Weekly Market Commentary - August 30th, 2024 - Click Here for Past Commentaries

August stocks ended at or near record highs depending on the index, but not before first going through a near 10% correction

-

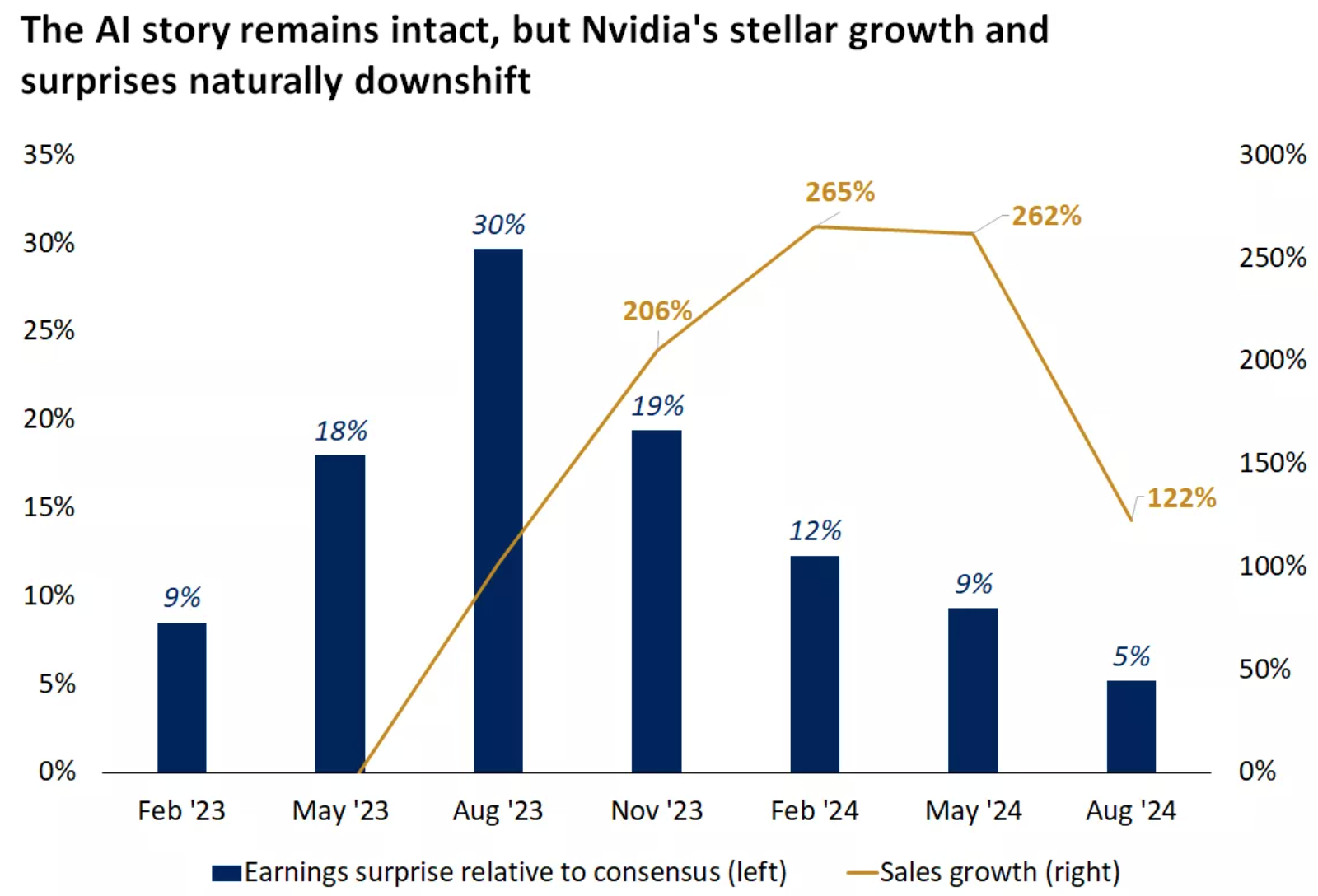

NVIDIA in Focus: Last week all eyes were on NVIDIA, the clear leader in AI development, and the

excitement it has generated. NVIDIA represents over 6% of the S&P 500 and has

a market capitalization of $3.1 trillion, second only to Apple. NVIDIA's results did not change

the market narrative, nor did it trigger a big reaction across the tech sector. But the results

highlighted a headwind that the mega-cap tech winners face: that of lofty expectations.

