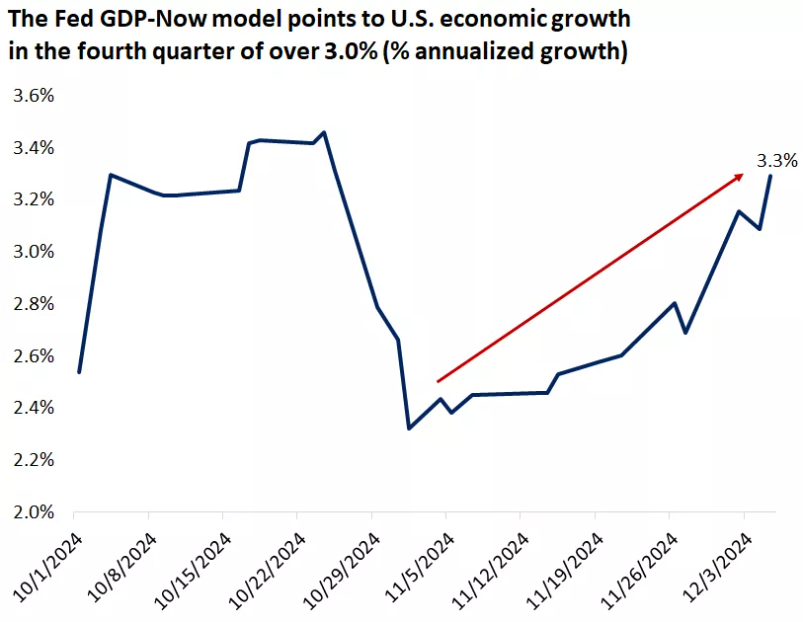

Since 2020, U.S. economic growth has been impressive, with GDP growth rates well above

long-term trends. 2024 has been no exception. The quarterly annualized growth rates this

year have averaged 2.5%, and the fourth quarter appears on pace to exceed this. According

to the Fed GDP-Now forecast, the fourth-quarter economic growth forecast is near its highest

since the quarter began, at around 3.3%.

-

We know the backbone of the U.S. economy is the consumer, which drives about 70% of GDP.

Of course, consumers have faced challenges over the past year in elevated inflation readings

and higher interest rates, which have pressured both spending and borrowing. Nonetheless, data

continues to point to healthy rates of consumption in the U.S., particularly for services,

including leisure, hospitality, travel and dining.

Perhaps one component of this is the dichotomy between lower-income and middle-/upper-income

consumers. The latter have benefited from increased wealth effects from areas like higher

stock markets and stable and higher home prices. This in turn has supported better spending

from this cohort, which generally makes up about 70% of overall consumer spending.

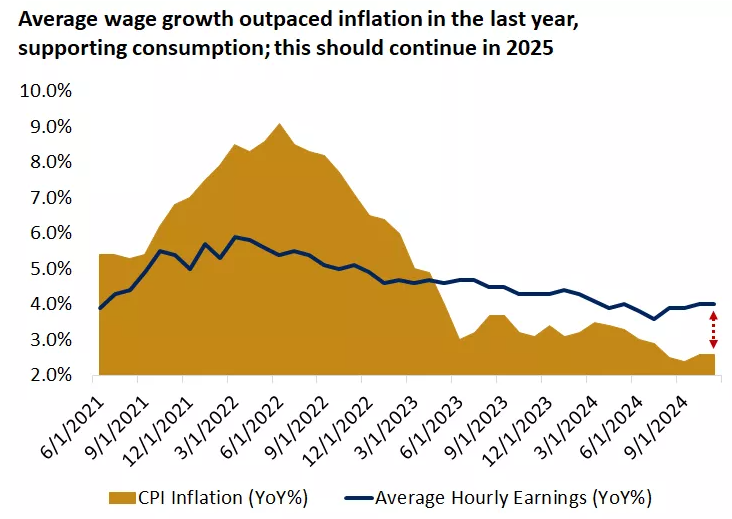

More broadly, we have also seen positive trends in real wage gains across households. Since 2023,

wage growth has outpaced the rate of inflation, which has been supportive of consumer confidence

and consumption. We would expect this trend to continue as we head into 2025 and as inflation,

in our view, moderates further and remains contained in the 2% - 3% range.

