Weekly Market Commentary - April 26th, 2025 - Click Here for Past Commentaries

-

Equity and bond markets staged a relief rally last week, as the U.S. administration softened further

its stance on trade and as worries over the Fed's independence subsided. With the U.S. seemingly

looking for a path to reduce tariffs, the peak in trade uncertainty and market volatility may be behind us.

Having moved away from extreme pessimism, any further gains will likely require more tangible

developments and agreements with major countries, rather than just signs of easing tensions.

Markets could remain rangebound for a time, with periodic bouts of volatility, before working back

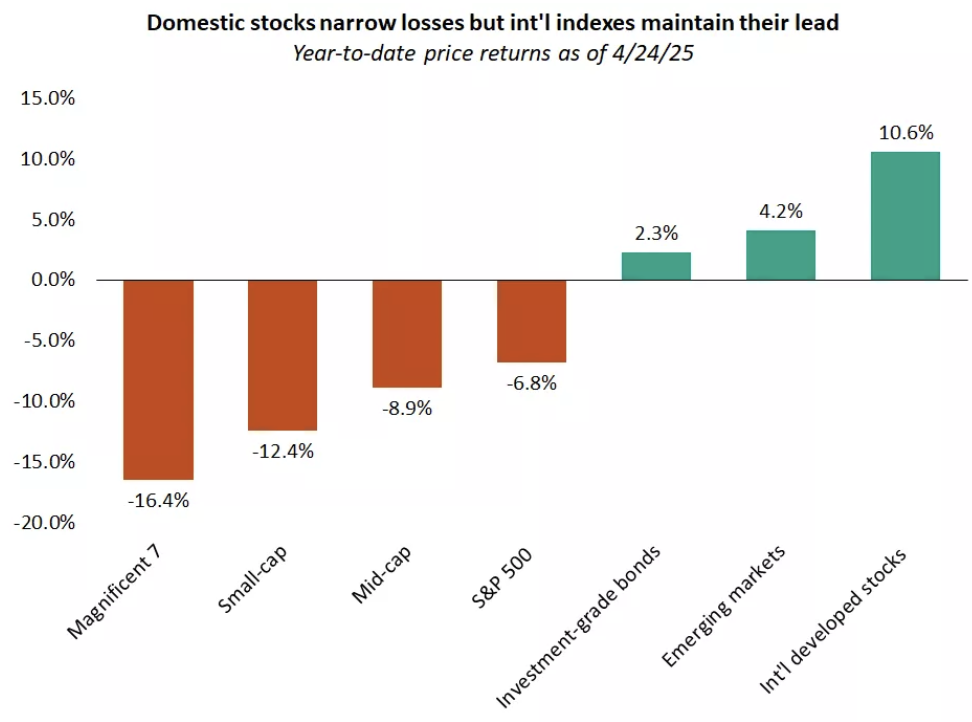

toward early-2025 prices. While we expect a relatively flat year for the S&P 500, diversified

portfolios could fare better, as international equities have maintained, and in some cases

widened, their lead even as U.S. stocks rebounded.

Together with trade developments, the current focus is on corporate profits. We think mid-single-digit

growth is achievable if the economic growth slowdown doesn’t turn into something worse. From a sector

standpoint, we see opportunities in health care and financials.