NVIDIA exceeded consensus estimates on second-quarter sales, earnings, and third-quarter

guidance, but it did so without blowing them away to the same extent that it had in

prior quarters.

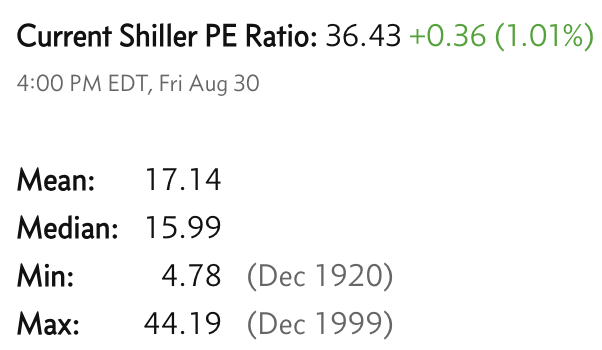

While on a league of its own, the 122% sales growth is smaller than last quarter's 262% growth, and similarly, the 5% upside earnings surprise is smaller than last quarter's 9% surprise. Because of tough comparisons from a year ago and the law of large numbers, we believe growth will inevitably slow in quarters ahead for NVIDIA, and more broadly, for the Magnificent 7 companies that have led this year's gains. This deceleration, together with elevated valuations, implies that the market heavyweights could spend some time catching their breath and possibly take the back seat for a change.

While the solid results failed to impress, the fundamental story around AI remains unchanged. Cloud providers and other big tech companies continue to spend heavily on this technology, with demand outstripping supply. Only time will tell whether companies will reap the benefits of their investments, but for now the perception is that the missed opportunities for innovation and the cost of not investing in AI is greater than the cost of investing.