-

The labor market has also been a source of strength for the U.S. consumer. As we know, when

consumers feel confident in their jobs, they tend to be more willing to spend.

Last Friday's nonfarm-jobs report in the U.S. confirmed that the labor market remains healthy.

The total jobs added came in at 227,000, above forecasts of 220,000, and rebounded nicely from

last month's revised figure of 36,000, which had been weighed down by natural disasters and a

strike at Boeing. The average monthly jobs-added figure this year is 180,000, which, while

below last year's 242,000 average, is still above longer-term averages of about 150,000.

Similarly, the U.S. unemployment rate ticked higher last month, from 4.1% to 4.2%, but

remains comfortably below long-term average unemployment rates of around 5.7%. In our view,

the labor market continues to normalize after a period of outsized strength after the pandemic

in 2020.

While we could see some further moderation ahead, we anticipate that the unemployment rate

remains contained, below 4.5%, and we may see a reacceleration in the labor market in the

back half of next year. This could be driven by lower rates, better economic and corporate-earnings

growth, and potential pro-growth policies that may spur additional hiring needs.

-

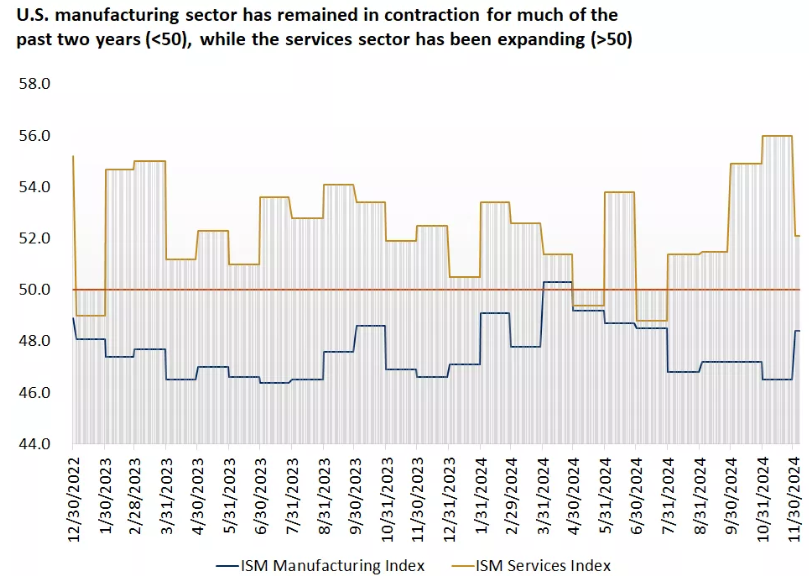

In the U.S., the services sector makes up about 70% of GDP and continues to be an area

of strength for the economy. Services include areas like financial, transportation, and

leisure and hospitality services.

This part of the economy has been holding up well, particularly compared with the manufacturing sector.

The Institute for Supply Management (ISM) puts out a monthly index for both services and manufacturing

based on a survey of purchasing managers across nearly 400 companies. This ISM data indicates that

the U.S. services sector has been expanding over the past year, while the manufacturing sector has

remained largely in contraction.

However, in the most recent ISM reading, the new-orders components of the data – often considered a

leading indicator of economic activity – pointed to expansion in both the manufacturing and services

sectors. In our view, the U.S. manufacturing sector may be set to stabilize and improve in the year

ahead alongside a resilient services economy, which should provide support to overall

economic growth.

