Weekly Market Commentary - Dec 27, 2025 - Click Here for Past Commentaries

-

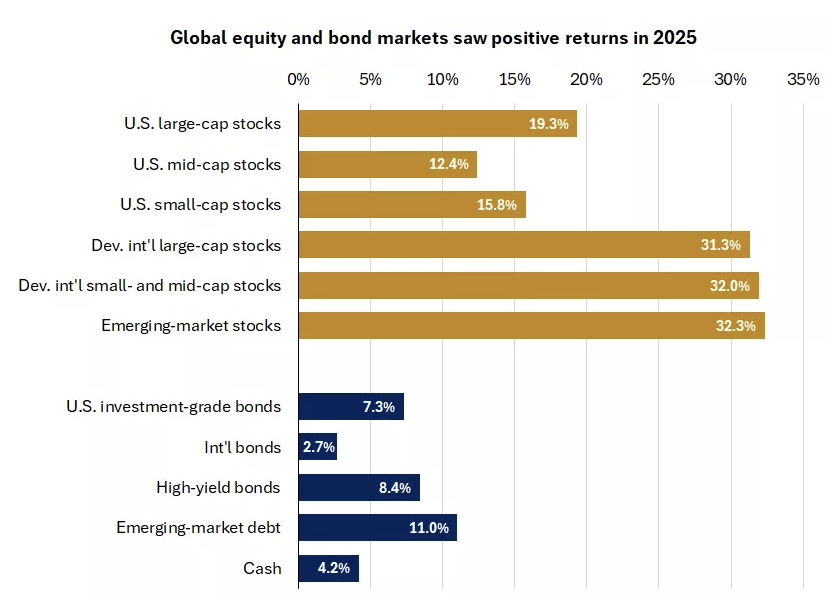

Positive returns across global asset classes in 2025: Global equities and bonds delivered gains in 2025,

with markets overcoming trade-policy uncertainty and a record-long government shutdown.

AI enthusiasm supports U.S. markets and the economy: Technology remained among the top-performing S&P 500 sectors, driven by robust profit growth and ongoing AI investment. Strong tech spending also supported U.S. economic growth.

International stocks shine: International stocks outperformed U.S. equities by 13% in 2025, reinforcing the case for global diversification.

Declining short-term yields weigh on cash returns: Cash lagged U.S. investment-grade bonds and equities, highlighting the opportunity cost of holding excess cash

-

2025 was a rewarding year for investors, with global equity markets delivering strong returns. The S&P 500

recorded 39 new all-time highs, while stock markets in Germany, the UK, and Japan also surged to record levels.

Bonds, though trailing equities, posted positive returns, with U.S. investment-grade bonds achieving their

strongest annual gain since 2020. Credit-sensitive fixed-income investments fared even better, with

emerging-market debt and U.S. high-yield bonds gaining over 8%. This week’s report highlights four themes

that shaped 2025 and outlines actions to help investors prepare for the year ahead.

-

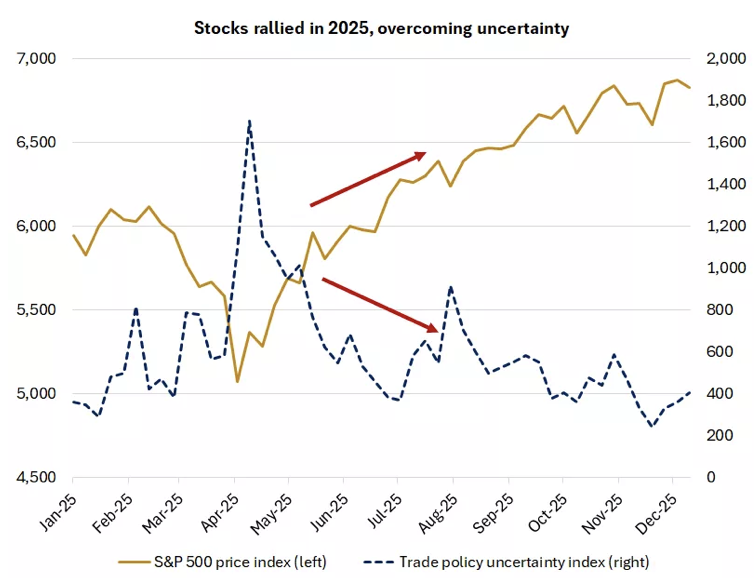

After two years of relative calm in markets, volatility returned in 2025 as investors faced trade-policy

upheaval and a record-breaking government shutdown. The S&P 500 logged 13 daily moves of more than 2%

(six higher, seven lower), exceeding the combined total of the prior two years. Twelve of these occurred

in the first half of the year following the Trump administration’s April tariff announcements, which pushed

the U.S. effective tariff rate to its highest level in roughly 100 years. Stocks fell sharply on recession

fears, with the S&P 500 dropping 19% from its peak.

