Weekly Market Commentary - Aug 8th, 2025 - Click Here for Past Commentaries

-

Equity markets rebounded this past week, led by strong performance among technology and

consumer discretionary stocks.

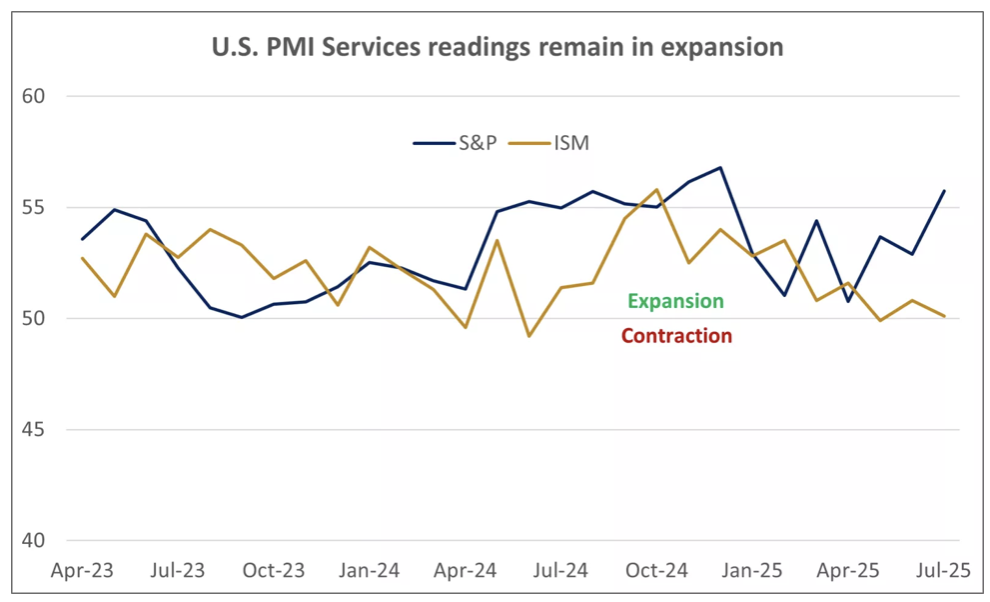

The services sector of the economy — representing roughly 71% of the U.S. GDP — remains in expansion,

though key readings continued to diverge in July.

Labor-market productivity rose in the second quarter, helping to offset solid wage gains to keep unit

labor costs contained relative to output.

Corporate earnings have been stronger than expected, driving earnings growth estimates sharply

higher to 9.7%, from 3.8% at the end of the second quarter.

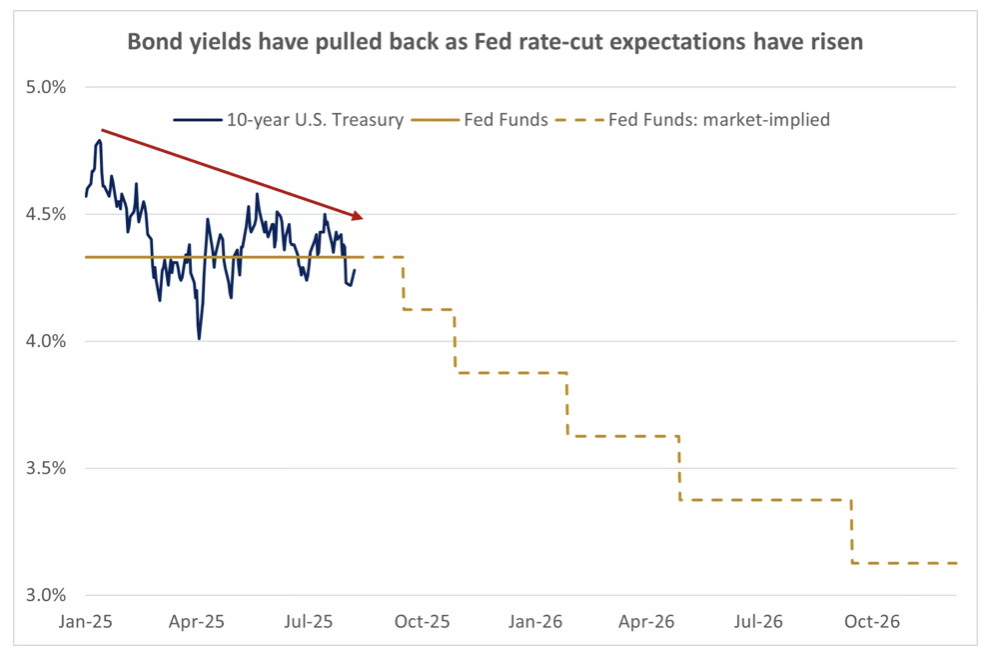

Bond yields rose, as Treasury auctions drew somewhat weaker demand, though the broader

trend remains lower.