-

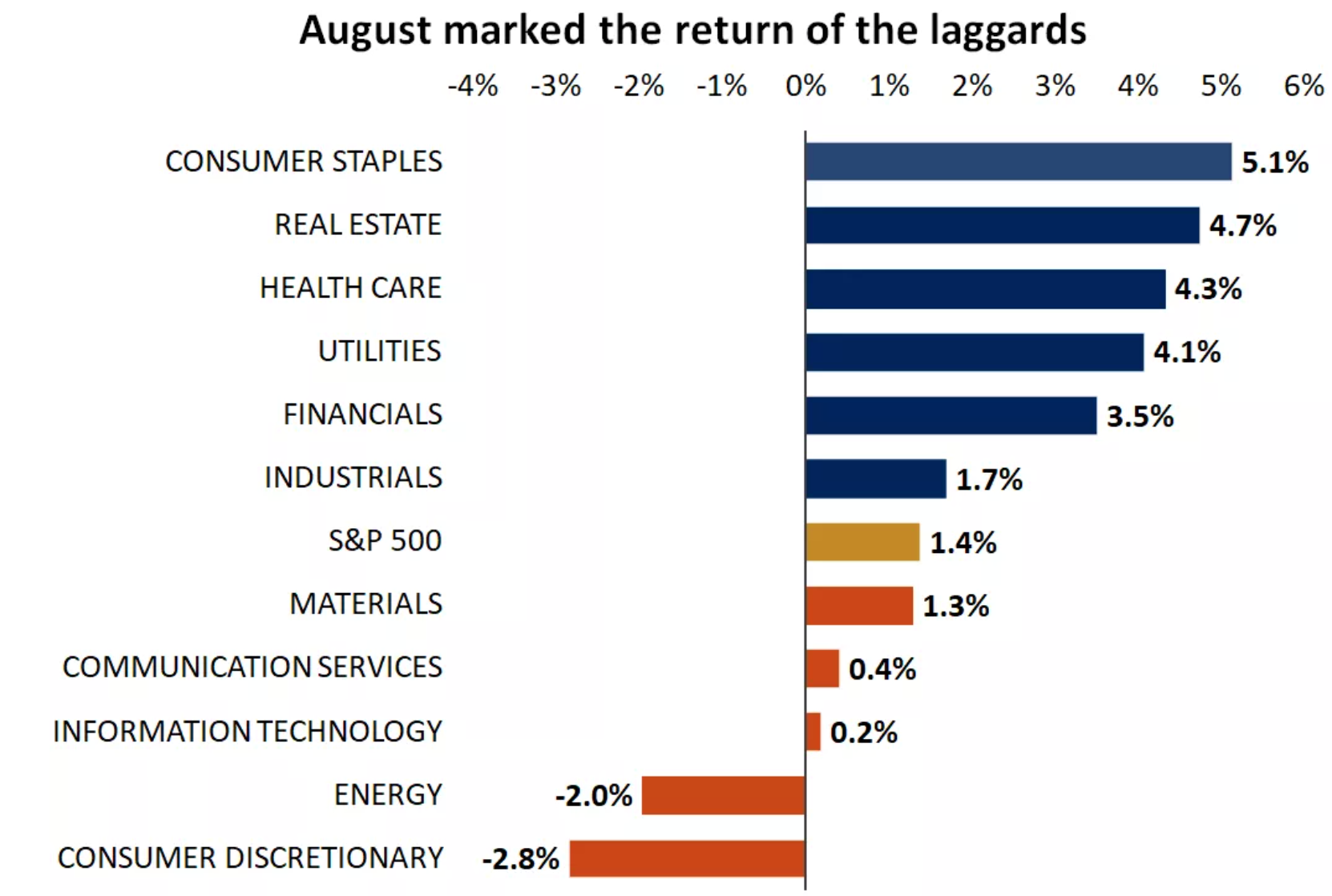

Earnings and Growth: The vigorous rebound in stocks after the near 10% correction

was enough to more than wipe out the losses, producing a small gain for most major indexes

in August. But unlike the first half of the year, a broader range of sectors and stocks are

now driving the rally, indicating a gradual shift in market leadership that we've been

anticipating. While the S&P 500 has yet to hit a new high after the early August pullback,

the equal-weight index has reached new highs, indicating that the market volatility has

worked to the advantage of the "average" stock.

Supporting the theme of broadening, S&P 500 earnings growth excluding the Magnificent 7 stocks was positive for the first time in five quarters. Nine of the 11 sectors had positive growth, with the biggest upside surprises coming from financials, health care and utilities, in addition to tech1. We think the improving earnings trends beyond the mega-cap tech will lead to more balanced gains in the last four months of the year.

-

Profit Story:: With 99% of the S&P 500 companies having already reported results, the

second-quarter earnings season is largely complete. An above-average 80% of the companies

have exceeded analyst estimates by 5.2%, with the index earnings growing 11.4%, a notable

acceleration from the first quarter. Importantly, the full-year 2024 and 2025 earnings

estimates still point to 10%+ growth for each of the two years. The upshot is that corporate

profits remain on solid ground, providing ongoing support to the bull market despite

periodic shifts in investor sentiment.