However, subsequent negotiations lowered tariffs to levels still elevated by historical standards but meaningfully below the April peak. De-escalating trade tensions, steady economic activity, and ongoing AI enthusiasm helped drive strong earnings growth and market gains, with the S&P 500 posting its third consecutive year of returns over 15%.

-

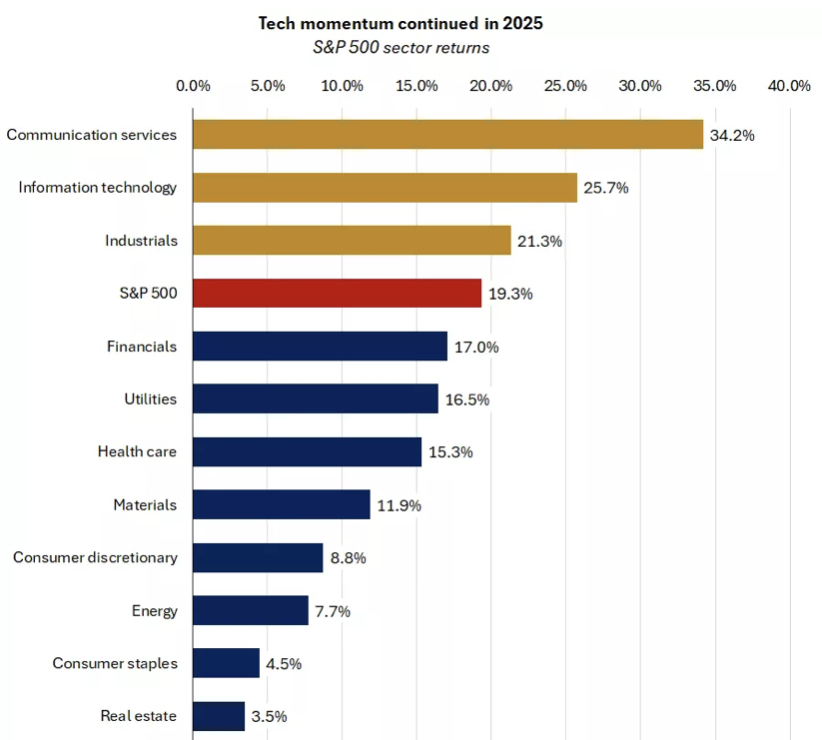

The technology and communication services sectors ranked among the top performers in the S&P 500 for

the third consecutive year, each gaining more than 25%. These sectors also delivered the strongest

earnings growth, with profits on track to rise over 15%, supported by robust AI investment trends.

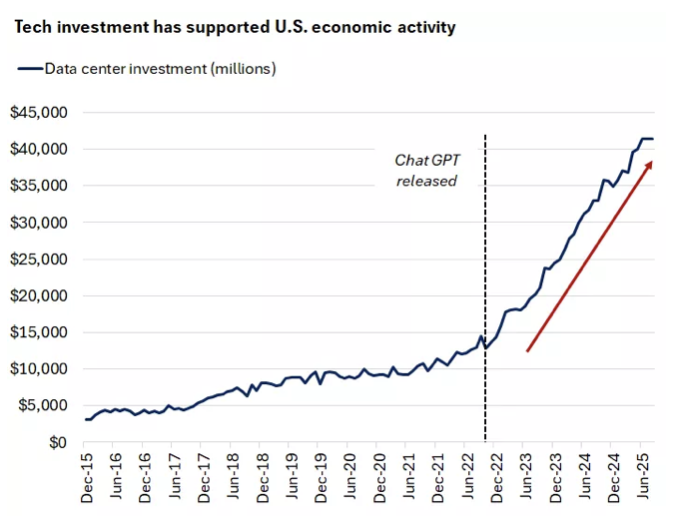

Technology investment also supported economic growth in 2025, with data-center investment roughly tripling since the launch of ChatGPT in late 2022. While data centers represent a small share of overall U.S. investment, other tech investment—such as information processing equipment—grew at a strong 8.4% annualized rate in the third quarter, while nonresidential investment as a whole averaged 6.5% quarterly growth during the first three quarters of 2025.