-

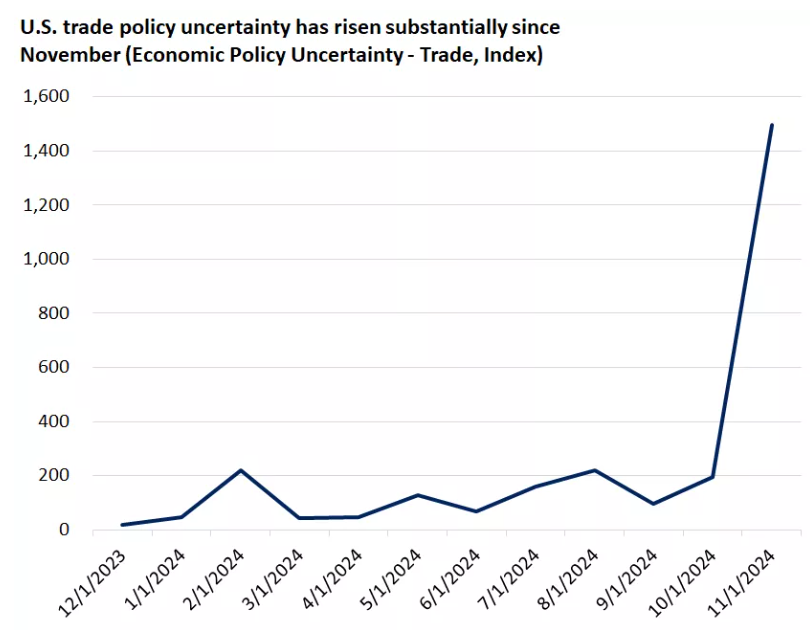

As we head into 2025, the U.S. economy will undoubtedly face challenges, and markets will

have new "walls of worry" to climb. These could include uncertainty around policy coming out of

the new White House. Policy changes to areas like tariffs and immigration could weigh on consumer

confidence, inflation, and overall economic growth. Any escalation in trade conflicts could also

spark volatility and uncertainty. However, in our view, the most extreme versions of these policy

proposals are unlikely to be adopted, and the overall impact to the economy will likely be

contained.

In addition to government policy uncertainty, markets may also face some uncertainty around Federal Reserve rate-cutting policy. If growth remains robust and any risk of inflation re-emerges, the rate-cutting cycle may be shallower than already expected. Nonetheless, we believe that the fed funds rate is heading lower over the next 12 months, even if just incrementally so, which should be supportive to the consumer and corporations.

-

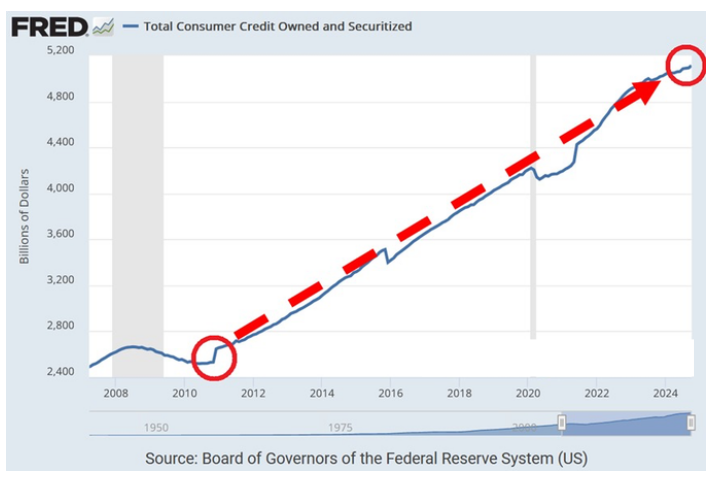

Total consumer credit jumped by $19.24 billion in October to a record $5.11 trillion.

Over the last 4 years, have only been 2 months without an increase in consumer credit.

Revolving debt, which includes credit cards, soared by $15.72 billion, the most since June 2022,

and hit an all-time high of $1.37 trillion.

Non-revolving credit rose by $3.52 billion, to $3.74 trillion, also a record.

Meanwhile, the average credit card interest rate jumped to an all-time high of 23.37% in Q3 2024.

Americans are drowning in debt to fight inflation.

-

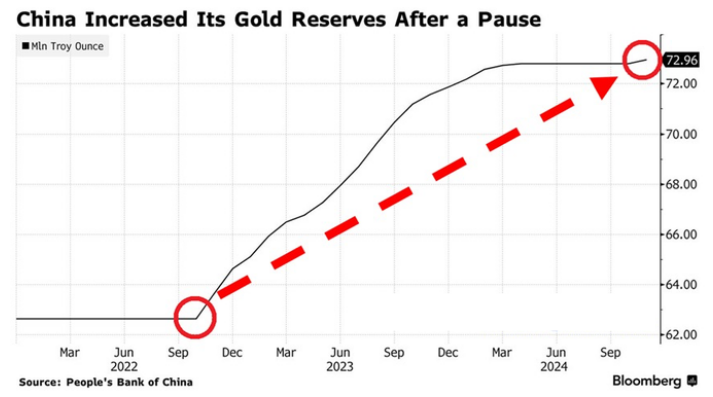

China’s central bank gold reserves hit a record 72.96 million fine troy ounces in November.

