Weekly Market Commentary - Aug 16th, 2025 - Click Here for Past Commentaries

-

Inflation remains manageable but not resolved. July’s CPI was in line with expectations, but sticky services

inflation and rising producer prices suggest upside risks persist. The Fed pivot appears to be gaining traction,

with inflation coming in less severe than feared and labor-market data showing signs of cooling, pushing

market-implied odds of a September rate cut to more than 80%. An "insurance" cut may be warranted as a preemptive

move next month. Upcoming Fed easing, with the economy still resilient, may help broaden market leadership.

Last week's outperformance of small-caps, value stocks, and the equal-weighted S&P 500 may have provided a

taste of that. Timely opportunities in equities may include rate-sensitive sectors like consumer discretionary

and financials, while mid-caps could offer cyclical upside with a quality tilt. In fixed income, we think

short-term bonds offer liquidity and stability, and seven- to 10-year maturities provide attractive yields

in a potentially lower-rate environment.

-

To cut or not to cut—that looks to be the question the Fed now faces, as mixed inflation readings give way to

growing signs of labor-market softness. Though the path to rate cuts remains uncertain, the narrative is

tilting toward a cautious move, perhaps marking a meaningful shift in tone ahead of Chair Powell’s speech at

the Jackson Hole Symposium on August 22. We offer our take on July's inflation data and its potential

implications for Fed policy and portfolio positioning.

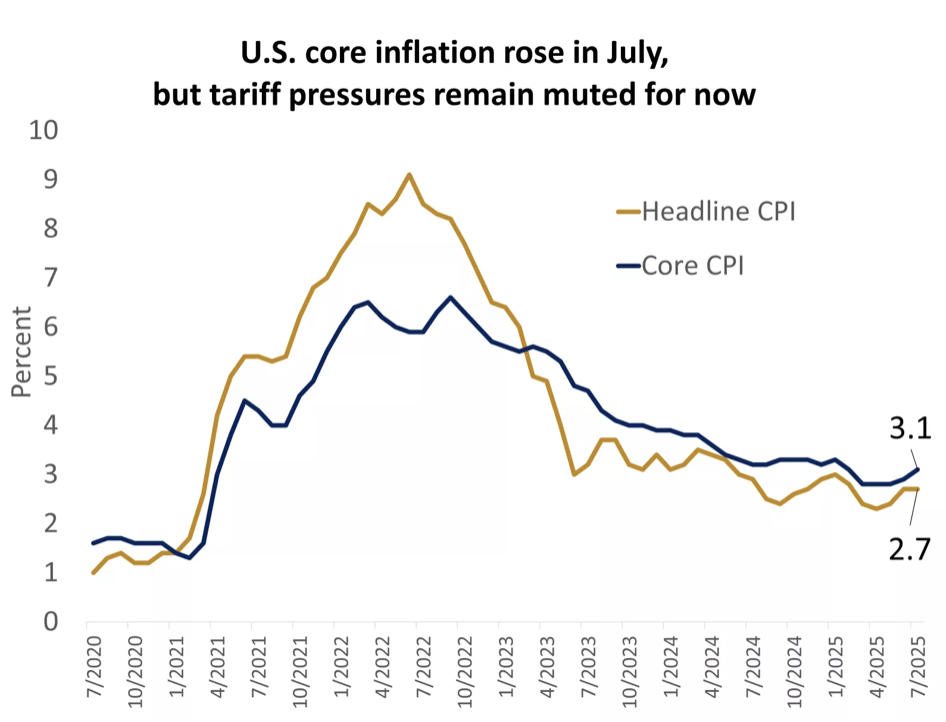

Markets were closely watching last week’s consumer price index (CPI) report, anticipating a potential tariff-driven uptick in July inflation. The headline CPI held steady at 2.7%, thanks in part to a decline in gasoline prices. Meanwhile, core CPI, which excludes food and energy, rose to 3.1% from 2.9%, its highest level since February. Both figures came in largely in line with expectations, offering some relief to equity and bond investors.