-

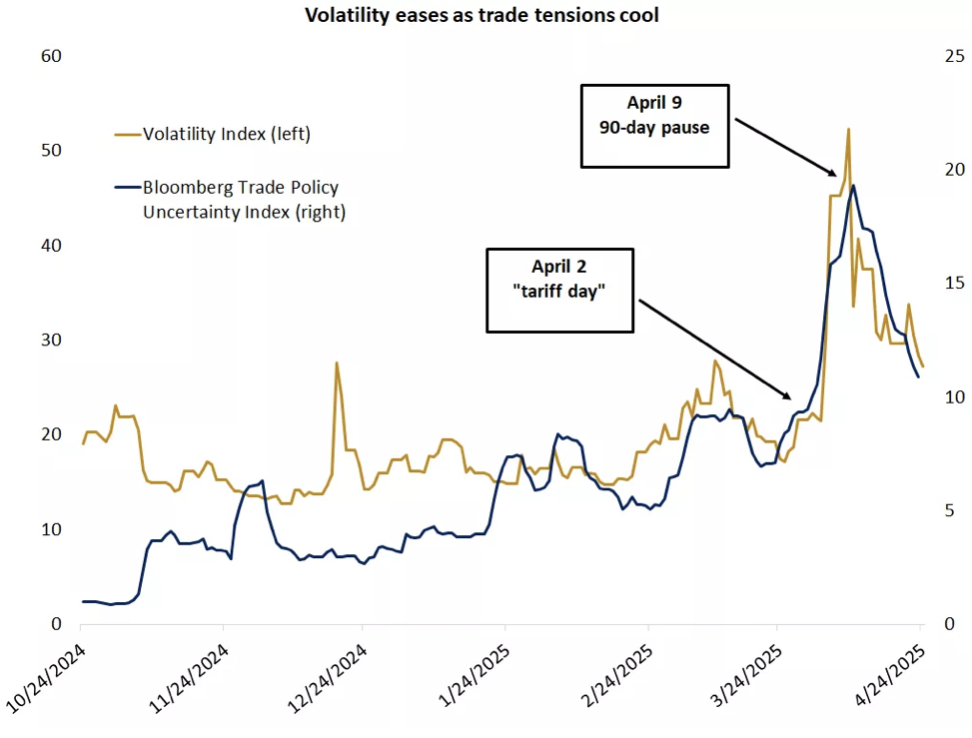

Following initial concerns that the historically high tariff rates announced on April 2 would persist, there

have been a series of positive developments suggesting that the U.S. administration is softening its

stance on trade. The 90-day pause on the new tariffs was a significant first step, but the tit-for-tat

tariff hikes with China would still result in the average rate on imported goods jumping to more than

20% from around 2.5% last year.

However, media reports mentioned last week that the administration is considering cutting its tariffs on Chinese imports in an effort to de-escalate tensions. And China is said to be considering exempting some U.S. goods from tariffs as costs increase. Separately, Treasury Secretary Bessent said that the U.S.-South Korea bilateral trade discussions were “very successful” and may result to an agreement soon, while also mentioning that the U.S. is making “significant progress” toward a trade deal with India.

As the last couple of weeks showcase, the narrative and headlines on trade can change faster than the weather changes in springtime St. Louis. Until an actual deal with a major country is made, uncertainty will linger, in our view. Nonetheless, with the U.S. administration looking for a path to reduce tariffs, the peak in trade uncertainty and market volatility may be behind us.

-

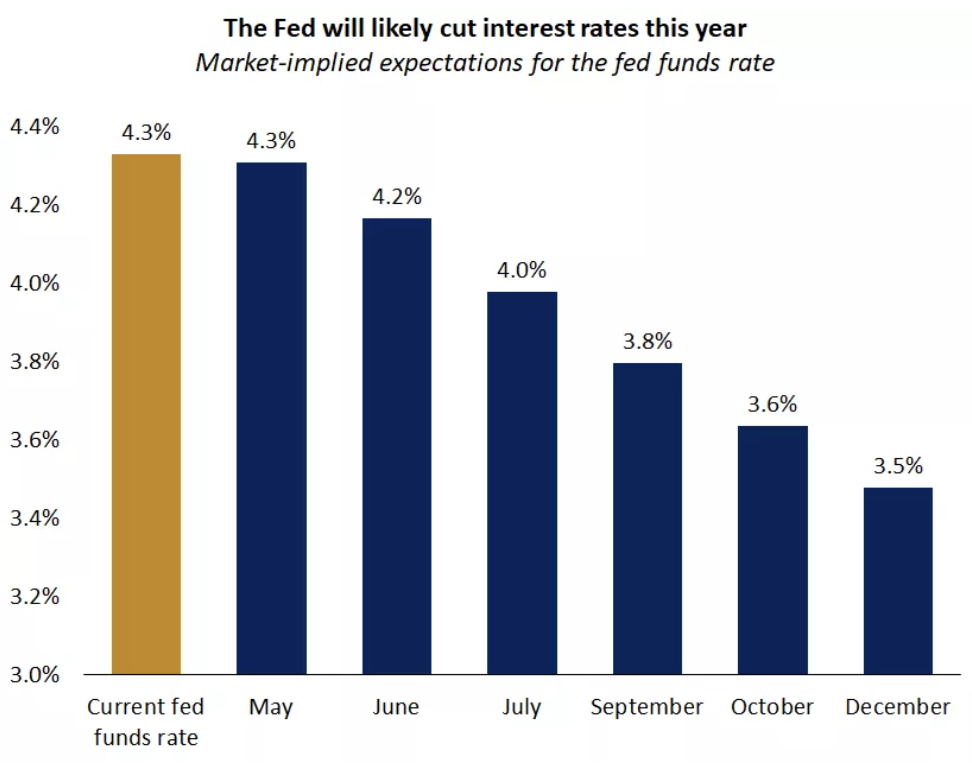

After expressing his frustration that the Fed hasn't moved to lower interest rates further, President

Trump said last week that he has "no intention of firing" Fed Chair Powell. The threats to the Fed

independence, the bedrock of a credible monetary policy, was a contributing factor to the brief rise

in Treasury yields. With these worries fading, the 10-year yield has now returned back to near the

middle of our 4.0%-4.5% range that we expect to persist this year.

