Weekly Market Commentary - April 12th, 2025 - Click Here for Past Commentaries

-

Equity markets recouped some of their recent losses following a reversal on the high tariffs

announced on April 2. A 90-day pause was granted for all countries except China, as the tit-for-tat

with the U.S. continues.

The pivot signals a more conciliatory stance and opens the door for negotiations. While the peak in

trade uncertainty may be behind us, the path forward remains bumpy. The likely mix of positive and

negative headlines could keep markets on edge. However, with volatility near historic extremes,

there's more room for it to fall than rise.

The spike in volatility, the reset in valuations, and signs that the worst-case trade war scenario

may be averted suggest that stocks may find some support and possibly attempt to carve out a bottom.

We suspect that the next chapter in the trade war will be de-escalation, but investors are not yet

out of the woods. Further progress on trade deals will be needed. In the meantime, we recommend avoiding

emotionally charged decisions and instead focusing on diversification, quality investments, and a

long-term perspective.

-

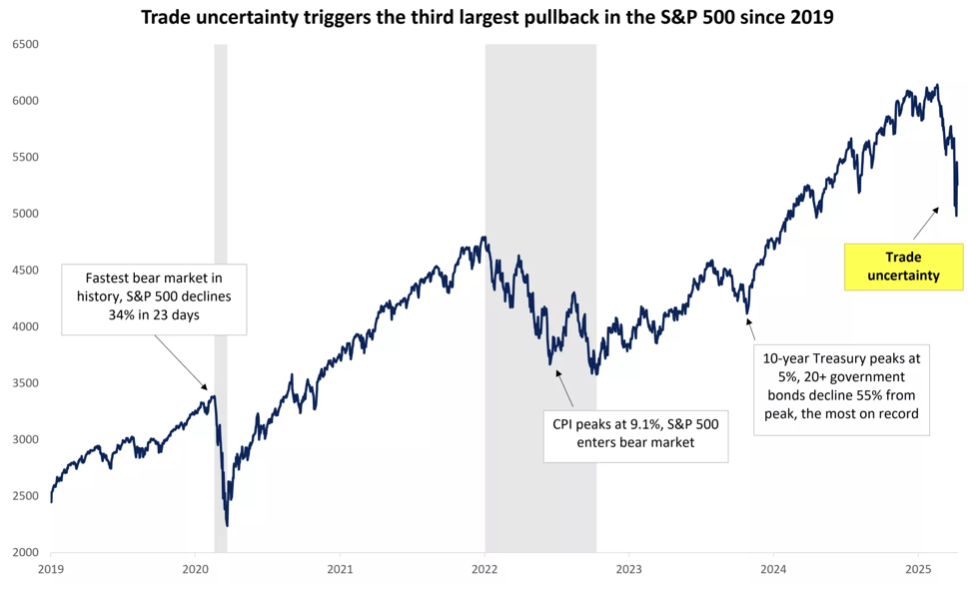

Policy shifts continue to drive sizable market swings amid a barrage of headlines and trade developments.

After flirting with a 20% decline from its peak on February 19, a threshold that separates bear from

bull markets, the S&P 500 posted its third-largest daily gain since World War II. The rally followed a

White House announcement of a 90-day pause on the newly proposed "reciprocal" tariffs for those countries

that did not retaliate to the April 2 announcement. The tariff rate now moves lower to 10%, except for

China, whose tariff rate was increased to 145%. In response, China raised its tariffs on U.S. imports

to 125%.

We offer the following perspective on what the latest developments in the trade saga may mean for markets. We also explore what history tells us about market behavior during and after periods of extreme volatility, like the one we are navigating now.

-

The U.S. April 2 tariff announcement elicited responses from other countries, some of which chose

to retaliate (China and Europe initially), while others chose to negotiate (Japan, South Korea, Vietnam).

A tit-for-tat between the U.S. administration and China - each raising import levies in turn - fueled

fears of an escalating trade war and rattled financial markets. The S&P 500 declined 12% between

April 3 -April 8, and the financial fallout spread to the bond market and the U.S. dollar1. But as

stocks were on the verge of entering a bear market, the U.S. administration softened its approach,

announcing a 90-day delay on the implementation of the "reciprocal" tariffs with the exception of China.

Whether the tariff turnaround was part of a greater plan, or a response to the increasing economic and market risks, it signals a pivot to a more conciliatory approach. The 90-day pause provides time for negotiations, potentially allowing countries to strike deals. Perhaps peak trade uncertainty is now behind us. However, businesses and investors are unlikely to get the clarity they seek right away. Negotiations will kick into high gear, but that process may take a while, and, in the meantime, there will likely be a mix of positive and negative headlines keeping volatility elevated.