-

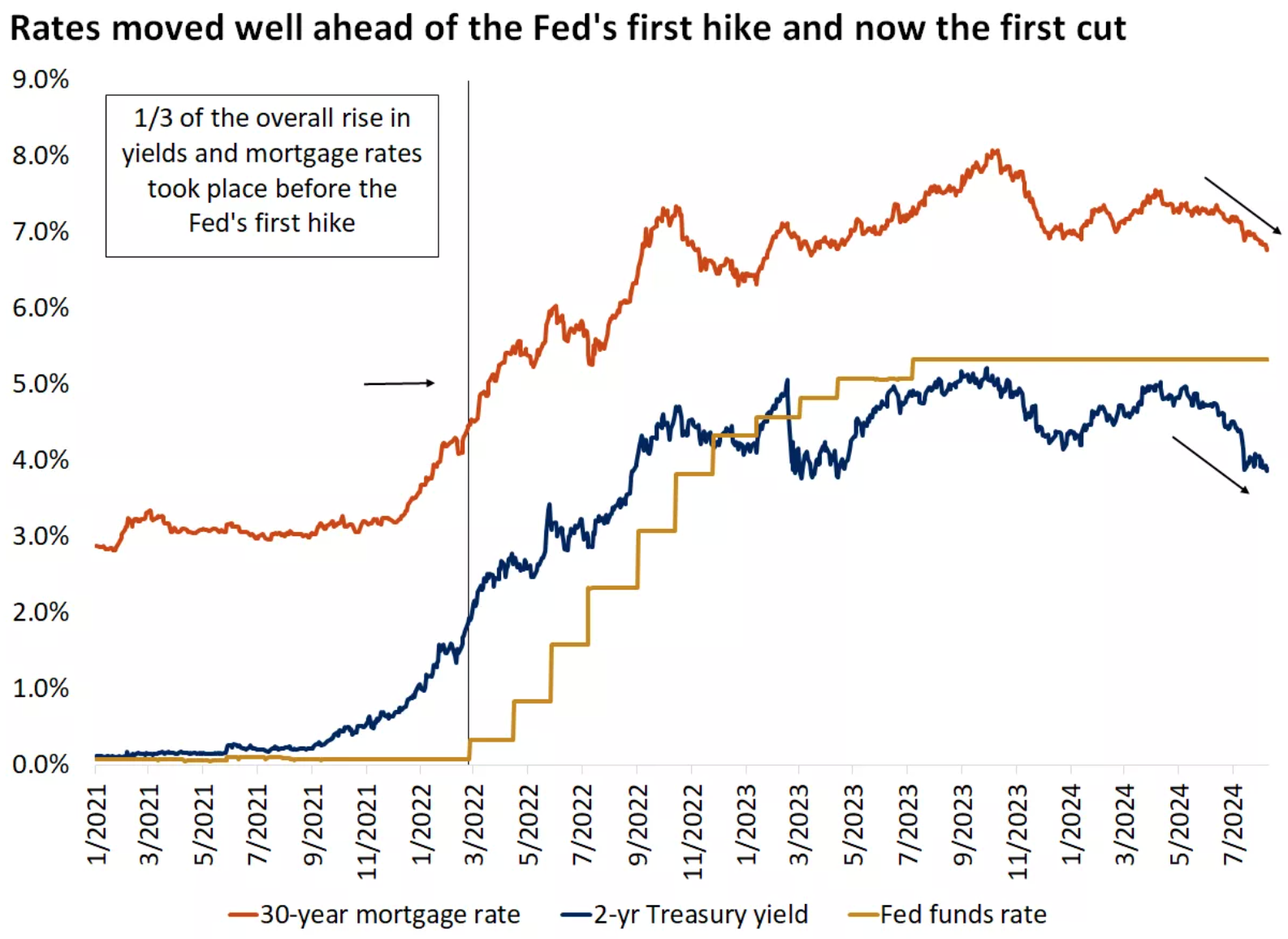

Rate Cuts: Arguably the biggest macroeconomic development in August was the Fed's

message at the annual Jackson Hole symposium that "the time has come for policy to adjust."

After 16 months of rate increases and 13 months of holding rates in restrictive territory,

policymakers are now prepping the ground for the first rate cut of this cycle in a couple

of weeks when the Fed meets on September 18.

With inflation making further progress toward the 2% target, policymakers have become more sensitive

to achieving the second part of their dual mandate, which is maximum employment. As they seek to

engineer a soft landing, the gradual cooling of the labor market is raising some flags. While the

mission is not yet accomplished on the price-stability front, the Fed's preferred measure of

inflation, the core personal consumption expenditures price index (PCE), increased 0.2% from June,

the third mild increase in a row, leaving the annual pace unchanged at 2.6%.

Like in early 2022 when the market sniffed out what was coming and yields spiked even before the Fed started hiking rates, bond yields have taken a dive over the past two months in anticipation of the upcoming rate-cutting cycle. As a result, more of the debate now is about how fast and how far instead of the direction of travel. Bond futures price in a 1% reduction in the Fed policy rate by year-end, followed by a 1.2% drop in 2025, implying nine rate cuts and a near 3% fed funds rate, down from 5.5% currently. No doubt these expectations will fluctuate based on the incoming inflation and employment data, but the key takeaway is that Fed policy will start turning less restrictive, easing a source of anxiety for investors.

-

From Inflation to Growth & Challenges: Up until recently, economic data was mainly interpreted and

viewed through the lens of what it means for the Fed. Good news for the economy could be bad

news for the market. And vice versa, bad news for the economy could be good news for the

markets because it would imply that inflation will cool further, leading the Fed to cut rates

and yields to drop. But as inflation is now in the neighborhood of 2% and the Fed has made

its intentions clear, we are back to bad news being bad news. Exemplifying this point,

the soft July jobs report was a key reason behind the recession fears that triggered

the biggest pullback in stocks this year.

Last week's second-quarter GDP revision highlighted that the economy not only hasn't been contracting, but it has been growing at an above-trend pace. Growth was revised to 3% annualized from 2.8%, driven by strong consumption growth.