However, the underlying details revealed some surprises. Goods prices increased just 0.2% month-over-month, matching June’s pace, while services prices accelerated by 0.4%, driven by notable increases in airfares, medical services, and auto repairs.

The glass-half-full interpretation is that tariffs, one of Fed Chair Powell’s key concerns, were not the primary driver of the core inflation uptick. Still, it may be premature to draw firm conclusions. Notably, producer prices also rose more than expected last week, marking the fastest pace of wholesale inflation in three years. This helps raise the possibility that businesses could begin passing higher import costs onto consumers, something they’ve largely avoided so far.

Also, the renewed momentum in services costs underscores the risk of declaring victory over inflation too soon. That said, we see no signs of a 2022-style inflation surge on the horizon. Any tariff-related price pressures are likely to be temporary, and the broader inflation outlook remains manageable for now, in our view.

-

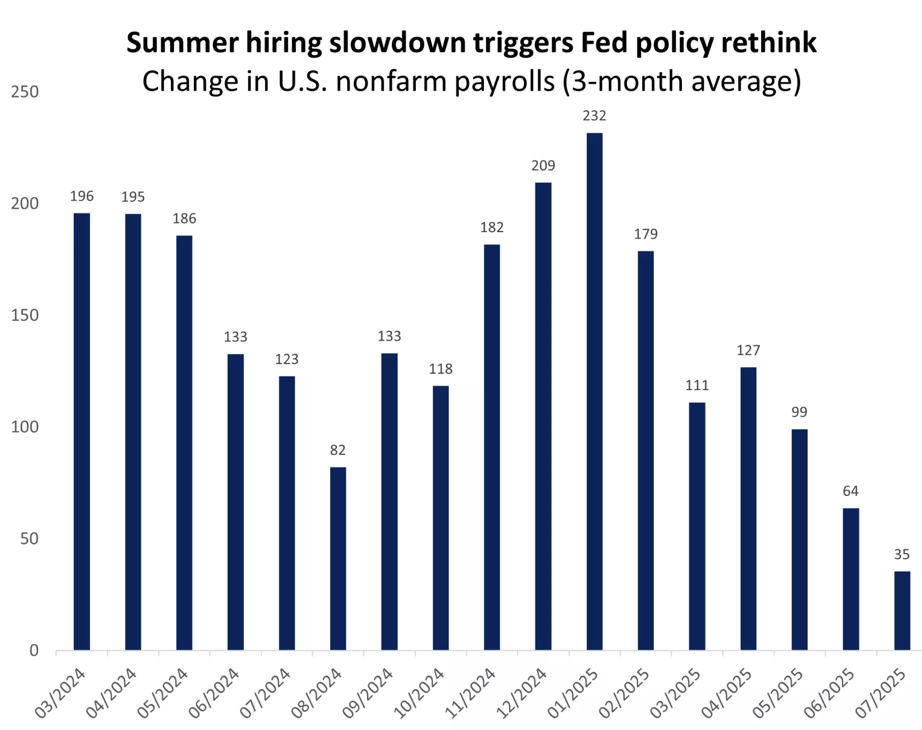

At its July meeting, the Fed held rates steady in the 4.25%–4.5% range, but, notably, Governors Bowman and

Waller dissented, favoring a quarter-point cut. Their divergence hinted at growing internal concern over

economic momentum. Since then, inflation has come in softer than feared, and labor-market conditions appear

to have cooled, with the three-month pace of job gains now the slowest since 2020. Had the committee had

this data in hand, it’s reasonable to think they might have opted to cut, in our view.

Reflecting this shift, bond-market expectations for a September rate cut have surged to 85%, up from just

40% before the latest employment and inflation reports. Some investors are even debating the size of the

cut, a standard quarter-point or a more aggressive half-point move.

We believe an "insurance" cut next month is warranted given labor-market softness, but not guaranteed.

Calls for a larger cut may be premature, especially with consumer spending continuing to grow at a brisk

pace and inflation risks still lingering. Importantly, there’s still one more CPI reading and jobs report

before the Fed’s September 17 decision, and both could reshape the narrative. However, we think that

inflation would need to surprise significantly to delay a cut, and we expect Chair Powell to use the

Jackson Hole conference to lay the groundwork for the Fed’s return to easing.