Under our base-case scenario, where the U.S. imposes a 10% universal tariff on all imported goods with higher levies on China and certain sectors, like semiconductors and pharma, we see GDP slowing to a below trend 1.5% - 1.7% growth. Core inflation is likely to peak around 3.5% - 4% before falling as demand slows. With the economy softening but not falling into a recession as the average tariff rate settles around 10%-15% instead of the 20%+ currently, the Fed is unlikely to provide much accommodation. It currently remains in wait-and-see mode and may stay on pause when it meets again on May 7. But by June or July, policymakers will likely have more clarity on the impact of tariffs. Signs that growth and the labor market will be cooling will likely lead the Fed to cut rates two-to-three times this year.

-

The rebound in markets since the April 9 tariff-pause has triggered a 10% rally in the S&P 500

from the low, leaving the index about 10% off its February 19 high1. Prices are now at a key area,

sitting between the pre-April 2 low and the post-April 2 high. Having moved away from extreme

pessimism, any further gains will likely require more tangible developments and agreements with

other countries, rather than just signs of easing tensions.

Historically, after sizable market declines as the one experienced this year, it takes a while for volatility to return to average levels. More often than not, bottoming is a process, with stocks retesting prior lows. Two notable recent exceptions were the 2018 near-20% decline in the S&P 500 and the 2020 pandemic-induced bear market, where in both cases stocks experienced a V-shaped rebound, helped by a Fed pivot in 2018 and a strong combination of fiscal and monetary support in 2020. With the Fed constrained on what it can do by lingering inflation pressures and the government dealing with the reality of high deficits, we don’t expect a V-shaped rebound to the prior highs.

However, we also don't see the case for a prolonged decline or a deepening bear market. Unlike 2008, there are no major imbalances or excesses in the economy, in our view, to exacerbate a slowdown. Debt-service payments as a percent of disposable income are below levels seen in the last decade and the long-term averages, while unemployment remains low and wage growth has exceeded inflation for the past 23 months. And unlike in 2022, the Fed is in the midst of a rate-cutting cycle and is not looking to hike again.

What happens next will largely depend on trade developments and the pivot to a pro-growth agenda. Markets could remain rangebound for a time, with periodic bouts of volatility, before working back toward early-2025 prices. While we expect a relatively flat year for the S&P 500, diversified portfolios could fare better, as international equities have maintained, and in some cases widened, their lead even as U.S. stocks rebounded.

-

In the two-week span between April 21 and May 2, 60% of the S&P 500 companies will have reported

earnings, including six of the Magnificent 7 companies. The earnings season is off to a solid start,

with 75% of companies reporting earnings above estimates, surprising positively by 10% compared with

the last 10-year average of 7%. Yet, these results do not reflect any tariff headwinds to sales

growth and profitability, which is why the focus is on forward-looking guidance.

Some consumer-facing companies are warning of a slowdown in consumer spending amid macroeconomic uncertainty and are pulling guidance for the year. As a result, earnings growth estimates for the full year have declined from 14% in January to 9.5% now. We think mid-single-digit growth is achievable if the economic growth slowdown doesn’t turn into something worse. A 10% drop in valuations this year may be partially offset by a rise in corporate profits, which would be a decent outcome, in our view, considering the trade uncertainty and outsized returns over the past two years.

From a sector standpoint, we see opportunities in health care and financials. Health care is a sector that is expected to lead earnings growth in the first quarter and offers both defensive and growth characteristics. Financials is less exposed to trade headwinds and can also benefit from the administration pivoting to tax cuts and deregulation in the back half of the year. It is noteworthy that despite the broad risk-off tone for markets this year, financials – an economically sensitive sector - made a new high relative to the S&P 500 last week.

-

Final Words: Markets are down and fed is going to cut

interest rate, greed warranted. Buy safety such as VOO and growth such as VGT. Balance.

