Weekly Market Commentary - Aug 23rd, 2025 - Click Here for Past Commentaries

-

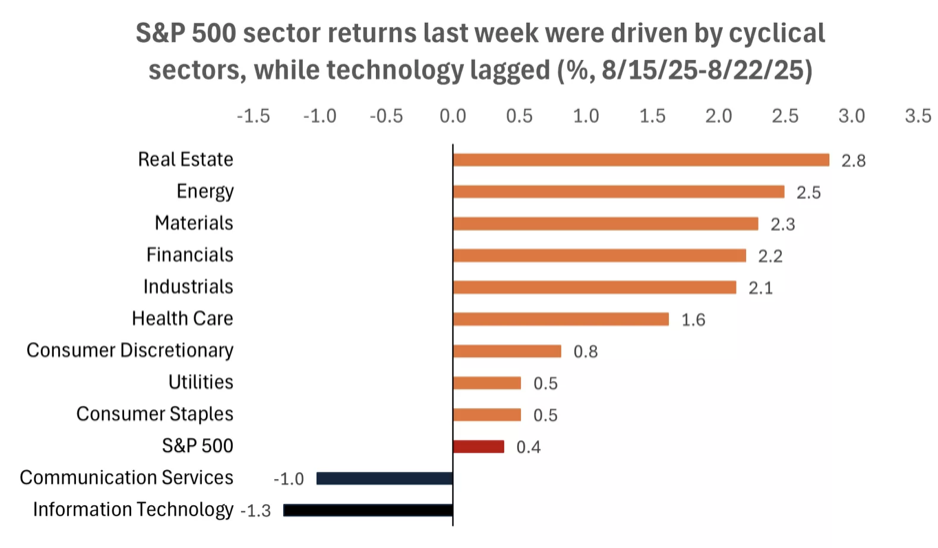

Stock markets rallied sharply on Friday after Fed Chair Jerome Powell's speech at the Jackson Hole

symposium, bringing the S&P 500 to a modest gain for the week. Underneath the surface, equity markets

experienced a bit of a rotation: Mega-cap technology stocks underperformed, while value and cyclical parts

of the market played catch-up.

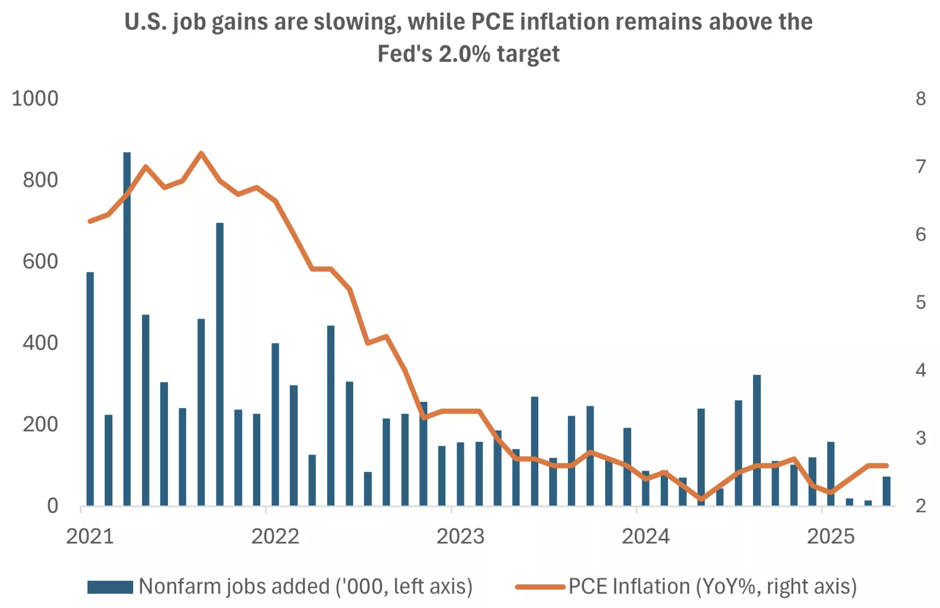

At the Fed's annual Jackson Hole symposium on Friday, Fed Chair Powell signaled that incoming data may

warrant a shift in the Federal Reserve's current policy rate. While the Fed remains on alert for higher

inflation trends in the months ahead, it also recognizes that the labor market has the potential to

deteriorate quickly given recent signs of softening. Markets overall appeared to welcome the signal that

interest rates could be heading lower.

