Weekly Market Commentary - August 23rd, 2024 - Click Here for Past Commentaries

Last week brought the Federal Reserve's annual symposium in Jackson Hole, Wyoming,

a monetary-policy red carpet of sorts, where the movie isn't shown but previews

and interviews add detail and anticipation.There are no

policy decisions made at this meeting, but it did provide a prelude to the Fed's

upcoming official meetings, where expectations for action are high.

Markets spent the week largely treading water, awaiting the latest perspectives from monetary

policymakers, including the much-anticipated speech from Fed Chair Powell on Friday. There were

no surprise endings, but we do think the commentary provided some takeaways that will be

important for markets ahead.

- September in Focus: Markets have been fixated on – and driven predominantly by – the timeline to rate cuts for the better part of the last year. The wait is almost over, as we think the commentary from Chair Powell is consistent view that interest-rate cuts will commence in September. The Fed has held its policy rate steady for more than a year now, with the extended pause stemming from the fact that the central bank's dual mandate (stable inflation plus maximum employment) was not yet in a position that could warrant a change in policy settings. Time has come.

- Unemployment: With unemployment running below 4% from February 2021 to April 2024 (for perspective, the average over the last 40 years has been 5.8%), the employment side of the mandate has not required much attention. Conversely, with core inflation averaging 4.7% over the last 24 months (compared with a 40-year average of 2.9%), the Fed has focused policy moves squarely on bringing down inflation. With the trends in inflation and employment now both on the move, and with the economy showing a bit of fatigue recently, we expect the Fed's attention will now be more balanced, with an effort to support the labor market and economy playing a more prominent role in upcoming rate decisions.