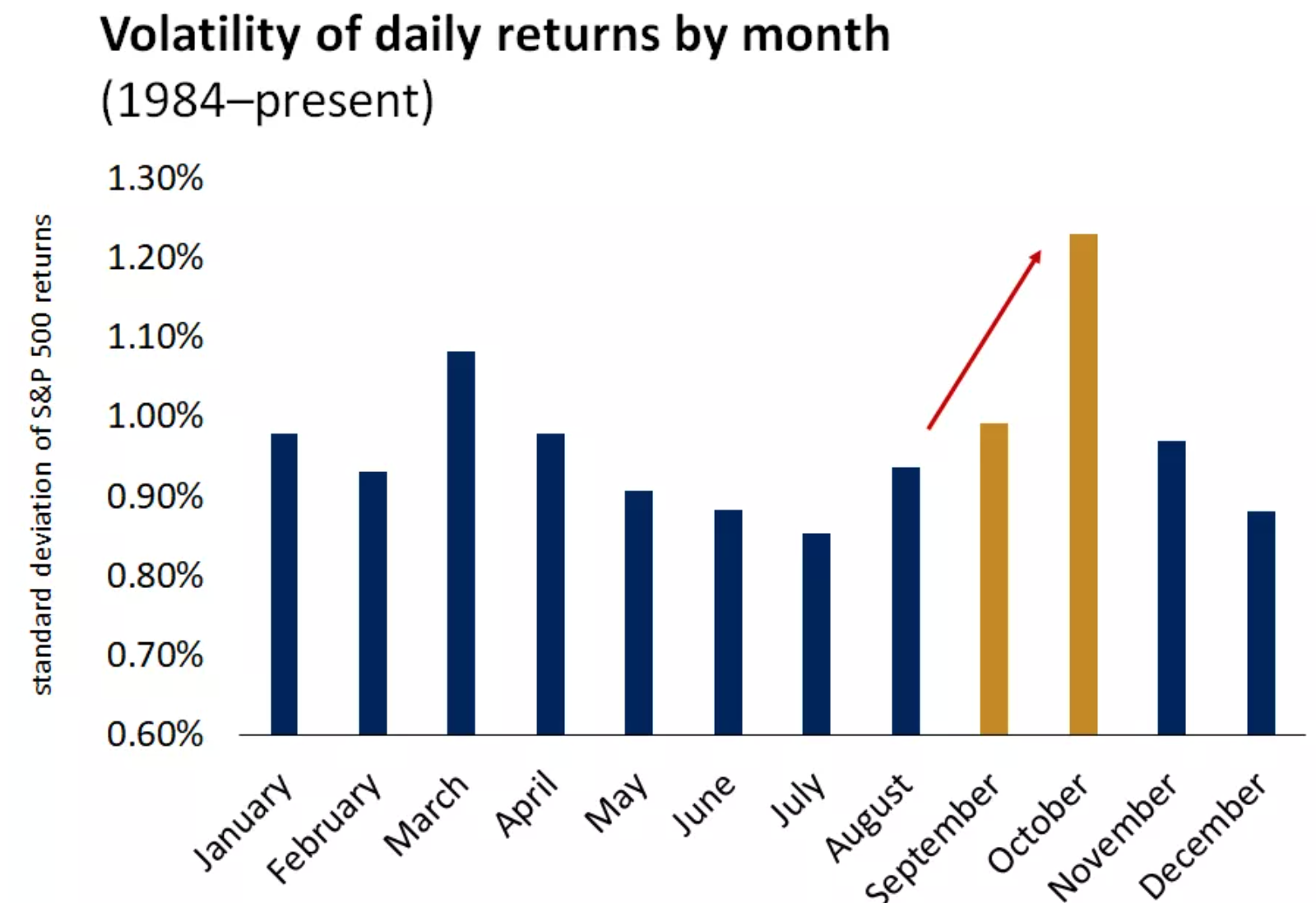

The market is wrapping up the summer on a firmer footing near all-time highs, helped by a growing economy and corporate profits, lower bonds yields, and expectations of easier Fed policy. However, we wouldn't sound the "all-clear" regarding market volatility, as the next two-month stretch that will lead us to the November election day has historically been seasonally challenging for stocks, with bigger daily fluctuations and lower returns. The potential for volatility to reemerge highlights the importance of investment discipline and appropriate diversification across asset classes, styles and sectors, especially as the August round trip hinted that subtle leadership shifts are underway.