Finally, large retailers, including Walmart, Target, and Home Depot, reported earnings last week. Overall,

the companies pointed to consumers that continue to spend, especially on value and discount goods, despite

uncertainties around tariffs and the economy.

-

Fed Chair Jerome Powell delivered his annual speech at the Jackson Hole symposium on Friday, and he signaled

that the Fed is willing to shift its policy rate from the current levels of 4.25% to 4.5%. However, Powell was

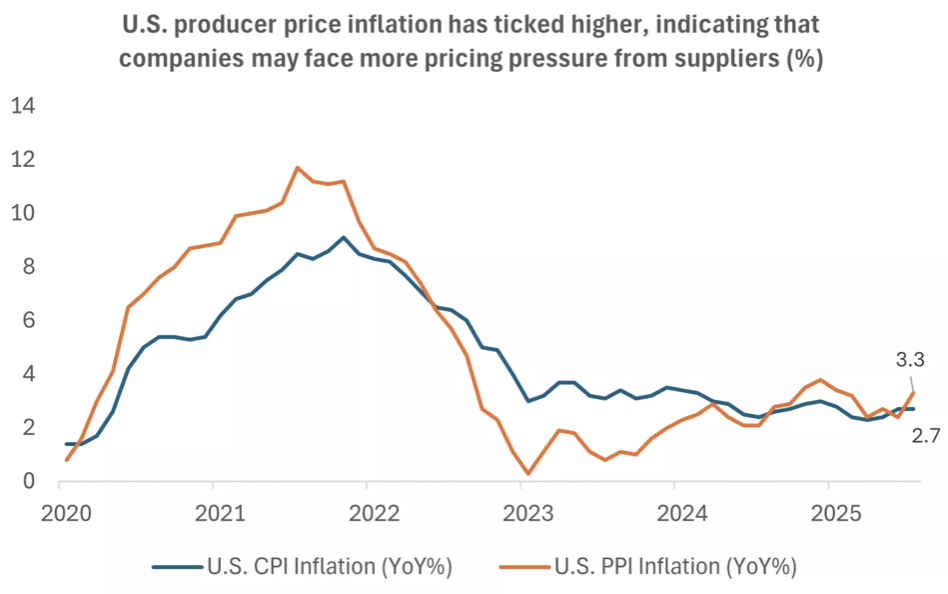

clear that the Fed remains in a tough position: Inflation is likely to rise in the months ahead, while the labor

market has shown early signs of cooling. In our view, the Fed will likely cut rates in September by 0.25%; however,

it will likely be data-dependent after that, watching both inflation measures and labor-market data carefully.

More broadly, we continue to see one to two rate cuts likely this year, followed by one to two rate cuts next

year.

Powell elaborated on his views on both inflation and the labor market in his Jackson Hole update. Regarding inflation, he noted that a reasonable base-case scenario was for inflation to rise from here, but this increase may be relatively short-lived. If tariffs do not consistently move higher, inflation should stabilize over time. Meanwhile, on the labor market, Powell noted that employment was in a "curious balance," with both the supply of labor and demand for labor softening, leaving the unemployment rate at a still resilient 4.2%. However, he also suggested the downside risks are rising, and these could materialize quickly, underscoring the Fed's rationale for potentially moving interest rates lower.