-

The S&P U.S. Services Purchasing Managers' Index (PMI) rose to a new high for the year of 55.7 in July.

The reading was ahead of forecasts to hold steady at 55.2 and above the key 50.0 mark reflecting expansion.

July's accelerated expansion was led by surging demand in the technology sector, along with higher financial

services activity, aided by improving financial conditions1. Output prices rose as companies reported passing

along tariff-related input-cost increases to customers.

The Institute for Supply Management (ISM) Services PMI extended its broader trend lower, falling to 50.1,

missing estimates of 51.3 but remaining in expansion territory. Slower growth in business activity was a

key driver behind the drop. While tariffs do not apply to services directly, the new exports and imports

indexes moved to contraction, from expansion, reflecting trade disruptions. Price pressures also continued,

rising at the fastest pace since 2022.

Overall, the services sector — accounting for roughly 71% of U.S. GDP — remains in expansion territory.

While the economy appears to be slowing, we don't expect a recession, and growth should reaccelerate in

2026, in our view, backed by fiscal stimulus, Fed rate cuts, deregulation and the potential for reduced

trade tensions and uncertainty.

-

Nonfarm business sector productivity increased at a 2.4% annualized pace in the second quarter, beating

estimates pointing to a 2.2% rise. Despite a softer labor market, hourly compensation grew a healthy 4.2%

year-over-year, comfortably above inflation of about 2.7%. This means consumers, on average, are receiving

positive real wage gains, which should provide disposable income to help support consumer spending and the

economy, in our view.

Productivity gains partially offset solid wage gains to keep unit labor costs, which adjust hourly wages for higher output, contained at 1.6% annualized. We believe modest increases in unit labor costs, if sustained, should help counteract the impacts of tariffs on inflation.

-

With 90% of S&P 500 companies reporting quarterly results, corporate earnings season is winding down.

Walt Disney Company and McDonald's announced earnings that exceeded estimates. Importantly, Walt Disney's

revenue was about in line with forecasts, while that of McDonald's beat expectations, indicating that,

combined with other recent data, consumers appear to remain mostly resilient.

Earnings results have been stronger than expected, as 82% of S&P 500 companies have beaten analyst estimates, with an average upside surprise of 8.5%. As a result, forecasts for earnings growth have been revised sharply higher to 9.7%, from 3.8% at the end of the quarter, showing that prior downgrades appear to have been overdone.

Earnings growth has been led by the communications and technology sectors, both of which are higher more than 20% year-over-year. Performance has been broad as well, as earnings are down for just two of the 11 sectors — energy and materials — which represent less than 5% of the market capitalization of the S&P 500. Earnings growth is forecast to slow over the quarters ahead but still combine for 10.1% growth for 2025, aided by the first quarter's strong 12.8% rise. While we believe earnings could slow further as tariffs likely weigh on corporate profit margins, earnings should be sufficient to support stock prices over time, in our view.

-

Bond yields rose this past week, as the Treasury auctioned $42 billion of 10-year notes and $25 billion

of 30-year bonds that drew somewhat weaker demand. For the 10-year auction, total bids as a multiple of

those accepted, known as the "bid to cover ratio," dipped to 2.35, compared with the year-to-date average

of 2.57. While government budget deficit concerns are likely weighing on demand, the benchmark yield has

fallen from its July peak near 4.5%.

Following last week's nonfarm-jobs report reflecting a slowing labor market, bond markets priced in expectations for the Fed to cut rates more quickly, likely resuming in September, in part to help support the labor market.