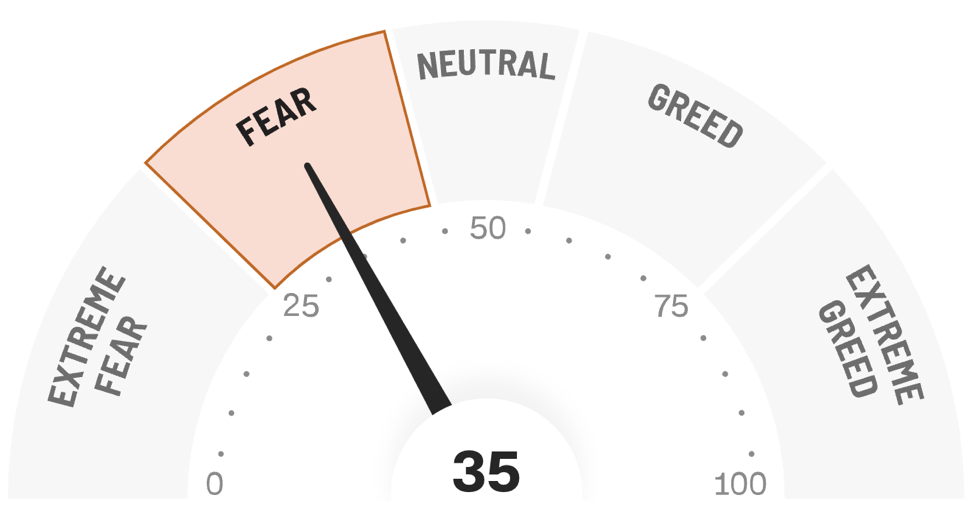

Below is CNN Greed vs Fear Index, pointing at 'Fear'.

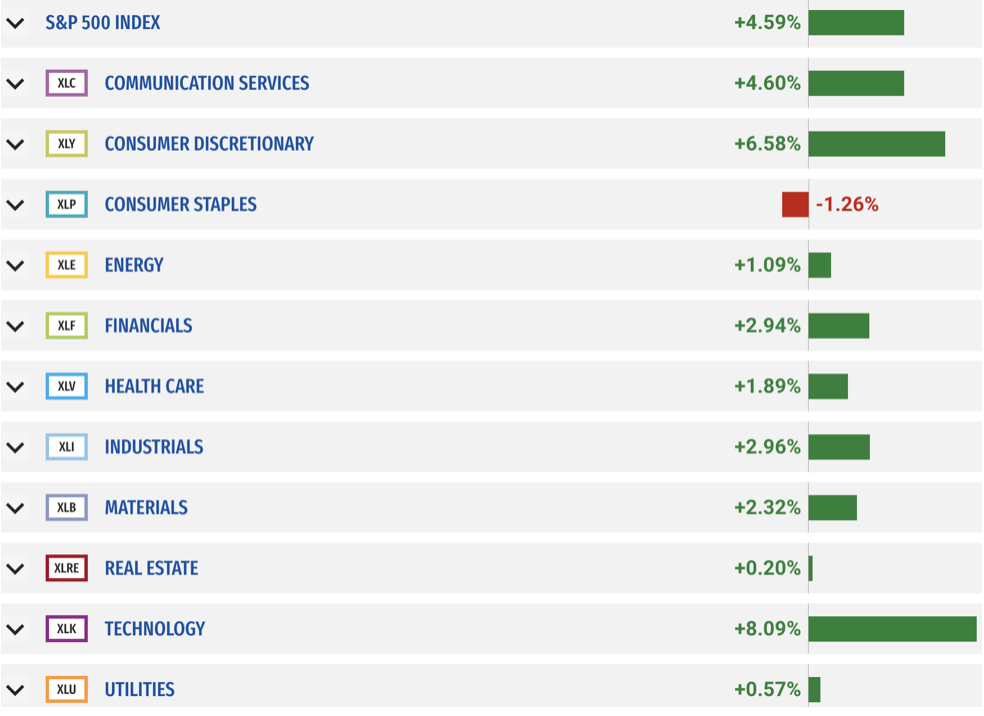

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

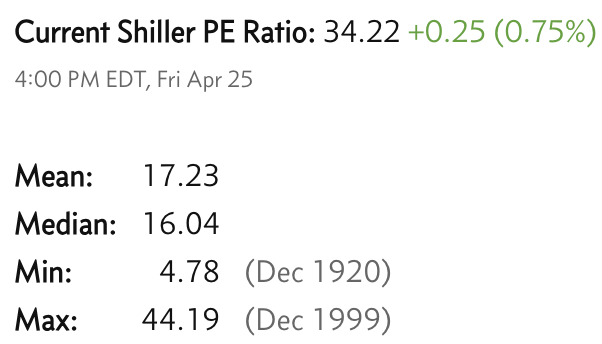

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.