-

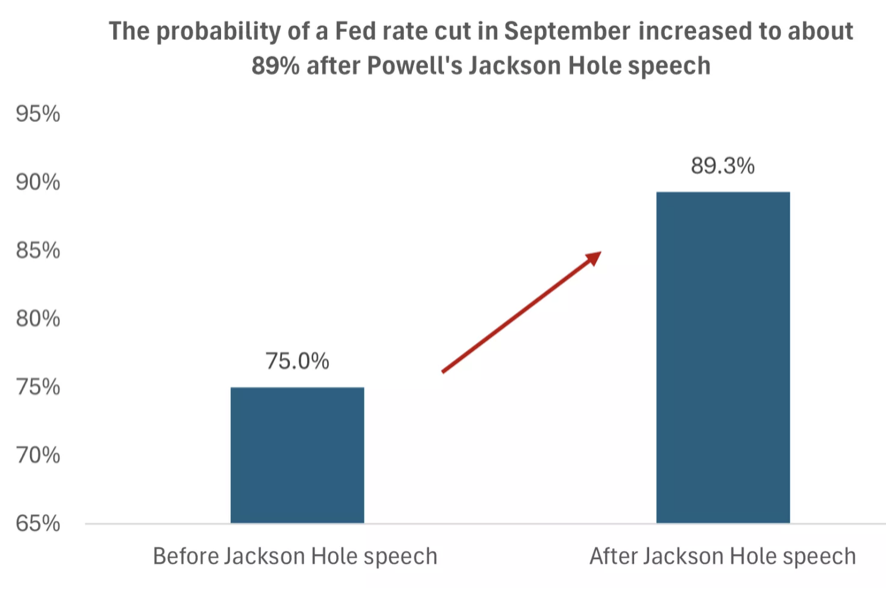

Overall, Powell's speech gave a boost to both stock and bond markets. The S&P 500 rallied over 1.5%, with

interest-rate sensitive sectors like consumer discretionary, industrials, and real estate leading the way

higher. Bond yields also moved lower, which is supportive of lower consumer and corporate borrowing costs.

The probability of a rate cut at the September FOMC meeting rose from about 75% to about 89%. According to

CME FedWatch, markets are now pricing in two rate cuts this year, in September and December, which, in our

view, is a reasonable base case.

-

In addition to the Fed's Jackson Hole symposium, this past week investors also digested several big box

retail earnings. Companies like Walmart and Target reported results that exceeded analyst expectations,

despite uncertainty around tariffs and concerns that consumers may slow spending. Last month, online retail

leader Amazon also saw strong 11% growth in its North American retail sales segment for the second quarter.

In addition, home-improvement giants Home Depot and Lowe's reported that consumers continue to spend on

small-scale home-improvement projects.

From a tariff perspective, Walmart, for example, indicated that it did not pass through increased costs on several lower-ticket items; however, it did increase pricing on select higher-margin products. The company expects costs to continue to gradually rise, especially as its inventory will be replenished at higher tariff rates. This aligns with the Fed's comments on near-term inflation trends as well.

Overall, in our view, the retail earnings picture in the second quarter points to a U.S. consumer that is resilient for now, although companies largely expect rising costs in the coming quarters. We think the good news is that retailers seem willing to absorb some of the tariff-related cost increases, while also likely diversifying supply chains and pushing some costs onto their largest suppliers. Corporations across sectors have thus far navigated the tariff uncertainty well, in our view, which appears to be reflected in the solid earnings reports and upside surprises this quarter.

Nonetheless, while goods prices look to have been contained, we may see them trend higher in the months ahead. However, assuming tariff rates don't move continually higher from here, we believe these should be one-time price increases that over time have limited impact on monthly or annual inflation rates.

-

After a strong rally in the stock market, with the S&P 500 now up about 30% since the April 8 lows, we believe

some bouts of volatility are likely in the weeks ahead. This comes as we move toward the seasonally choppier

months of September and October, and as inflation may move higher and U.S. economic data may soften in the

coming quarters.

However, historically, we also know it’s normal to experience two to three pullbacks in the market in any given year, especially in years with elevated uncertainty. And we see any coming bouts of volatility as opportunities for investors to diversify and to add quality investments at better prices. We believe this is especially true now that we appear to have more meaningful catalysts in place, including a Fed that seems more willing to shift policy rates lower, and the passing of a U.S. tax bill that will likely help support corporate spending in the year ahead.

So, where do we see opportunities for investors today? We continue to favor stocks relative to bonds in this environment. Within stocks, we recommend overweight positions in U.S. large- and mid-cap stocks, which we believe offer diverse exposure in tech and nontech parts of the market and remain favorable versus international developed equities. From a sector perspective, we favor sectors that offer exposure to both growth and value, including consumer discretionary, financials and health care. Finally, for investors looking for income within investment-grade bonds, we recommend bonds in the seven- to 10-year maturity space, which we believe still offer favorable yields and the potential for price appreciation, especially if the Fed lowers rates from here.