In assessing the need and capacity to cut interest rates, the Fed will likely be constrained by its price-stability mandate. The Fed's preferred personal consumption expenditure (PCE) inflation measure rose to 2.6% annualized in June, from 2.2% in April, presenting challenges for the Fed. While inflation remains above the 2% target, the fed funds rate — currently near 4.3% — likely remains restrictive. A neutral fed funds rate tends to be about 1% above inflation, providing room to bring rates down to a less restrictive policy stance, in our view.

Overall, we continue to expect 10-year Treasury yields to stay in the 4%-4.5% range, which aligns with our annual outlook at the beginning of this year. Fed rate cuts should push the short end of the yield curve lower, in our view, likely helping prevent intermediate-term yields from rising much further, unless inflation reaccelerates or economic growth increases significantly. Government budget deficit concerns could continue to weigh on auction demand, potentially preventing intermediate-term bond yields from falling much below 4%, unless growth cools further, which could flatten the yield curve.

-

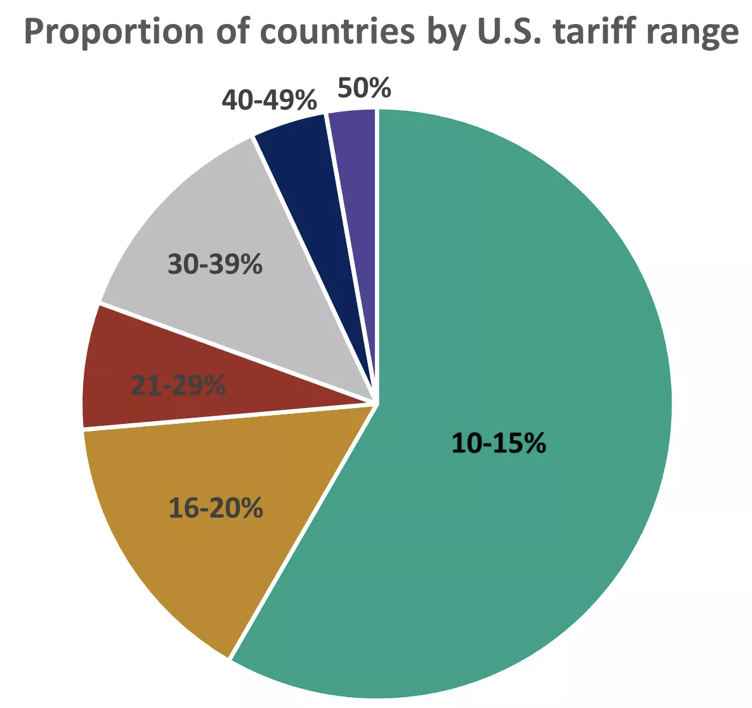

With the tariff pause expiring on August 7, higher tariff rates took effect this past week. Tariffs for

most U.S. trading partners rise from the 10% baseline set back in April. While tariffs vary widely from

10% to up to 50%, most countries face import taxes in the 10%-20% range, as shown in the chart below.

President Trump also announced new 100% tariffs on semiconductors (computer chips), though exemptions were more generous than expected. Companies with at least some production in the U.S. will reportedly receive exemptions, which should reduce effective tariff rates significantly from the headline 100% figure, in our view.

Higher tariffs could squeeze household purchasing power and corporate profit margins, potentially weighing on consumption and investment. However, the impact should be limited to near-term price hikes that aren't an ongoing source of inflation over the long term, in our view. Any additional progress in finalizing trade agreements should further ease trade tensions, in our view, and we think any flexibility in lowering tariffs should help contain inflation and growth risks.

-

While the economy appears to be slowing, we expect a reacceleration in 2026 and 2027, supported by

tailwinds of fiscal stimulus, Fed rate cuts, deregulation, and the potential for reduced trade tensions

and uncertainty. We recommend overweight allocations to U.S. large-cap and mid-cap stocks, which we

believe should perform well in this environment. Within U.S. stocks, we favor the consumer discretionary,

financial services and health care sectors. The strong performance of international stocks this year,

driven by the pullback in the U.S. dollar, highlights the importance of maintaining allocations beyond

the U.S. However, we suggest an underweight position in international developed-market large-cap stocks.

Within U.S. investment-grade bonds, consider extending duration. Bonds in the seven- to 10-year range can offer the opportunity to lock in yields for longer and the possibility of price appreciation as the Fed likely resumes rate cuts, with potentially less sensitivity to deficit concerns than long-term bonds.