-

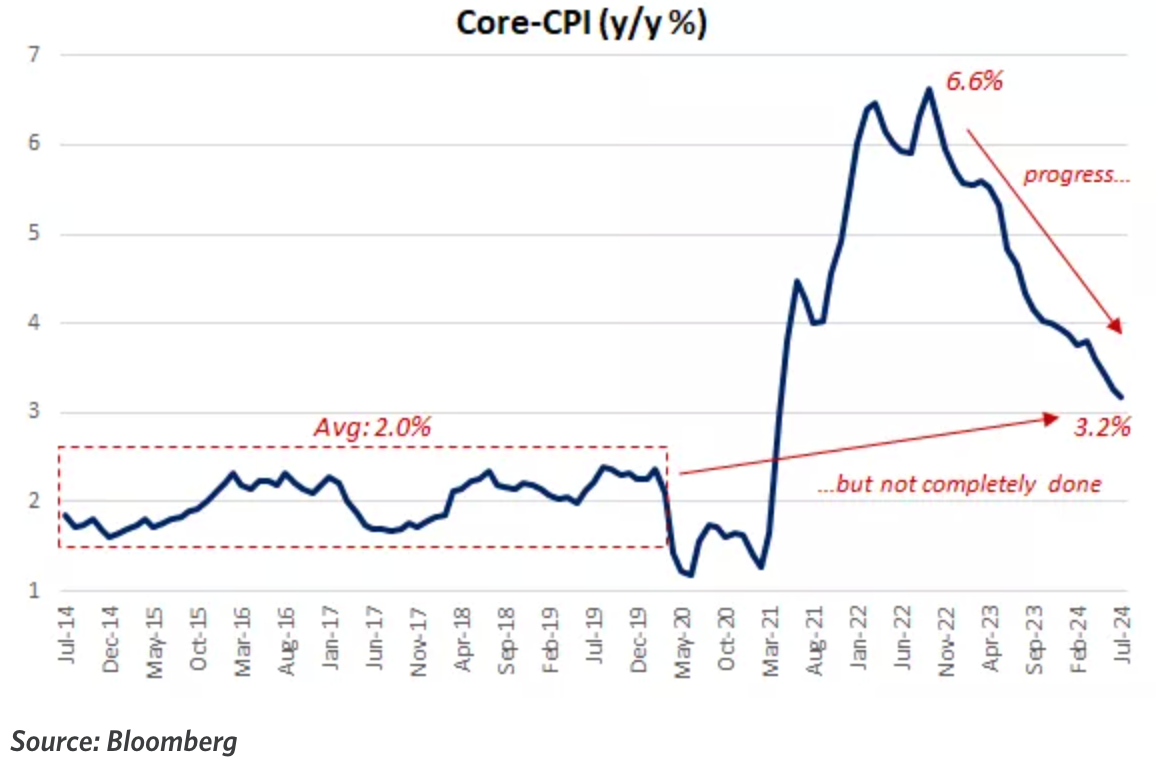

Core CPI: Core CPI (consumer price index) at 3.2%, having declined for four straight

months and now sitting at its lowest reading since April 2021, we think sufficient progress

has been made for the Fed to be able to ease monetary policy. Recent underlying price data

suggest to us that the rate of inflation should continue to moderate and will not require

the current restrictive interest rates to do so.

- Off of the brake: The conditions are unique this time, as the Fed is not seeking to address a collapsing economy or arrest a seizing financial system. The Fed often cuts rates to press on the gas pedal, stimulating a sputtering economy. We think the upcoming rate-cutting cycle is more about letting off of the brake, upon which the Fed has had its foot firmly pressed for the last two years.

- 25-basis-point cut: We think the Fed will make incremental, 25-basis-point (0.25%) cuts to its policy rate. The last rate cuts were in March of 2020, when the Fed executed a 50-basis-point and 100-basis-point cut to address the fallout from the COVID-19 shutdown. The policy-easing cycle that began in 2007 commenced with an outsized cut (0.50%) and included numerous large rate cuts as we navigated the housing market collapse and global financial crisis. Similarly, the easing cycle following the tech bubble pop and 9/11 in 2001 included numerous 50-basis-point rate cuts. We don't see a need at this stage for a dramatic move by the Fed, and in the absence of any particularly weak upcoming jobs reports, we think a string of 25-basis-point rate cuts is the likely approach, as the Fed seeks to find a neutral stance for its policy rate.

-

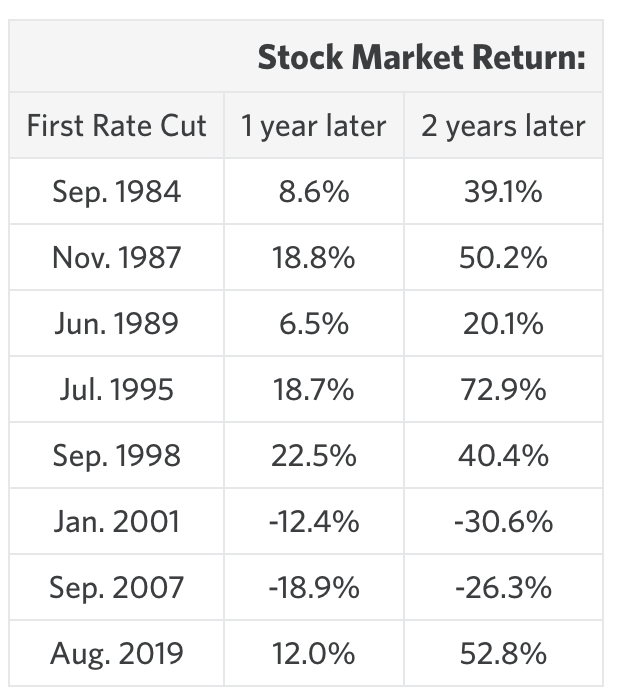

Word of Caution: In the last 1 year, S&P has given us solid returns of 35%.

Will the party continue? Our view, may be till next administration is in place i.e. Feb-March 25, but

a correction is well overdue. Look at the historical chart below after first rate cut.

It is a mixed result, our view, result might be much like 2001 and 2007. This will lead to market for stock pickers as sector rotation will continue. Caution is warranted.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.