We believe AI has the potential to remain a powerful long-term driver of economic growth and corporate profits. However, we recommend avoiding overconcentration in a single theme. As part of our opportunistic equity sector guidance, we suggest overweighting the industrials, health care, and consumer discretionary sectors, offset by underweights in consumer staples and utilities. We recommend maintaining neutral exposure to all other sectors.

-

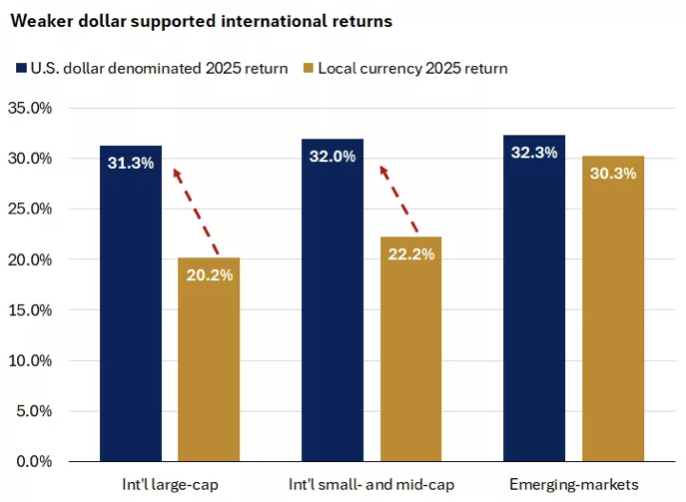

The benefits of global diversification were evident in 2025, with international stocks outperforming U.S.

equities by 13%—the largest margin since 2009. Fiscal stimulus in Germany and monetary easing by the European

Central Bank supported eurozone economic activity and markets. In Japan, equities posted strong gains despite

higher U.S. tariff rates, with corporate profit margins reaching an all-time high.

A weaker U.S. dollar, particularly against the euro, further supported developed international market returns. Political and fiscal uncertainty in the U.S., a narrowing yield advantage versus other developed markets, and increased currency hedging by foreign investors drove a decline of over 9% in the ICE U.S. Dollar Index—the steepest annual drop since 2017.

In emerging markets, currency effects were less pronounced; however, strength in technology-heavy regions such as China and Korea propelled emerging-market equities to a 32% gain.

We believe 2026 will be another favorable year for international markets, reinforcing the importance of global diversification. With the largest 10 stocks comprising roughly 40% of the S&P 500, we believe including exposure to international equities can broaden investor opportunities and help manage risk. As part of our opportunistic asset-allocation guidance, we recommend overweight positions in international developed small- and mid-cap stocks, which could benefit from steady economic activity in Europe and Japan, as well as emerging-market equities, which we believe offer exposure to the AI theme at more attractive valuations than in the U.S.

-

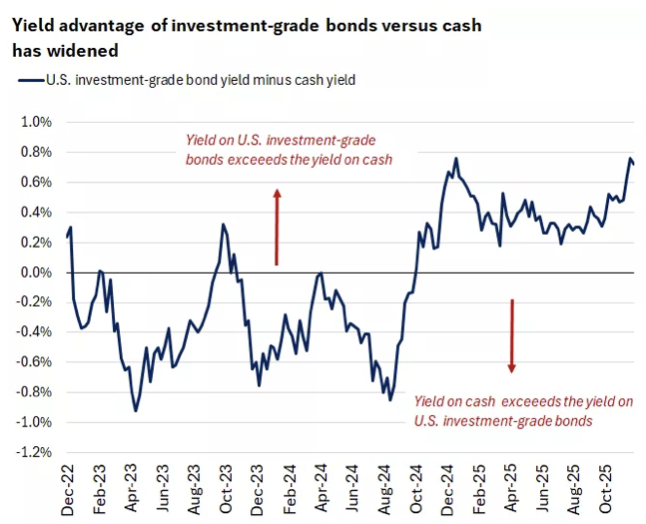

After underperforming cash in three of the past four years, U.S. investment-grade bonds gained more

than 7% in 2025, outperforming cash by roughly 3%—the widest margin since 2020. Treasury yields declined

across most maturities, driven by 0.75% in Fed rate cuts and a cooling labor market, leading to solid

gains for investment-grade bonds. With yield a key driver of fixed-income returns, the yield advantage

of investment-grade bonds over cash also contributed to their outperformance in 2025. At the end of 2025,

the yield on investment-grade bonds was approximately 0.7% higher than that of cash, near the upper end

of its three-year range.