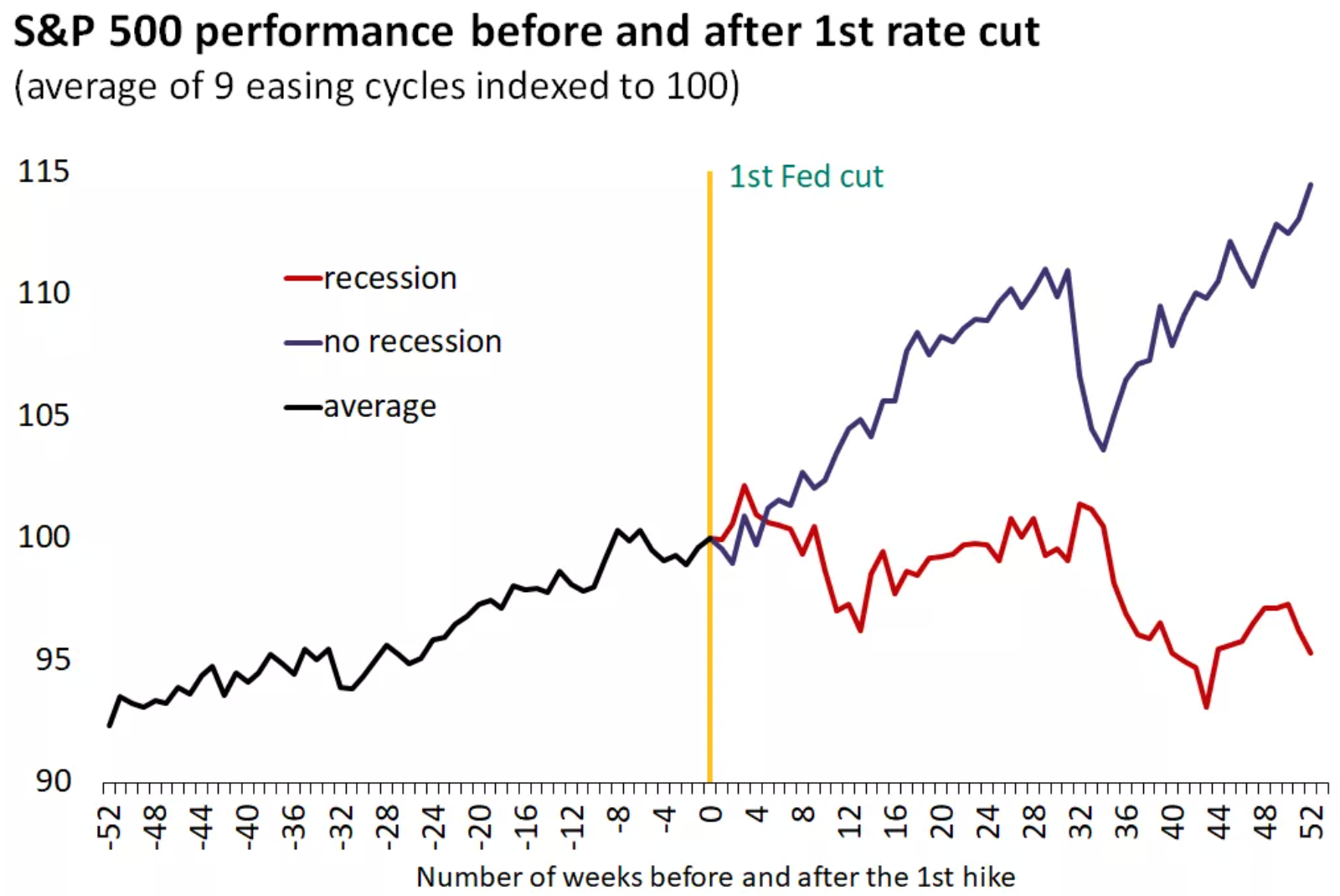

Beyond seasonality, which doesn't leave a lasting mark on performance, we think the upcoming shift in Fed policy has important implications. While rate cuts are not a panacea, the gradual easing in borrowing costs should help support consumer and business spending. From a market perspective, the start of a rate-cutting cycle that coincides with no recession has historically led to strong equity returns 12 months after the first rate cut. And in the fixed-income space, the lower path of policy rates has led to consistently positive investment-grade bond returns, while highlighting the reinvestment risk of short-term cash investments.