With U.S. stocks near record highs, valuations appear somewhat less attractive. We believe corporate earnings growth will be essential to drive further gains over the remainder of the year. Focusing on quality can take on even greater importance, in our view, as markets may experience volatility if economic data softens in the months ahead or trade tensions persist for a while longer. We believe the fundamental backdrop remains intact, and pullbacks can offer opportunities to invest at better prices or to rebalance to maintain diversification.

-

Final Words: Market indicates Greed. Buy Gold and Silver (GLD & SLV ETF's).

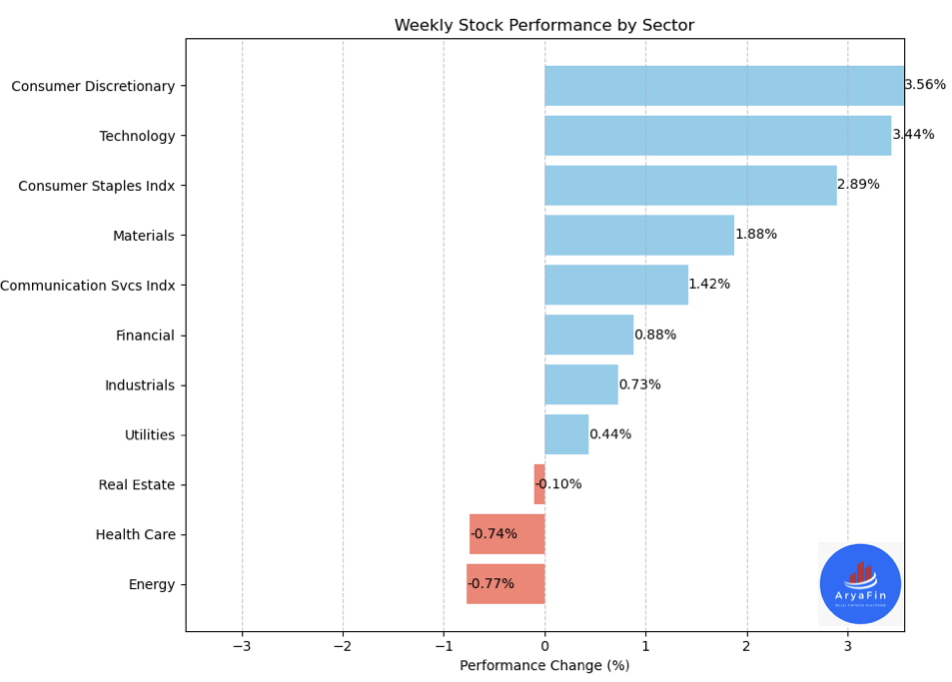

Below is last week sector performance report.

Weekly Sector Performance for Aug 4-8, 2025:

$XLE Energy (Change: -0.77%), (RSI: 43.56)

$XLK Technology (Change: 3.44%), (RSI: 64.44)

$XLC Communication (Change: 1.42%), (RSI: 54.57)

$XLY Consumer Discretionary (Change: 3.56%), (RSI: 56.22)

$XLP Consumer Staples (Change: 2.89%), (RSI: 61.07)

$XLF Financial (Change: 0.88%), (RSI: 47.50)

$XLV Health Care (Change: -0.74%), (RSI: 41.38)

$XLI Industrials (Change: 0.73%), (RSI: 52.59)

$XLB Materials (Change: 1.88%), (RSI: 46.12)

$XLRE Real Estate (Change: -0.10%), (RSI: 43.08)

$XLU Utilities (Change: 0.44%), (RSI: 61.31)

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

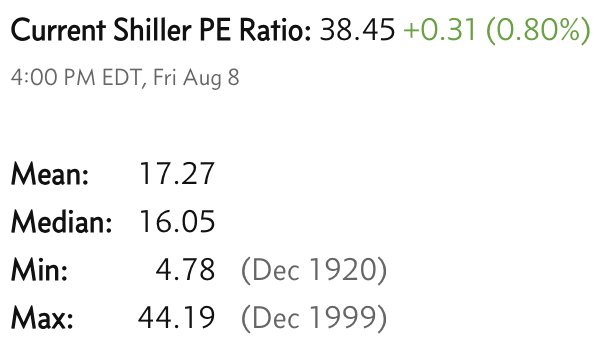

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.