-

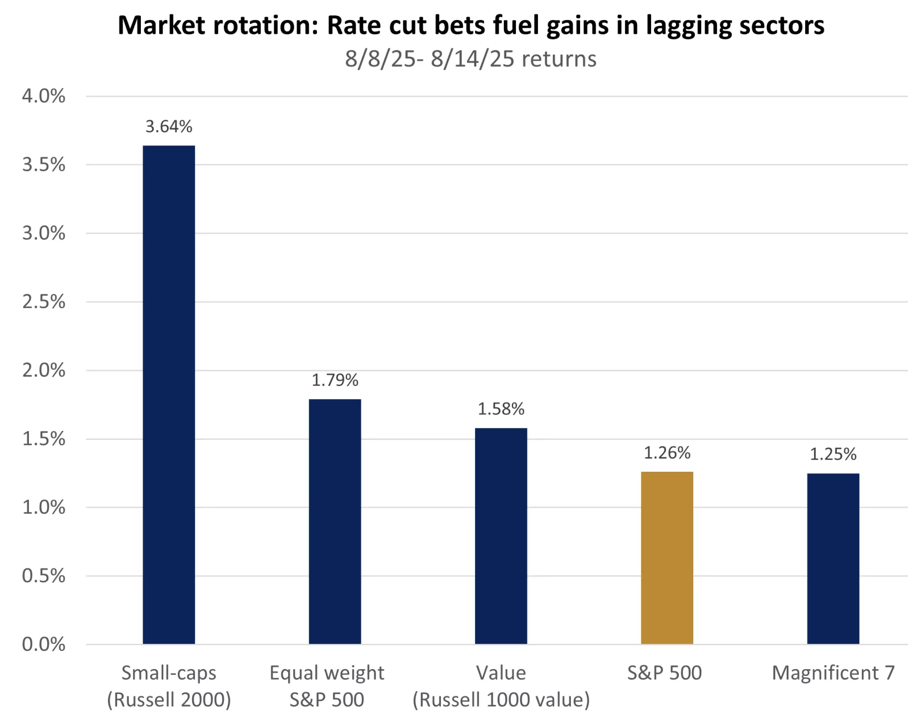

Last week’s market action offered an early glimpse of how investors may position for a potential Fed pivot

in September. Small-cap stocks, which are more sensitive to interest rates due to their reliance on debt

financing, rose over 3% for the week. Meanwhile, value-style investments and the equal-weighted S&P 500,

which gives each company the same influence regardless of size, outperformed the traditional cap-weighted

index, signaling a welcome broadening of market leadership.

In past cycles, the market’s response to Fed easing depends on whether rate cuts are preemptive ("insurance cuts") or reactive.- Insurance cuts, like those in 1995, 1998, and 2019, aim to support the economy before clear signs of trouble and tend to be bullish for equities.

- Recession-driven cuts (reactive), such as in 2001 and 2007–2008, often coincide with poor risk sentiment and weaker market returns.

-

Measured rate cuts this year and next could help further boost investor sentiment. Potential

beneficiaries include rate-sensitive and cyclical industries, such as homebuilders, real estate, and banks.

We favor the consumer discretionary and financials sectors, which could get a lift from the upcoming Fed

pivot. Our slight overweight to health care reflects near-record low valuations relative to the broader

market.1 At the asset-class level, mid-caps could offer a way to position for lower rates while avoiding

some of the risks associated with smaller-cap stocks. If the U.S. dollar weakness persists, given other

central banks are closer to neutral, emerging-market equities could benefit, and we maintain a neutral

allocation there.

-

Fed rate cuts typically drive short-term yields lower, as they closely track policy rates. While long-term

yields may also decline, they could remain elevated due to inflation and fiscal concerns. In this environment,

we think short-term bonds offer stability and liquidity for near-term needs, while longer-term bonds provide

attractive yield opportunities. We favor bonds with seven- to 10-year maturities, and we maintain our view

that the 10-year Treasury yield will remain in the 4%–4.5% range over the coming months. Yields may move to

the low end of the range next year as Fed policy potentially moves closer to neutral.