-

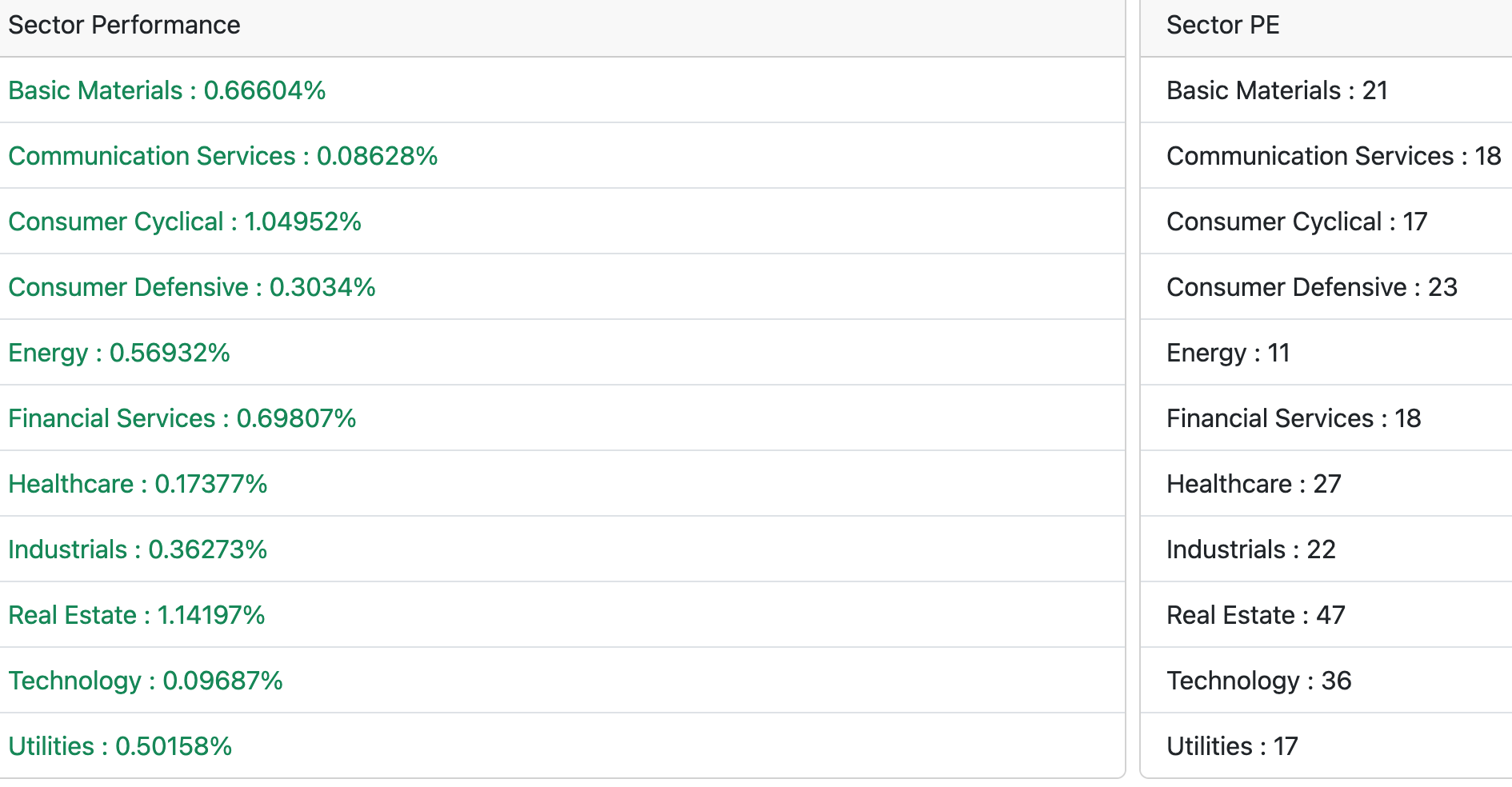

Word of Caution: We are keeping our caution lights on, and be very selective,

avoiding tech (not selling) and looking at Oil / Defense / Chemical sectors for value.

Below is our daily sector performance report - warrants caution.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.