China bought 160,000 fine troy ounces of gold last month, resuming purchases after 6 months.

China’s gold reserves have risen by a whopping 10 million ounces over the last two years.

As a result, the value of the country’s gold reserves reached $193 billion in November, near the record $199 billion posted in October.

Meanwhile, gold prices have rallied 28% year-to-date, and trade just 5% below all-time highs.

China's gold stockpile is back on the rise.

-

Central banks bought 60 tonnes of gold in October, the largest monthly net purchase so far in 2024.

Meanwhile, China resumed gold purchases in November after a 6-month pause.

This year alone, India and Turkey have purchased 77 and 72 tonnes of gold.

Central banks have now purchased 694 tonnes of gold year-to-date, comparable to levels seen in 2022.

Why are central banks buying so much gold?

-

While November CPI inflation was 2.7%, inflation is much higher in many basic necessities:

1. Car Insurance Inflation: 12.7%

2. Transportation Inflation: 7.1%

3. Car Repair Inflation: 5.7%

4. Homeowner Inflation: 4.9%

5. Rent Inflation: 4.4%

6. Hospital Services Inflation: 3.8%

7. Food Away From Home Inflation: 3.6%

8. Electricity Inflation: 3.1%

Headline CPI inflation is at a 4-month high and Core CPI has been 3.3% for 3-straight months. The Fed is cutting rates while inflation has leveled off well above their 2% target.

-

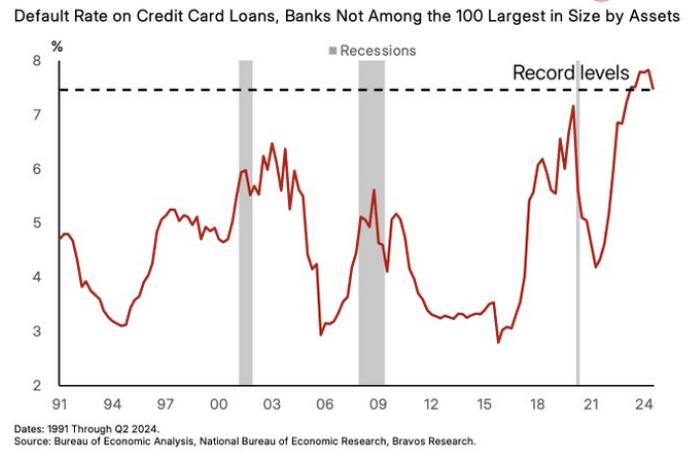

Credit card defaults from small lenders hit RECORD levels.

Surpassing even the Dot Com bubble & Financial Crisis peaks

-

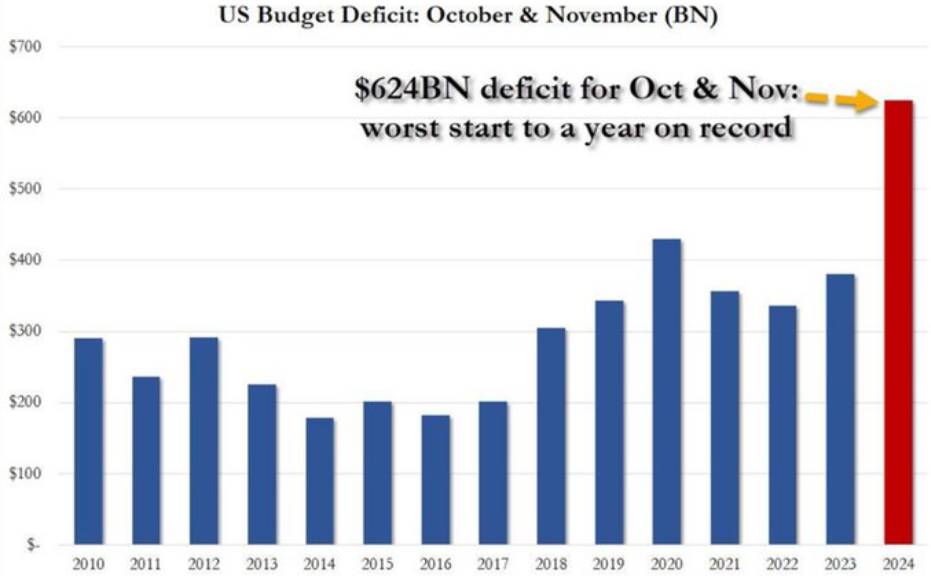

The US budget deficit spiked by a massive $367 billion in November 2024.