-

To sum up, the path to rate cuts may be uneven, as we have seen over the last two years, where markets have

been eager for rate cuts and sometimes disappointed that the Fed has not delivered them. But we believe the

direction of travel for rates is likely to remain lower. With inflation treading water and labor-market

strains becoming more pronounced, the balance of risks may soon tip toward action. Chair Powell’s upcoming

remarks at Jackson Hole could validate the now-high expectations that, after a seven-month pause, rate cuts

will resume in September.

In this environment, we believe diversified portfolios, which include both growth-style investments benefiting from long-term AI tailwinds and value-oriented exposures poised for a cyclical boost from easing policy, may be well-positioned for the evolving Fed narrative.

-

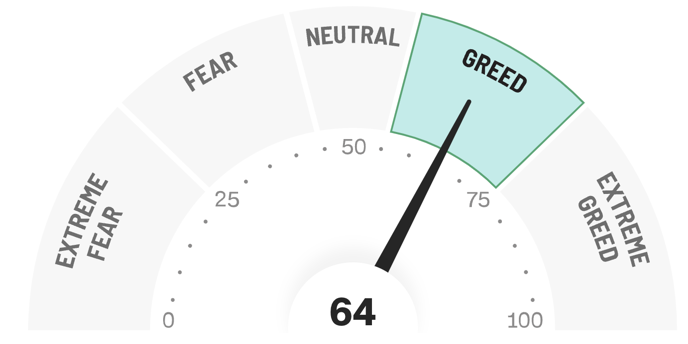

Final Words: Market indicates Greed. Buy Gold and Silver (GLD & SLV ETF's).

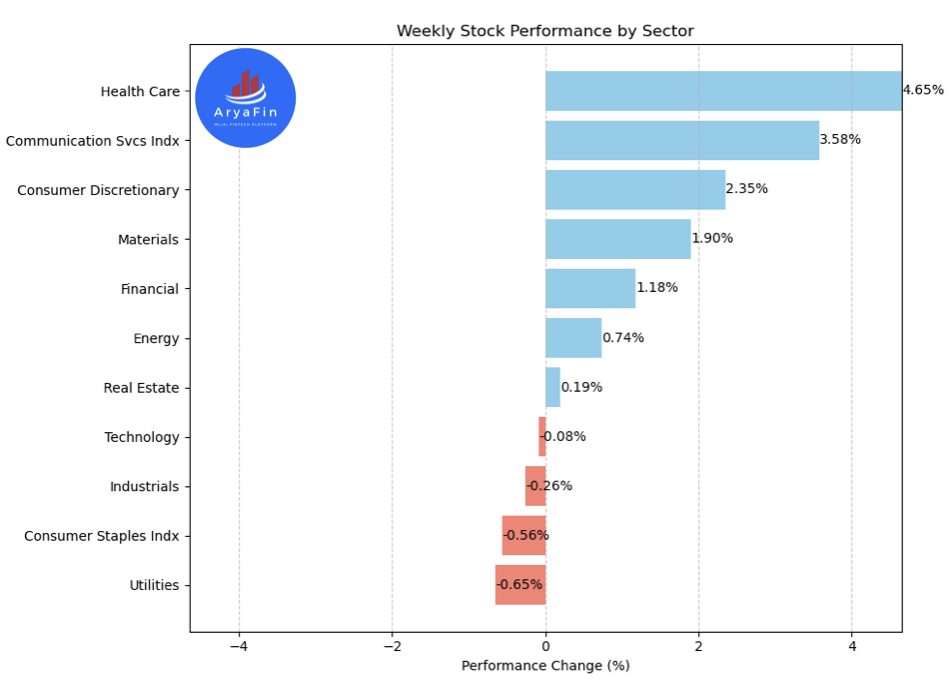

Below is last week sector performance report.