We expect the Fed to modestly ease monetary policy in 2026, which could put some downward pressure on short-term interest rates and reduce the return potential of cash. However, given our outlook for steady economic growth and persistent budget deficit concerns, we see limited scope for a decline in long-term yields, with the 10-year Treasury yield likely trading between 4% and 4.5% in 2026. In our view, this could lead to a further widening of the yield advantage between U.S. investment-grade bonds and cash, potentially setting the stage for another year of bond outperformance. For investors holding excess cash, consider reallocating to other asset classes—such as equities or fixed-income investments—based on your risk tolerance.

Despite challenges, 2025 delivered positive results for diversified investors, with global equities and bonds posting strong returns. We expect 2026 to bring its own twists and turns, and we look forward to working with each of you to help navigate them.

-

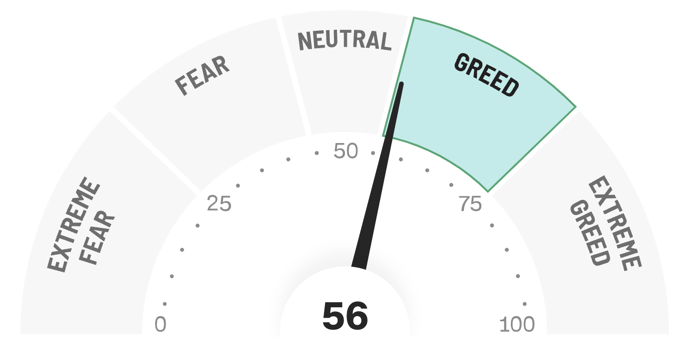

Final Words: Market indicates greed. No new buys.

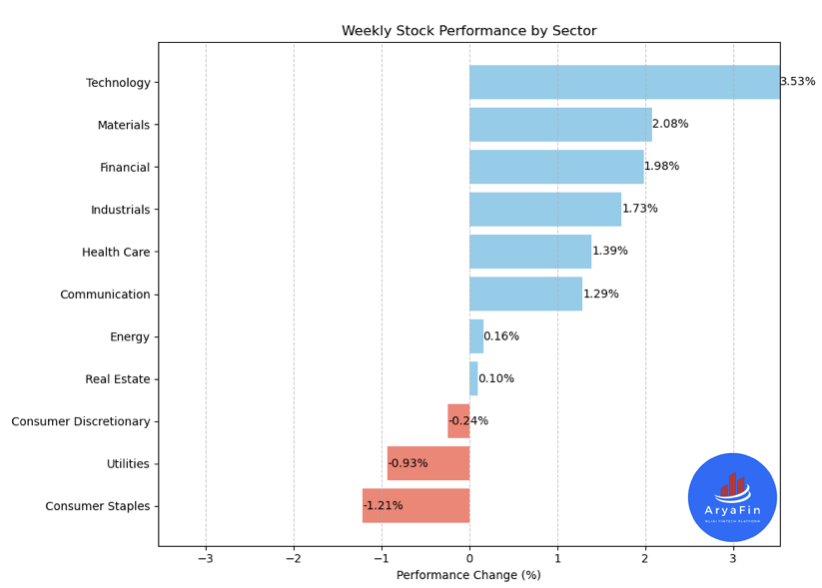

Below is last week sector performance report.

Weekly Sector Performance for Dec 22-26, 2025:

$XLE Energy: 0.16%, RSI: 44.31

$XLK Technology: 3.53%, RSI: 56.14

$XLC Communication: 1.29%, RSI: 64.42

$XLY Consumer Discretionary: -0.24%, RSI: 59.46

$XLP Consumer Staples: -1.21%, RSI: 48.83

$XLF Financial: 1.98%, RSI: 69.45

$XLV Health Care: 1.39%, RSI: 60.42

$XLI Industrials: 1.73%, RSI: 58.55

$XLB Materials: 2.08%, RSI: 69.30

$XLRE Real Estate: 0.10%, RSI: 45.46

$XLU Utilities: -0.93%, RSI: 41.49

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

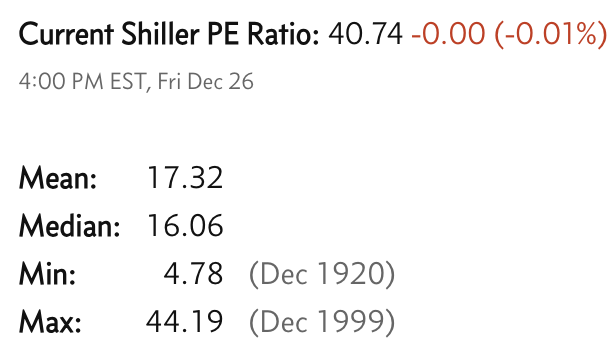

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.