This was $14 billion above the median expectation of $353 billion.

For the first 2 months of the Fiscal Year 2025, the total deficit now stands at $624 BILLION, the highest on record.

This is up a staggering 64% from the $380 billion seen last year and above 2020 pandemic levels.

To put this into perspective, the budget gap was 3 TIMES lower on average during the 2013-2017 period.

-

S&P 500 Price to book, brings us so close to being the most expensive market of the modern era.

-

US Debts:

* National debt: $36.2 trillion

* Personal debt: $25.6 trillion

* Mortgage debt: $20.5 trillion

* Student loan debt: $1.7 trillion

* Credit card debt: $1.3 trillion

-

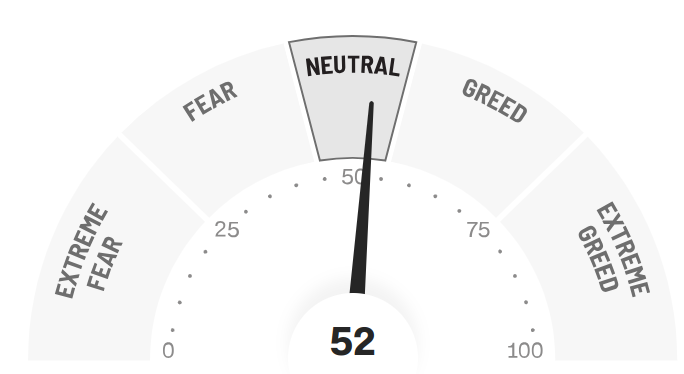

Final Words: Markets are at the alltime high and fed is cutting

interest rate, caution warranted. Below is CNN Greed vs Fear Index, pointing at

'neutral' while global political turmoil is at peak.

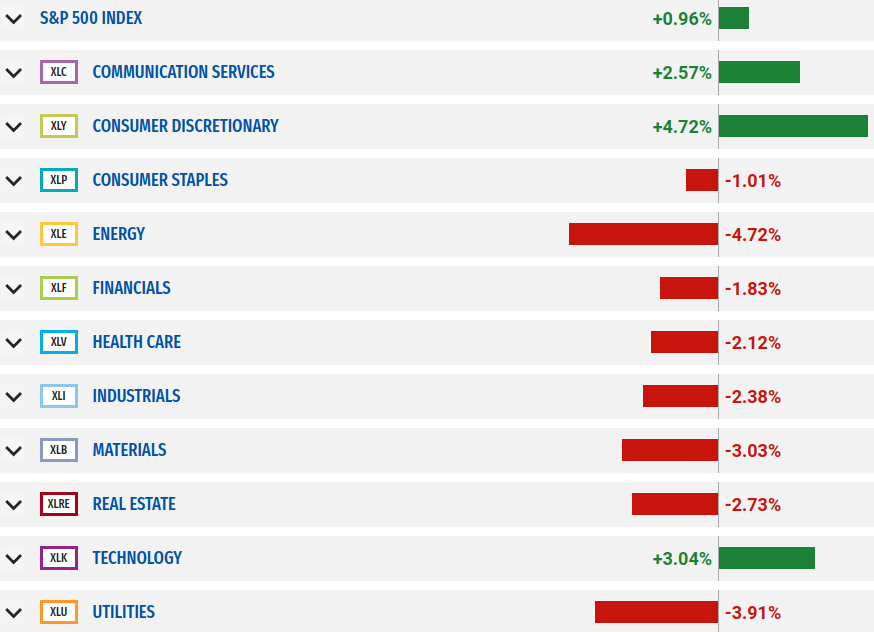

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

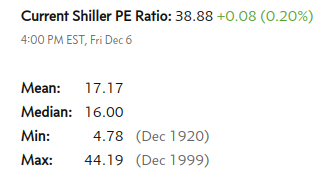

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.