-

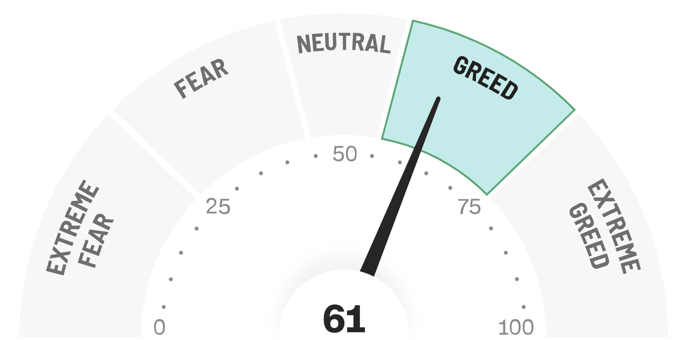

Final Words: Market indicates Greed. Buy Gold and Silver (GLD & SLV ETF's).

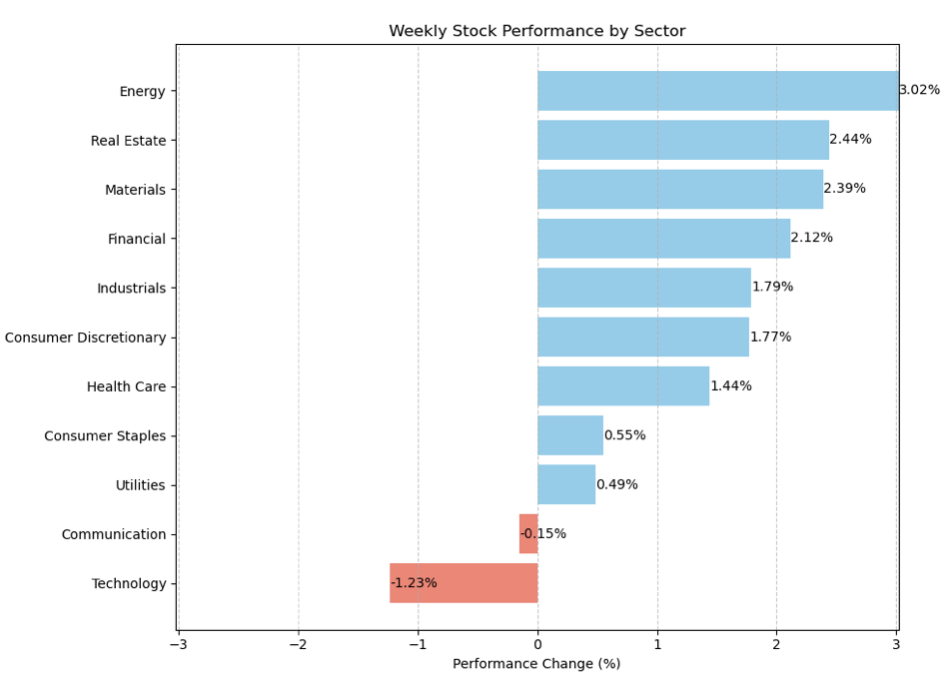

Below is last week sector performance report.

Weekly Sector Performance for Aug 18-22, 2025:

$XLE Energy (Change: 3.02%), (RSI: 62.32)

$XLK Technology (Change: -1.23%), (RSI: 52.23)

$XLC Communication (Change: -0.15%), (RSI: 63.98)

$XLY Consumer Discretionary (Change: 1.77%), (RSI: 66.03)

$XLP Consumer Staples (Change: 0.55%), (RSI: 56.04)

$XLF Financial (Change: 2.12%), (RSI: 62.29)

$XLV Health Care (Change: 1.44%), (RSI: 63.41)

$XLI Industrials (Change: 1.79%), (RSI: 60.24)

$XLB Materials (Change: 2.39%), (RSI: 62.49)

$XLRE Real Estate (Change: 2.44%), (RSI: 58.22)

$XLU Utilities (Change: 0.49%), (RSI: 56.62)

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

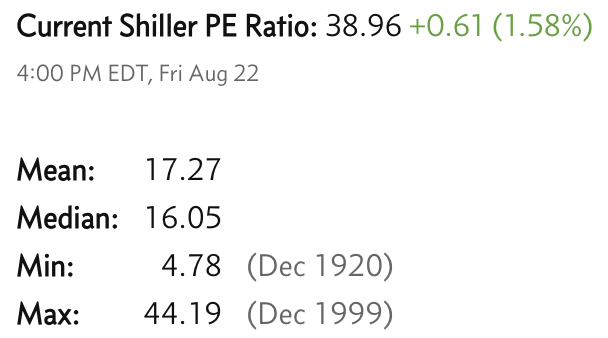

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.