-

Compared with the April 2 tariffs, the 10% universal baseline rate now looks moderate and manageable

for the economy. However, the big jump in levies for China, the U.S.'s biggest source of imports,

suggests that the average tariff rate is still poised to jump to about 20% – 25% from 2.3% in 2024.

Last week's actions signal that the administration is open to negotiations. Nonetheless, in a scenario where these tariffs stick, economic activity would slow meaningfully. Based on a 2018 Fed model that was developed to assess the impact of the trade war during the first Trump administration, we estimate a potential 2.4% hit to GDP over the next couple of years, assuming no fiscal offsets, like tax cuts or stimulus.

The upshot is that the range of outcomes remains wide, and there are already signs that businesses are slowing hiring and consumers are pulling back on discretionary purchases. However, there are buffers, suggesting that a growth slowdown won't turn into a prolonged contraction in activity.

* The economy is facing this period of uncertainty from a strong starting point. Whether we look at consumer finances, corporate balance sheets, or the labor market, all point to healthy but likely softening conditions. And we do not see any major imbalances or excesses in the economy like in 2008.

* The market volatility is policy-induced, and the policy agenda may soon shift to pro-growth measures. A lot of the focus early in the year has been on trade and efforts to constrain government spending. However, the administration may start pivoting to more market-friendly policies, which are taking longer to implement.

* Unlike the bear market in 2022, the Fed remains in a rate-cutting cycle and could step in to cut more aggressively than expected if there is a notable uptick in unemployment. While dismissed by the market as old news ahead of the tariff impact, the March CPI offered some encouraging news for policymakers. Inflation unexpectedly cooled, as core CPI dropped to 2.8% from 3.1%, the slowest since March of 2021 when inflation first started surging.

-

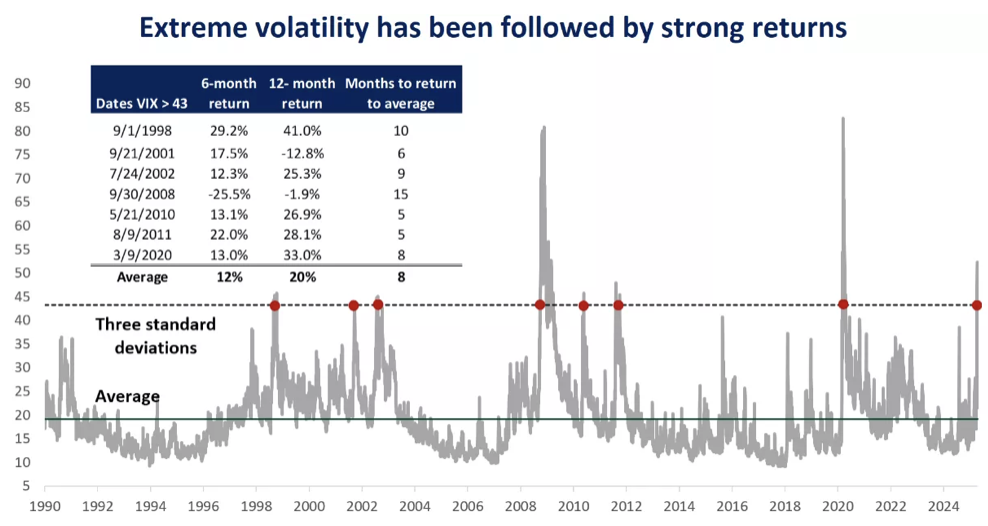

Historically, the average intraday move (difference between the daily high and low) for the

S&P 500 has been around 1%. But since the higher tariff plan was revealed on April 2, the average

intraday move has jumped to a jaw-dropping 7%.

Highlighting the extreme market fluctuations and uncertainty, the volatility index (VIX), also known as the fear index, has spiked to the highest since the early days of the 2020 pandemic. The index has been that high only eight times in the past 35 years. Typically, it takes a while for volatility to return to normal, on average about eight months. But what history shows is that fear creates opportunities for those that follow a disciplined and patient approach. Once the VIX index has exceeded 43 (it reached a high of 52 on 4/8/25), forward six- and 12-month equity-market returns have been strong. That is not because volatility itself is good, but because spikes in volatility tend to occur when pessimism is already priced in.

-

A V-shaped recovery in stock prices is not likely as long as trade headwinds persist.

Especially as the upcoming earnings season, which kicked off on Friday with the banks,

may show many firms slashing their guidance for the year.