Weekly Sector Performance for Aug 11-15, 2025:

$XLE Energy (Change: 0.74%), (RSI: 48.15)

$XLK Technology (Change: -0.08%), (RSI: 59.44)

$XLC Communication (Change: 3.58%), (RSI: 68.56)

$XLY Consumer Discretionary (Change: 2.35%), (RSI: 63.65)

$XLP Consumer Staples (Change: -0.56%), (RSI: 55.05)

$XLF Financial (Change: 1.18%), (RSI: 52.36)

$XLV Health Care (Change: 4.65%), (RSI: 59.50)

$XLI Industrials (Change: -0.26%), (RSI: 49.30)

$XLB Materials (Change: 1.90%), (RSI: 53.30)

$XLRE Real Estate (Change: 0.19%), (RSI: 46.24)

$XLU Utilities (Change: -0.65%), (RSI: 55.56)

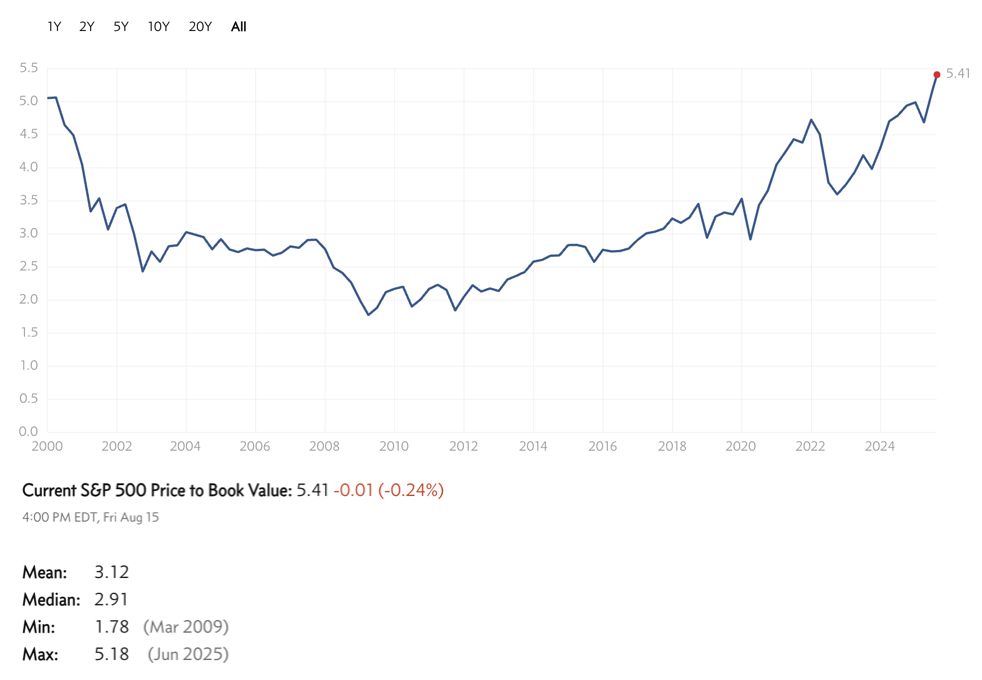

S&P 500 Price-to-Book Value is extremely elevated.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

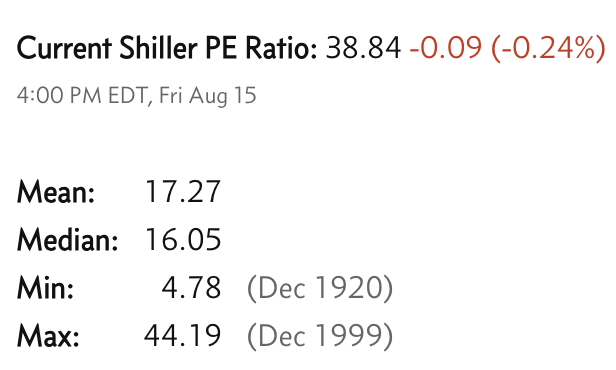

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.