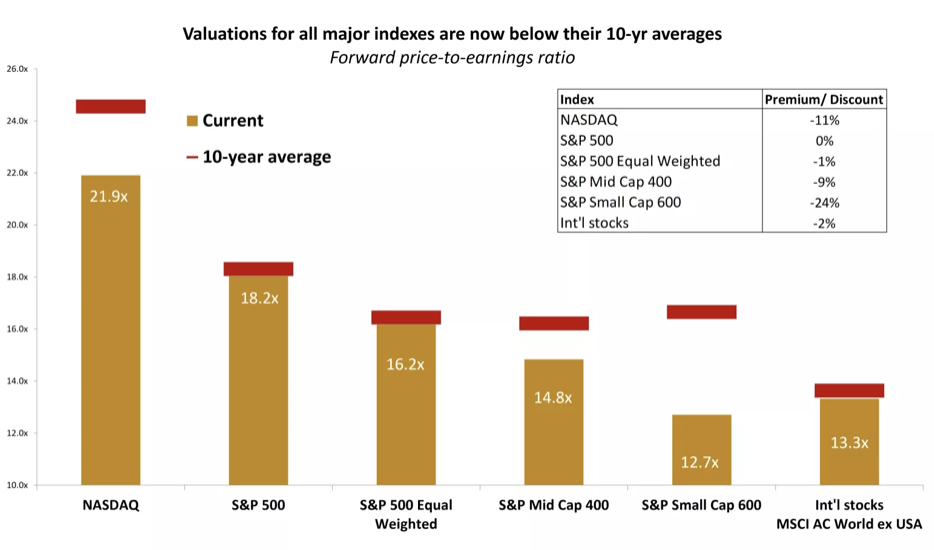

However, the upside of this down market is that valuations are now looking more compelling and are no longer stretched, which was a concern coming into this year. All major indexes are trading at or below their 10-year historical averages, potentially setting the stage for improved long-term returns.

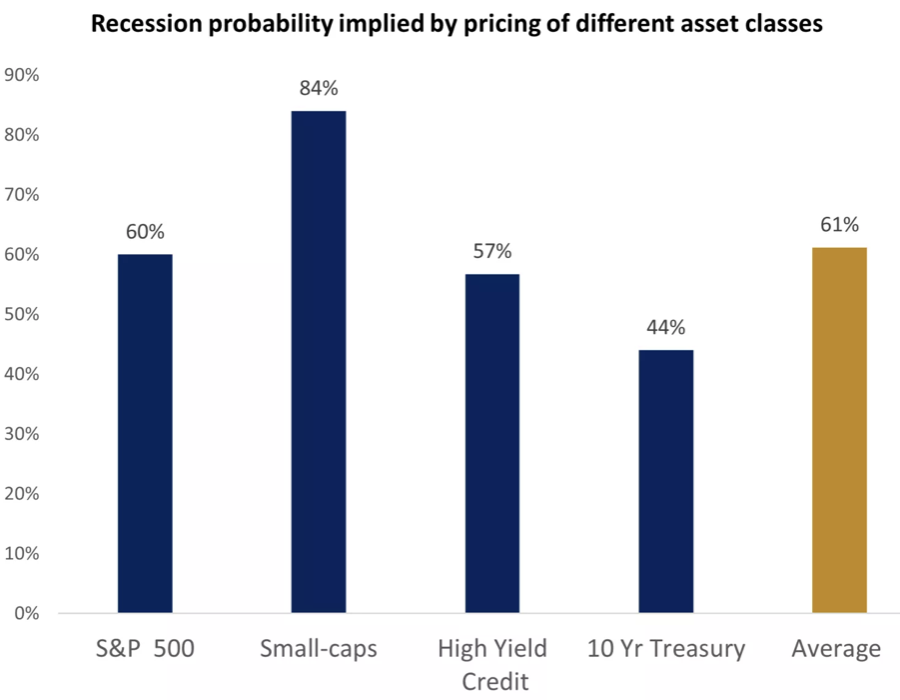

The spike in volatility, the reset in valuations, and signs that the worst-case scenario in the trade war appears to be averted, suggest that stocks may find some support and try to carve out a bottom. Risks have risen, but a recession is not inevitable, and stocks appear to have already priced in a significant degree of bad outcomes. Based on how different indexes have performed in past recessionary periods, the current declines imply a high chance that the economy and corporate profits will decline materially. If that outcome does not materialize, we believe the markets will start to stabilize first, and eventually recover.

-

We are not out of the woods yet, as progress on trade deals will be needed for markets to

calm down. We hope that next chapter in the trade war will be de-escalation. But hope is not

a strategy. To navigate this environment, we recommend adhering to the following principles:

- Focus on what you can control (diversification, quality investments, long-term perspective).

- Amid headline noise, avoid making emotionally charged decisions, which more often than not lead to subpar outcomes.

- Time in the market is better than timing the market.

- Understand the risks of not investing. Assuming 3% inflation, prices will double during a normal 25-year retirement period. Therefore, it is critical to own assets that can help you maintain your purchasing power over time.

-

Final Words: Markets are down and fed is going to cut

interest rate, greed warranted. Buy safety such as VOO and growth such as VGT. Balance.

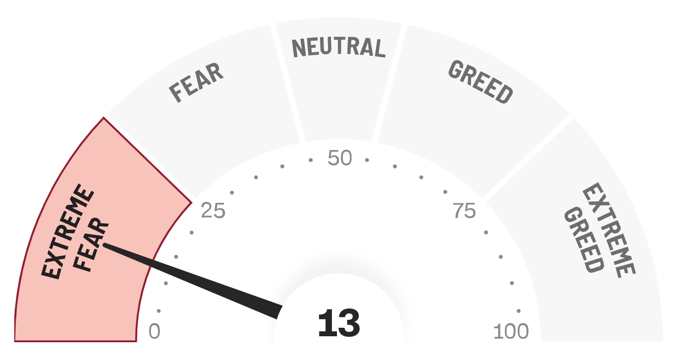

Below is CNN Greed vs Fear Index, pointing at 'Extreme Fear'.

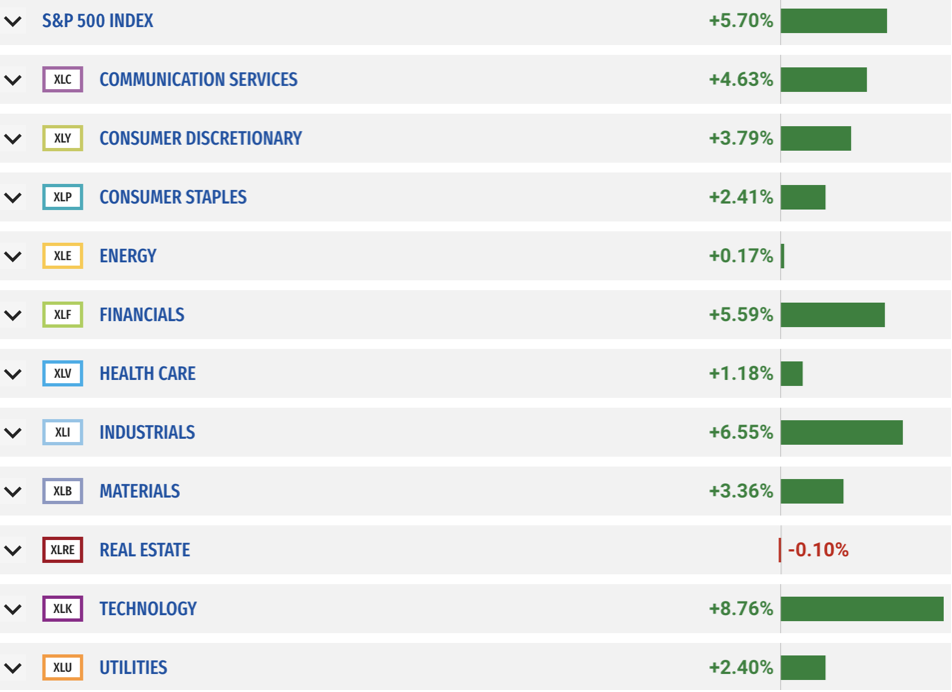

Below is last week sector performance report.

If you are looking for investment opportunities, you can take a look at our

Hidden Gems

section, and if you want to see our past performance, visit our

Past Performance section. If you are looking for

safe and low cost Exchange Traded funds(ETFs), check out our

ETF recommendations.

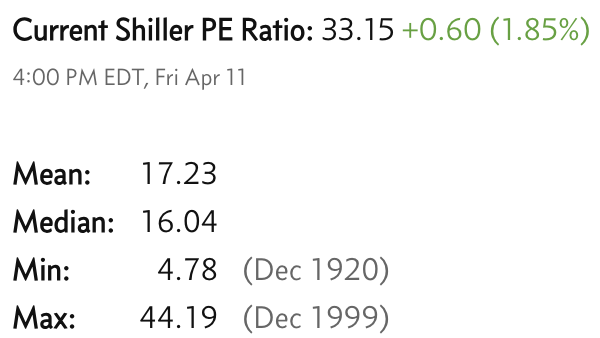

Currrent Shiller PE (see below) is showing overbought conditions as index is far above mean/media

and our AryaFin engine is indicating caution. Have a good weekend.